Take What the Defense Gives You

Key Takeaways

- This week we discuss why we think the Merge is an undercrowded trade.

- We review the implications of increasing leverage in the ETH futures market as well as the sustained negative funding rates for ETH perps (Hint: Potential Squeeze).

- An increase in transactions coupled with a recent network upgrade present Arbitrum as an intriguing opportunity for investors. We discuss ways to achieve exposure to the tokenless L2.

- Both ETH and BTC continue to trade at an MVRV below 1.0, meaning that their respective realized caps (on-chain cost bases) are greater than their market caps. In these assets’ short existence, this relative value range has served as a long-term generational buying opportunity for investors.

- Strategy – We continue to be long BTC 0.84% , ETH 0.98% , and SOL into year-end and think that Merge-adjacent names, including LDO, RPL, OP, and MATIC, still present attractive opportunities for high-beta exposure into the Merge. Investors should look to use any dips as buying opportunities.

So Long Summer

As the sun sets on a tumultuous summer, we bring you a note filled with resolve as we continue to discuss the opportunity that remains on the table for those positioning ahead of the Merge. For those wishing to review a comprehensive summary on the matter, we invite you to check out the report we released this week. Despite the recent selling pressure across risk assets, we still think there is an opportunity for ETH to outperform heading into and/or following the Merge once the change in flows starts to manifest.

One of the emerging reasons we continue to add on pullbacks here is that data suggests that investors are simply underexposed/not positioned long into the network upgrade.

We have previously discussed the popularity of being delta neutral into the Merge and being long ETH/BTC, but based on market data, we think that the plain long spot ETH/USD is an undercrowded trade.

Increase in Leverage

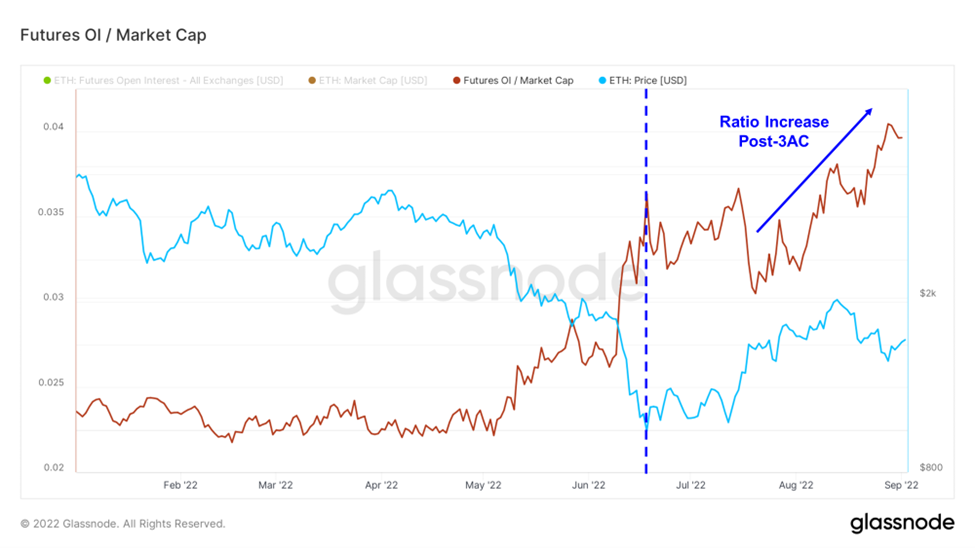

Below we note that leverage is increasing as denoted by futures open interest divided by the total ETH market cap. We put a vertical line on the chart to denote where the fallout from 3AC cratered prices to YTD lows, thus informing us of where this ratio started to increase due to heightened derivatives volume as opposed to a declining denominator.

This tells us two things: (1) many are speculating on the ETH price using futures contracts, with the greatest increase in leverage being from early to mid-August, and (2) the amount of leverage in the system could lead to increased volatility depending upon which “direction” these futures contracts are positioned. Of note, part of this leverage is certainly exacerbated by the delta neutral positioning by many funds ahead of the Merge.

