Buying More SOL, Plus Another Election Trade Idea (Core Strategy Rebalance)

Key Takeaways

- Small Cap Correlations: The recent breakout of IWM and the broadening out of the equity market rally is a positive sign for crypto.

- Election Odds: The best-case scenario for crypto—a GOP sweep—has climbed to 45% odds on Polymarket.

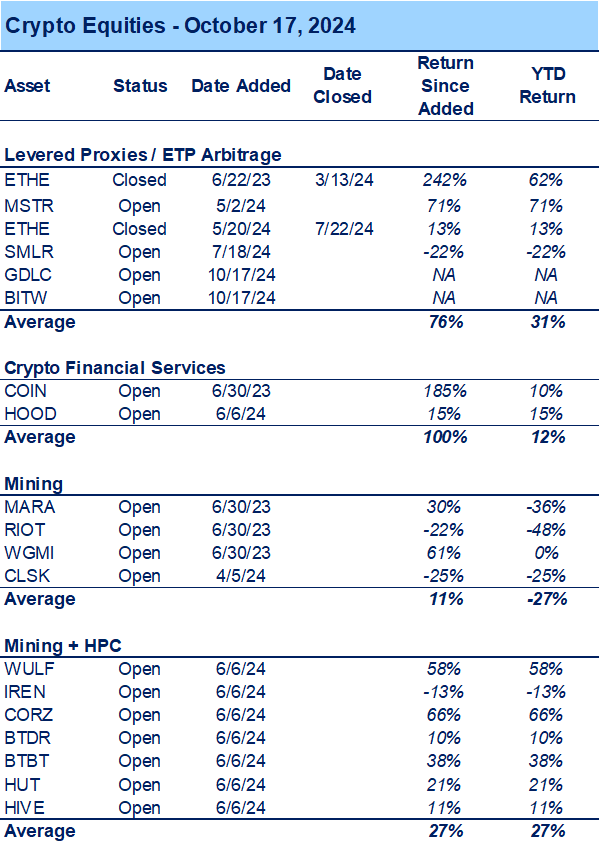

- Trade Idea: Grayscale’s GDLC, along with Bitwise's similar fund, BITW, present a compelling opportunity ahead of the election.

- Buying More SOL: We view now as a good time to deploy the rest of the stablecoins in our Core Strategy and think that SOL is a good place to park this capital, a perspective that is buttressed by soaring DEX volumes and capital flows into the network.

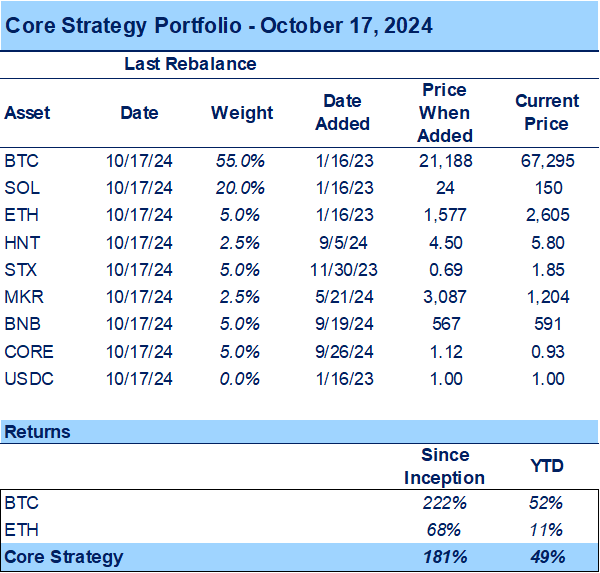

- Core Strategy: As year-end approaches, we remain optimistic about the crypto outlook. With hard landing risks fading after the Fed's dovish but reassuring stance, we believe now is the time to take calculated risks in one’s crypto portfolio. Our focus remains on the majors, with selective exposure to altcoins like HNT, MKR, STX, BNB, and CORE. As a reminder, our Core Strategy allocation model, along with crypto equity baskets and trade recommendations, is included at the end of each note.

Small Cap Breakout a Positive Indicator for BTC

It is a common refrain among passive industry observers that BTC is strongly correlated with large-cap tech stocks, leading some to view BTC as a quasi-leveraged version of QQQ. However, we think this perspective is limiting. If you were to rely on QQQ as a barometer for crypto market conditions, you would experience several periods of underperformance over the course of a liquidity cycle.

