ETH: Is it Finally Time to Rotate?

Key Takeaways

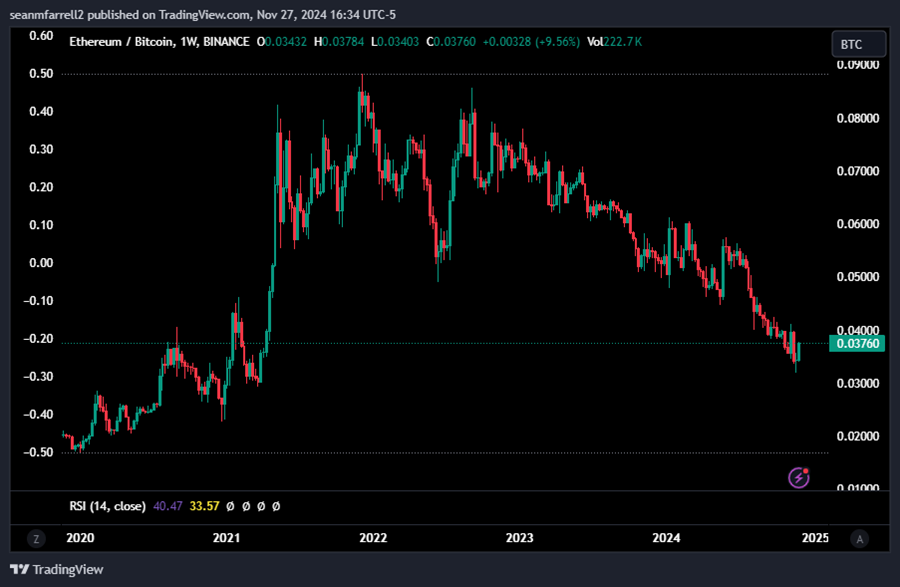

- ETHBTC has been in a prolonged downtrend since December 2021, dropping from 0.09 to 0.035.

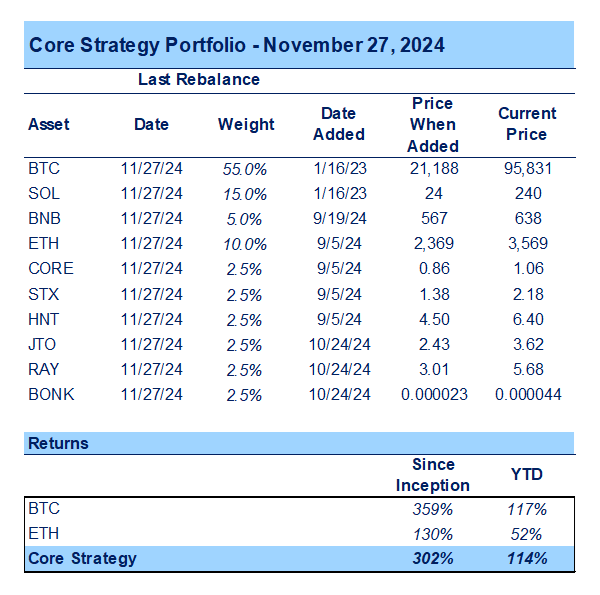

- Our Core Strategy has prioritized BTC and SOL this cycle, maintaining an underweight position in ETH for 12–15 months.

- ETH’s large market cap, messaging problems, fragmented ecosystem, and reliance on institutional capital have limited its performance relative to BTC and other altcoins.

- Increased CME futures activity, improving risk appetite (e.g., PSCT/SPX and IWM/SPX ratios), and positive ETF flows signal a potential rotation from institutions out of BTC and into ETH.

- ETH's allocation in the Core Strategy has been increased from 5% to 10%, while BTC’s has been reduced from 60% to 55%, reflecting rising expectations of a near-term ETH “catch-up” trade.

