World Cup Trade Ideas

Key Takeaways

- Cryptoassets reacted negatively to Powell’s press conference but rebounded impressively in the subsequent trading sessions.

- MATIC has outperformed following the announcement that Instagram is launching an end-to-end toolkit enabling users to mint and sell NFTs on Solana and Polygon via Instagram.

- Despite the carnage in Q2 of this year, the second half of 2022 has had considerable idiosyncratic opportunities.

- Strategy – We explore the importance and bull case for social tokens and discuss why Chiliz (CHZ) and Algorand (ALGO) are interesting trade ideas heading into the World Cup. We remain constructive on select assets (core: BTC, ETH, SOL -1.33% , merge-adjacent: LDO, RPL, OP -0.49% , MATIC) through the balance of the year.

Idiosyncratic Opportunities Abound

The euphoric part of the bull market for crypto was largely about finding the fastest horse paired with one’s relative risk appetite. Unfortunately, in a bear market, most horses, notably the weaker or tired ones, no longer want to race. However, the past few months have revealed that ample opportunities exist to find the few horses that have some giddy-up in them.

The two environments require fundamentally different approaches. The latter requires a more active investing style focused on managing risk. Recently we have tried to surface more of these short-term, tactical opportunities to clients.

Last week, we raised an intriguing bull case for DOGE and SHIB. We provided the caveat that any denouncement of DOGE integration into Twitter could derail the trade and that any spike in SHIB should be de-risked expeditiously. Both assets went on to have a phenomenal weekend, with DOGE nearly doubling and SHIB rising over 30% from the Friday close. We are resurfacing this trade merely to highlight that opportunities are still out there despite the macro backdrop.

MATIC Outperforms

On the topic of idiosyncratic performance, MATIC has displayed some impressive price action in recent weeks as the Polygon business development team continues to prove itself as one of the best in the industry.

Following Polygon’s initiative with Reddit a few weeks ago, which integrated NFTs with the “front page of the internet,” they announced this week that they are releasing an end-to-end toolkit enabling users to mint and sell Solana and Polygon NFTs on Instagram.

While we will need to wait to see the level of adoption that unfolds, this is an impressive development for the NFT space and is an excellent example of how development teams will need to create unique ways for users that are not crypto-native to access cryptoassets and crypto rails. We have had MATIC among our recommended names for a while now and anticipate that it might continue to be a solid asset to own over the longer term.

