Nothing Has Changed Except Price

Key Takeaways

- Our constructive outlook on crypto in 2H and our thesis on ETH outperformance remain intact. We highlight reasons suggesting the latest pullback is attributed to technical exhaustion and leveraged liquidations in a low-volume environment.

- The divergence in short-term correlations between ETH, BTC, and equity indices provides color on ether’s recent outperformance.

- We highlight several different trading strategies that investors are employing to establish a bullish position around the Merge, two of which are designed to mitigate macro risk.

- Bitcoin miners continue to raise cash, as miners sold more BTC in July than they mined.

- Strategy – We continue to be long BTC 0.84% , ETH 0.98% , and SOL into year-end and think that Merge-adjacent names, including LDO, RPL, OP, and MATIC, still present attractive opportunities for high-beta exposure into the Merge. Investors should look to use any dips as buying opportunities. The recent rally, coupled with prevailing market narratives and miner dynamics, suggests it might be wise to be overweight large cap altcoins in the medium term.

Risk Assets Retreat (For Now)

After several consecutive weeks of bullish price action across risk assets, we have seen markets pull back on both technical exhaustion and underwhelming global economic data.

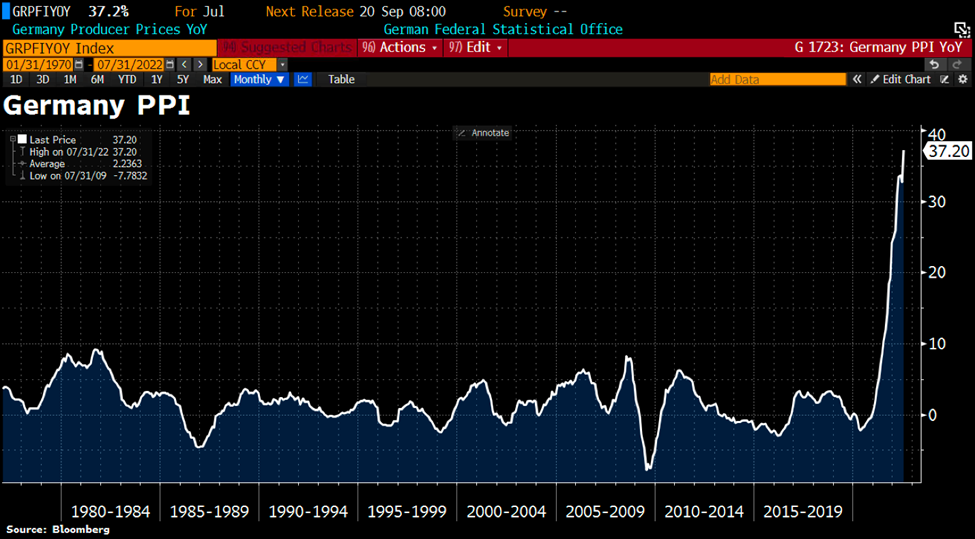

As we write this note, the global crypto markets have retraced 7.0% over the preceding 24 hours, with the most substantial drawdown occurring in the overnight hours upon the opening of equity markets in Europe. Ongoing concerns over the potential for an impending energy crisis were exacerbated by an elevated German PPI number that shattered analyst expectations.

Beyond this morning’s price action, we have watched all week as rates have moved higher on the back of some hawkish Fed commentary, pushing the dollar higher as well. Below, we see that the DXY has moved conclusively higher, and without any idiosyncratic bullishness in the crypto markets this week, both BTC and ETH have moved lower with unrivaled synchronicity.