For instance, in Q2 of this year, when the market was awash with bullish fervor around NVIDIA and AI, tech stocks soared on solid earnings and growth projections. Yet, BTC performed rather poorly during this period. This disparity arises because BTC trades according to shifts in monetary and fiscal conditions. Historically, these conditions have also affected large-cap tech stocks for extended periods, but they are not always in sync, such as during the earnings-driven rally of earlier this year.

To better gauge the direction of the monetary and fiscal tides, one should look to indices that have stronger ties to the cost of money than large-cap tech companies like NVIDIA or Meta. Small caps have a much higher sensitivity to rate expectations, the yield curve, and other monetary and fiscal factors due to their higher leverage, lower profitability, and share of floating rate debt.

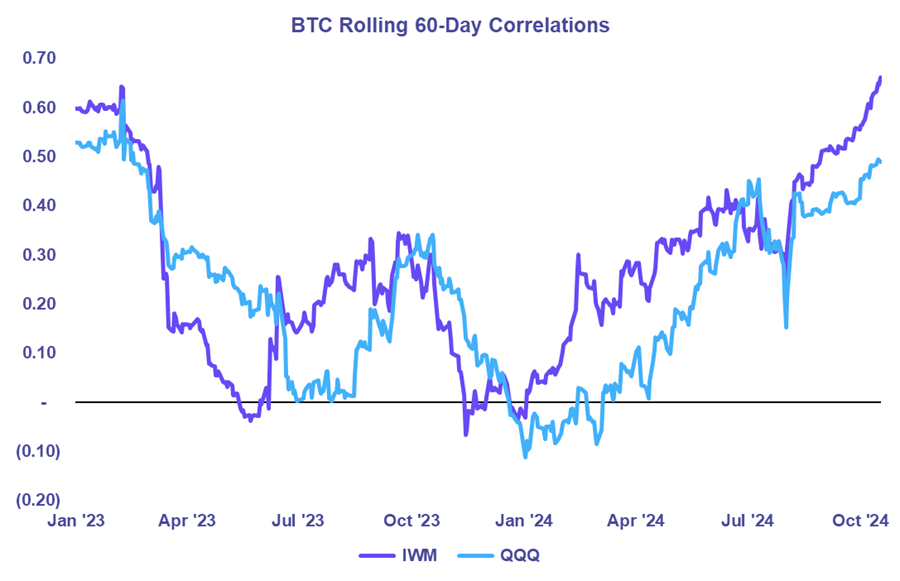

When we examine the rolling 60-day correlations between BTC and QQQ, and BTC and IWM, we find considerably tighter correlations between BTC and IWM.

This relationship is further reflected in the visible relationship between BTC and the relative performance of small caps relative to the SPX.

The takeaway here is that if one is looking to an area of the equity market for a correlative relationship to BTC, it makes sense to focus on small caps as they are more sensitive to macro conditions, rather than large cap indices like QQQ or SPX.

