A Crypto Investor’s Guide to Election Day

Key Takeaways

- The Senate likely flips red—a positive development for crypto regulation.

- We outline potential power balances post-election, rating each scenario from a regulatory perspective.

- While regulatory conditions are set to improve regardless of the Presidential outcome, we anticipate a sharp binary reaction to the results: higher on a Trump win and lower on a Harris win.

- Macro factors will eventually retake the reins, with elements such as a dovish Fed, the end of QT, potential debt ceiling issues, and expanding fiscal deficits supporting higher crypto prices in the medium term.

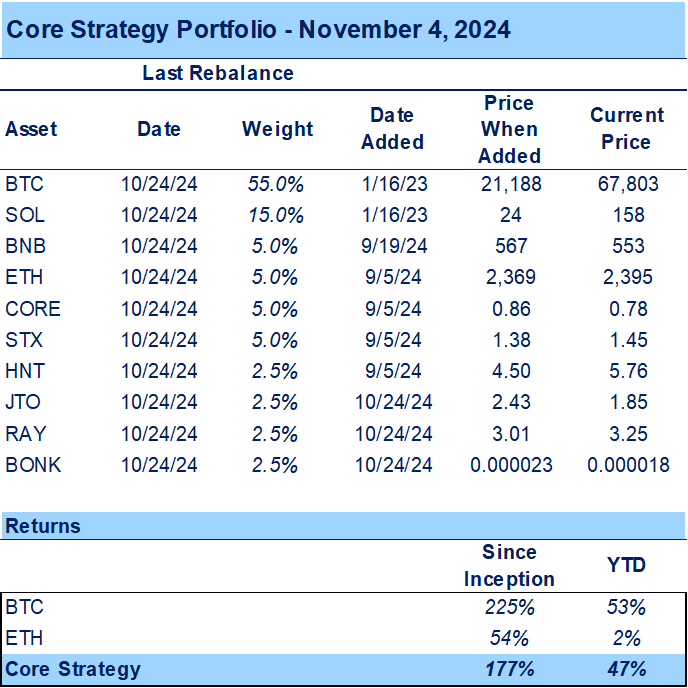

- Core Strategy – Even with a potential drawdown on a Harris win, risks still skew asymmetrically to the upside (BTC retests bottom end of range to the downside vs. $100k+ to the upside). Looking beyond the election, we maintain an optimistic outlook for the crypto market through year-end due to favorable seasonality and improving liquidity conditions. We remain biased toward being overweight SOL while selectively adding exposure to altcoins such as BNB, HNT, JTO, BONK, RAY, STX, and CORE (heavy on BTC and SOL beta). As a reminder, our Core Strategy allocation model, along with crypto equity baskets and trade recommendations, can be found at the end of each note.

Trump Maintains a Slight Edge, But It’s Essentially a Tossup

Well, it’s here, folks – the moment that markets have been building up towards since January—the general election to decide the next President of the United States.

As our clients know, we have been closely tracking polling and prediction market trends over the past several months, and these have served as a key input in our recommendations.

Odds for both candidates have oscillated around the 50% threshold since the race restarted back in July, with both experiencing periods of optimism within their respective bases. However, neither has been able to conclusively pull away from their opponent. Thus, we enter election day with Trump maintaining a slight edge, but in a probabilistic sense it remains a tossup.

The Destination Remains Unchanged

Today, I want to once again state our higher-level views as they pertain to the election and then discuss how we expect the market to react post-election.

First, regardless of the outcome of the presidential election, the current electoral math makes it extremely likely that the Senate flips Republican. In our view, this is unequivocally good for the crypto industry, as Senate leadership (Brown, Warren) has been outwardly hostile toward the industry. They are the ones who have steadfastly supported the set of prudential regulators largely responsible for the “regulation via enforcement” regime we have been mired in over the past several years.

Furthermore, any cabinet or agency positions nominated by the next President would need to be approved by this new Senate, meaning that, even if Harris wins, more extreme and possibly anti-crypto nominees would not pass Senate muster. Additionally, this red Senate would be paired with a House that, even if it flips blue, has already shown some proclivity toward bipartisanship as it pertains to crypto (they passed the FIT 21 bill earlier this year with bipartisan support).