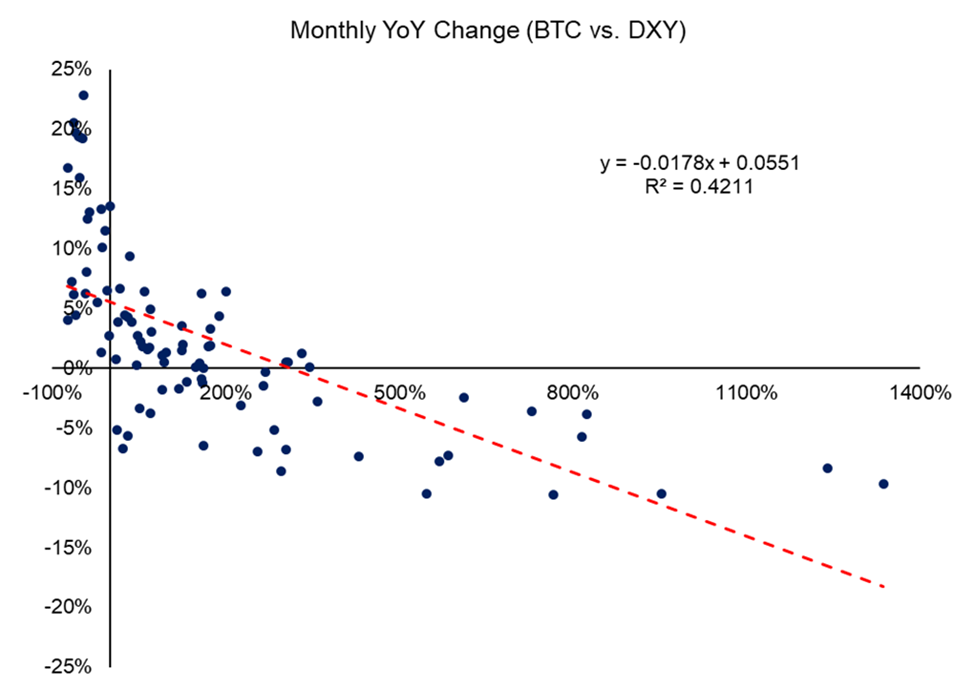

As a reminder, in bitcoin’s short existence, it has had a relatively strong inverse relationship with the DXY. Of course, this makes sense, given it has generally served as beta on risk assets. The chart below features monthly returns since 2015 for DXY and BTC.

More Bark Than Bite

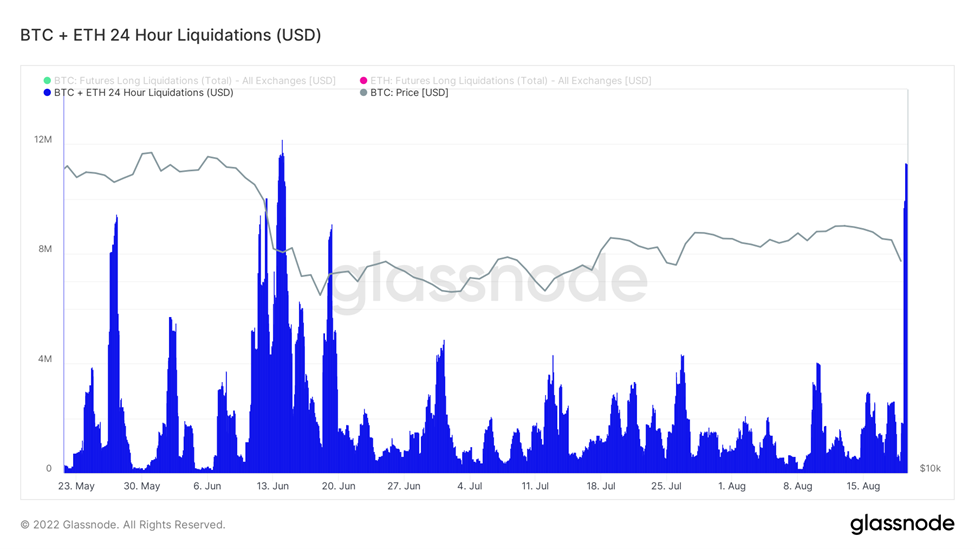

As mentioned above, this week’s pullback can best be characterized as having more bark than bite, as most of the price action in crypto was triggered by sizeable liquidations of leveraged-long positions. Below we can see that BTC and ETH liquidations over the last 24 hours have rivaled some of the worst days of an objectively tumultuous, liquidation-filled year.

