HNT Continues Outperformance as Offload Data Grows, Stacks Begins Nakamoto Upgrade

Crypto Market Update

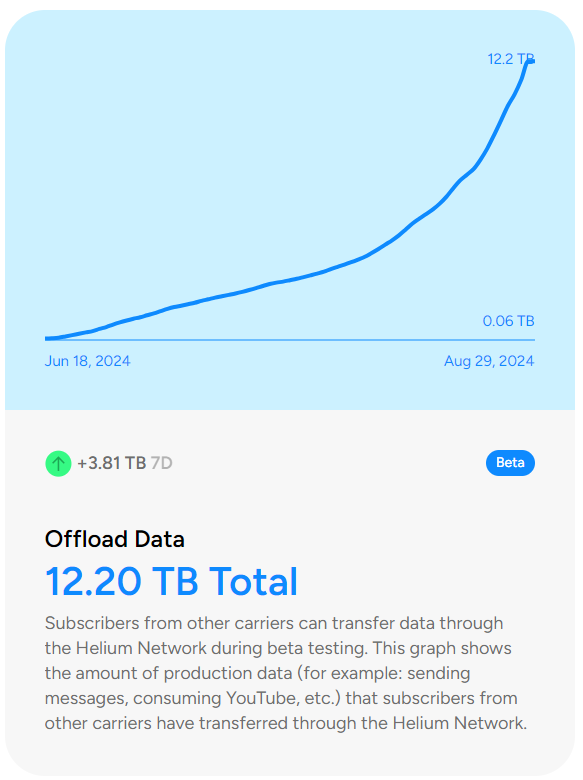

In stark contrast to the recent BLS job number revisions, the government revised its Q2 GDP estimate higher this morning to 3%, leading to a jump in rates and the DXY. However, this data also apparently boosted confidence in the soft landing trade, as rate-sensitive indices like IWM are outpacing ^SPX and QQQ 0.88% . Chip-adjacent stocks are also performing well, spurred by another earnings beat from NVDA -0.84% , benefiting miners in our AI basket, including IREN -2.71% , HIVE -1.03% , WULF -1.87% , and CORZ -2.84% . BTC 2.85% has rebounded to nearly $61k, while ETH 3.39% and SOL 4.65% are lagging, trading around $2600 and $145, respectively. The standout performer is once again HNT 5.63% , which continues to excel in line with the adoption of the ongoing carrier offload program for Helium Mobile. The program has gained 120k new subscribers over the past 7 days and has offloaded 12.2 TB of mobile data since its inception in mid-June.

Stacks Begins Nakamoto Activation

The Nakamoto Activation Sequence for Stacks (STX N/A% ) commenced yesterday as the final code was delivered to network operators. They now have one Stacking Cycle (Cycle 92) to upgrade their systems. Following a successful transition from Cycle 92 to Cycle 93, core developers will select a final hard fork block to fully activate the Nakamoto rules, which will introduce faster blocks and full Bitcoin finality. The sBTC, a bridging asset that allows Bitcoin to be used within the Stacks ecosystem for decentralized finance (DeFi) and smart contracts, is expected to be ready for mainnet release approximately four weeks after the hard fork. However, developers are targeting at least two full stacking cycles of network stability before releasing sBTC.

IREN Reports Strong Earnings

IREN -2.71% , formerly Iris Energy, reported $184.1 million in Bitcoin mining revenue for the fiscal year ending June 30, 2024—a 144% increase from the previous year, driven by nearly doubling its self-mining capacity from 5.6 EH/s to 10 EH/s and mining a record 4,191 BTC. The company also generated $3.1 million in AI cloud services revenue. Despite increased electricity and operational costs, IREN reduced its net loss to $29 million, down from $171.9 million the prior year. With a total capacity of 15 EH/s as of August 28, IREN aims to reach 30 EH/s by the end of 2024. IREN, one of the names in our HPC miner basket, is up over 20% on the current bounce in BTC, favorable earnings, and an NVDA -0.84% earnings report that confirmed the broader AI compute demand remains robust.

Technical Strategy

Helium continues to show impressive strength and with Thursday’s rise above $7.515, looks set to close at the highest level since early March. This is bullish for HNT 5.63% , and likely drives price up to $10-$10.50 which would serve as the first meaningful level of resistance for HNT on this rally since early July. Momentum has failed to get too overbought given the stair-stepping nature of this rally, but its uptrend from July is very much intact and the pullback in August failed to do much damage ahead of this week’s rally. Rallies look likely into mid-September before this shows much evidence of stalling out, and dips likely are buyable at $6.15-$6.50 before this pushes back to new monthly highs.

Daily Important MetricsAll metrics as of 2024-08-29 16:45:31 All Funding rates are in bps Crypto Prices

All prices as of 2024-08-29 16:45:11 Exchange Traded Products (ETPs)

News

|