World Cup Narrative on Our Radar

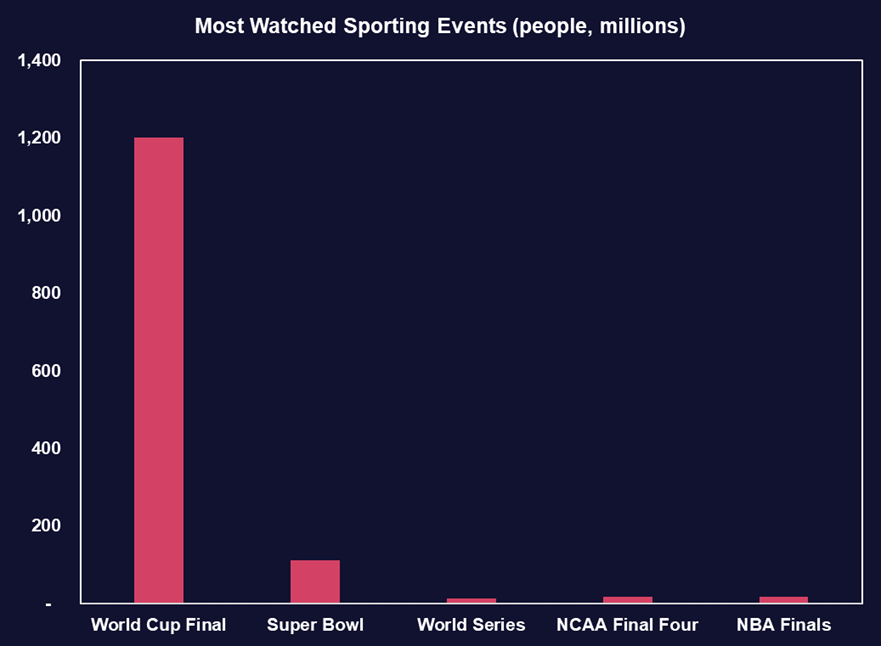

We are starting to see a potential new narrative on the horizon. This narrative centers on the World Cup, one of the most widely viewed sporting events across the globe. The chart below speaks to the tournament’s magnitude, as the number of eyeballs on the World Cup Final makes the Super Bowl look like a non-event.

In fact, if you count up all of the people who watched at least one minute of the last World Cup (throughout the tournament), it would amount to over 3.2 billion people or nearly half of the world’s population.

The World Cup is set to kick off (I think that’s the correct terminology) on November 20th and will run through December 18th. Thus, one must speculate that, with so many eyeballs focused on one event, there must be some implicit tailwinds for cryptoassets.

We think that both Algorand (ALGO) and Chiliz (CHZ) are in a unique position to capitalize on any narratives that develop around the tournament.

Chiliz Looks Spicy

Social Tokens

Social tokens are an emerging category of digital assets that allow a broad array of entities to develop and manage relationships with their respective communities. While in the past, individuals, teams, and brands would need to rely on distribution platforms to establish a relationship with a particular investor or fanbase, social tokens disintermediate this relationship by selling a token to relevant constituents.

The best models around social tokens are still being iterated on, but within current applications, they can (1) be monetized should the issuer be successful in their line of business, (2) provide the holder with intangible value in the form of privileged access to certain information, events, or perks, or even (3) provide the holder with value in the form of governance rights over certain decisions that the issuer makes. This list likely misses a few of the purported benefits of social tokens but summarizes the significant developments to date.

Chiliz

Social tokens themselves are often quite limited in market cap and liquidity. This makes sense, given that their utility is often best served in niche verticals that benefit from a more intimate relationship with fans. However, a core piece of infrastructure surrounding social tokens is the platforms through which individuals, teams, brands, etc., can seamlessly create and issue their own tokens. The native tokens for these platforms are often much larger from a market cap perspective and feature ample liquidity on both DeFi and CeFi exchanges.

One of the emerging players in this area over the past couple of years has been Chiliz (CHZ). Chiliz is an independent, semi-permissioned chain that serves the Socios app. The native token, CHZ, is both an ERC20 token on Ethereum and a BEP2 token on Binance and is used as the medium of exchange on the Socios app. Beyond this endeavor, Chiliz is developing a more open, interoperable chain titled Chiliz 2.0, which will allow more projects to build on its platform (more on this later).

Socios Overview

The Socios app is a fan loyalty and rewards app that has developed several partnerships with the NFL, NBA, NHL, UFC, PFL (Professional Fighting League), Soccer (MLS and international leagues), gaming, and motorsport. To date, there are 75 fan tokens issued with a total market cap of nearly $2.5 billion, the majority of which have been issued by both club and international soccer teams.

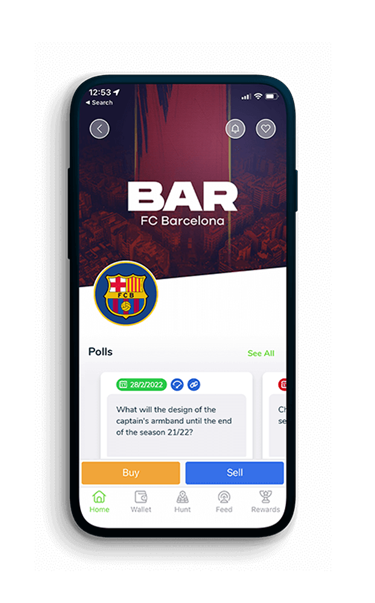

The app allows teams to connect with fans directly by offering them governance over certain decisions that can be voted on. For instance, in the screenshot below, we can see that one decision posed by FC Barcelona was the design of the captain’s armband.