Second, crypto prices have performed fairly well over the past couple of years, even amidst the debanking of the industry and an onslaught of predatory lawsuits from the SEC. We think it is right to expect a violent binary reaction to the election results (Trump higher, Harris lower), but eventually, we will resume trading in concert with changes in the macro backdrop.

And lest we forget, the macro backdrop remains constructive for crypto prices in the medium term:

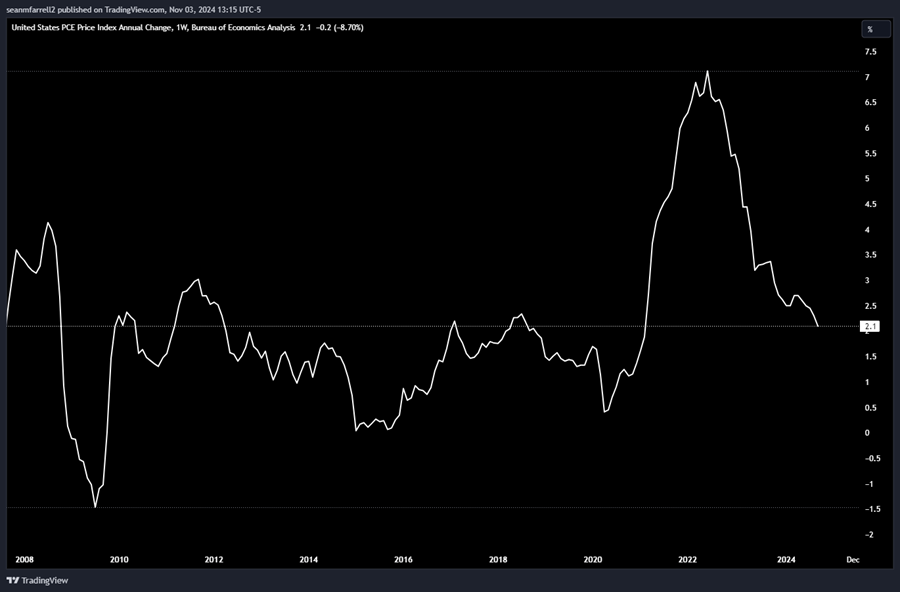

- The Fed is dovish, with another 50 bps of expected cuts over the next two meetings. With PCE, their preferred measure of inflation, clocking in at 2.1%—just a sneeze above their target—and with non-farm payrolls continuing to show softness, there is no real reason for them to shift their stance.

