Closing Thoughts on Algo Stables

Key Takeaways

- While we previously attempted to quantify the runway LFG had before they needed to replenish the Yield Reserve, LUNA-2.93% ’s sudden death spiral was difficult to predict.

- We acknowledge the community value that Terra has built, but perhaps forking for a new chain is not the best way to preserve this value. Instead, there are plenty of existing IBC-compatible chains that pose as good alternatives to rebuild.

- Algorithmic stablecoins have been debated heavily in light of LUNA's unfolding throughout the last fortnight. Although the consensus view now is that algo stables are experimental at best, it is important to acknowledge that not all of them are created the same.

- Projects on our radar that best illustrate this fundamental difference in tokenomics include (but are not limited to) Lemma Finance (built on Ethereum) and UXD Protocol (built on Solana). Both projects are cash-and-carry algo stables, with distinct features from Terra’s stablecoin / sharecoin model.

- Bottom Line: To be clear, we maintain our stance that algorithmic stablecoin models today are highly experimental at best - given last two week’s events, the jury is still out, perhaps until the next bull-market cycle. Algo stable projects who prove their salt throughout the bear market and continually push their advantage will build moats in the form of liquidity network effects.

Figure: GCR, Galois Capital, 0xHamz, Freddie Raynolds & Co. Emerging Victorious Against Terra

Closing Thoughts on Terra

Earlier readers of DeFi Digest will remember our initial primer on Anchor Protocol and the update we published when Anchor introduced the Dynamic Earn Rate. While we attempted to quantify the runway LFG had before they needed to replenish the Yield Reserve, $LUNA’s sudden death spiral was difficult to predict.

Instead, as detailed in last week’s Crypto Weekly, it took a series of concurrent events (Terra moving Curve liquidity from UST3Pool to 4Pool) and a malicious actor (or a nervous whale) to trigger the ensuing mayhem over a mere three days.

A plausible alternative scenario would have been for Do to run out of venture funding to replenish Anchor’s Yield Reserve, Anchor Earn Rate dropping before $UST demand falls and compresses $LUNA’s price. $UST would eventually de-peg, perhaps unfolding across the span of a year.

Interestingly, DeFi’s transparency only exacerbated the panic. On-chain sleuths first reported LFG’s UST liquidity withdrawal on Curve Finance. The proceeding size swap of UST to 3Pool could have been a malicious actor, but it could also have been a whale (or a consortium of whales) farming 20% UST on Anchor with size who panicked once they saw the door shutting (3Pool liquidity drying up). We assume parties who were trying to get out after that were defensive instead of offensive.

If that were the case, the obvious question then becomes: Why did they choose the most value-destructive way to exit? They could have shorted on perps to get hedged on UST (funding rates were not insanely negative yet). They could have used Terrastation to burn UST and mint LUNA to sell into deeper LUNA liquidity on DEXes & CEXes. They could have made an OTC trade with brokers to TWAP sell LUNA over time. And once it de-pegged to the downside, they could have easily done the burn-UST-mint-LUNA dance to arb it back up.

All these follow-up questions to the whale (or consortium of whales) which assume their non-malicious intent remain unanswered, leading many to believe that they were, in fact, trying to instigate (or at least cover themselves in the event of) a bank run.