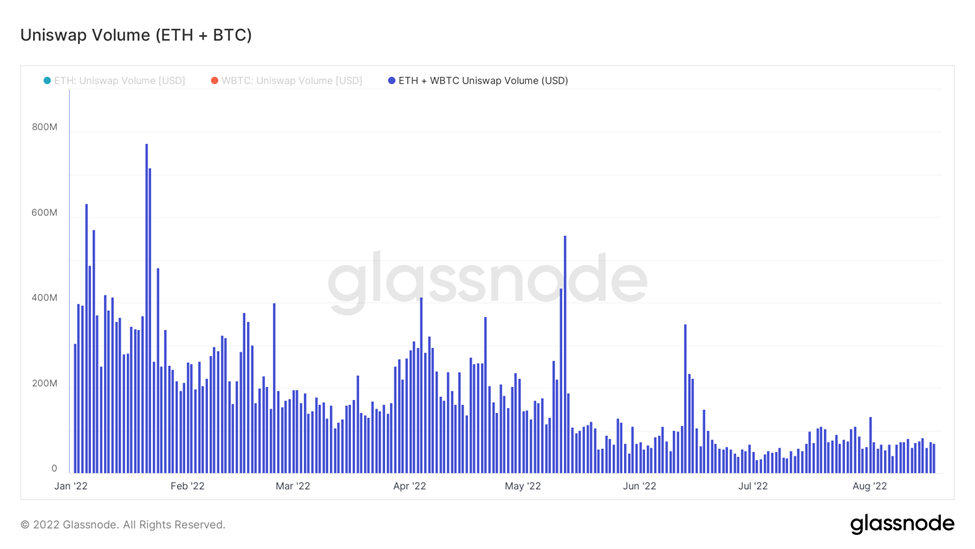

To corroborate this viewpoint, we can look to spot volumes that should demonstrate a relative lack of buying and selling. Below we can see that USD volumes for both ETH and WBTC on Uniswap (UNI) were relatively muted compared to the pair of liquidation cascades in May and June. We would expect more spot selling if this were an actual capitulatory event rather than a technical pullback augmented by leveraged traders caught offsides.

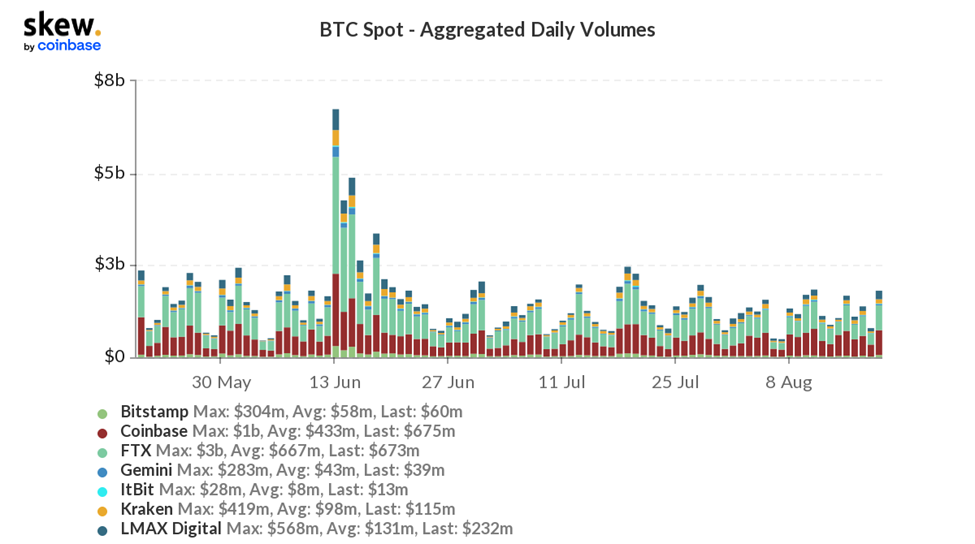

To close this loop, we can look at spot volumes on centralized exchanges, which paint the same picture.