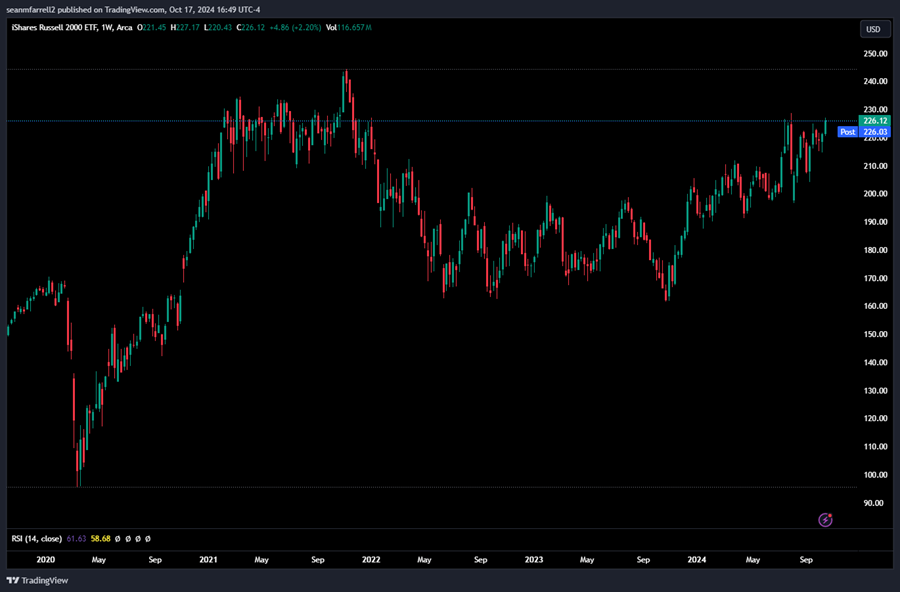

With the above in mind, the recent breakout of IWM and the broadening out of the equity market rally is a very positive sign for crypto. A market that is rotating into small caps is likely one that is conducive for BTC to achieve its own breakout.

Trump Maintaining Election Momentum

Our longer-term view remains that while there is unlikely to be a sustained discount to crypto prices due to a potential Harris presidency, there should be a “Trump premium” considered for crypto prices. Thus, election-related trends remain a key reason to remain constructive on crypto in the near term.