Longs Have Been Getting Wiped Out

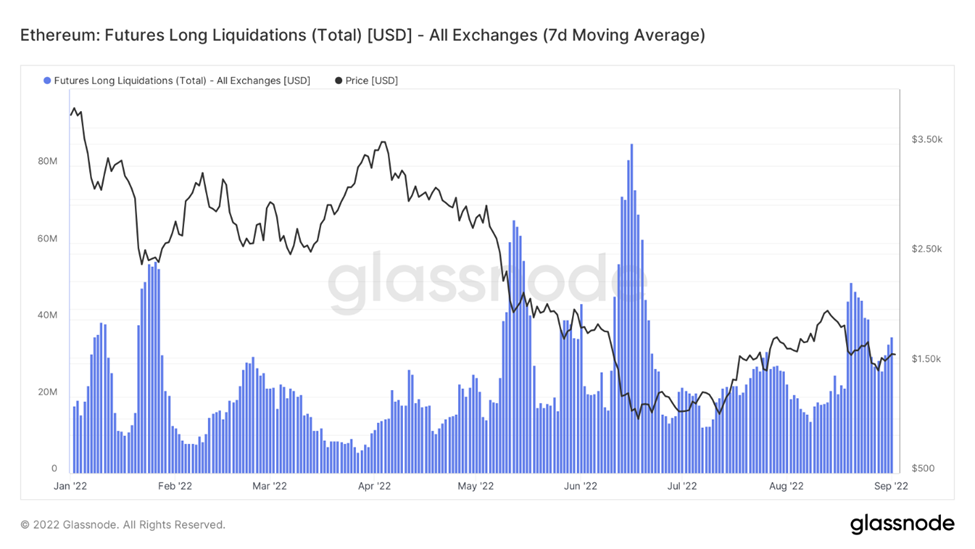

Encouraged by this sustained increase in leverage, we have witnessed sizeable liquidations of leveraged long positions over the previous 2-3 weeks.

As shown in the chart below, the magnitude of liquidations has often rivaled the carnage during the UST and 3AC meltdowns.

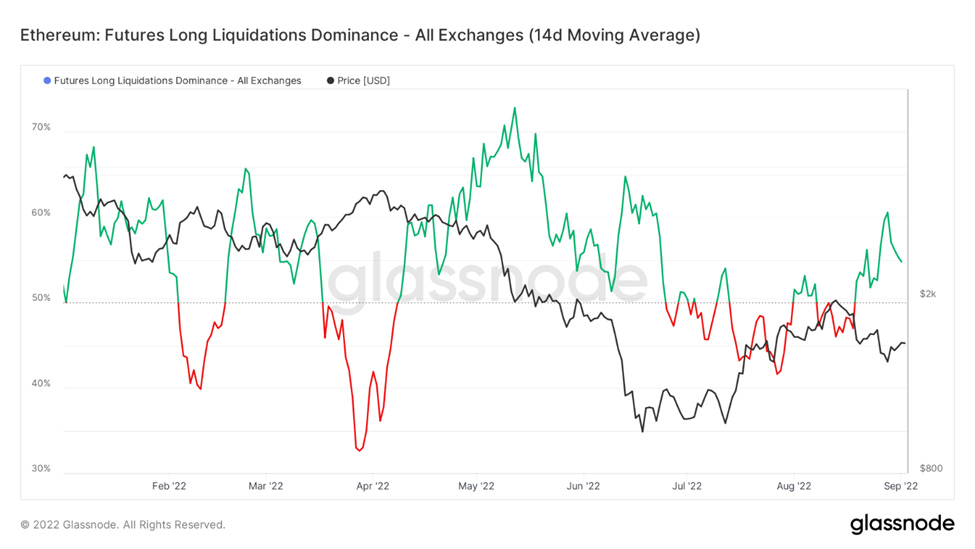

To be sure that the liquidations have not been bidirectional, we can look to futures long liquidations dominance, which gives us a sense of the relative positioning of investors getting liquidated. Based on the 14-day trend, we can reasonably conclude that the leverage featured in the OI/Market Cap chart above is at least somewhat skewed towards more demand for the short side of the trade at current ETH prices.

