CME Basis Suggests We Are Near a Tradable Low, Plus Some Thoughts on Positioning Ahead of the Election

Key Takeaways

- Deluge of Negative Catalysts: This week brought a wave of negative catalysts, including missile attacks, natural disasters, strikes, and a rise in rates/DXY. With much of this negativity already priced in, we believe the risk outlook now skews to the upside.

- CME Basis Signals a Potential Low: CME annualized basis dropping below 6% marks a potential tradable market bottom, similar to prior instances this year where BTC found support after the basis fell below 7%.

- Trading the Election: Senate control flipping Republican post-election could lead to a more favorable regulatory environment for crypto, regardless of what happens in the White House. However, tactically, it is prudent to consider that prices will correlate with Trump's odds on election night.

- XRP and the Election: Given the SEC's appeal of the Ripple lawsuit and our tactical election views, XRP emerges as a strong candidate for those looking to trade around the election outcome.

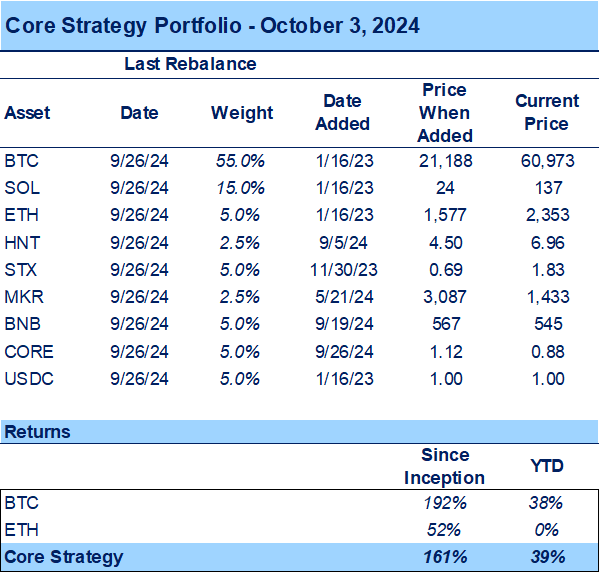

- Core Strategy: As year-end approaches, we remain optimistic about the crypto outlook. With hard landing risks fading after the Fed's dovish but reassuring stance, we believe now is the time to take calculated risks in one’s crypto portfolio. Our focus remains on the majors, with selective exposure to altcoins like HNT, MKR, STX, BNB, and CORE. As a reminder, our Core Strategy allocation model, along with crypto equity baskets and trade recommendations, is included at the end of each note.

A Rough Stretch Amid Rising Uncertainty Skews Risks to the Upside

The past five trading days have been challenging for the crypto market, marked by significant uncertainty stemming from various geopolitical and economic events. Among the notable sources of market distress are:

- Geopolitical Tensions: Iran’s missile attack on Israel has led to heightened anticipation of an Israeli response, with oil prices spiking to $74.

- Natural Disasters: A devastating hurricane in the Southeast U.S. is expected to disrupt numerous companies and jobs for weeks, possibly months.

- Labor Strikes: The potential longshoremen strike, which threatens to halt all trade via ports in the Eastern half of the U.S., has added further pressure.

- Fed Hawkishness: During an interview on Monday, a somewhat “hawkish” Fed Chair Powell shifted futures pricing from a 50-bps cut to a 25-bps cut at the next meeting.

- Economic Data Uncertainty: Market participants are also nervous ahead of tomorrow’s jobs report, despite a hotter-than-expected Services PMI this morning.

On balance, these events have nudged the market toward the “no landing” scenario on our Fed landing map.

This is reflected in the relative outperformance of large caps over small caps, an increase in the DXY, and rising rates following the missile strike on Monday.

However, there are two upcoming data points in the next five trading days that could move the market back into “soft landing” territory:

- Jobs Report (Friday): Ideally, we want the jobs report to be “on target” or slightly below forecast. A hotter-than-expected number could push rates higher next week, while a too-low number might lead to “hard landing” pricing.

- CPI Report (Next Week): While less crucial than jobs data, a cooler CPI next week would still help bring rates lower and support the “soft landing” trade leading into the election.

Regardless, given this week’s deluge of negative catalysts, the risk outlook seems to skew to the upside from here, particularly if the upcoming data surprises favorably.