A Look at ETH Relative Outperformance

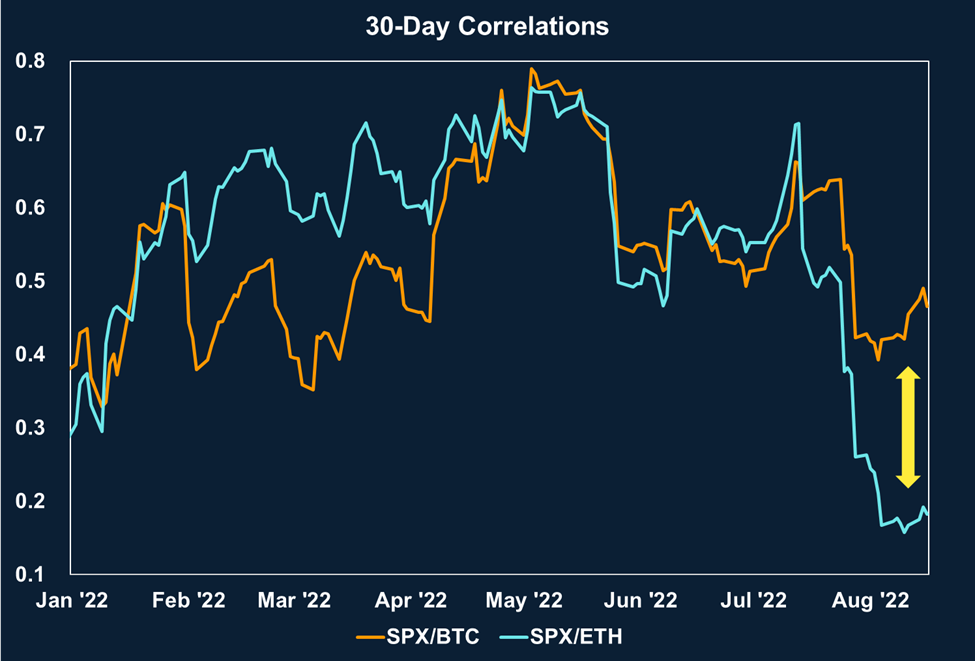

If you follow our work, you know we have been relatively more constructive on ETH than BTC, largely due to the impending Merge and excessive stress on Bitcoin miners. While we appreciate that equities often dictate the directional bias of ETH and the broader crypto market, we would like to briefly look at some charts that provide nuance to the discussion of correlations and speak to ether’s demonstrable outperformance YTD.

First, observing the short-term correlations with traditional equity indices is important. Below we map out the 30-day correlations between ETH and BTC to the ^SPX and QQQ 0.88% . While both leading crypto names have moved in tandem with each other for the better part of this year, we see a clear divergence starting about a month ago, in which ETH began to move towards a correlation of 0, and BTC remained generally correlated to SPX. While it is reasonable to assume that correlations in the immediate term could start to rise, this is a critical divergence to keep in mind as we move closer to Mainnet Merge on September 15th.