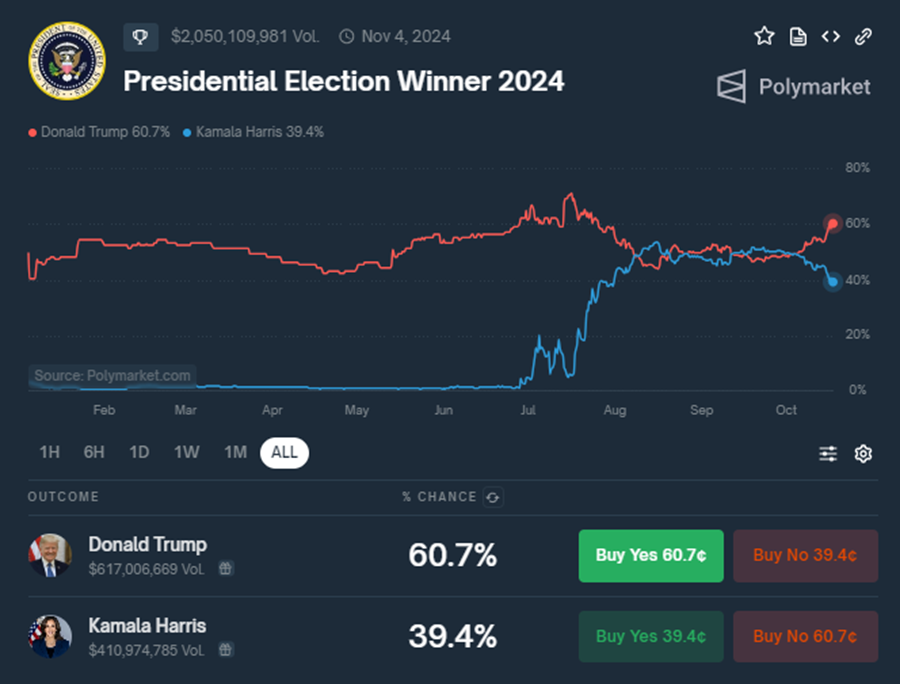

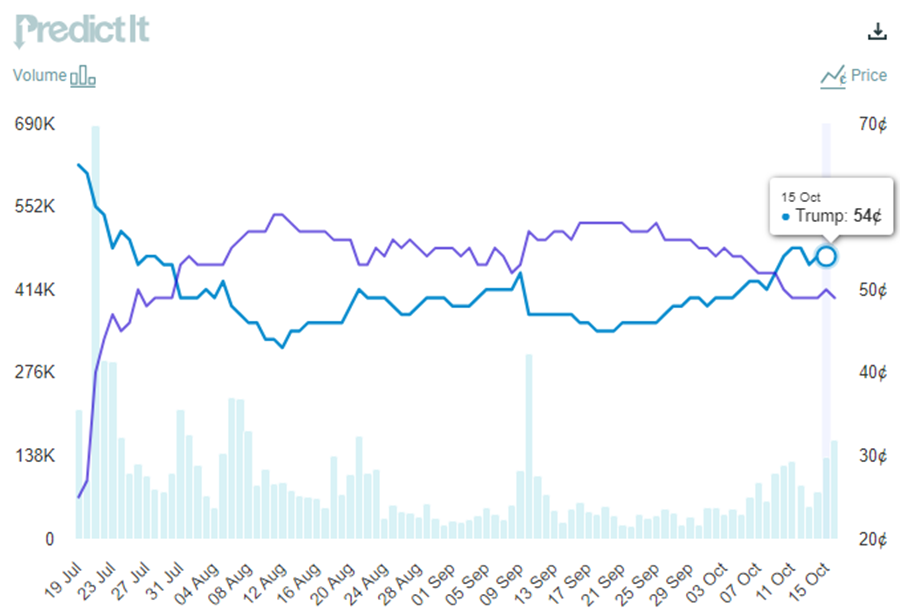

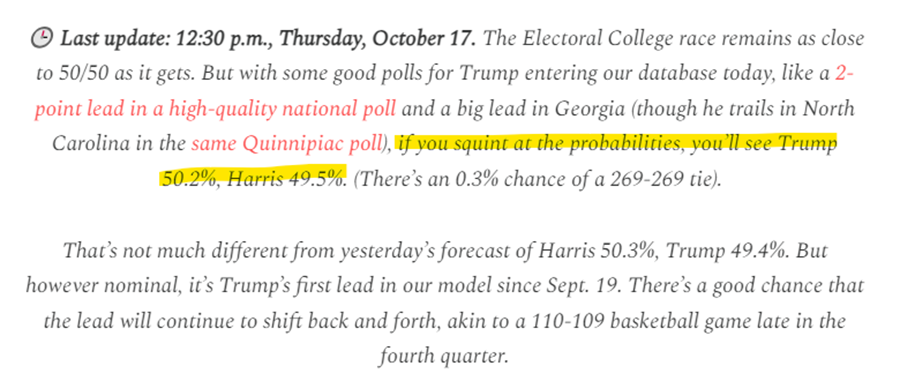

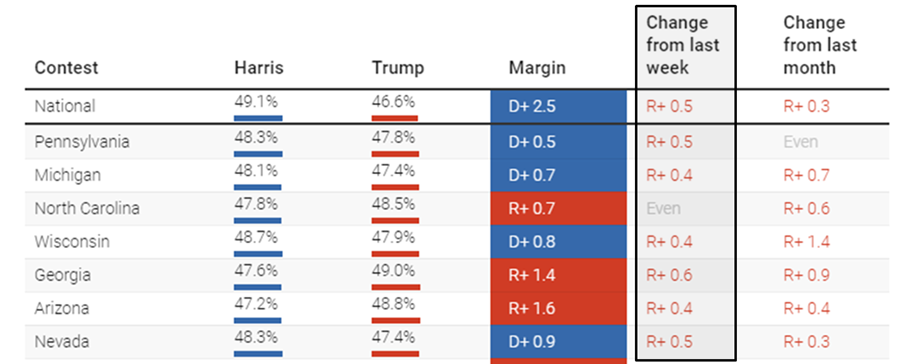

Over the past couple of weeks, we have been documenting the shifting tides in the presidential election, with polls and prediction markets increasingly favoring Trump. This week, we have seen much of the same, with Polymarket reaching a whopping 60.7% odds for Trump, PredictIt moving to 54%, and Nate Silver—the gold standard in election