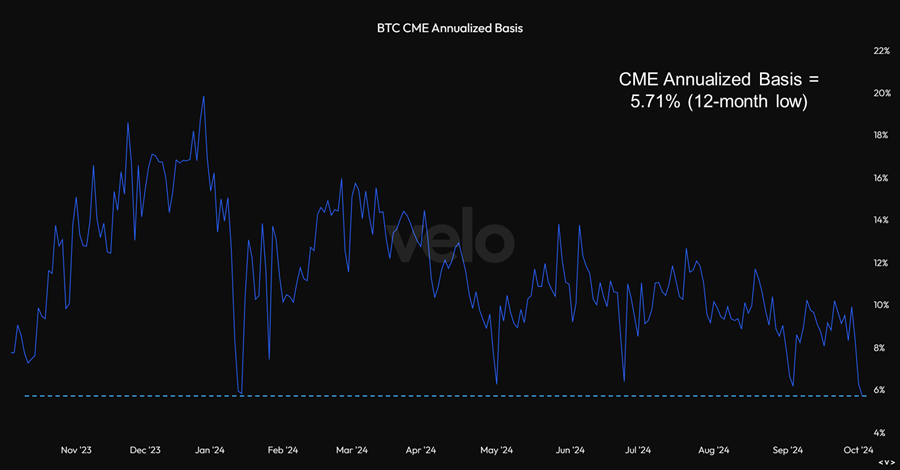

CME Basis Signals a Potential Tradable Bottom

The annualized CME basis has dropped below 6%, marking a new 12-month low and only the second time this year that it has reached this level. Thus far this year, the annualized basis falling below 7% has signaled that a tradable market bottom was near.

Excluding the most recent data point, CME basis has fallen below 7% four times this year. In three of those instances, BTC found a bottom within just a few trading days. The one exception occurred in January, when outflows from GBTC were putting downward pressure on prices. While this event led to an extended period of price decline, it was an idiosyncratic factor that is no longer relevant. Even then, BTC found a bottom 11 calendar days later and rallied quickly to new highs.

The other nuanced instance was in June, where CME basis correctly signaled a bottom, but there was some additional downside volatility seven days later as the German government began selling their BTC holdings over a long holiday weekend. Despite this volatility, the overall trend moved higher shortly thereafter.

With CME basis once again falling below 7% as of October 1st, we believe a similar bottoming pattern may emerge, suggesting a tradable bottom could be near.

Regulatory Outlook Post-Election: A Potential Improvement for Crypto

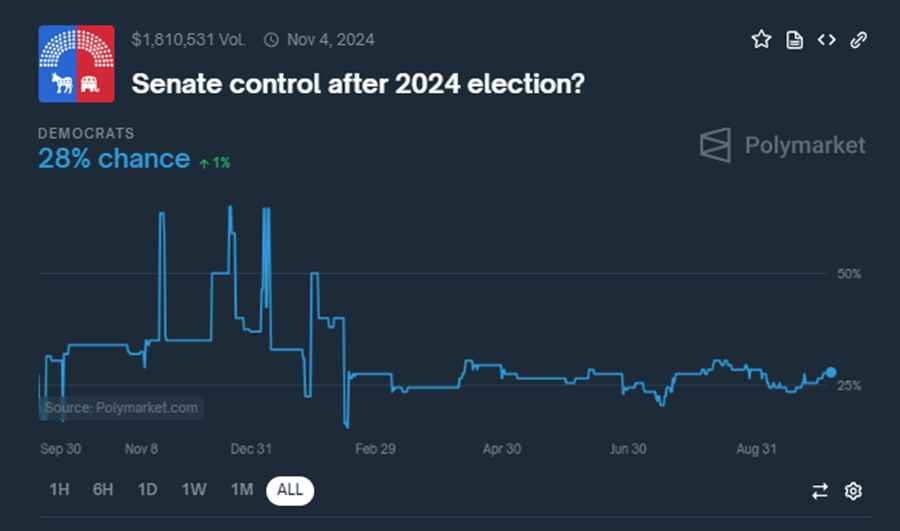

To reiterate our stance on the regulatory picture post-election, it is more likely than not that the regulatory backdrop will improve, largely due to the increasing odds of the Senate flipping Republican. Since the Senate must approve all agency and cabinet appointments made by the White House, a Republican-controlled Senate would have significant sway over regulatory matters. Furthermore, this shift would mean the Senate Banking Committee would also turn Republican, effectively removing key members of Congress who have been the most hostile towards crypto from their influential positions.