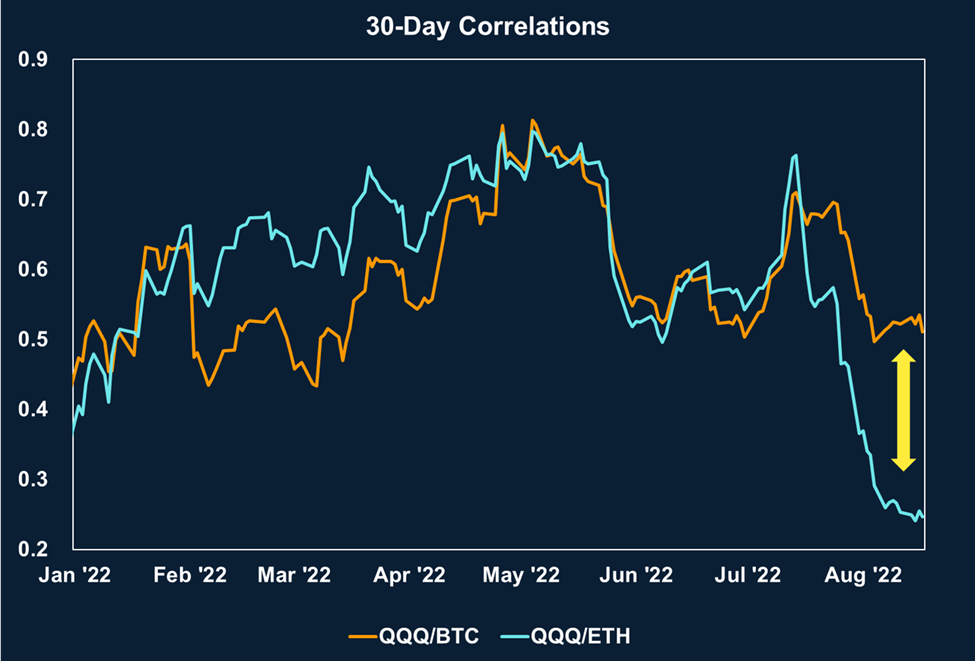

The correlations with QQQ 0.88% are even more pronounced, with ether’s correlation continuing to decline as bitcoin turns higher.

Bitcoin has long been the preferred “liquidity sink” in crypto markets. However, we would argue that over the past few months, ETH has supplanted BTC as the preferred liquidity sponge, as ETH dominance (excluding leading stablecoins) has moved 30% higher while BTC dominance has moved 9% lower since early July.

Some Popular Ways Traders Are Positioning Around the Merge

With a macro setup that we feel constructive on but could reasonably be categorized as “messy,” many investors are finding unique ways to position around the Ethereum network upgrade. The three most popular ways to approach the Merge thesis:

- Long Spot or Futures

- Delta Neutral / Fork Trade

- Long ETH/BTC

Long Spot/Futures

This is the simplest way to approach the balance of this quarter. Being long spot, ETH allows one to capture upside that could be amplified by easing inflation figures in September. It will also enable the investor to capture the forked ETH token investors are planning to be “airdropped” to ETH tokenholders following a successful Merge and subsequent fork of the existing PoW chain.

The significant risk here is an unforeseen drastic change in the macro backdrop that leads to a broad selloff in risk assets to the extent that even a bullish catalyst like the Merge is susceptible to price declines.

Delta Neutral (the “Fork Trade”)

As noted above, there is a high probability of a forked token being released into the market, like the forked bitcoin tokens such as bitcoin cash that were airdropped into user wallets during the blocksize wars several years ago. Despite the high probability of this ETH PoW chain being devoid of any applications or usage, there is a non-zero chance of these tokens being worth a non-negligible amount, as demonstrated by previous bitcoin fork tokens that are rarely used but still attract hash power and have a price greater than zero.

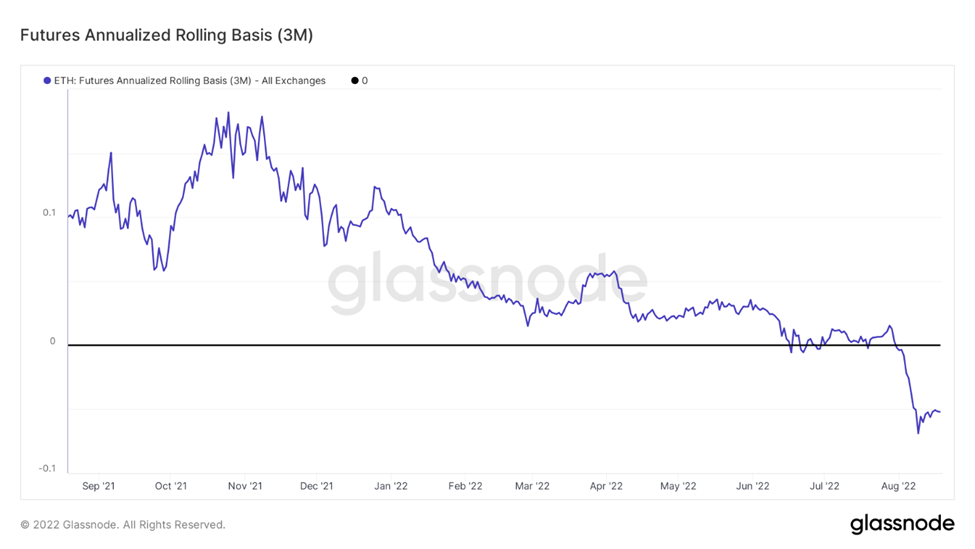

Below we see that ETH futures have turned negative, indicative of traders shorting futures contracts and going long spot. This allows for a risk-mitigated, delta-neutral way to farm the forked token. This risk with this strategy is that the futures market is mispricing the forked token (currently about 5% of ETH price) to the upside and that as an investor, you could miss out on potentially substantial gains in spot ETH holdings.