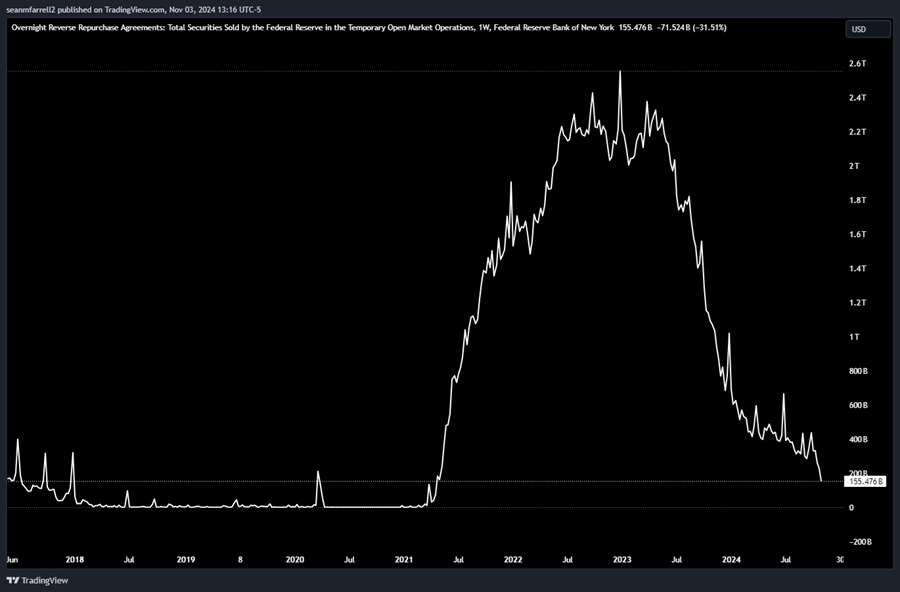

- The balance sheet runoff is likely nearing completion. The RRP, the Fed’s noted measure of excess liquidity in the banking system, is down to $155 billion from over $2.5 trillion at its peak. Once this is depleted, it is a sign to the Fed that banking reserves may no longer be ample. Thus, it is likely that QT will come to an official close over the next 3–6 months.

- If we end up with a split Congress, a scenario with a high likelihood in the event of a Harris victory, it is likely that we will be confronted with another debt ceiling battle in January. This was the macro event that helped catalyze the start of the BTC bull run back in January 2023. The government will once again become limited in its capital-raising ability and must spend down the Treasury General Account (TGA) into the private sector.

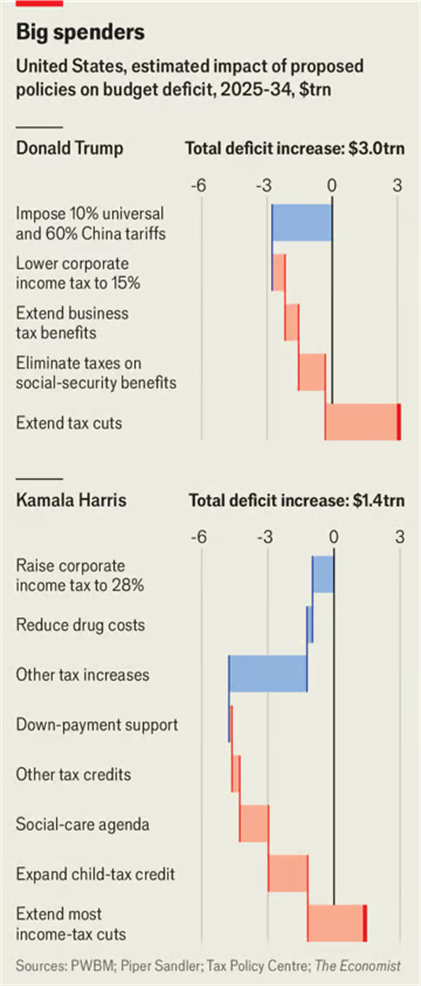

- Regardless of who wins on Tuesday, neither will bring any semblance of fiscal constraint to the table, ultimately resulting in ever-expanding fiscal deficits—an environment in which you want to be short fiat and long liquidity-sensitive assets.