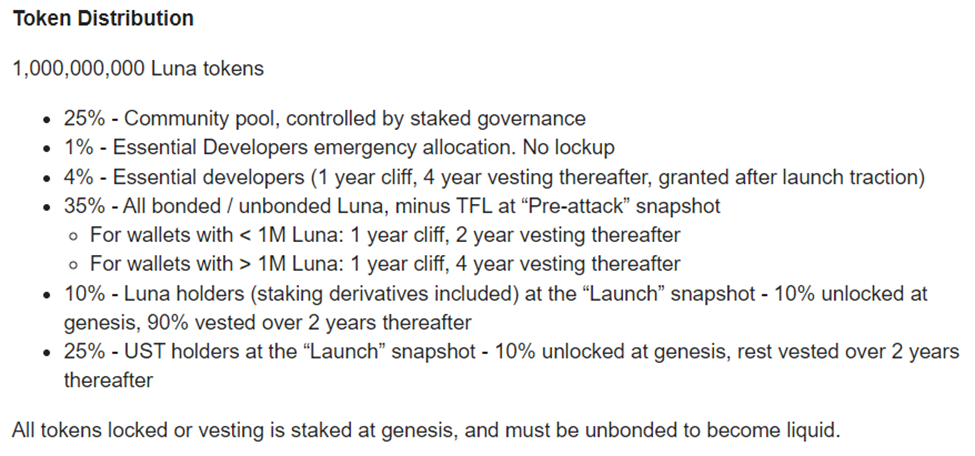

Since then, members within the Terra community have suggested several ways of moving forward before Do Kwon ultimately deciding on this proposal (live doc). In order to preserve the Terra community, he proposed a fork of the Terra ecosystem, albeit drawing criticisms from other industry heavyweights like Vitalik Buterin (Ethereum) and Changpeng Zhao (Binance).

This is mainly because the new chain (called Terra, with older chain rebranding to Terra Classic) prioritizes LUNA holders indiscriminately (who are predominantly institutions) over UST holders (who are predominantly retail and have historically regarded Anchor as a savings platform).

Figure: Tokenomics of Pending LUNA Fork

While we acknowledge the community value that Terra has built, perhaps forking for a new chain is not the best way to preserve this value. Instead, there are plenty of existing IBC-compatible chains that pose as good alternatives to rebuild.

Terra’s old ecosystem was built on the premise of their stablecoin UST. So if UST will not be included in the newly forked Terra, does the fork still make sense, especially if other existing blockchains are also pushing for interoperability? We will see.

That said, hindsight is always 20/20. How the black swan event unfolded speaks as much to the strength of the ‘LUNA-tics’ community Do Kwon and co have built as the (near) blind faith investors have placed with the now infamous founder of Terra and Basis Cash.

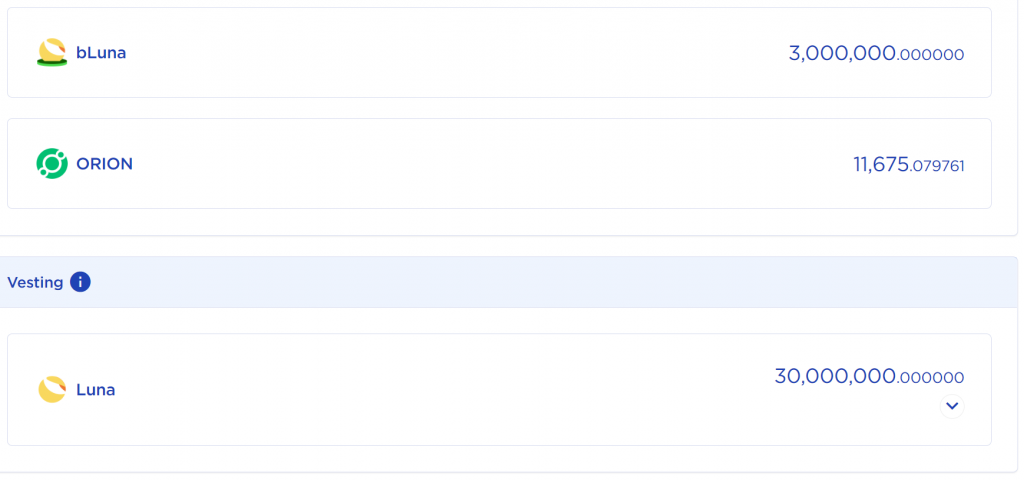

Figure: Pain In One JPEG

Figure: Panic In One JPEG

The blow-up has understandably drawn strong criticisms towards algorithmic stablecoins. The Fundstrat Crypto team attended Perrmissionless in Palm Beach and Arca’s Conference in New York, throughout which the sustainability of algo stables had been debated heavily. Although the consensus view now is that algo stables are experimental at best, it is important to acknowledge that not all of them are created the same.

Projects on our radar that best illustrate this fundamental difference in tokenomics include (but are not limited to) Lemma Finance (built on Ethereum) and UXD Protocol (built on Solana). Both projects are cash-and-carry algo stables Fundstrat’s categorizations in Stablecoins I, with distinct features from Terra’s stablecoin / sharecoin model.