Long ETH/BTC

This is another way to mitigate global macro risk, but in a way that bets on the continued outperformance of ETH relative to BTC. While we would posit that actively shorting BTC is a risky endeavor, in this circumstance, it makes logical sense if you assume that macro might force most of crypto marginally lower while ETH continues to outperform on a relative basis. The risk here is that the spread between ETH and BTC performance is lower than anticipated, and thus gains are muted.

More Signs of Bitcoin Miner Stress

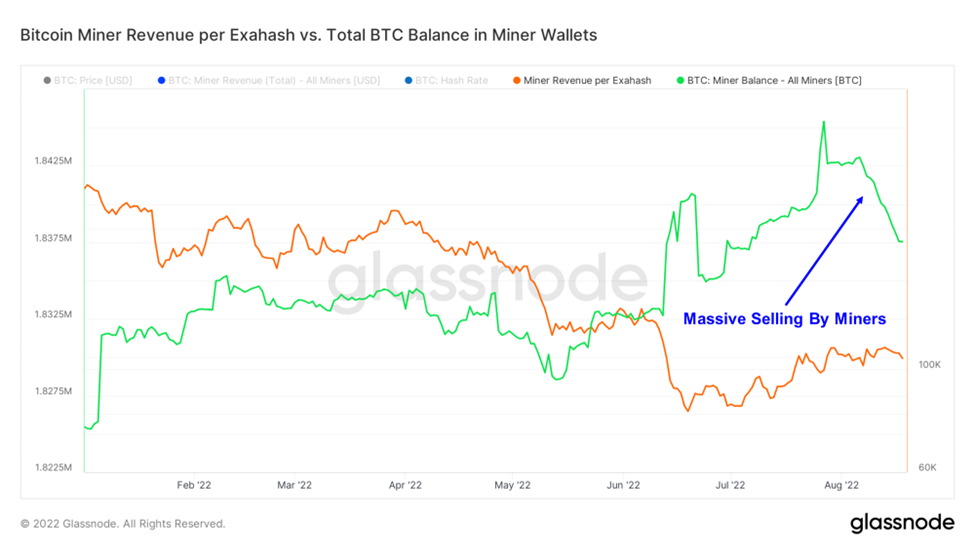

We will keep this section brief since it is a drum we have been beating for a while now. Miners continue to show a bias toward raising cash, as many debt-laden and less well-capitalized miners have liquidated a considerable portion of their BTC over the preceding couple of months.

The past few weeks have seen a relative onslaught of selling pressure from miners. Since the beginning of August, miner balances have moved conclusively lower.