prognostication—shifting slightly in favor of Trump (even if only by a few bps). As a reminder, the important thing with the Silver model (and the prediction markets) is the trend, and as of now, the trend appears to still favor Trump.

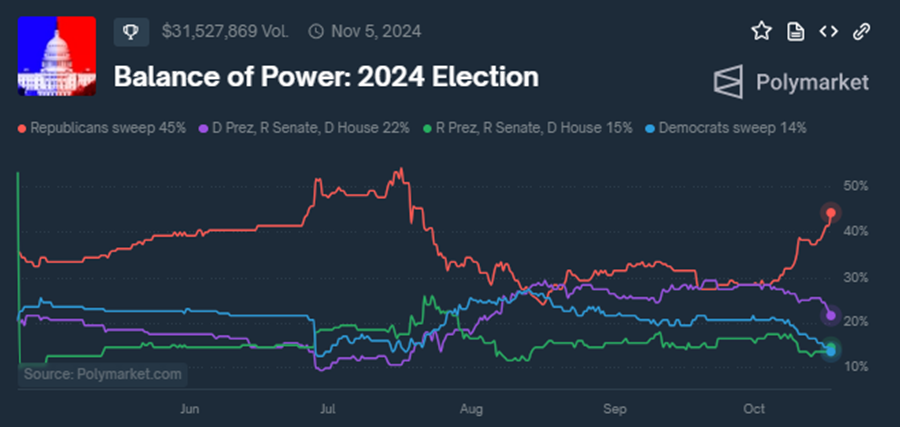

One new data point we wanted to highlight this week are the combined “balance of power” odds. This is a prediction market on Polymarket that measures the odds of different combinations of control over the White House, House, and Senate.

