Crypto Research

254 Results

CPI STILL HOT Despite oil prices falling and inventories growing, lagging CPI data came in hot this week. It was expected to be an eye-popping 8.8% but still managed to surprise to the upside. The CPI print of 9.1% was the highest in four decades as gas prices soared 11% month-over-month. _Source: BLS_ Due to the perceived lack of inflation relief, markets immediately reacted to the news, upping the consensus...

UPDATE ON THE MERGE Despite one of our potential catalysts for the year being struck down this week (the GBTC conversion to spot ETF), the prospects for a 2022 Ethereum remain intact. This weekend, ETH developers will attempt the second of three testnet merges on the path to mainnet Merge. Testnet merges are essentially dress rehearsals for the main event – the Merge of the Ethereum mainnet. The first testnet...

Last week we noted that Three Arrows Capital (3AC), a prop shop headed by the once-beloved Su Zhu and Kyle Davies, was on the brink of exiting the industry. Well, if you have been following our daily market updates, you know by now that this did indeed happen, and 3AC unleashed chaos of leverage unwinds on its way out the door. In the past week, we witnessed yet another bout...

THE BLOODBATH The bloodbath that has persisted for the better part of the past seven months continued this weekend, with the market shedding an additional $200 billion in total market cap, falling below the $1 trillion mark for the first time since late 2020. Yesterday was the single biggest decline for bitcoin (-16%) since March 2020. At the time of writing (early morning hours of June 14th), there have been...

MERGE UPDATE If you recall, several potential catalysts for this year were highlighted during our 2022 preview. A major one was the proposed transition of Ethereum from its current Proof-of-Work (PoW) to a Proof-of-Stake (PoS) architecture through a process colloquially termed the “Merge.” This is a catalyst that we felt the market was heavily discounting due to Ethereum developers’ track record of delays (Some thought this would take place five...

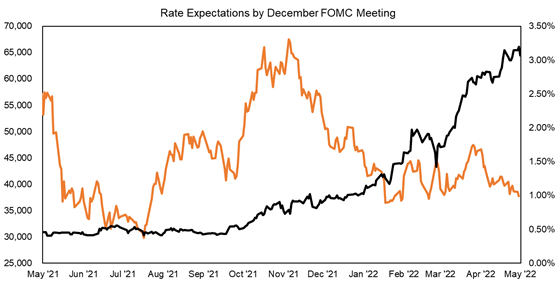

Recently, we have been quite cautious about cryptoasset prices in the immediate term, recommending that investors hedge to the downside. We still think this is appropriate given the relentless hawkish signaling from the Fed and lack of conclusive softening economic data. While we believe there are signs of inflation turning over, we find it difficult to rationalize anyone with near-term liquidity needs to bet the farm on cryptoassets. _Source: TradingView_...

MOVING SIDEWAYS To the relief of many crypto investors, the market has mostly churned sideways this week. Volumes have receded following the large selloff a couple of weeks ago as Bitcoin fights to avoid its _NINTH CONSECUTIVE RED WEEKLY CANDLE_. _Source: TradingView_ As we have been discussing, altcoins have not found much respite amid the market tumult either, as bitcoin dominance continues to show strength, surpassing 46% again this week....

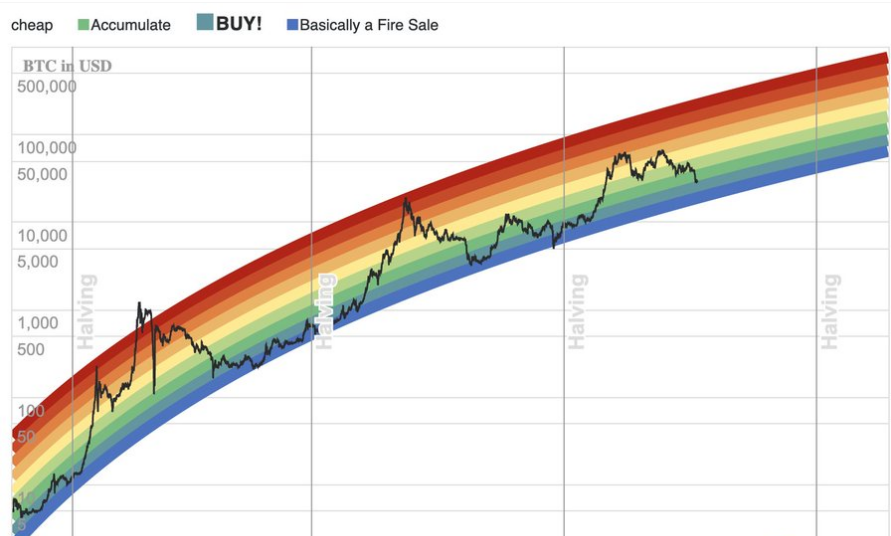

THE QUESTION REMAINS – WEN[1] BOTTOM? Since the November highs, most of the downward pressure on crypto prices has been the product of macroeconomic headwinds. Inflation has yet to conclusively rollover, and the Fed appears intent on stifling demand to bring down the costs of consumer goods. Last week, we had the first instance this year of an idiosyncratic event specific to the crypto markets shaking investors and sending prices...

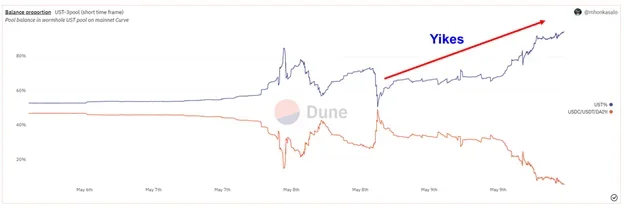

THE MAKINGS OF A QUASI-BANK RUN As if investors needed more reasons to be bearish, the market was thrown into a slight bout of chaos on Monday after a quasi-bank run on UST. Please refer to our prior work on the topic for further background information on UST’s functionality, Luna Foundation Guard, Anchor, and stablecoins. FIRST PEG-BREAK We have ample reason to believe that the “run” on UST was not...

FOMC RECAP This week, investors were provided with one of the bigger “head-fakes” in recent history. The May FOMC meeting took place on Tuesday and Wednesday, after which Jerome Powell announced a 50-bps rate increase to the target Fed Funds rate and plans to commence with the balance sheet runoff less than a month from today. While these measures were largely priced in, his statements did take the risk of...

WEEKLY RECAP This week’s price action left much to be desired by those trading in either direction as most major cryptoassets continued to exhibit sideways price action. After briefly falling below $38k on Tuesday, BTC found a bid and has since recovered, sitting around $40k at the time of writing. Similarly, ETH is below $3.8k but recovered alongside bitcoin and is once again challenging the $3k level. The rest of...

WEEKLY RECAP Outside of a Sunday-night dip, cryptoassets have performed robustly, with bitcoin reclaiming the $40k level and ether reestablishing its perch above $3k. This week, crypto investors ventured further out on the risk curve as DeFi and Web3 sectors outperformed currencies. Interestingly, the privacy sector recorded another green weekly candle, as privacy-focused names including Monero (XMR), Zcash (ZEC), and Decred (DCR) each increased more than 15% over the last...