Silvergate's Future in Doubt, Polygon Releases Digital Identity Product

Market Update

- Traditional indices have continued their slide this week on fears of stickier inflation and higher for longer monetary policy. The SPY 0.14% is down 0.27%, and the QQQ -0.07% has fallen 0.56%, while the DXY (+0.60%) hovers around $105, and US Treasury yields continue to rise. Crypto markets are following suit, with BTC and ETH dropping 1.43% and 2.47%, respectively. Binance’s custodial arm, Ceffu, is resuming its pursuit of a license in Singapore after withdrawing its application in 2021. Ceffu is expected to submit an application to the Monetary Authority of Singapore as soon as registration opens. The move comes as Binance is trying to shift some of its business focus to enterprise customers compared to retail clients.

- Crypto-friendly bank Silvergate failed to file their 10-k for the 2022 fiscal year within its prescribed time period yesterday. They filed a 12b-25 stating that they are working diligently to complete the 10-k, but they do not expect to be able to complete it by the extension date of March 16th. Additionally, the filing stated that recent losses “could result in the Company and the Bank being less than well-capitalized. In addition, the Company is evaluating the impact that these subsequent events have on its ability to continue as a going concern.” In light of missing the deadline and out of an abundance of caution, multiple companies, such as Coinbase and Galaxy Digital have issued statements claiming they will be halting transfers to and from Silvergate. The stock has received multiple downgrades from analysts at various firms. The collection of negative news has led to Silvergate’s stock opening Thursday trading down nearly 43%.

- Polygon has launched a new product called Polygon ID, enabling users to prove their identity credentials without revealing unnecessary private information. Digital identities are a hot topic across the crypto industry and Polygon ID is hoping to be “the self-sovereign, decentralized and private identity for the next iteration of the internet.” Polygon ID leverages zero-knowledge (ZK) cryptography, enabling users to prove verifiable information without sharing it with the verifier. An example would be someone purchasing alcohol and using Polygon ID to show they are over the age of 21 without disclosing other personal information typically shown on a driver’s license like name, address, height, and weight. Developers can integrate Polygon ID to enhance KYC processes or restrict access to users who don’t meet necessary criteria, all while customer privacy is kept intact.

Daily Technical Strategy

Mark L. Newton, CMT

Head of Technical Strategy

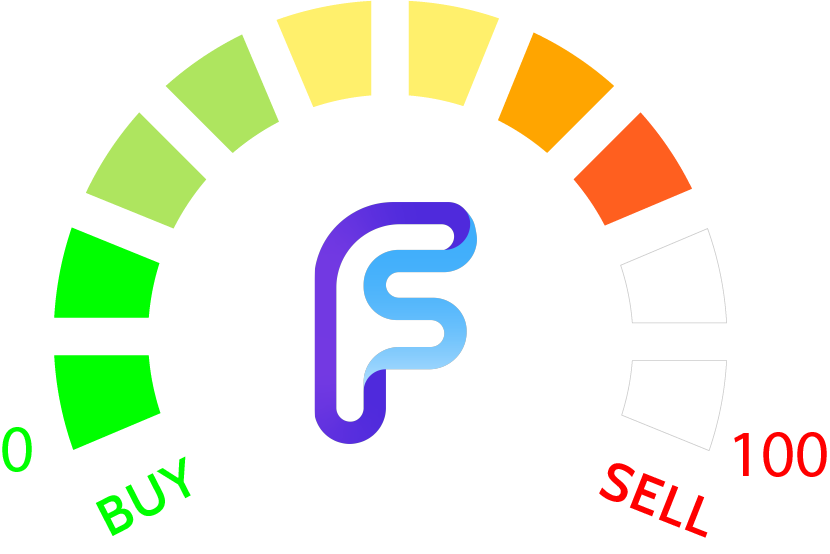

EOS has managed to avoid much of the downdraft which has occurred in many coins over the last week, and its snapback from trendline support argues for a coming retest of early February highs. The act of EOSUSD having pulled back from mid-February and bottoming near $1.07 helped this successfully hold the uptrend from late December. Furthermore, the quickness with which this before rallying sharply to regain much of last week's loss makes this quite attractive from a structural standpoint. Short-term and intermediate-term momentum remains bullish, and it's likely that EOS rallies to test and exceed the recent $1.36 high en-route to $1.50 which represents a 61.8% Fibonacci retracement zone of resistance. Intermediate-term, the act of exceeding $1.50 should bring about at least a move up to test March 2022 peaks near $3.17 which will be an important area when reached. Pullbacks in the near-term should find support at $1.12-$1.15 before pushing back higher.

Daily Important Metrics

All metrics as of March 2, 2023 12:33 PM

All Funding rates are on bps

Crypto Prices

| Symbol | Market Cap | Last Price | Daily Change | Year to Date | Relative to BTC YTD |

BTC BTC | $450B | $23,306 | ↓ -1.73% | ↑ 41% | |

ETH ETH | $199B | $1,626 | ↓ -1.80% | ↑ 36% | ↓ -4.97% |

ADA ADA | $12B | $0.3464 | ↓ -4.01% | ↑ 40% | ↓ -0.34% |

DOGE DOGE | $11B | $0.0801 | ↓ -2.12% | ↑ 14% | ↓ -26% |

MATIC MATIC | $10B | $1.20 | ↓ -2.52% | ↑ 57% | ↑ 16% |

SOL SOL | $8.3B | $21.82 | ↓ -3.11% | ↑ 120% | ↑ 80% |

DOT DOT | $7.3B | $6.28 | ↓ -2.88% | ↑ 44% | ↑ 3.78% |

LINK LINK | $3.7B | $7.21 | ↓ -2.63% | ↑ 30% | ↓ -11% |

NEAR NEAR | $1.9B | $2.22 | ↓ -3.59% | ↑ 75% | ↑ 34% |

Exchange Traded Products (ETPs)