While this may seem frivolous in nature, fans are drawn to this type of prompt and are compelled to support their team. Further, some teams even offer monetary incentives. Many teams burn a portion of the outstanding supply when they win games.

International Team Tokens Surging

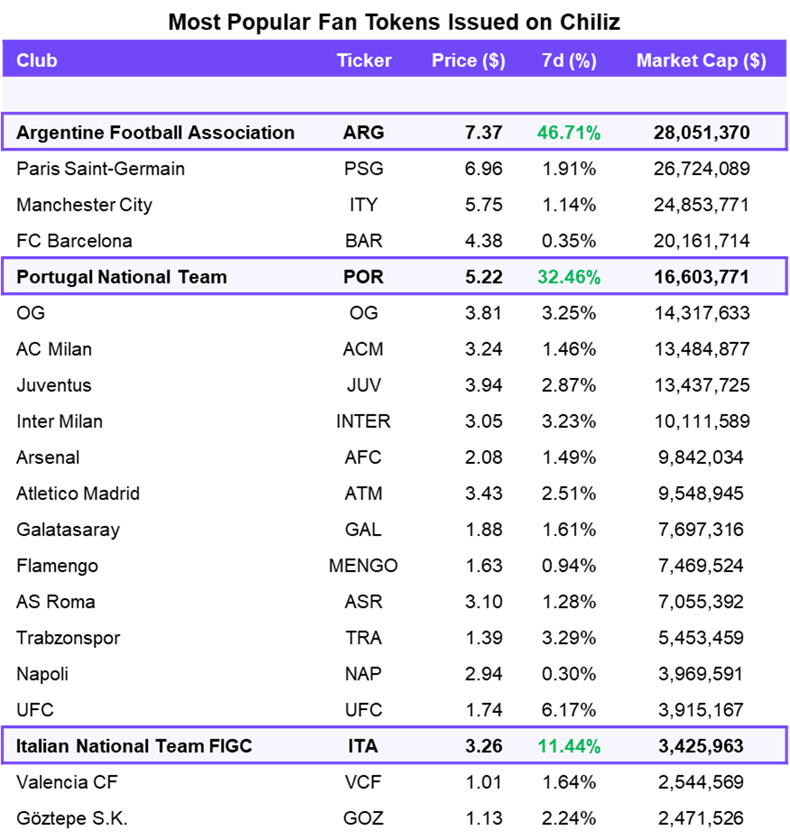

Below is a list of the larger fan tokens issued on Socios. The vast majority of them are tokens of a major soccer club. Even more intriguing is the price action around a particular cohort of these tokens.

The international teams, as highlighted by the boxes below, have surged in value over the past week, possibly indicating momentum building toward voting decisions and monetization methods that will transpire leading up to and during the World Cup.

Planned Expansion Adds a Fundamental Element

In addition to the narrative-driven momentum behind the approaching World Cup, there are fundamental reasons to pay more attention to CHZ. As alluded to above, the team is currently developing its Chiliz 2.0 product, which aims to create a more open ecosystem that will enable vetted third-party developers to build alongside Socios. In this world, the CHZ can be used outside of the Socios app, potentially in DeFi applications.

