Grayscale Prepares for Bitcoin Mini Trust, SEC Amends Binance Complaint

Crypto Market Update

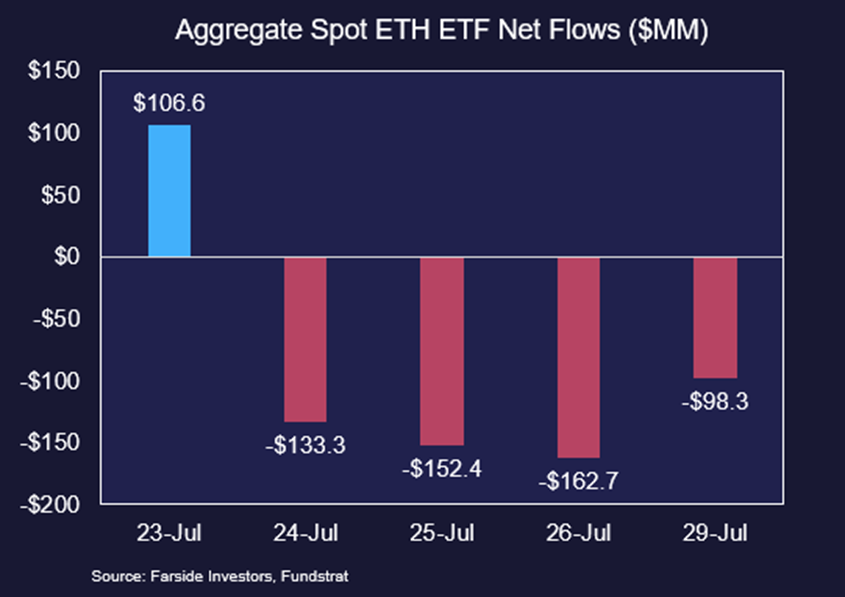

U.S. equity indices are moving lower, with the SPY -1.19% trading at $540.95 and the QQQ -1.68% showing more pronounced losses, trading at $457.75. Economic data this morning exceeded expectations, with job openings and consumer confidence both surpassing estimates, although rates are still showing modest declines. Crypto assets are mixed, with BTC -1.68% holding slightly above $66k and ETH -0.98% gaining slightly to $3,320, and ETHBTC increasing above 0.05. Yesterday marked the fourth consecutive day of ETH ETF outflows, with ETHE outflows overwhelming the positive flows from other issuers. Net flows have totaled -$440 million since launch, although yesterday represented a decline in the pace compared to last week.

Grayscale Prepares for Bitcoin Mini Trust Trading

Grayscale’s Bitcoin Mini Trust should go effective tomorrow and trade under the ticker “BTC” pending final approval from the SEC. Today is the listed record date for the initial creation and distribution of shares, meaning that from and after today, anyone who purchases GBTC will not be entitled to any Mini Trust shares. 10% of the Bitcoin held in the GBTC trust will be converted to the Mini Trust at a ratio of 1:1. BTC’s fee is set at 0.15%, compared to GBTC’s 1.5% fee. The Mini Trust will give GBTC holders exposure to a lower-fee product without triggering a taxable event and hopefully reduce the amount of outflows from GBTC. GBTC -3.21% was down 10% in early morning trading as they rebalance the two.

SEC Amends Binance Complaint Regarding Third-Party Tokens

The SEC is moving to amend its complaint against Binance, removing its language seeking a court ruling on whether specific tokens sold on Binance were securities. The original complaint filed in November alleged that multiple assets on the Binance platform constituted sales of investment contracts under the Howey test. The third-party crypto assets in question include SOL -1.47% , ADA 1.53% , MATIC 2.78% , FIL 1.93% , ATOM 1.14% , AXS -7.37% , COTI 2.80% , ALGO -0.13% , MANA 2.23% , and SAND -0.54% . In the joint status report filed Monday, the SEC’s proposal would obviate “the need for the court to issue a ruling as to the sufficiency of the allegations as to those tokens at this time.” The defendants and the SEC disagreed on whether the discovery process should begin, with the defendants claiming they would like to see the full amended allegations before allowing discovery to proceed.

Technical Strategy

Ripple traders are hoping that lawsuits potentially come to an end this week as price action continues to reflect lots of near-term optimism. Its daily chart shows the bullish triangle pattern from 7/17 which is giving way to an upside breakout as of today, 7/30/24. Thus, a rally up to $0.68-70 looks likely in the short run (from its current $0.62850 but could prove to be strong resistance into early August. Thus, despite a very good gain throughout the month of July, XRP -0.59% looks to be approaching its first meaningful area of resistance on this rise. Following a test of $0.68 in the days ahead, I suspect that August might give way to some near-term consolidation which might retrace 38-50% of its July gains before additional rallies into this Fall get underway.