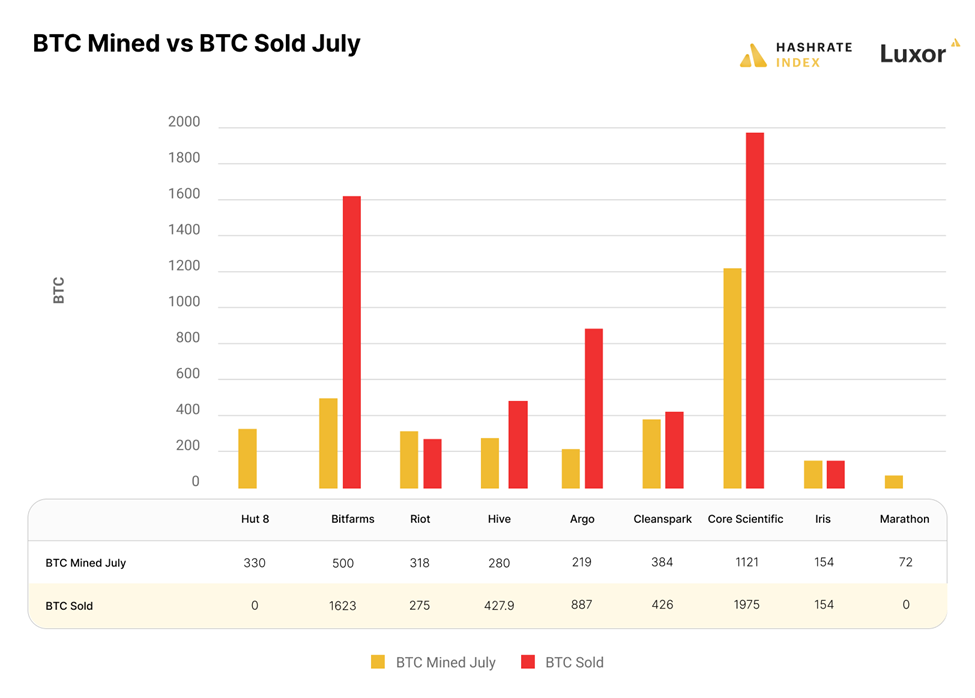

This August selling comes on the heels of a July in which the world’s largest miners sold more BTC than they mined. With difficulty lower in July than preceding months, these miners were likely taking advantage of comparatively healthy margins.

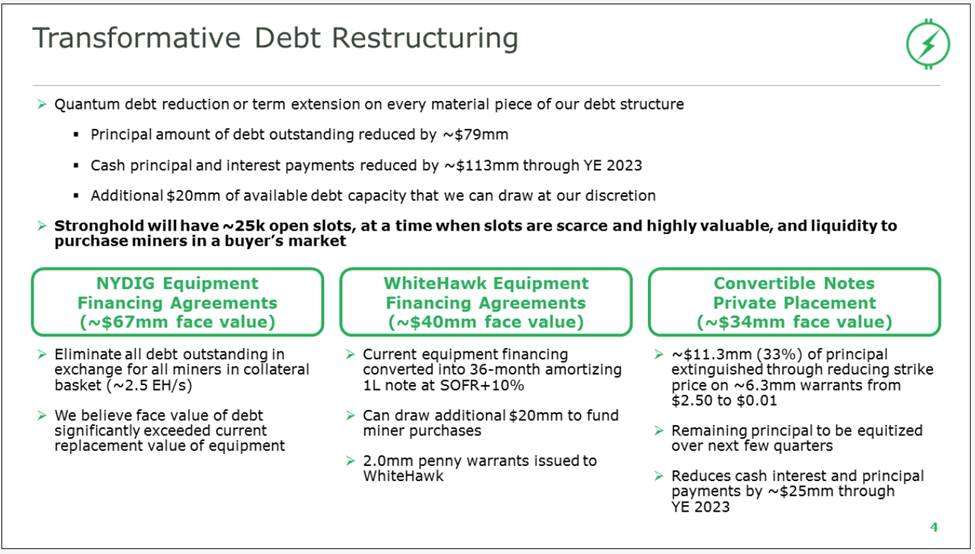

We even saw a publicly traded miner need to undergo a debt refinancing this week. A page pulled from Stronghold Digital’s most recent earnings report suggests a surrender of ASIC collateral in exchange for extinguishing debt.