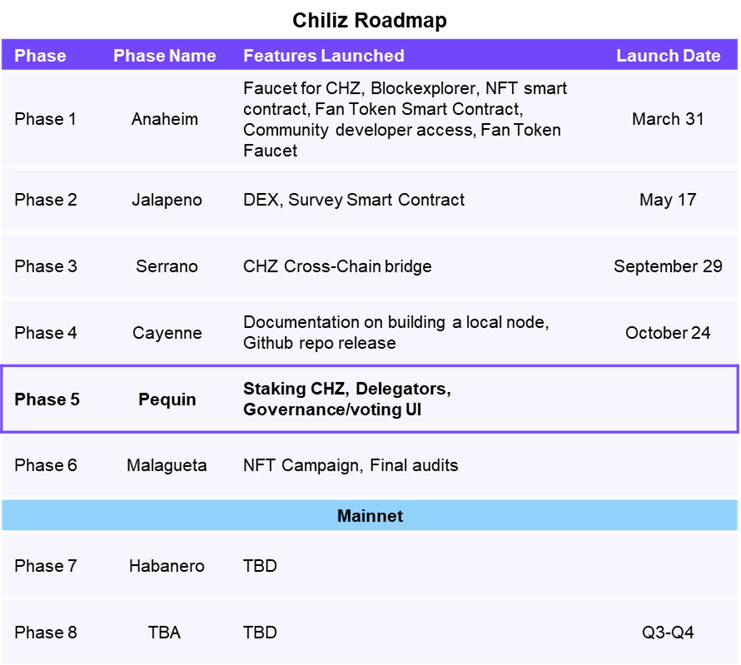

As demonstrated below, the Chiliz team is nearing the launch of Mainnet and will enable staking at some point in Q4, potentially around the time of the World Cup. It is possible that this further catalyzes the price action around the token.

Looking Ahead

Again, CHZ is a lower market cap token and is native to a semi-permissioned chain, meaning there is a lack of censorship resistance on the Chiliz platform. Thus, this is undoubtedly a name farther out on the risk curve than the assets we involve in our core recommendations. However, the event-driven and product development tailwinds seem material enough to place a small allocation to CHZ for the next 4-6 weeks.

Should the trade gain some steam, we would look to (1) the start of the tournament and (2) halfway through the tournament as areas where we would likely want to de-risk.

Algo Worth A Look

The second leg of our World Cup thesis is Algorand (ALGO), a proof-of-stake (PoS) layer 1 blockchain that employs a unique consensus mechanism called Pure Proof of Stake (PPoS), which relies on random node selection to promote user-centric decentralization and security while ideally enabling the platform to scale more efficiently than competing L1 blockchains. The Algo token is the native currency of the network. ALGO has underperformed other prominent L1s over the past couple of years. Its underperformance largely stems from a lack of developer adoption and questionable Tokenomics at launch.

However, it has recently made exciting strides on the business development front, forging a partnership with FIFA, the upcoming World Cup tournament organizer. In addition to exposure from simply being a premiere sponsor, they were tasked with constructing the recently launched NFT platform, FIFA + Connect, which will issue NFTs based on players, teams, and moments from the World Cup. This alone may garner some attention from both those inside the crypto ecosystem and outside of it.