While the best scenario for the crypto industry would be for both the White House and the Senate to turn red, the probability of the latter happening is still approximately a coin flip. However, Senate control has a much higher likelihood of shifting as we approach November, especially compared to the House or White House, as evidenced by Polymarket odds.

Below is a summary of comments I received from Tom Block, explaining why a flip in the Senate from Democratic to Republican control could significantly impact crypto:

Tom explains that few in Washington have the power of a Committee Chair. In both the House and the Senate the Chair of a Committee exercises wide power over what the Committee will do from holding a hearing, who the witnesses will be, and whether or not to consider a bill in a so-called Mark-up Session. While the House Financial Services Committee has approved bipartisan crypto bills, the Senate under Senators Brown and Warren has been more hostile to the industry.

Of the 34 Senate seats that are up for election this year 23 are currently held by Democrats. The most vulnerable seat to flip is WV where conservative Democrat Senator Joe Manchin is not running for re-election and the seat is all but certain to flip to Republican. That leaves the Senate tied 50-50. Democrats are also defending seats in the Republican states of MT and OH. Additionally, races in PA, MI, WS, AZ, MD, and NV are all currently held by Democrats and are rated competitive.

On the other hand, even the most optimistic Democrats see only two possible Democratic flips and they are in the very Republican states of TX and FL. In both states the Republican incumbents have low favorability numbers: Cruz in TX and Scott in FL. Both states have strong Democratic challengers but both states have strong records of voting for Republicans. Both states have Republican state legislatures, Republican Governors, and both US Senators are Republican.

Navigating Short-Term Volatility While Keeping a Broader Perspective

To summarize our medium/longer-term perspective, unless the trajectory of the Senate changes, we see minor downside implications tied to the presidential election outcome. In other words, there will be a “Trump Premium,” but there is unlikely to be a sustained “Harris Discount.”

However, as the election approaches, we do anticipate narratives to dominate the order books and for there to be considerable volatility. Short-term trading trends are likely to track changes in Trump and Harris odds. A Trump victory would likely send crypto—particularly altcoins—much higher, while a Harris victory would likely result in a significant decline, especially for altcoins.

This is a tactical view that is worth managing risk around, but we think it’s important to maintain a more sanguine medium-to-longer-term perspective regardless of the outcome (again if the Senate flips red).

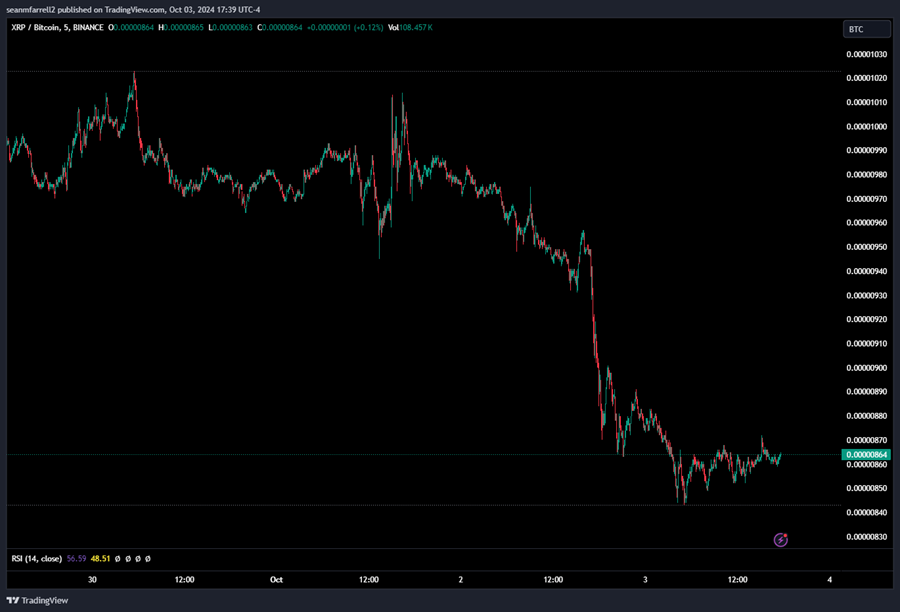

XRP Verdict Appeal Positions It as an Election Trade Opportunity

Given the evolving regulatory environment, XRP has emerged as a strong candidate for inclusion in an election trade basket, particularly for tactical traders seeking directional exposure to election outcomes.

