Near-Record ETF Inflows, G7 Central Banks Commence Rate Cuts

Crypto Market Update

Risk assets are experiencing a broad rally today, supported by relatively constructive macro data. The significant data point released today was the ISM Services PMI, which came in at 53.8, an expansionary figure above the expected 50.8, and well above the prior month’s 49.4. Importantly, prices paid came in at 58.1, below the expected 59, which is a positive sign from an inflation perspective. As expected, the Bank of Canada cut its benchmark overnight rate by 25 basis points to 4.75%, commencing the cutting cycle among G7 countries. The market anticipates a similar cut from the ECB tomorrow. BTC -7.76% has rallied back to above $71k, attempting to break through the May 20th high of $72k. SOL -13.45% is following suit, up a similar amount and attempting to move above $175, while ETH -16.30% is still churning sideways just above the $3800 level. Major outperformers of the day include a pair of memecoins, ORDI -27.95% and FLOKI N/A% , as well as STX -0.22% , which has followed through on its strong performance yesterday, up another 10%. Rates are moving lower across the curve yet again, with the 10Y below 4.3% for the first time since early April. Major equity indices are in the green, with tech showing strong outperformance.

Flows Returning in a Big Way

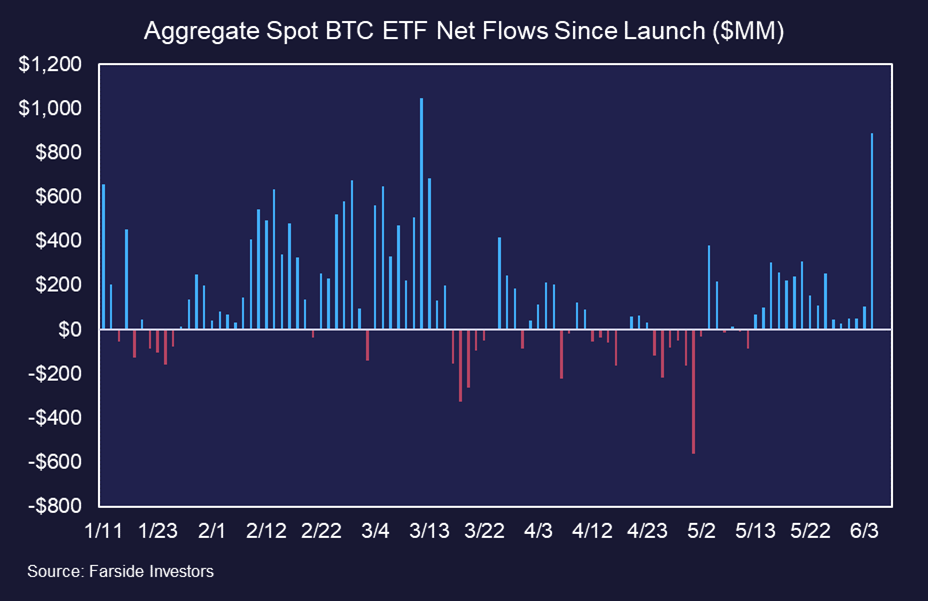

Yesterday, we saw nearly $900 million in total net inflows into BTC spot ETFs, marking the second-highest daily total since their launch and the 16th consecutive day of aggregate net inflows. This suggests that recent economic data, which is trending towards a Goldilocks-like setup, is bringing flows back into the market. Fidelity had an impressive day with $379 million in inflows, while IBIT followed closely behind with $274 million.

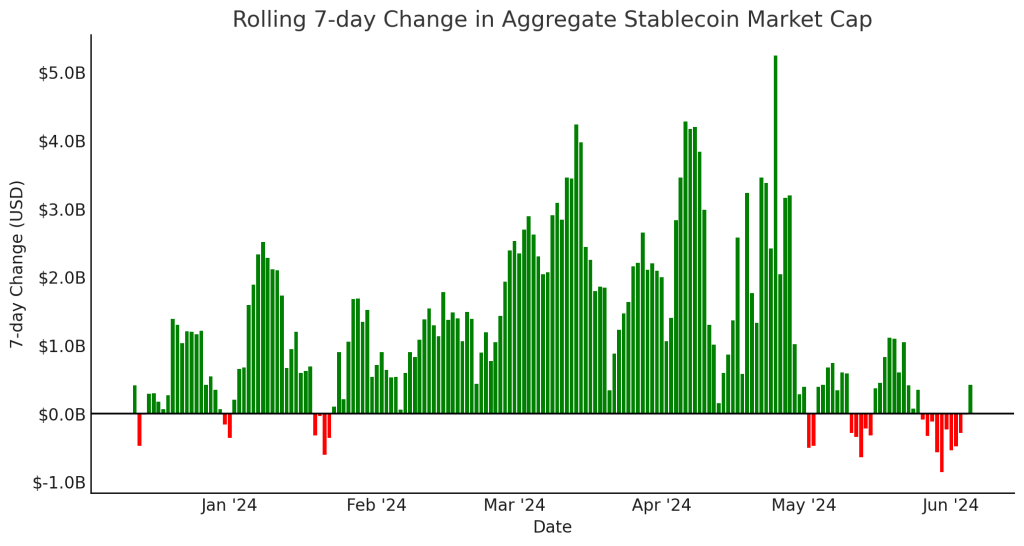

Additionally, we are seeing some positive movement on the stablecoin front. Recently, this has been one of the more negative data points, with the aggregate stablecoin market cap declining towards the end of May and into June. However, we have seen stablecoin growth for 5 out of the last 6 days, another positive sign of flows returning to the market.