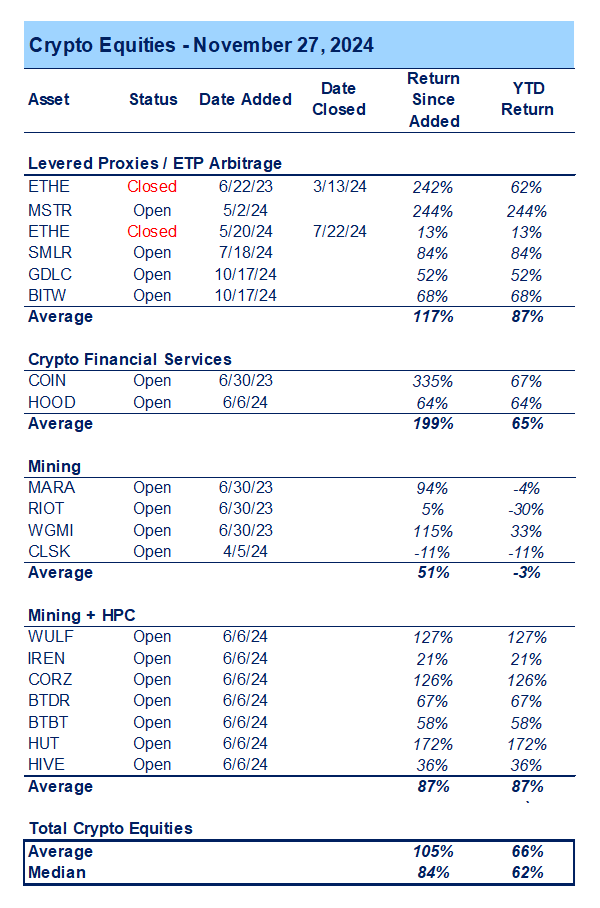

- Core Strategy – Corporate buying and favorable regulatory and political tailwinds have helped navigate a choppy period for risk assets. Our base case assumes these tailwinds will persist through year-end, and that assets are further supported by a declining DXY and lower yields. We remain overweight on SOL and continue to favor altcoins like BNB, HNT, JTO, BONK, RAY, STX, and CORE, prioritizing assets with high SOL and (potential) BTC beta. Additionally, we see an attractive risk/reward opportunity to position for an ETH catch-up trade. As a reminder, our Core Strategy allocation model, along with crypto equity baskets and trade recommendations, can be found at the end of each note.

Turning Cautiously Optimistic

There is a lot of pain in the ETHBTC chart. It peaked in December 2021 and, save for several brief rallies, has been on a downwards slope ever since. It peaked at just under 0.09 and currently trades around 0.038.

Fortunately, we have anchored most of our attention on BTC and SOL this cycle, as BTC has continued to lead the market in a generally top-heavy, idiosyncratic market regime. In the Core Strategy, we have been underweighting ETH for the better part of the last 12-15 months, with a brief increase in relative favorability around the approval and launch of the ETH ETF. Admittedly, we may have been premature in calling the ETHBTC bottom during that time.

We maintain that ETH will have its moment in the sun. But it’s important to recognize that, much like BTC, ETH has transitioned into the realm of traditional finance. It has evolved from being the preferred asset for crypto-native capital seeking beta exposure to BTC to an asset that now relies on institutional capital stepping in as the marginal buyer.

Some Background on How We Got Here

For liquid funds in crypto, ETH has always been a core holding. However, for better or for worse, it has grown out of this role due to its size, its messaging problem, and its adoption by traditional institutions.

Size: The size “issue” is the most straightforward factor to consider. Despite ETHBTC’s persistent downtrend, ETH still commands a $420 billion market cap—approximately 20% of Bitcoin’s market cap. This makes the level of inflows required to generate outsized returns significantly higher compared to earlier cycles and, critically, compared to smaller altcoins.

As the bull market progressed, BTC attracted substantial inflows despite its size. It has received flows from crypto-native investors that recognize its traditional early-cycle leadership as well as flows from a whole new cohort of non-crypto-native institutions spurred by the newly launched ETF products.