It remains near consensus that the Senate will flip to the GOP, with only a 14% chance of a Democratic sweep. This would be the downside case for crypto, as this is the government composition in which the current regulation-via-enforcement strategy would likely persist.

The best-case scenario for crypto—a GOP sweep—has climbed to 45% odds, well above the 22% chance of a Democratic White House and House with a Republican Senate. This intuitively makes sense, as stronger turnout for the GOP could equate to victories in both the White House and the House.

GDLC and BITW Offer Compelling Election Trade Opportunities

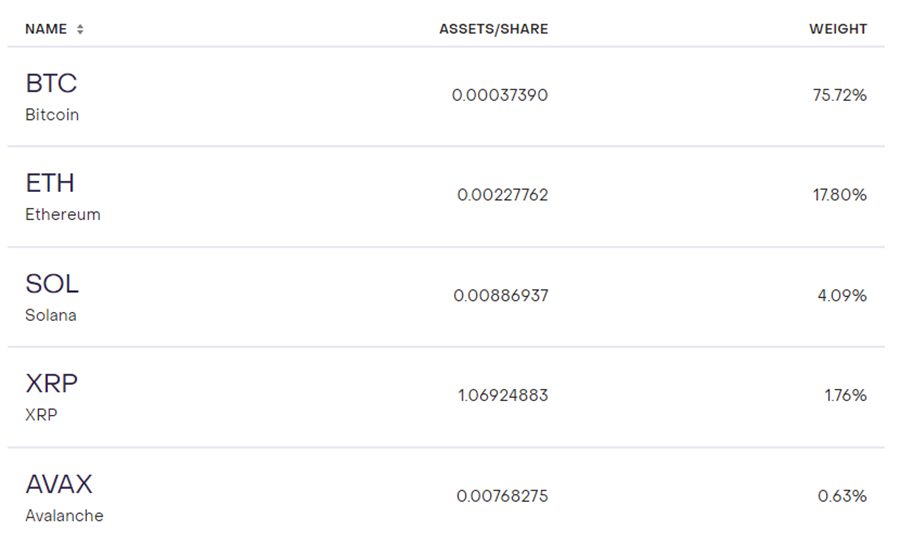

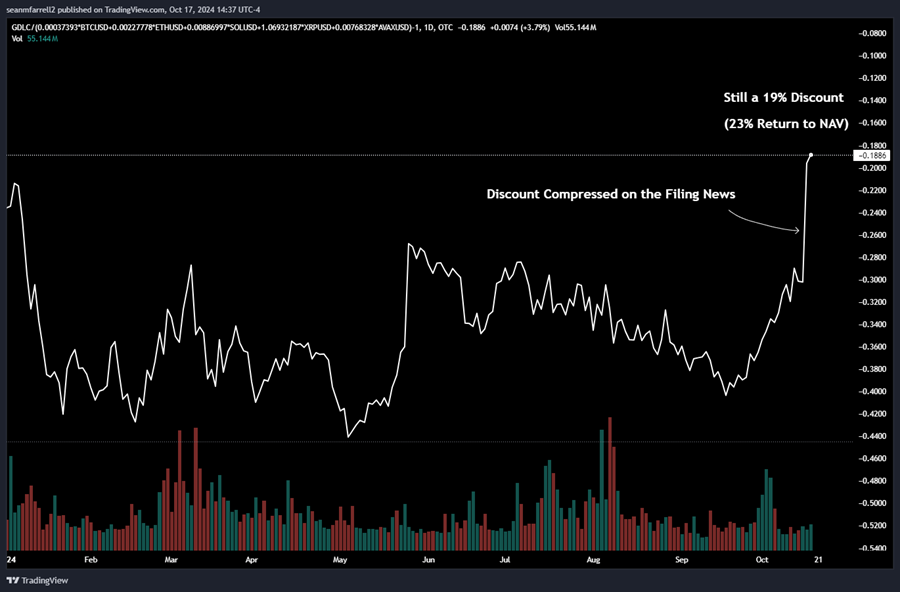

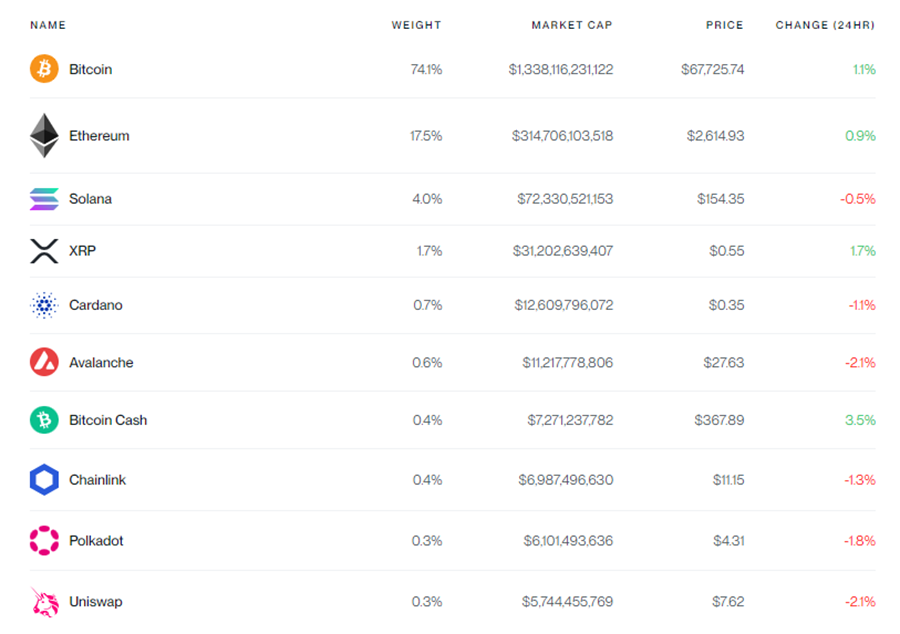

On Tuesday, Grayscale filed to convert its Grayscale Digital Large Cap Fund (GDLC) into an ETF. The fund tracks the CoinDesk Large Cap Select Index, which includes BTC, ETH, SOL, XRP, and AVAX. Currently traded OTC, the fund lacks a creation/redemption mechanism and therefore trades at a discount to its net asset value (NAV). This dynamic is similar to how Grayscale’s BTC and ETH trusts traded prior to converting into ETFs.

While GDLC holds altcoins like XRP, SOL, and AVAX, the percentage of AUM allocated to these assets is relatively small compared to its holdings of BTC and ETH.

Following the news of the ETF filing, the fund’s discount compressed from around 30% to 20%, and as of today, GDLC maintains a 19% discount to NAV.

We believe that GDLC, along with Bitwise’s similar fund, BITW, presents a compelling risk/reward opportunity ahead of the election on November 5th, and could be viewed as a favored “Trump Trade” going forward, as it is assumed that the current SEC would strike down this application while a Trump-appointed SEC might give them the go-ahead.

The key risk in the near-term is that the SEC denies the application before it gets filed in the Federal Register. Acknowledgment in the Federal Register is the step that activates the normal timeline for ETF approval. If the SEC denies the application before it hits the Federal Register, we would likely see the discount expand.

However, we have some precedents to consider. In June, VanEck and 21Shares both applied for spot SOL ETFs. As anticipated by most, these were ultimately denied, but it took the SEC over 50 days to deny this application, waiting until August 20th to do so. If we assume they take just as long to deny this application, it will put us well after the election – making the election the sole catalyst in which direction the discount moves.

Further, even with that risk being understood, it is worth considering whether denial from the current SEC would affect the “election trade” aspect of this thesis at all.

If the SEC denies the application prior to the election, we likely see a quick resurgence in the discount to NAV, but it ultimately would return to being a proxy for election odds, since upon a Trump presidency, Grayscale could just refile their application.

We view this as a good way to gain exposure to Trump’s odds in the upcoming election. Assuming no appreciation in the underlying assets, if GDLC were to converge to NAV, we would be looking at a 23% return.