Source: DefiLlama, Fundstrat

Short Position Report on RIOT

Kerrisdale Capital released a short position report on Riot Platforms (RIOT -0.42% ), criticizing U.S. bitcoin mining companies for their unpredictable revenue, high capital costs, fierce competition, and regulatory challenges. They argue that Riot’s reliance on stock dilution, operational inefficiencies, and decreasing profitability make it a fundamentally poor investment compared to direct bitcoin holdings, predicting the stock will underperform as these issues become more evident to investors. Kerrisdale highlights the increasing global competition from new mining projects and the dominance of Chinese equipment suppliers. Our initial take is that it is hard to argue against the dilution point, which has disappointed many and is a major reason the company has underperformed year-to-date. However, we view that as already being priced in. Miners are historically a cyclical trade reliant on BTC’s reflexive performance, the company’s operational leverage, and occasionally squeezed short positions to outperform. Therefore, we have trouble seeing a favorable risk/reward in shorting RIOT here.

Technical Strategy

Maple’s rally to the highest closing levels since mid-April is a promising technical development that should propel this higher up to near $20.50 before much resistance. Technically speaking, the recent two-month pattern resembles a reverse Head and Shoulders pattern and Wednesday’s breakout should help this begin a push back to retrace at least 50% but more likely 61.8% of the prior drawdown from late March without too much trouble. Volume is likely to expand to at least the highest levels in a month as of today’s close, and any act of MPL -11.24% closing near the highs of today’s range should help this breakout extend. Pullbacks should encounter firm support near $15-$15.25 which would make this more attractive on a risk/reward basis. However, given today’s surge, it’s more likely that immediate upside follow-through gets underway

Daily Important MetricsAll metrics as of 2024-06-05 12:00:30 All Funding rates are in bps Crypto Prices

All prices as of 2024-06-05 11:50:22 Exchange Traded Products (ETPs)

News

|

Reports you may have missed

Crypto Receives a Boost from Strong Jobs Print, WULF Sells Hash Rate to Expand AI Capabilities

CRYPTO MARKET UPDATE The crypto market is moving higher today, lifted by stronger-than-expected jobs numbers. The BLS reported 254k jobs added last month, far exceeding the market estimate of 140k, while August's figures were revised up from 142k to 159k. The unemployment rate also dropped to 4.1% from 4.2%. In response, rates rallied, the DXY spiked, and the futures market largely priced out the possibility of a 50 bps rate...

MARKET UPDATE Crypto is broadly lower today as geopolitical conflict continues to weigh on risk assets, with BTC -7.76% falling to $60k and ETH -16.30% approaching the low $2,300s. Aptos (APT -2.11% ) is one of the few gainers in the top 100 tokens as they have strengthened their presence in Japan via an acquisition of HashPalette, a Japanese NFT service provider and developer of Palette Chain. AAVE -22.98% is also showing slight gains following...

CRYPTO MARKET UPDATE Crypto prices have rebounded slightly following yesterday's sharp selloff, with BTC -7.76% climbing back above $61,000 and SOL -13.45% moving above $145, while ETH -16.30% is lagging, trading around $2,400. Among today's outperformers is SUI -22.12% , which appears resilient despite a $115 million token unlock yesterday. Oil is partially retracing its early rally, gold is lower on the day, and yields are moving higher, suggesting at least a temporary reversal of...

MARKET UPDATE Markets are selling off in the first day of Q4, fueled by geopolitical fears as tensions rise in the mid-east. The SPY -0.54% and QQQ -0.15% have dropped 1.14% and 1.92%, respectively, while the VIX has surged over 17%. XAU and DXY are gaining as investors move towards safe-havens. Crypto assets have also sold off, with BTC -7.76% briefly dropping below $62k and ETH -16.30% below $2.5k. Among altcoins, SUI -22.12% is showing...

Articles Read 1/2

Enjoyed the read? Subscribe now for unlimited access!

Get invaluable analysis of the market and stocks. Cancel at any time.

Already have an account? Sign In 1e3fbf-32d937-927b98-a6e3f2-53d52c

Already have an account? Sign In 1e3fbf-32d937-927b98-a6e3f2-53d52c