In contrast, smaller assets with compelling narratives—particularly integrated L1s like Solana and Sui—have outperformed in the early stages of the bull market. These assets benefited from strong narratives or increased fundamental traction and, given their smaller market caps, offer a more favorable risk/reward dynamic compared to ETH.

ETH faced additional competition for flows due to the complexity of its ecosystem. Liquidity has become fragmented across various L2s and applications, many of which have their own tokens. These tokens, often preferred by crypto-native investors, offer implicit beta to ETH itself.

This fragmentation, combined with competition from other assets, has prevented ETH from capturing the incremental flows needed to reverse the ETHBTC downtrend. Consequently, this structural headwind has persisted for ETH throughout this cycle.

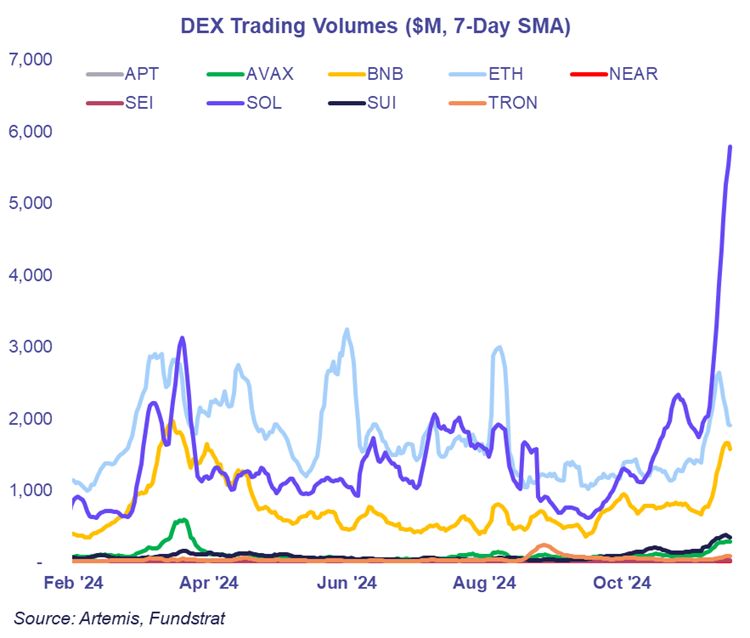

Messaging: Concurrent with the size/bid mismatch described above, ETH has also been plagued by a massive messaging issue. ETH has a long-term vision that it is executing on. It has a rollup-centric roadmap in which ETH remains the primary settlement layer and scales execution and data availability at different levels of the Ethereum stack. It is executing effectively on this roadmap (transition to PoS, 4844, etc.) but there are holes in the developer and user-experience at the L2 level that are not yet solved, meanwhile the base layer remains unusable for high-performance applications. Simultaneously, the market watched as Solana, a platform that is much more application-ready due to its high throughput and monolithic stack, garnered the lion’s share of new crypto users (See DEX Volumes below). Thus, ETH was faced with a troubling dilemma as it could not market itself as the preeminent smart contract platform.

During this period, many in the ETH ecosystem also bizarrely tried to claim that ETH is better money than BTC. This is quite a flimsy claim for several reasons (a lack of ossification, a greater level of centralization, and more attack vectors than a PoW chain are primary reasons). But even if one disagrees with my assertion, it does not matter because investors have already made their decision on which asset serves as sound money, and that is BTC (last I checked, the US government is not contemplating creating a strategic ETH reserve).

Thus, ETH has been stuck in this no man’s land where it is not as friendly to users or developers as competing integrated chains like SOL, and it is also not the incorruptible money that BTC is, leading to the appearance to many that ETH no longer has a place in the market. To be clear, I do not think this is true. As we mentioned above, the ETH ecosystem is still executing its vision despite its complex nature, and it still maintains a greater level of censorship resistance compared to other L1 smart contract platforms, but this messaging has certainly served as a headwind for price.

