High Beta Merge Ideas

Key Takeaways

- Another week of risk assets performing well in the face of subpar economic data combined with surprisingly positive tech earnings suggests this year’s bottom is in.

- We provide an update on the Ethereum Merge’s timing and look at how the market is positioning around the event.

- We discuss potential opportunities in liquid staking provider governance tokens (LDO, RPL) and scaling solutions (MATIC, OP 10.24% ) for those looking to make higher-risk bets on the Merge.

- Strategy – We are long BTC, ETH, and SOL N/A% into year-end. Long and medium-term investors should look to use any dips as buying opportunities. The recent rally, coupled with prevailing market narratives and miner dynamics, suggests it might be wise to be overweight large cap altcoins in the medium term.

Data Dump

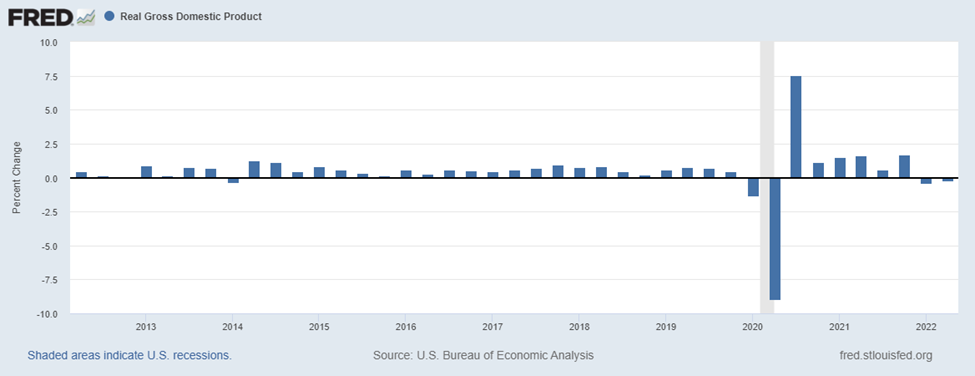

Last week, we discussed the market’s positive reaction to the deluge of negative economic data. Despite a continued murky economic outlook, risk assets performed well. This was an encouraging sign that gave us confidence that we have seen the market put in this year’s lows.

We also mentioned that this past week would be another crucial week of data, with an expected negative real GDP report, a consequential FOMC meeting, and a slate of critical tech earnings.

On Wednesday, Chairman Powell took to the podium and announced that the Fed was raising rates by 75 bps. The market reacted positively and perhaps even interpreted the FOMC press release and subsequent press conference as dovish, given the sustained rally the following day.

On Thursday, GDP came in negative for the 2nd consecutive quarter, which was unsurprising. However, like the action around rate hikes, markets took this in stride.

The other critical risk heading into the week was a slate of big tech earnings. While Facebook had its metaverse-driven woes, other large-cap names, including Amazon, Microsoft, and Apple, all had relatively positive earnings compared to market expectations.

We think this is a good sign that implies a more robust consumer than GDP would suggest and removes the “earnings revisions” risk for risk assets in the immediate term.

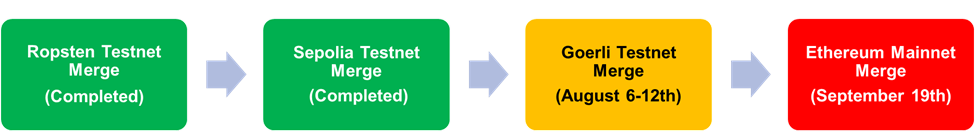

Merge Timeline Ossifying

This week, we also received confirmation regarding the timeline of the Merge. The final testnet is scheduled to take place starting next week. Should all go well with this last trial run, it will be all systems go for the Mainnet Merge on September 19th.

Below, we update the Merge timeline we have been using to reflect this new data.