| Symbol | Premium to Nav | Last Price | Daily Change | Year to Date | Relative to BTC YTD |

| GBTC | ↓ -46% | $11.25 | ↓ -2.26% | ↑ 36% | ↓ -4.98% |

| BITW | ↓ -60% | $8.63 | ↑ 0.20% | ↑ 61% | ↑ 20% |

| ETHE | ↓ -55% | $7.08 | ↓ -2.88% | ↑ 49% | ↑ 8.05% |

| BTCC | ↓ -0.12% | $4.31 | ↓ -0.12% | ↑ 42% | ↑ 1.56% |

News

QUICK BITS

The Block Coinbase is no longer accepting, initiating payments with Silvergate Coinbase is no longer accepting or initiating payments to or from Silvergate. The post Coinbase is no longer accepting, initiating ... |

MARKET DATA

CoinDesk Digital Asset Investment Products’ AUM in February Reaches Highest Level Since May 2022 AUM for digital asset investment products rose 5.2% in February from the previous month, a CryptoCompare report says. |

CoinDesk Silvergate Downgraded by JPM, Canaccord Amid Doubts of Bank’s Solvency JPMorgan cut its recommendation on the stock to "Underweight" from "Neutral" and withdrew its price target. |

CRYPTO INFRASTRUCTURE

CoinDesk Australia’s Central Bank Taps Mastercard and Others to Test CBDC Use Cases The Reserve Bank of Australia has revealed a set of projects that will develop use cases for a digital dollar, the eAUD, during its testing phase, currently und... |

CoinDesk Binance's Custody Arm Ceffu Will Apply For Singapore License: Report Binance rebranded its custody arm to Ceffu earlier this month. |

REGULATION

CoinDesk Core Scientific Bankruptcy Judge Set to Approve $70M Financing Deal From B. Riley The judge also indicated he would allow stockholders to form an official committee in the bankruptcy. |

FUNDRAISING AND M&A

CoinDesk Hosts of Bankless Podcast Raising $35M Crypto Venture Fund: Sources The popular crypto podcast is branching out beyond its media roots to invest in emerging Web3 startups. |

BtcEthereum Exclusive: Web3 security platform NotCommon goes live backed by $1.5M funding NotCommon is a one-stop shop for both artists and collectors to trade and exhibit work. The platform also aims at protecting users and combat the uptick in cyb... |

PRODUCT UPDATES AND PARTNERSHIPS

CoinDesk Polygon Rolls Out Zero-Knowledge, Privacy-Enhanced Identification Product Under the design for Polygon ID, a bar owner could theoretically use the credential-verification system to verify that a patron is of age, without ever having t... |

CoinDesk Decentralized Betting Protocol Thales’ Staking Model Deploys to Arbitrum By expanding to the largest layer 2 scaling solution, Thales aims to become more resilient and encourage protocol usage. |

Decrypt.co Wallet Provider Safe Taps Payments Giant Stripe in New Developer Stack Launch Developers can now leverage Safe’s new software development kit to build Web3 apps with the help of account abstraction. |

Reports you may have missed

MARKET COMMENTARYU.S. EQUITIES ARE RELATIVELY FLAT AS THEY CONSOLIDATE ABOVE PRIOR ALL-TIME HIGHS. THE SPX IS TRADING AT 5,300, AND THE NDQ IS HOVERING NEAR $18,600, WHILE THE DXY 0.00% (-0.07%) IS SHOWING A SLIGHT DECLINE, TRADING AT $104.4. Crypto assets are showing strength, with BTC 1.18% rising 2.84% to $67.1k and ETH 2.82% surging 4.86% to $3,090. Liquid staking tokens are building on Ether's outperformance, as LDO 1.06% and PENDLE 8.02% have gained 10.11% and 13.43%, respectively. Similarly, layer-2...

CRYPTO MARKET UPDATETODAY, WE ARE SEEING SOME MINOR CONSOLIDATION IN THE CRYPTO MARKET COINCIDING WITH THE SLIGHT BOUNCE IN THE RATES AND DXY 0.00% . BTC 1.18% is trading just north of $65k, while ETHBTC continues to struggle, with ETH 2.82% moving lower for the 5th consecutive day and still trading below the $3k mark. Despite the market consolidation, SOLBTC is still green on the day as SOL 3.83% works to regain the $160 level....

MARKET COMMENTARYINVESTORS WELCOMED THIS MORNING’S SLIGHTLY SOFTER THAN EXPECTED CPI DATA AND A LARGE DOWNSIDE MISS ON U.S. RETAIL SALES, ALLEVIATING INFLATION CONCERNS AND HELPING TO PROPEL STOCK INDICES TO NEW INTRADAY ALL-TIME HIGHS. The SPY 0.14% and QQQ -0.07% have gained over 1% to surpass $528 and $451, respectively, while US treasury rates have turned significantly lower, with the US10Y dropping below 4.34%. Crypto is responding in similar fashion with BTC 1.18% ...

Tornado Cash Developer Sentenced to 5 Years in Prison, LayerZero Succeeding Against Sybils

CRYPTO MARKET COMMENTARYAPRIL PPI CAME IN MIXED THIS MORNING, WITH A LARGE UPSIDE SURPRISE IN MOM READINGS (0.5% VS. 0.3% EXP.) AND YOY METRICS LARGELY IN LINE WITH EXPECTATIONS. The upside in the MoM reading was offset by March figures being revised downwards. Yields initially spiked upon the data release but have turned negative across the curve. Equities are showing mild gains as attention shifts towards tomorrow’s CPI data release. The SPY 0.14% has gained 0.17% and the QQQ -0.07% has gained 0.31%. Crypto assets are...