Institutional Adoption: Finally, it is worth considering the mental reliance on TradFi that the market has acquired since ETH received its own spot ETFs. Having been blessed by Blackrock as the number two asset to own behind Bitcoin, ETH is now institutionalized. It has CME futures, options, and spot ETFs and is the only other crypto asset with some regulatory comfort as it pertains to its security designation status.

Thus, we surmise that following the disappointing launch of the ETH ETFs back in July, any remaining ETH bulls native to crypto lost their last ounce of bullishness (relative to BTC and SOL) and abandoned the asset altogether. We suspect that these investors will only return to the ETH well once there is a provable bid emanating from TradFi investors.

Taken altogether – the size of ETH, its messaging problems among crypto-natives, and its institutional integration – we think that it’s reasonable to conclude that the marginal buyer of ETH will be non-crypto native institutions.

What to Look For

If we are relying on TradFi institutional capital to be the marginal buyer of ETH, what market indicators should we look for to gain confidence in relative ETH strength?

First, it’s important to understand that ETH is much different and much riskier than BTC in the eyes of TradFi. If we had to guess, TradFi investors likely view ETH as more of a low-quality tech stock than a macro-sensitive commodity like BTC.

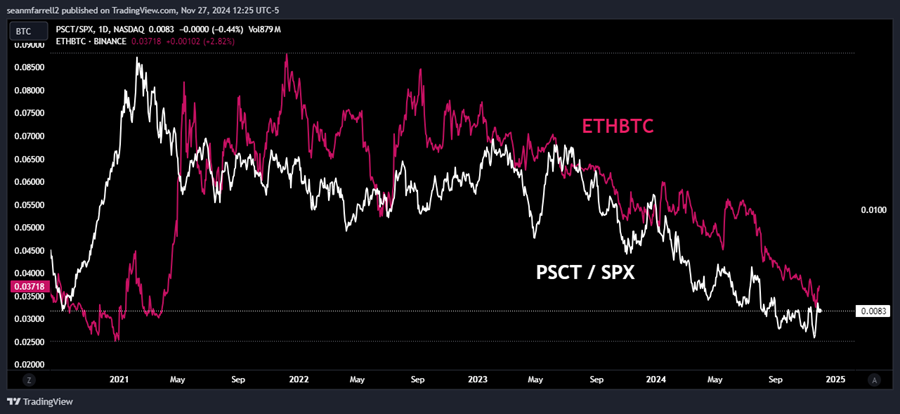

Thus, we should be on the lookout for a market in which lower-quality stocks (smaller cap, highly leveraged, less profitable, etc) start to outperform larger cap names. We can look to something like PSCT (small-cap tech ETF) / SPX to gain an understanding of how TradFi is viewing high-risk tech names relative to the broader market.

As you can see below, PSCT/SPY and ETH/BTC have tracked quite well. While we are yet to see a conclusive breakout, it does seem that PSCT is gaining some ground relative to the S&P 500, with this ratio showing a 5% gain since the start of November.

IWM / SPX is another ratio that we could examine to gauge the appetite of investors to venture farther out on the risk curve. IWM is a broader measure of small cap stocks as opposed to the tech-specific ETF above. We can see that this is another ratio that seems to be making progress. It has yet to significantly break out, but IWM has demonstrated relative outperformance in recent months.