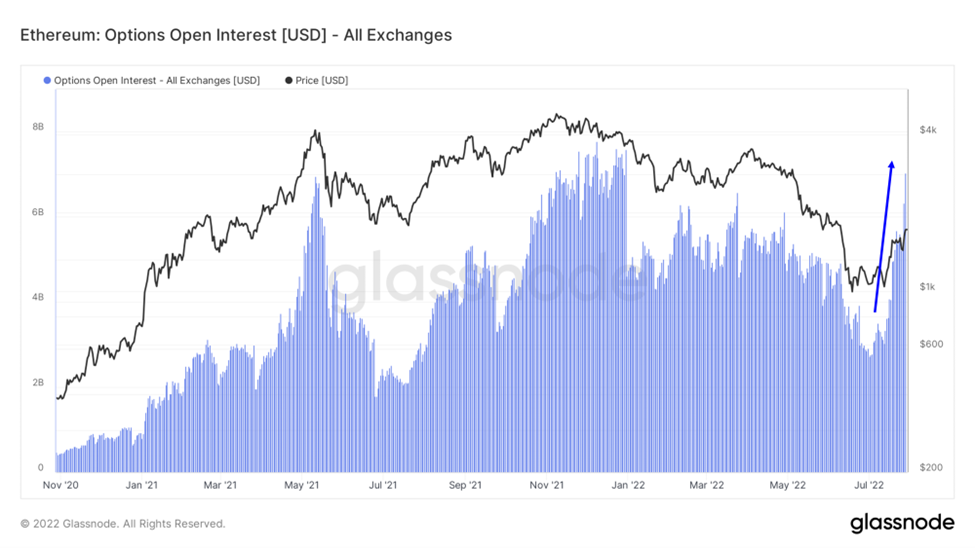

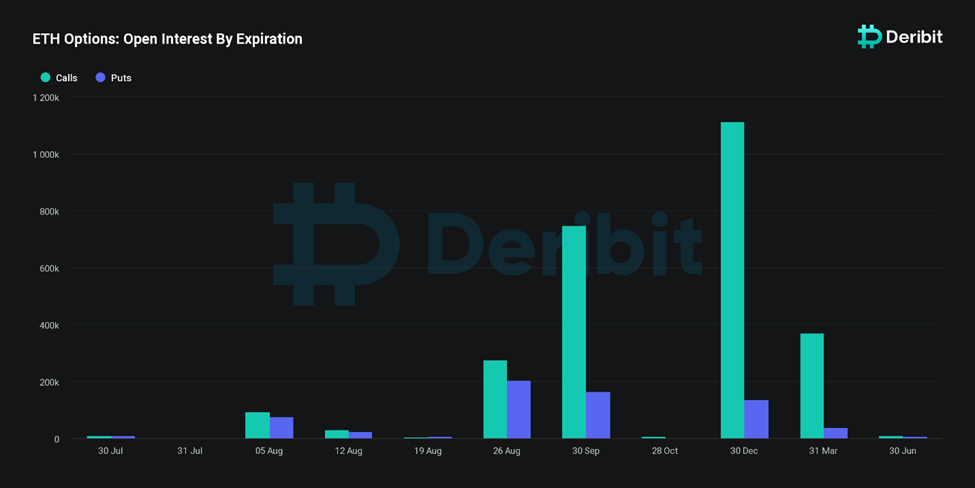

We have continued to see the derivatives markets place considerable wagers on Ethereum’s transition to proof-of-stake, as demonstrated by the parabolic increase in options open interest.

Below, we can see that the lion’s share options OI for September and December are calls. Put/call ratios for each term are 0.22 and 0.12, respectively. Meanwhile, the put/call ratio for August options is 0.74.