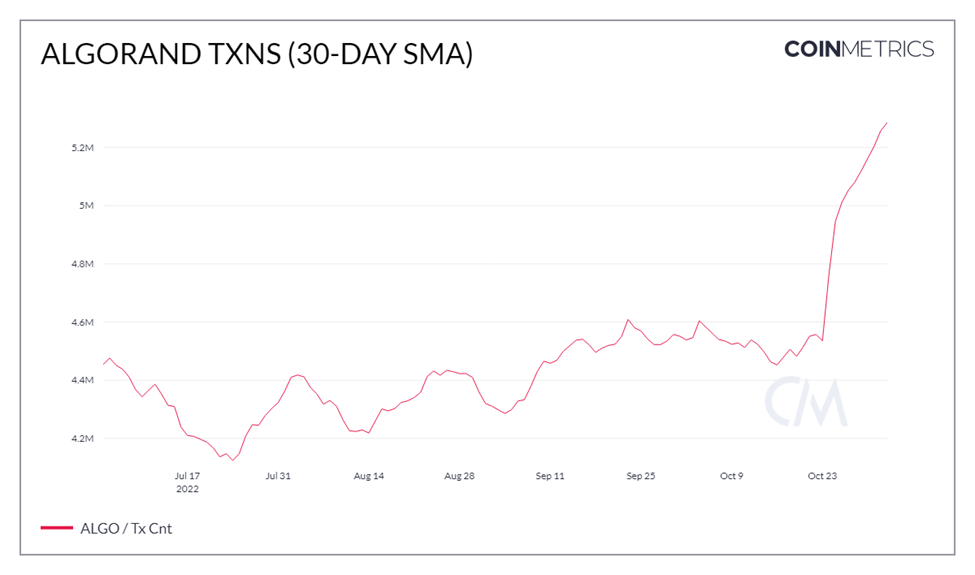

In terms of momentum, we can see below that the number of transactions on the network has increased dramatically in recent weeks, possibly due to a combination of anticipatory World Cup-driven price action, early adoption of the NFT platform, as well as an underlying DeFi ecosystem that has outperformed other networks in terms of TVL growth.

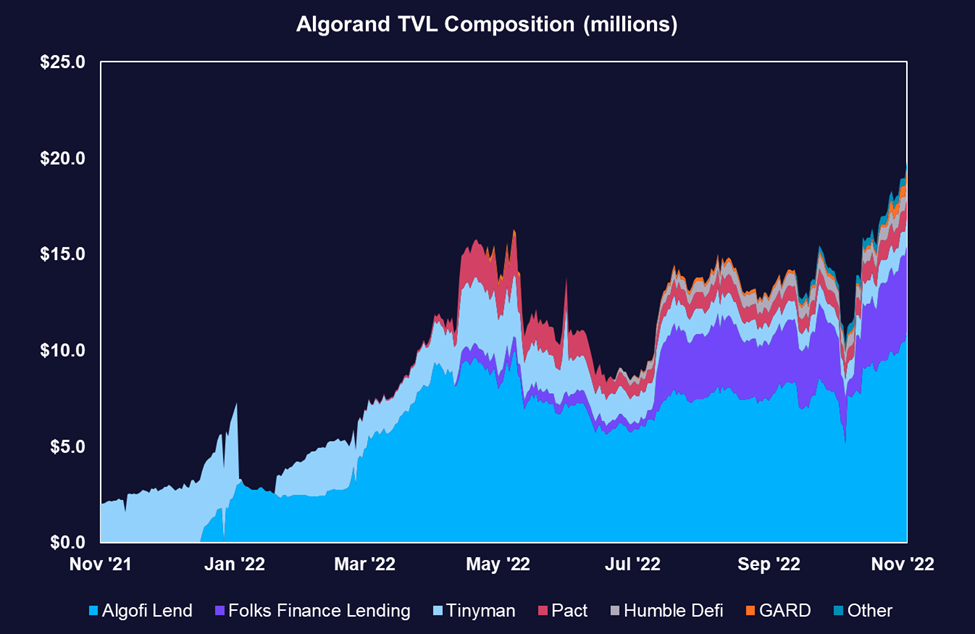

Below we see that since launching smart contracts in late 2020, DeFi activity was relatively muted up until this year. In recent months, aggregate TVL and TVL diversity has increased at an impressive clip. Algorand still trails most major DeFi ecosystems, but the point is that it is finally growing, just in time for the World Cup.

Looking Ahead

Algorand is arguably much less risky than CHZ, but the upside might be more limited on a percentage basis, given its larger market cap and Tokenomics, which are not necessarily as conducive for parabolic bull runs as other L1s might be (low fees and low staking requirements).

However, one can see from the chart below it has been a rough year for the token, and any partial attempt to reclaim its YTD high would result in considerable gains. Thus, we would entertain this opportunity with an approach similar to CHZ, with a probable holding period of 4-6 weeks, looking towards the start/middle of the tournament as a possible time to de-risk.

Articles Read 1/2

Enjoyed the read? Subscribe now for unlimited access!

Get invaluable analysis of the market and stocks. Cancel at any time.

Already have an account? Sign In 3fecad-98d66e-9107ee-174267-cb87f0

Already have an account? Sign In 3fecad-98d66e-9107ee-174267-cb87f0