Not All Algorithmic Stablecoins Are Created The Same

In Stablecoins I, we wrote about how UXD Protocol leverages customer’s deposits of digital assets ($BTC, $ETH, $SOL) to use as collateral to short the assets themselves on perpetual futures. Effectively, the aggregate delta-neutral position ‘backs’ $UXD itself. As of 5/19, $UXD is trading at a $41.6m market capitalization, backed by $41.6m in $BTC, $ETH, and $SOL collateral and a $41.6m short position in perpetual futures on these same assets.

To mint a $1 of $UXD, users deposit $1 worth of SOL/ETH/BTC collateral on UXD protocol, which will be used to establish the delta-neutral position described above in Mango Markets, a decentralized perpetual futures exchange.

The ‘Reserve‘

UXD did a token sale of $UXP for $57m $USDC back in January. Funds raised were deposited into an ‘Insurance Reserve.’ This reserve is not dissimilar to Anchor’s Yield Reserve, in that harvested funding replenishes the Insurance Reserve when funding rates are positive (excess demand for long leverage during bull markets), while the reserve gets drawn down when funding rates are negative (excess demand for short leverage during bear markets).

Without diving deeper, UXD’s Insurance Reserve eerily resembles Anchor’s Yield Reserve, where perhaps a prolonged bear market will deplete funds in the reserve before $UXD can find a breakthrough product-market fit. Granted, $UXD currently sits right inside the top #500 by market capitalization per Coingecko.

The Redemption Mechanism

Akin to $UST and $LUNA’s redemption mechanism, arbitrageurs can redeem $UXD for $BTC, $ETH, or $SOL when $UXD de-pegs to the downside. Conversely, the same traders can redeem $BTC, $ETH or $SOL for $UXD when it de-pegs to the upside.

There is reason to be optimistic, however. Note that UXD Protocol’s governance token ($UXP) that grants holders voting power over partnerships with decentralized DEXes, the nomination of collateral to be used, and other fund flow mechanics.

$UXP is not a sharecoin like $LUNA that absorbs the volatility of its corresponding stablecoin $UXD ($UST).

Furthermore, UXD’s collateral pool comprises L1 assets like Bitcoin, Ethereum, and Solana. The prices of these tokens are variable on factors including (but not limited to) the current tightening macro landscape, native PoW/PoS inflation rates, and native PoS staked % of circulating supply. If you’re still here after that mouthful, bear in mind there are other micro factors such as staked L1 tokens on borrowing, staking, or delta-neutral dApps (like UXD Protocol) that can affect the circulating supply (and correspondingly liquidity and price) of these collateral assets on UXD.

This is the key difference from Terra’s $LUNA, which is endogenous to the Terra ecosystem. The innate recursivity of using $LUNA to ‘back’ or be redeemable for $UST, coupled with $UST’s unsustainable dependence on Anchor’s Earn Rate to sustain its growth, created tail-risk that eluded even the brightest of minds in the space.

So if UXD doesn’t have the same recursive tail risk that UST had, what risks should $UXD holders look out for? The main risk is fragile peg stability infrastructure that can be caused by bridges/oracles/other DeFi infrastructure going down. This can be mitigated by multiple and deep $UXD-stablecoin pairs on decentralized liquidity pools, $UXD quoted as a trading pair on DEXes / CEXes similar to USDT, and high-volume-stress-tested redemption on UXD.fi itself. Should UXD survive high-volume position management and redemptions, (under)collateralization shouldn’t be an issue as the protocol is net fully-capitalized, as illustrated below.

Algo Stables Potential Redemption Arc

But perhaps some investors can give surviving algo stable projects the benefit of the doubt – that they have taken a leaf out of the Terra history books that will undoubtedly be written in the future.

Despite flat to increasingly negative funding rates since the beginning of the year when UXD launched, a mere $1.2m out of the $57m raised has been used to pay for the protocol’s short perp position. Assuming the market cap of UXD stays constant, the trailing-6-months $1.2m Insurance Fund reduction implies an annualized $2.88m burn, affording the team $57m (Insurance Fund Balance) / $2.88 (Annualized Burn Rate) = 19.8 years of runway. This number is artificially large as $UXD hasn’t grown to scale yet to cost the protocol hefty funding fees when rates are negative.