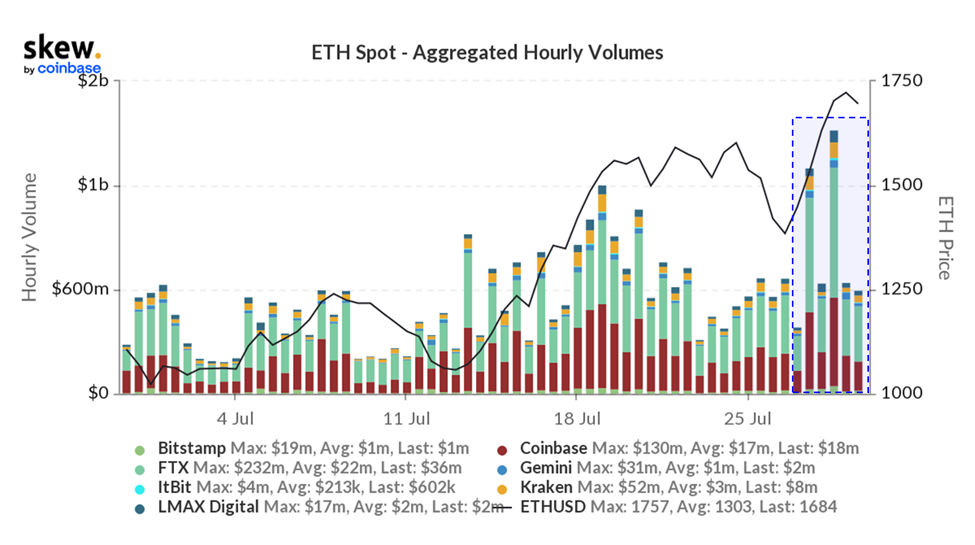

However, the speculation on ETH outperformance is not limited to options and futures markets. Below we see a pair of observable spikes in spot volume this week.

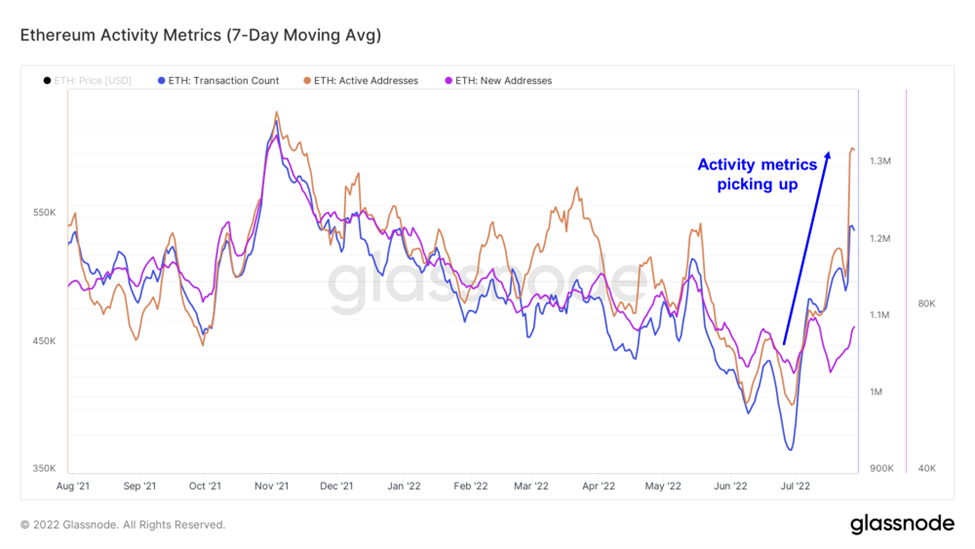

Further, we see increased on-chain activity within the Ethereum ecosystem. While new entrants into the ETH market are still relatively flat, transactions and active wallet figures are increasing substantially.

Demand to participate in the Ethereum economy provides a more constructive backdrop for the prospects of a sustained rally into the Merge.

High Beta Plays into the Merge

Now that we are likely to have a more constructive macro setup over the next month or two, we can be more aggressive in opportunistically opening positions in anticipation of the September transition.

For those looking to venture further out onto the risk curve, the past couple of weeks has shed some light on some of the better places to look for higher-risk plays on the Merge.

Last week, we discussed the increase in the price of liquid staking provider Lido (LDO).

For those just entering the fold, Lido provides a valuable service that allows Layer 1 token holders to lock up their tokens and earn staking rewards. Its most popular implementation of this service is on the Ethereum network. Lido users are issued a derivative token ($stETH) which can be used as collateral in various DeFi applications. Ultimately, the token provides holders the right to redeem 1 ETH upon the completion of the Merge and the eventual unlocking of ETH committed to the Beacon Chain.