PCE

RRP

Debt Ceiling Hit = Pro Liquidity-Sensitive Assets

Fiscal Situation

Possible Outcomes

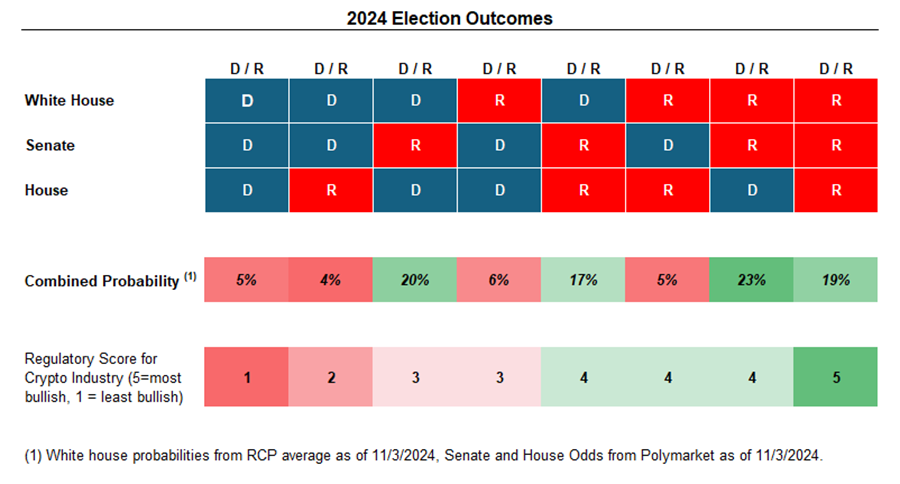

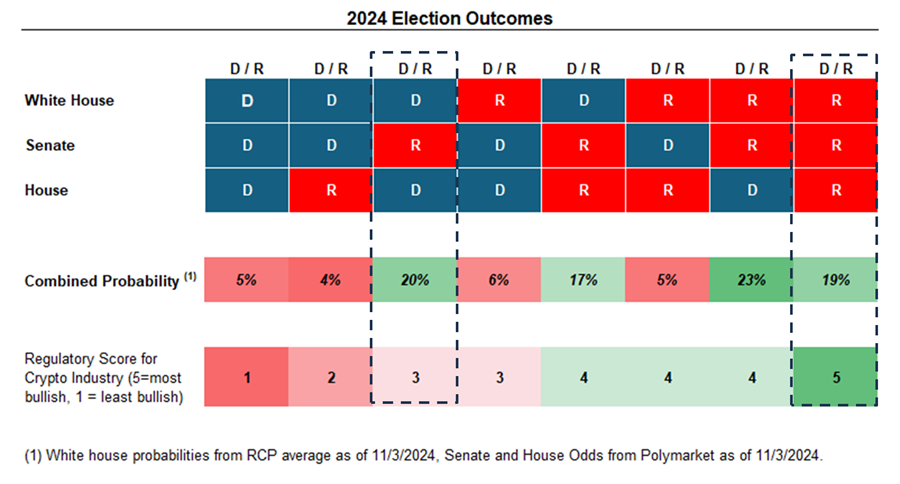

To visualize the possible election scenarios, we compiled the table below. It shows all of the possible combinations of the White House, Senate, and House, the classically combined probabilities as of yesterday, and our qualitative view on the regulatory backdrop in each scenario.

This 1–5 ranking is subjective and considers (1) the likelihood that the current set of prudential regulators are replaced with those who will cease Chokepoint 2.0, (2) the likelihood that a comprehensive market structure and stablecoin bill is passed, and (3) the possibility that BTC is adopted as a strategic reserve asset.

The two most likely outcomes, in our view, are a Harris White House with a split Congress or a red sweep. This is mainly because Congressional voting trends usually skew with presidential voting trends. Thus, if Trump wins, we should expect the House to be won by Republicans by a slim margin, and vice versa if Harris were to win.

The “Harris win/split Congress” scenario garnered a rating of 3 due to the key improvements that would come about from a Republican Senate. A red sweep garnered a 5 because it would immediately dismantle the anti-crypto regulatory apparatus, create a path for comprehensive legislation, and force investors to adjust their modeled probability of the U.S. adopting BTC as a strategic reserve asset upwards from zero.

The other two scenarios that we think are less probable but could certainly happen are a “Harris victory with a red sweep in Congress” and a “Trump win with a split Congress.” We would rate both of these with a score of 4 since we would see improvements in appointed regulators and would have a decent chance of passing legislation, but concessions would likely have to be made somewhere along the way with a divided government.

We Expect a Binary Reaction in the Immediate-Term

Now, in terms of immediate market reaction:

Trump Win:

- Bitcoin – BTC goes higher. We likely see a lot of volatility as leverage pours into the market, but the direction is clear, and the trajectory will be sharp.