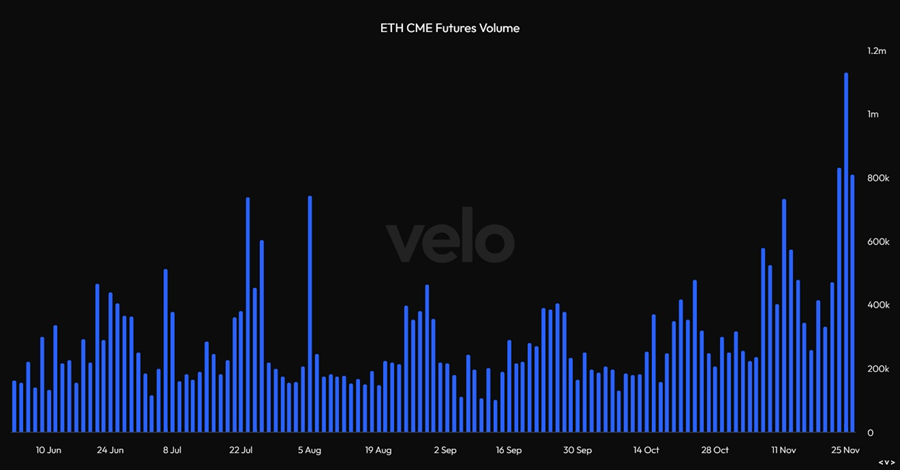

Second, we should focus on metrics that indicate “TradFi is bidding,” such as CME futures volumes, open interest, basis, and ETF flows.

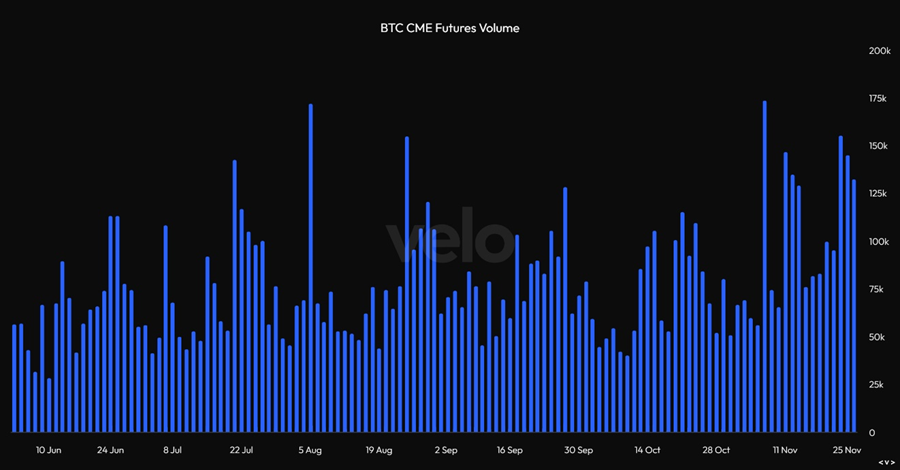

Notably, ETH CME futures volumes have spiked over the past several days, with November 25th marking the highest single-day volume ever recorded for ETH futures. That day saw 1.1 million ETH in volume, equivalent to nearly $4 billion in USD terms. While BTC futures volumes remain elevated and significantly higher than ETH volumes, we didn’t observe the same degree of increase in BTC futures activity.