Another similar opportunity lies in Bitwise’s similarly constructed multi-asset fund, BITW. This fund is also mostly comprised (91.5%) of BTC and ETH and would face a similar fate as GDLC should Bitwise apply to convert the fund.

Since there is no outstanding application from Bitwise, this fund is trading at a steeper 27% discount. If the market price were to converge to NAV, we would be looking at a 37% return, excluding any appreciation in the underlying asset prices.

A Good Time to Buy More SOL

Given the political, macro, and seasonal tailwinds at play, we think it is a good time to deploy the remainder of the stablecoins in our Core Strategy. We view SOL as a good place to park this capital, a perspective that is supported by a fundamentally bullish on-chain picture for the network.

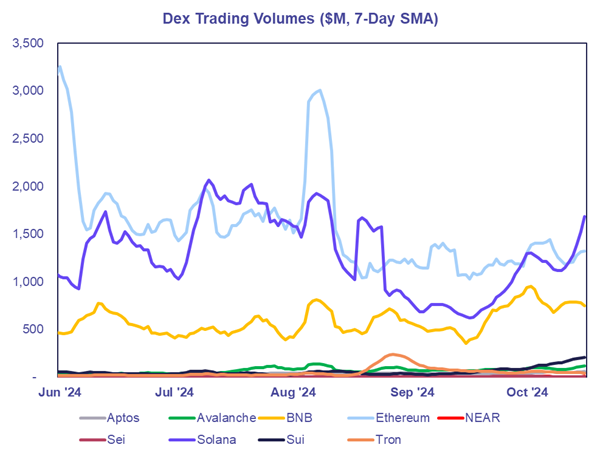

Recent data shows that DEX volumes on Solana have surged, returning to levels seen in July and August. While Ethereum has historically led in DEX volumes, trading activity on Solana has surpassed it in recent weeks, with its 7-day moving average now exceeding $1.5 billion.

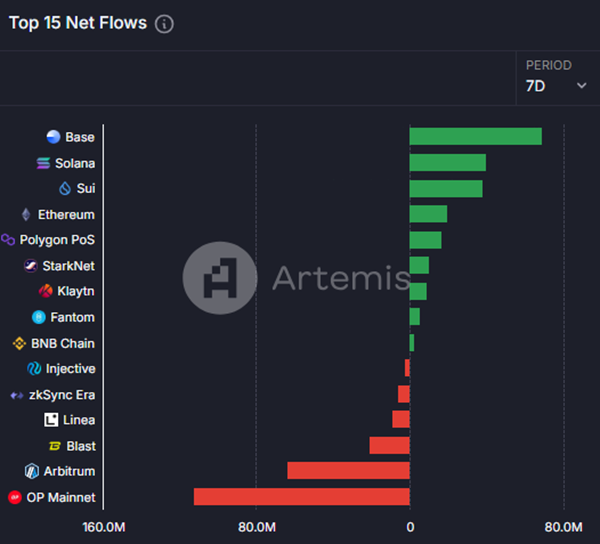

Furthermore, fund flows provide insight into which networks are attracting capital. Over the past 7 days, Solana has recorded the second-highest inflows among all networks tracked by data provider Artemis. As the saying goes—follow the money.

Core Strategy

As year-end approaches, we remain optimistic about the crypto outlook. With hard landing risks fading after the Fed’s dovish but reassuring stance, we believe now is the time to take calculated risks in one’s crypto portfolio. Our focus remains on the majors, with selective exposure to altcoins like HNT, MKR, STX, BNB, and CORE. As a reminder, our Core Strategy allocation model, along with crypto equity baskets and trade recommendations, is included at the end of each note.

Tickers in this report: BTC -0.68% , XRP -2.58% , SOL -0.33% , ETH -1.06% , HNT -5.66% , STX N/A% , MKR 2.66% , BNB 1.20% , CORE, MSTR -4.27% , SMLR 3.22% , COIN 0.30% , HOOD 0.28% , MARA -5.40% , RIOT 0.14% , WGMI -3.41% , CLSK -8.60% , WULF -4.60% , IREN -4.15% , CORZ -1.78% , BTDR -4.61% , BTBT -3.57% , HUT 2.19% , HIVE -6.86% , AVAX 0.59% , XRP -2.58% , GDLC, BITW