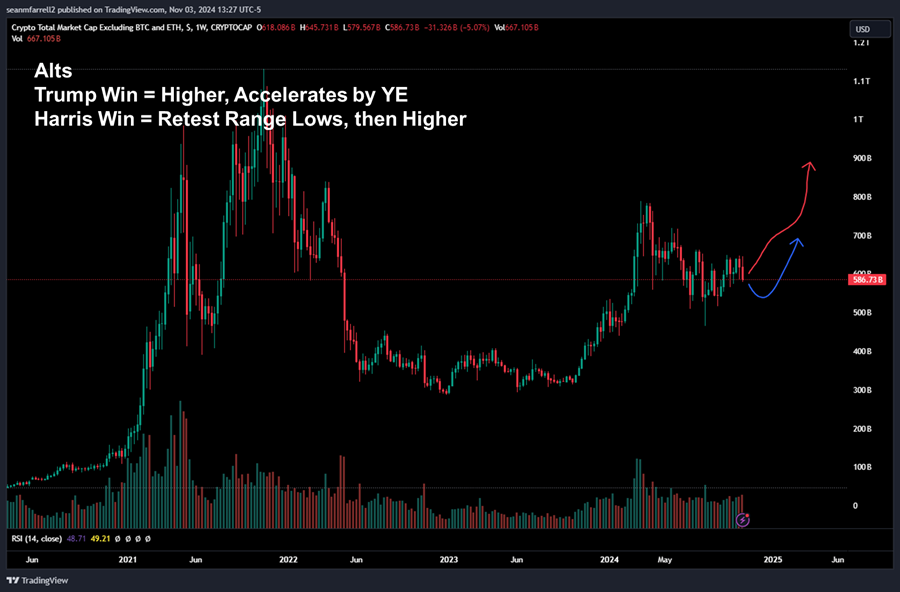

- Altcoins – Altcoins are also likely to move higher as the regulatory outlook shifts overnight (but as noted below, BTC still leads).

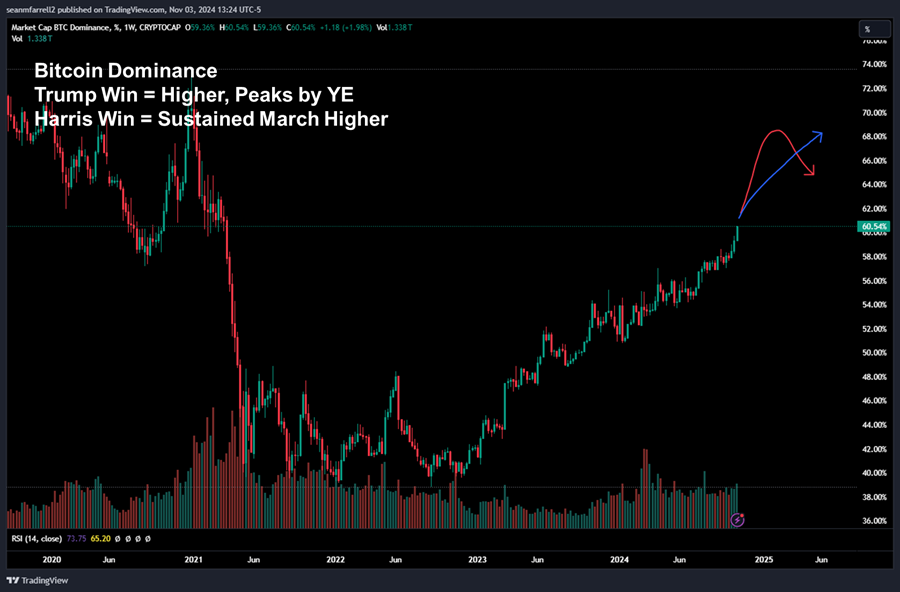

- BTC Dominance – Even though the regulatory environment for altcoins is improved, BTC will be the preferred avenue for traders initially since it is (1) the only asset that Trump has mentioned, and (2) still the primary avenue for flows into the industry. I think once BTC breaks out to a new all-time high and crypto-native traders are recapitalized from an inherent wealth effect, capital will rotate more broadly into alts. We will likely see this rotation happen toward the end of Q4 or Q1. This does not mean that one should not own alts – it simply means that one should remain selective about where they allocate. For us it is SOL and SOL beta as well as BTC L2s.

Harris Win:

- Bitcoin – BTC goes lower. I do not think we will break below the prior range lows. Further, the profit-taking over the past several days should mitigate the violence of this drawdown.