While it has been a valuable addition to the DeFi ecosystem, it has sometimes caused headaches for those using it as collateral since the price of stETH can diverge from the price of ETH due to the inherent risk of Merge delays and the potential for slashing.

Lido’s governance token, which allows its holders to vote on proposals surrounding critical decisions for the project, has surged on the back of increased confidence in the Merge.

We think it is possible that as we approach the September target Merge date, LDO and perhaps competing Ethereum liquid staking provider Rocket Pool (RPL) perform as high-beta plays to ETH.

In terms of entry price, it is worth noting that it has been a couple of weeks of incredibly bullish price action, so an immediate term pullback is always possible for such volatile names. However, despite the recent price action, both names are trading well below all-time highs, which means there is likely still ample opportunity to perform into September.

We have also seen Ethereum scaling solutions witness massive inflows on the back of Merge momentum.

Below we see a parabolic rise in prices for both Optimism (OP 10.24% ) and Polygon (MATIC), two layer 2 networks that are part of the broader Ethereum ecosystem.

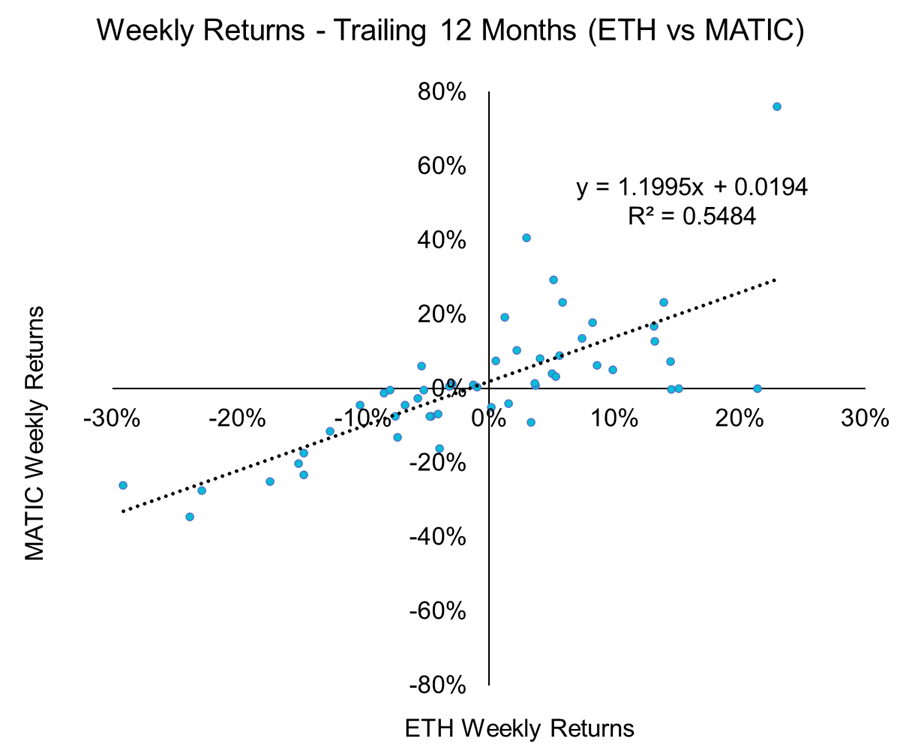

In contrast to the liquid staking governance tokens discussed above, a bet on layer 2 tokens performing as high beta plays on Ethereum has ample precedent.

Below, we plot the relationship between the daily returns of Ethereum and Polygon over the previous 12 months. This is an excellent data sample because the preceding 12 months have been quite shaky. Thus, one can not conclude that this strong relationship is from the entire market being in “up-only” mode.

The relationship is strong and positive and suggests outsized moves for MATIC relative to movements in ETH. The figures below would imply a 122% increase in MATIC price on a hypothetical 100% increase in ETH price.

For those looking to make higher-risk bets on the Merge, beyond holding ETH, we think that two opportunities lie in liquid staking governance tokens (LDO and RPL) and leading scaling solutions (MATIC, OP 10.24% ).