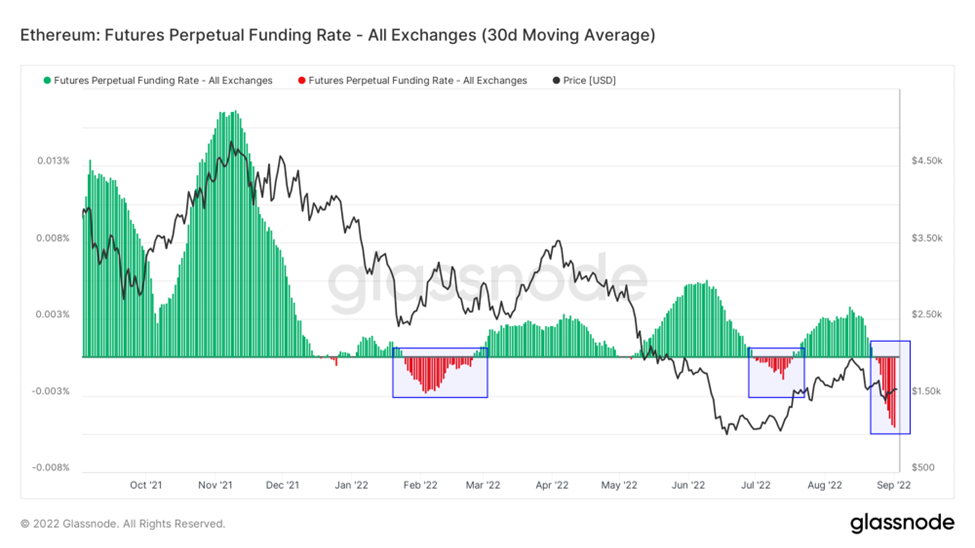

Further corroboration is seen in the funding rates for perps that we touched upon last week. The degree to which perps are positioned negatively is quite extreme, especially given the potential for risk assets to rip higher on marginally softer CPI figures less than two weeks from now. We think that the negatively positioned perps market suggests an overly bearish market positioning for ETH.

Further, in viewing the short-term pullback in the ETH/BTC chart below, one can assume that many of those in the spot market that were long ETH, sold in the face of puking risk assets. Thus, coupled with the charts above, one can piece together a current setup in which:

- Bidirectional OI has increased rapidly, partially bolstered by the desire for many to position delta neutral into the Merge.

- Based on the pullback in ETH/BTC a portion of those spot-long ETH positions from the market bottom sold in the face of a resurgence in macro uncertainty.

- Leveraged long positions have taken a beating, shifting the net demand in the futures market to the short side of the trade.

This gives us a scenario in which (1) if the market faces selling exhaustion soon, it could squeeze higher, and (2) the long ETH trade is undercrowded, heading into the Merge precisely two weeks from now.

Both ETH and BTC Trading Below Cost

While many are concerned about the laundry list of uncertainties in the economy, it is important to note the relative value that both ETH and BTC are trading currently. Both blue-chip cryptoassets are trading below their overall cost bases, as estimated by MVRV.

As demonstrated below, both assets show an MVRV below 1.0, meaning that their respective realized caps (on-chain cost basis) are greater than their market caps. In these assets’ short existence, this relative value range has served as a long-term generational buying opportunity for investors.