- Altcoins – Altcoins also experience a drawdown, likely one of greater magnitude than BTC.

- BTC Dominance – We likely chart a path consistent with what we have seen the past couple of years, with BTC leading the market and dominance rising at a steady pace (vs a sharper peak and distribution in the event of a Trump victory).

Charts

Please note the charts below are meant to illustrate our directional expectation for prices as opposed to exact price targets.

Core Strategy

Even with a potential drawdown on a Harris win, risks still skew asymmetrically to the upside (BTC retests bottom end of range to the downside vs. $100k+ to the upside). Looking beyond the election, we maintain an optimistic outlook for the crypto market through year-end due to favorable seasonality and improving liquidity conditions. We remain biased toward being overweight SOL while selectively adding exposure to altcoins such as BNB, HNT, JTO, BONK, RAY, STX, and CORE (heavy on BTC and SOL beta). As a reminder, our Core Strategy allocation model, along with crypto equity baskets and trade recommendations, can be found at the end of each note.

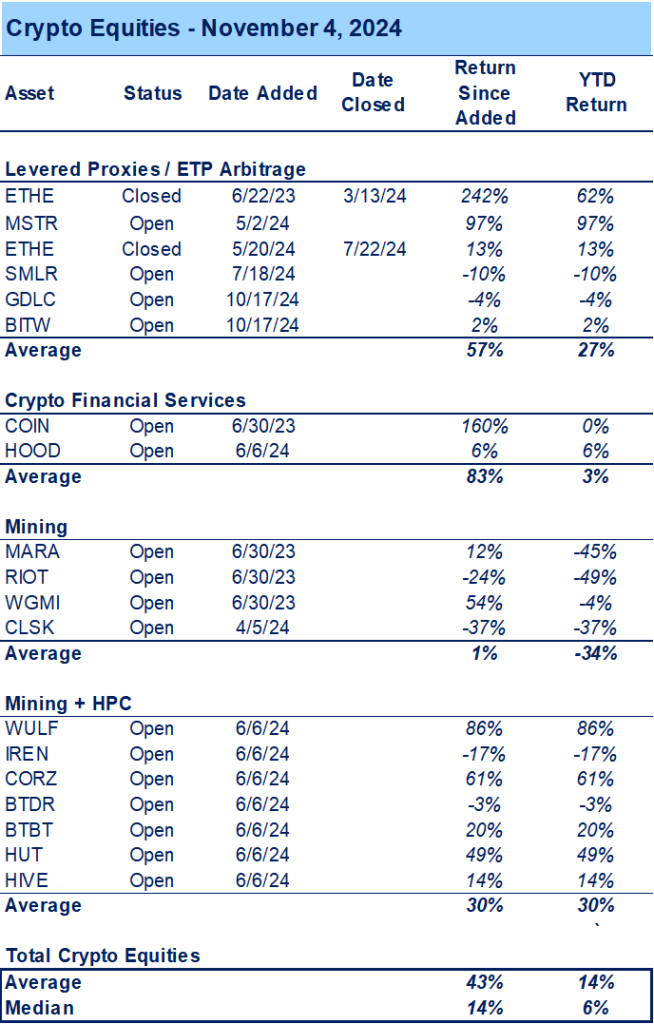

Tickers in this report: BTC 4.72% , XRP 6.19% , SOL 8.16% , ETH 6.39% , HNT 21.64% , STX N/A% , MKR 3.12% , BNB 4.40% , CORE 4.71% , JTO 5.65% , BONK 5.28% , RAY 6.95% , MSTR 8.83% , SMLR, COIN 17.12% , HOOD 7.13% , MARA 9.38% , RIOT 7.18% , WGMI 3.09% , CLSK 5.26% , WULF 1.63% , IREN 4.98% , CORZ 2.40% , BTDR -3.38% , BTBT 2.94% , HUT 5.77% , HIVE 5.14% , AVAX 4.20% , XRP 6.19% , GDLC, BITW 5.55%