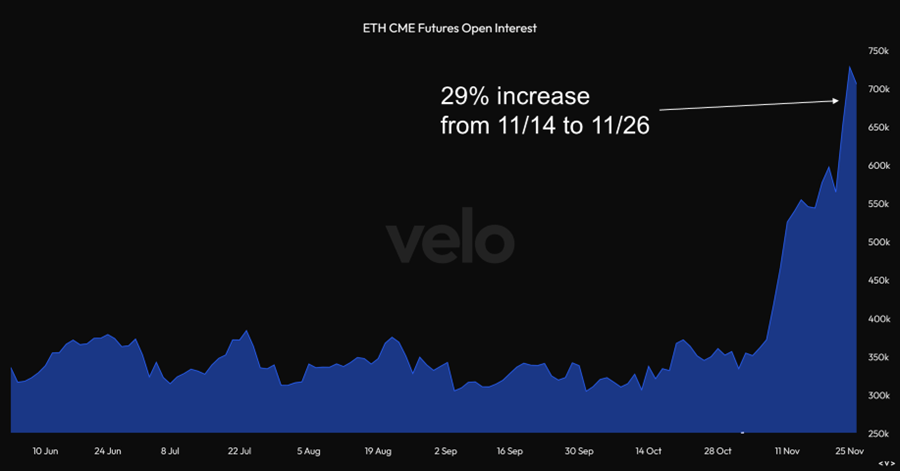

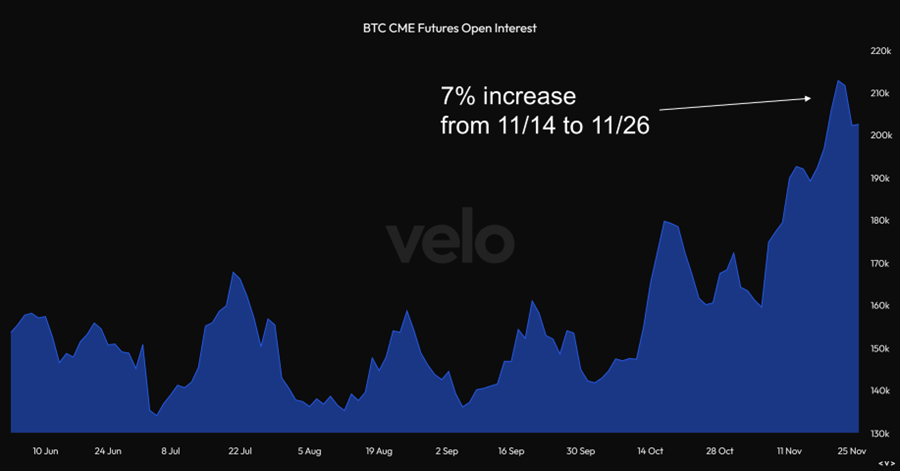

The disparity in recent volumes is also reflected in the open interest (OI) metrics. Coin-denominated ETH OI surged nearly 30% from 11/14 to 11/25, compared to just a 7% increase in BTC OI over the same period.