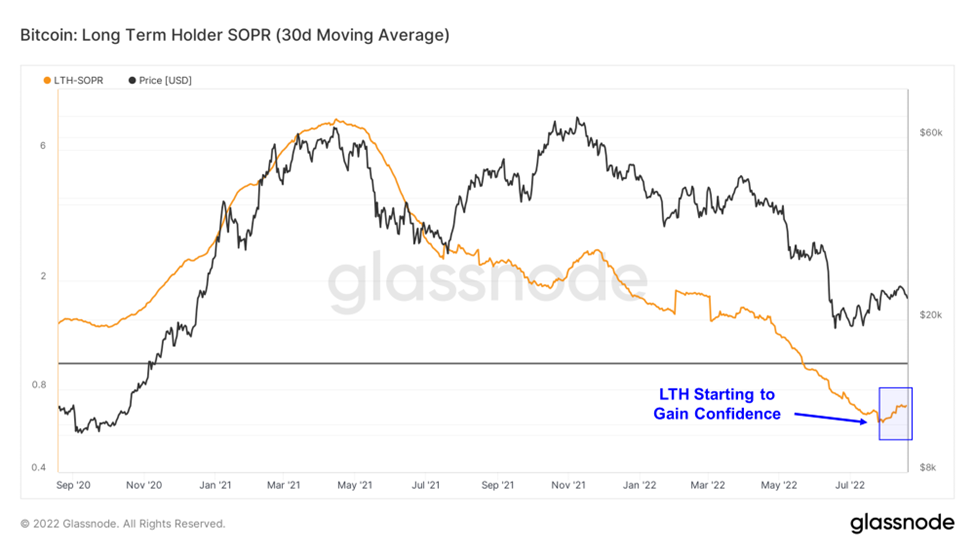

Encouragingly, for the first time, we are seeing signs that the liquidity conditions might be looking more constructive for bitcoin moving forward. Note that these are preliminary observations and are in no way indicative of a conclusive trend reversal.

As a reminder, SOPR gives us an idea of the overall profitability of holders selling their BTC on any given day. If SOPR is below 1, investors are exiting positions at a loss, while a SOPR above 1 means the average holder is selling for a profit. Therefore, SOPR trending higher essentially indicates that investors are gaining confidence that prices will continue to increase and are holding for a more profitable exit.

We can see that long-term holders of BTC are starting to gain increased confidence in bitcoin price action, holding on to sell at incrementally more profitable levels.

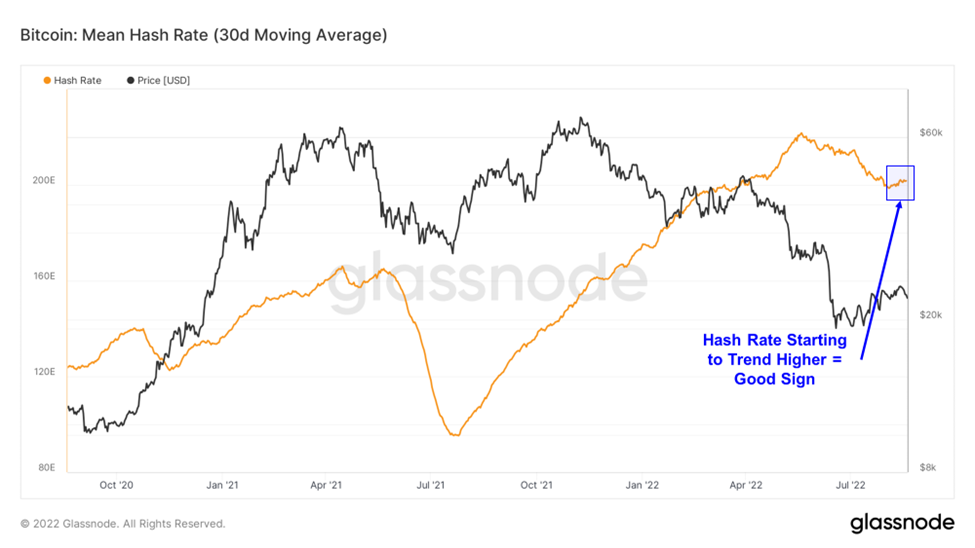

Likely influenced by a decrease in mining difficulty, we see the trend in hash rate start to reverse higher. While we would like to see this metric trend higher for a more extended period, this is nonetheless a promising development for the network.

Strategy – We continue to be long BTC 0.84% , ETH 0.98% , and SOL into year-end and think that Merge-adjacent names, including LDO, RPL, OP, and MATIC, still present attractive opportunities for high-beta exposure into the Merge. Investors should look to use any dips as buying opportunities. The recent rally, coupled with prevailing market narratives and miner dynamics, suggests it might be wise to be overweight large cap altcoins in the medium term.