If $UXD reaches a significant market cap (supported by mere token inflation) amidst persistently negative funding rates, we will publish a dynamic runway analysis of UXD Protocol (similar to Anchor’s days-to-reserve depletes) to assess sustainability.

However, even if UXD’s Insurance Fund depletes (amidst persistently negative funding rates), redemptions of $UXD to $SOL, $BTC, and $ETH will happen as UXD Protocol will not be able to pay for its short position. Although this will unwind $UXD’s market cap as a result, all of $UXD’s is backed 1:1 by their spot and short perp positions, allowing redemptions to occur as these positions unwind. Additionally, this aggregate delta-neutral position is on $BTC, $ETH, and $SOL, which are exogenous from the UXD ecosystem.

While this difference in tokenomics implies that UXD Protocol is not circular and meaningfully mitigates the risk of a bank run or recursive death spiral, it doesn’t achieve the same levels of capital efficiency that sharecoin-stablecoin models do. $1 of UXD is backed by a $1 spot $BTC/$ETH/$SOL (over which UXD has minimal control, unlike $LUNA and LFG) long and a $1 perp shot on the same assets.

It is, however, an improvement on MakerDAOs overcollateralized model, as UXD is net fully collateralized.

O.K. But What’s The Utility of $UXD?

All the non-recursivity, redemption sustainability, and collateralization stuff aside, don’t forget that:

Stablecoins. Need. Utility.

Because $UXD can only be minted when users deposit their BTC/ETH/SOL, it’s growth is limited by users’ deposits of these assets, similar to MakerDAO. By definition, they cannot mint beyond organic demand, since that same demand drives the minting of $UXD.

They can however, offer unsustainable $UXD incentives to UXD-stablecoin liquidity providers. Should they elect to do so, the market cap of $UXD will inflate through mercenary capital farming yields, and deflate once the same capital leaves when yields compress.

Apart from creating organic utility, the UXD team also needs to grow the $UXD market cap (by incentivizing $BTC/$ETH/$SOL deposits to mint $UXD) at a sustainable pace. Doing that will minimize Insurance Fund burn throughout bear markets, allowing them to push their advantage when bull markets resume.

Like other stablecoin founders, Kento is effectively racing against time afforded through the Insurance Reserve to embed native utility of the $UXD stablecoin, starting with Solana’s DeFi ecosystem.

Bottom Line: To be clear, we maintain our stance that algorithmic stablecoin models today are highly experimental at best – given last two week’s events, the jury is still out, perhaps until the next bull-market cycle. Algo stable projects who prove their salt throughout the bear market and continually push their advantage will build moats in the form of liquidity network effects.

Reports you may have missed

BRC-20 FEVER Ordinal transactions on Bitcoin have skyrocketed in the last few months, leading to an all-time high for daily transactions and pushing Bitcoin network fees to 2-year highs. The activity throttled BTC’s network so much that Binance was forced to temporarily shut down withdrawals and implement Lightening Network to service outflows without paying excessive fees. There are currently two types of Ordinal transactions on the network: 1) Ordinal NFTs...

Fundstrat’s recently launched Crypto Core Strategy offers subscribers a digestible tool to manage their crypto portfolio, with the goal of outperforming bitcoin. For those looking to amplify the returns of their long positions, this complementary issue of DeFi Digest strives to cast light on some of the best risk-adjusted yields. We first describe our methodology to filter for yield opportunities, then dive into the protocols offering the yields, and describe...

FIGURE: A TEAM OF PEPES CONCOCTING THE PERFECT TOKENOMICS Tokenomics (a portmanteau for token and economics) represents the monetary policy of tokens that directly contributes to their price fluctuations. In bull markets, tokenomics were given utmost priority, sometimes constituting full theses for investment decisions. When the euphoria wears off in the bear, however, founders and market participants are left realizing that tokenomics can delay a weak project’s demise, but cannot...