Derisking Continues After NFP Data, Celestia Releases 1GB Block Roadmap

Market Update

Risk assets are selling off following the release of Non-Farm Payrolls data this morning, showing 142k payrolls added in August compared to 165k expected, along with June and July numbers being revised sharply lower. The data has fueled recession fears while also sparking uncertainty over the Fed’s policy path and whether they will cut rates by 50bps or 25bps this month. Markets are currently leaning towards 25bps, assigning a probability of 75%, and pricing in close to a 50/50 chance of 100bps of cuts before the year ends. The SPY -0.12% has dropped to $542 and the QQQ -0.06% has fallen to $450 and rates continue to roll over. BTC 0.67% has dropped to $54.4k and ETH is displaying slight strength, falling to $2,315, and ETHBTC increasing 0.85%. Despite Bitcoin and Ether falling more than 3%, altcoins are holding relatively well, with TOTAL3 only down 0.90%. Gainers on the day include SUI 0.56% , ARB -4.27% , OP 5.10% , ONDO 1.16% , and APT 11.50% .

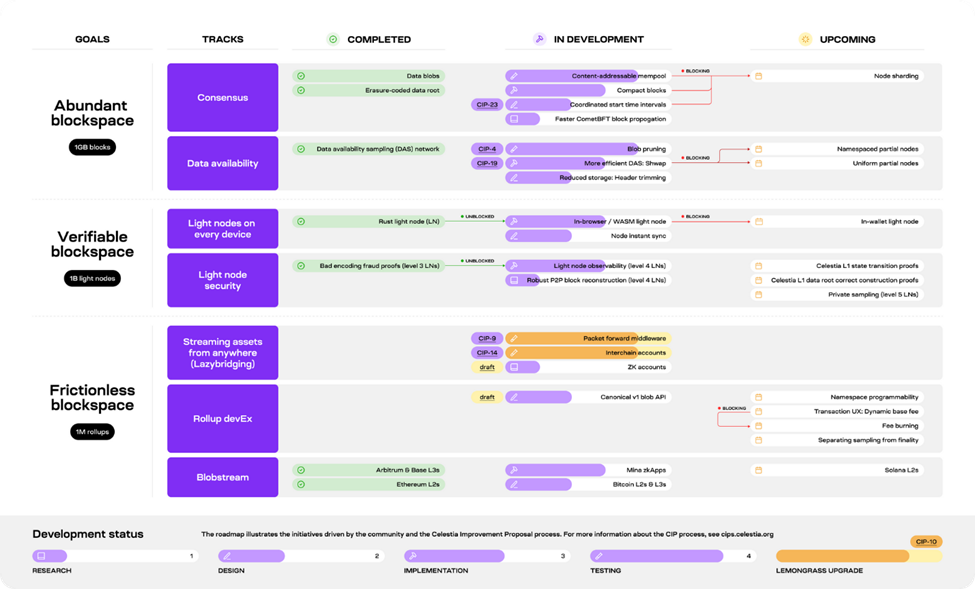

Celestia Releases New Roadmap

Celestia, data availability layer, released its updated roadmap, outlining its plans to scale towards 1GB blocks. The roadmap is organized into three different workstreams: abundant block space, verifiable block space, and frictionless block space. Celestia needs to ensure there is abundant block space for high throughput coming from various rollups, whether they are micropayment networks, on-chain games, or defi applications. Larger blocks can be achieved by optimizing Celestia’s consensus mechanism and supporting better data availability through sampling and reconstruction of larger blocks to lower node resource requirements. Secondly, larger blocks need to be able to be verified by anyone, which can be achieved through light nodes on any device, decentralizing the network and minimizing trust assumptions across node operators. Lastly, Celestia plans to reduce friction for developers with the implementation of lazy bridging and blob stream which should greatly enhance Celestia’s interoperability across the base layer, rollups, and other L1’s. Since launching last year, Celestia has grown its ecosystem to 20 rollups, and its blobs represent over 40% of data published.

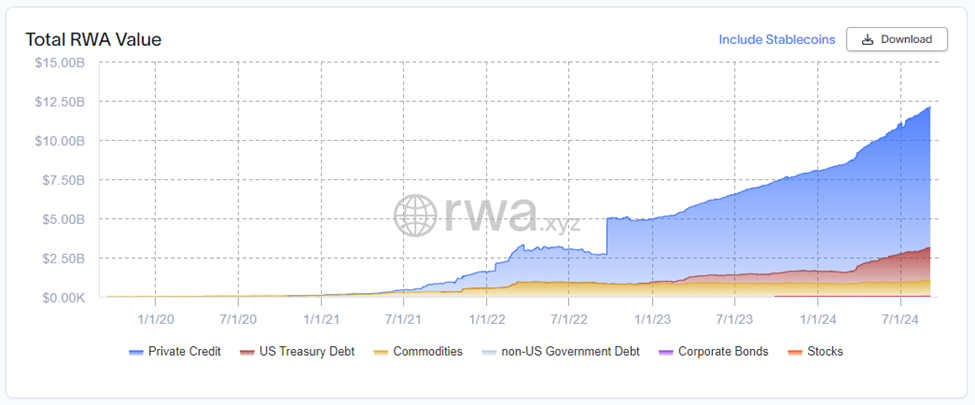

Libre Brings TradFi Funds to Aptos

Libre, a tokenization protocol, has launched three new tokenized funds from traditional finance managers on the Aptos Network. The funds include the Brevan Howard Master Fund, Hamilton Lane’s Senior Credit Opportunities Fund, and Blackrock’s ICS Money Market Fund, which collectively hold over $90 billion in AUM. Libre gives accredited investors access to traditional funds via blockchain networks with its fully digitized investment lifecycle, unlocking cost efficiencies and improving opportunities for investors and asset managers alike. Its API-first platform allows asset managers to seamlessly integrate into its suite of products and data infrastructure. Libre went live in Q1 this year, starting on Polygon and supporting tokenized funds, collateralized lending of SMAs, and access to crypto-native funds including Laser Digital’s (Nomura) Market Neutral Fund. Tokenized assets continue to gain meaningful traction, with total RWA assets (not including stablecoins) approaching $12.5 billion, almost double compared to this time last year.

Technical Strategy

Today’s break of August lows in Ethereum could likely result in even further losses for the month of September, as price has reached the lowest level since February. Weekly charts help to put this recent price damage into perspective, and suggest that ETH 0.63% likely will weaken down to what’s widely seen as strong support between $1900-$2000. This level represents both early August intra-month lows, along with adjoining a larger support trendline since June 2022, more than two years ago. However, despite this week’s trend deterioration, the one positive concerns the wave structure of the pullback since May 2024 which now clearly resembles the final wave of the most recent decline from May peaks which started just below $4,000. Overall, the severity of this week’s decline can allow for another 10% decline into mid-to-late September. However, this should be seen as a very strong area of support that would make ETH 0.63% an attractive risk/reward following a completed five-wave decline from May peaks four months ago.

Daily Important MetricsAll metrics as of 2024-09-06 13:23:44 All Funding rates are in bps Crypto Prices

All prices as of 2024-09-06 13:41:43 Exchange Traded Products (ETPs)

News

|