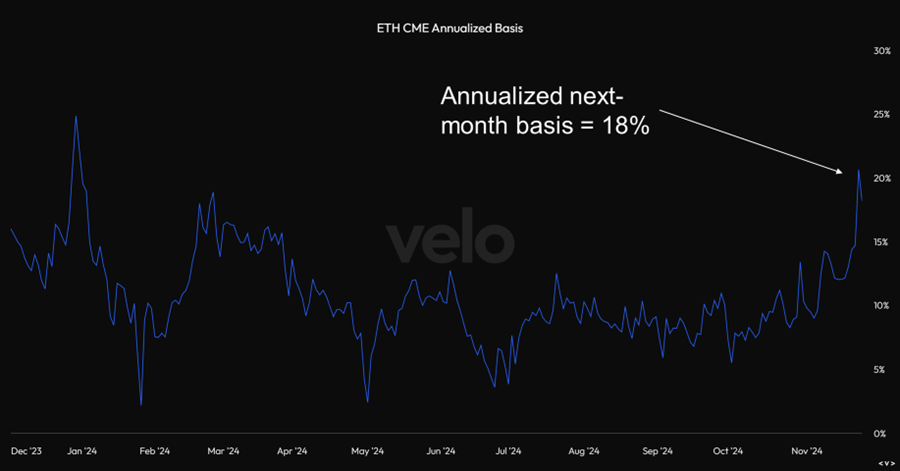

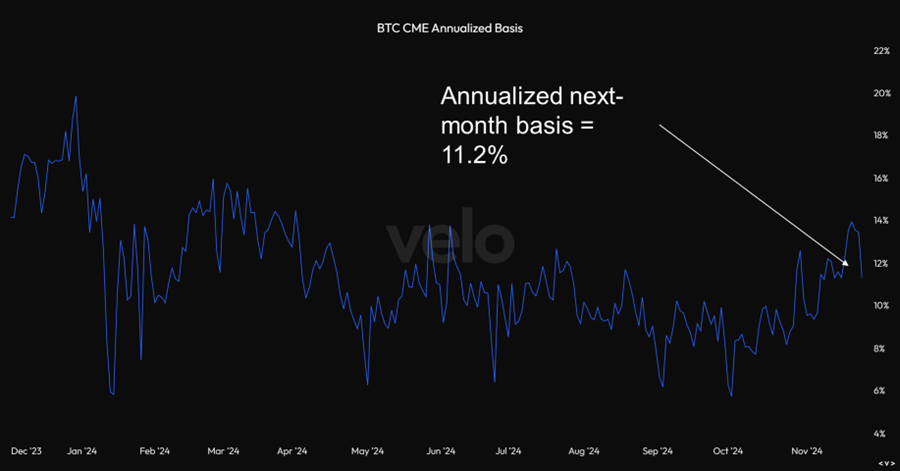

As one might anticipate, this sudden increase in participation in CME futures market has translated into the next-month annualized basis on CME rising to 18%. This means that traders are longing ETH with considerable leverage. This 18% basis currently dwarfs BTC CME basis of 11.2%.

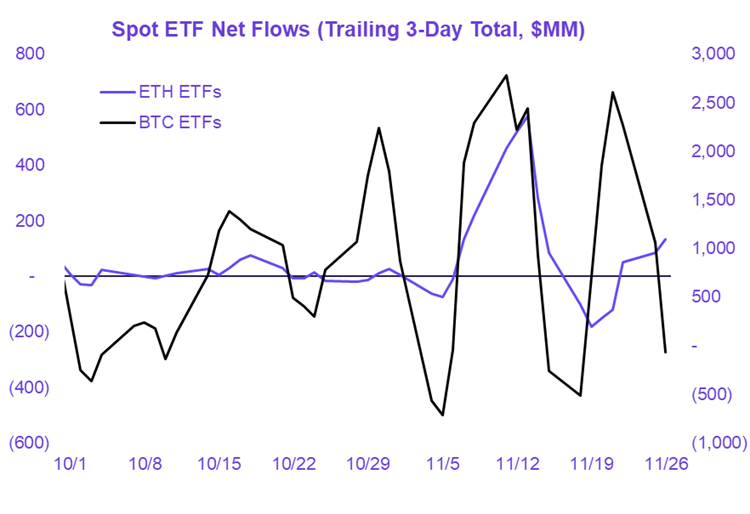

Finally, we can examine ETH ETF flows, which are likely to include both net longs and basis traders. While this metric might appear less definitively bullish for ETH, the past three days have seen positive inflows into ETH ETFs, in contrast to the past two days, which have recorded outflows from BTC ETFs.

Summary

To summarize, attempting to bottom-tick ETHBTC this cycle has caused significant frustration for many investors. However, based on the framework outlined above, the odds of near-term ETH outperformance appear to be improving. Accordingly, we are increasing our relative weight in ETH from 5% to 10% in the Core Strategy while reducing our BTC allocation from 60% to 55%.

Tickers in this report: BTC -1.18% , XRP -1.02% , SOL -1.79% , ETH -0.52% , HNT -0.90% , STX N/A% , MKR, BNB, CORE, JTO -6.58% , BONK -7.96% , RAY, MSTR 3.77% , SMLR 8.49% , COIN 1.91% , HOOD 4.01% , MARA 3.27% , RIOT 8.78% , WGMI 2.60% , CLSK 1.96% , WULF -1.23% , IREN 2.52% , CORZ 2.34% , BTDR 7.76% , BTBT 1.45% , HUT 3.63% , HIVE 2.84% , AVAX -2.67% , XRP -1.02% , GDLC, BITW

Articles Read 1/2

Enjoyed the read? Subscribe now for unlimited access!

Get invaluable analysis of the market and stocks. Cancel at any time.

Already have an account? Sign In 573c0d-660947-e250ee-9fa03d-111f73

Already have an account? Sign In 573c0d-660947-e250ee-9fa03d-111f73