This week, Bitwise filed a registration statement with the SEC for a spot XRP ETF, aiming to provide investors with exposure to XRP. If approved, this would be the first spot XRP ETF, though it now faces significant regulatory hurdles.

On Wednesday, the SEC issued a notice that it would appeal the U.S. Court’s decision in a lawsuit involving Ripple, which alleged that Ripple conducted over $1.3 billion in unregistered security sales via its XRP token. The court ruled that while institutional sales of XRP violated securities laws, programmatic sales did not, implying that tokens are not inherently securities—it’s the manner of sale that matters. This was a significant victory for the crypto space, and until the appeal is overturned, it remains so.

The SEC contends that the decision contradicts decades of Supreme Court precedent and securities laws, and the appeal will proceed to the 2nd U.S. Circuit Court of Appeals. Despite the appeal being widely anticipated, XRP saw a decline in the news.

We believe it’s worth noting that, regardless of XRP’s security designation, an XRP ETF likely faces a challenging road due to the lack of a liquid, regulated futures market of significant size—an obstacle faced by most crypto spot ETFs, including SOL.

However, this is about potential election-based trades, centered around probabilities and narratives. The market is likely to envision a scenario in which a more crypto-friendly SEC chair under a Trump administration rescinds this appeal and places some probability on that chair expediting the ETF’s approval, despite the lack of a regulated futures market. Thus, considering our tactical election views, XRP becomes a solid candidate for those looking to trade around the election outcome.

Core Strategy

As year-end approaches, we remain optimistic about the crypto outlook. With hard landing risks fading after the Fed’s dovish but reassuring stance, we believe now is the time to take calculated risks in one’s crypto portfolio. Our focus remains on the majors, with selective exposure to altcoins like HNT, MKR, STX, BNB, and CORE. As a reminder, our Core Strategy allocation model, along with crypto equity baskets and trade recommendations, is included at the end of each note.

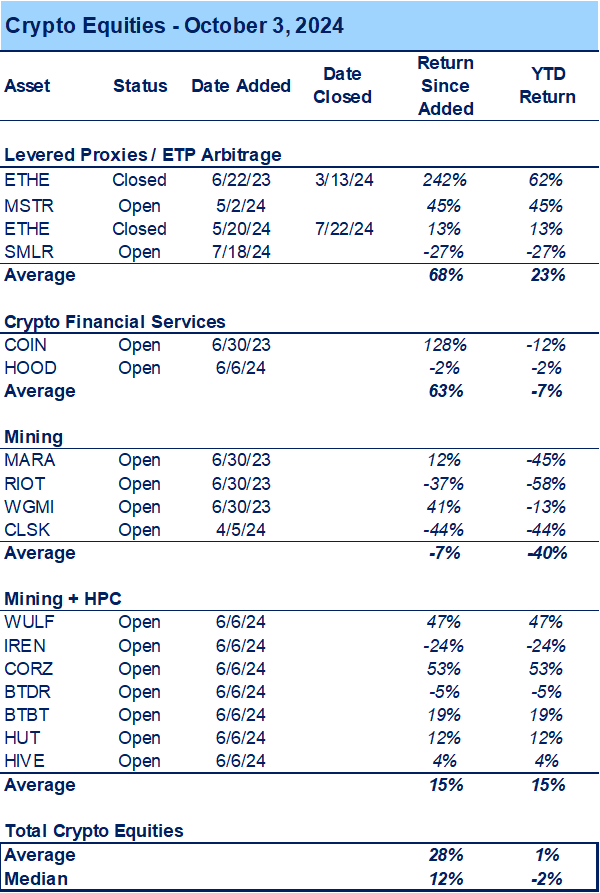

Tickers in this report: BTC 1.24% , XRP -0.90% , SOL 1.22% , ETH -0.03% , HNT -6.70% , STX N/A% , MKR -1.13% , BNB 0.20% , CORE -1.27% , MSTR 1.25% , SMLR, COIN -0.43% , HOOD -0.51% , MARA 4.75% , RIOT 2.29% , WGMI 0.02% , CLSK 4.31% , WULF -0.75% , IREN 1.77% , CORZ 2.69% , BTDR -19.61% , BTBT 0.61% , HUT 0.75% , HIVE -1.18%