Arbitrum Season

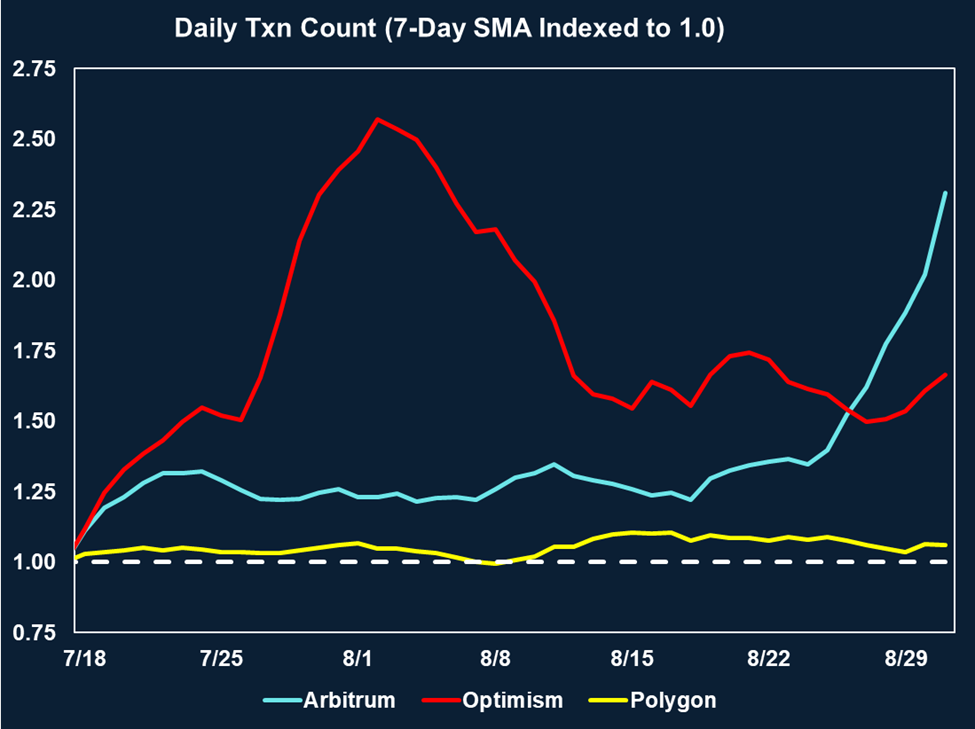

While we have previously discussed potential layer 2 opportunities in Optimism and Polygon, we have yet to discuss Arbitrum, the optimistic rollup network built atop Ethereum. This is primarily because Arbitrum, unlike Optimism and Polygon, lacks a native token.

Despite the lack of native token incentives, we have seen activity on the network skyrocket in recent weeks, as demonstrated below. This suggests that users are flocking to the network for its fast speeds, user-friendly apps, and the potential for a token airdrop in the wake of the Merge.

The recent increase in transactions also likely can be attributed to a network upgrade called Arbitrum Nitro, which is designed to dramatically increase transaction speeds. Further, developers recently announced Arbitrum Odyssey, an event through which users will be rewarded with NFTs for interacting with protocols on the network.

We have discussed how airdrop farming can be a solid bear market strategy, as many of these emerging layer 2 networks like to reward early users with native tokens (see: Optimism), and despite Offchain Labs (Arbitrum development team) repeatedly denying that they would be issuing a token, our team thinks it is more likely than not that they do eventually dish one out.

Thus, for those interested in Airdrop farming Arbitrum, we certainly recommend bridging over and test driving some of the applications already built there.

For those who do not wish to wait for the potential airdrop, but still want exposure to the Arbitrum ecosystem, we would steer you towards some of the projects listed below. These are all Arbitrum-native projects that have emerged and have been increasingly gaining traction in the form of TVL over the past couple of months.

To be clear, we would stop short of calling this a “recommendation,” for any of these tokens, since they are quite diminutive from a market cap perspective, lack liquidity, and carry a decent amount of smart contract risk.

However, for those looking to venture out on the risk curve, experiment with an emerging ecosystem, and possibly benefit from both Arbitrum-specific and Merge-related tailwinds, this list is a good place to start.

Take What the Defense Gives You

We titled this note “take what the defense gives you.” It is the start of fall, so forgive us for having football on the brain. But as the saying goes, oftentimes play calling is a lot easier than many would have you believe. If defenders are putting 8 in the box, throw the ball – if they are playing off the ball, run it up the middle. We suppose the difficulty in this process is reading the defense and anticipating what is going to be called ahead of time. That is the art of what we do.

As we sit here at the start of September, we see a market that is positioned negatively against an asset in ETH that has a fundamentally bullish catalyst on the horizon (yes, there is still technical risk in the Merge, but it is overpriced in our opinion). There is an inflation figure being released just before the Merge that we think has a strong probability of coming in soft, and there is a layer 2 network in Arbitrum that is outwardly signaling that they are going to do what they can to attract capital to the ecosystem.

The best risk/reward opportunities often arrive when people ignore the defense, and right now, in the immediate term, we have an opportunity to throw the ball over the top of defense that is stacking the box. Apologies for the extended sports metaphors. We will try to cut back on them next week.

Strategy

We continue to be long BTC 0.84% , ETH 0.98% , and SOL into year-end and think that Merge-adjacent names, including LDO, RPL, OP, and MATIC, still present attractive opportunities for high-beta exposure into the Merge. Investors should look to use any dips as buying opportunities.