Adding BNB to Core Strategy (Core Strategy Rebalance)

Key Takeaways

- Fed Nails It: Yesterday, the Fed did exactly what risk assets were looking for—implementing a dovish 50-bps cut and providing guidance for two more by year-end, all while maintaining reassuring economic commentary (though some bears misinterpreted this as hawkish). The bond selloff is simply the market pricing out a hard landing.

- Adding BNB: We are adding BNB to our Core Strategy this week, as it stands to benefit from both strong fundamentals and narrative-driven tailwinds heading into Q4.

- Increasing SOL and STX Allocation: We are also increasing our exposure to SOL and STX, which have been reliable sources of BTC beta this cycle. Additionally, Stacks continues to make progress on its Nakamoto upgrade.

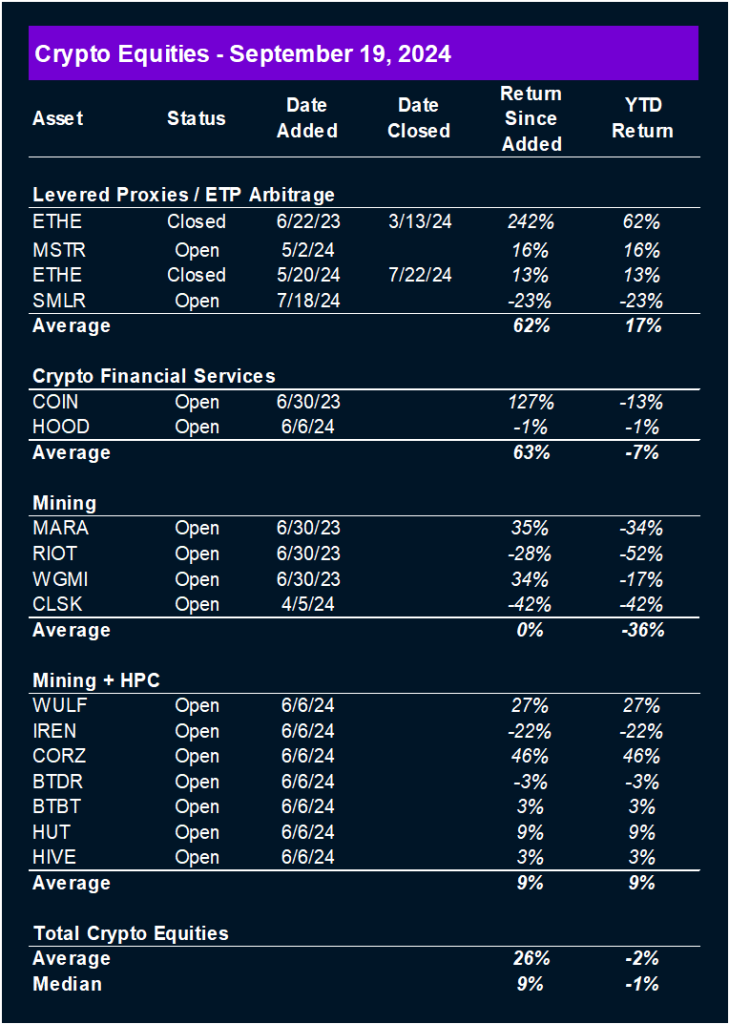

- Core Strategy Outlook: As we approach year-end, we remain optimistic about the crypto outlook, seeing the market’s lean toward a soft landing as constructive for prices. With the hard landing risk fading after the Fed's dovish but reassuring stance, we believe now is the right time to deploy some of the dry powder in our Core Strategy. Our focus remains on the majors, with selective exposure to altcoins like HNT, MKR, STX, and this week's new addition, BNB. As a reminder, our Core Strategy allocation model, along with crypto equity baskets and trade recommendations, is included at the end of each note.

Our Verdict: Powell Nailed It

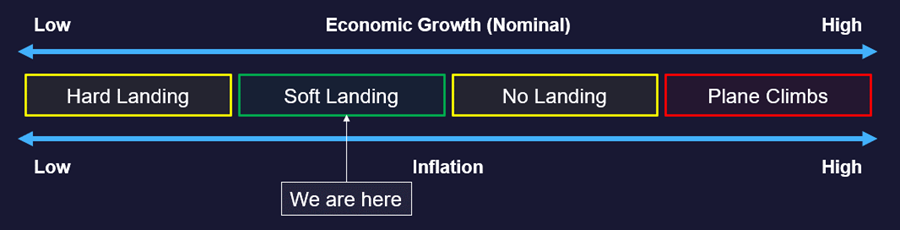

Yesterday, Powell did exactly what risk assets wanted him to do—their actions were dovish, with a 50-bps cut and guidance for two more by year-end, but their economic commentary remained reassuring. Many bears point to this as hawkish, and since it’s hawkish, it’s implicitly bad for risk assets (including crypto).

In our view, if Powell had taken a significantly more dovish stance than he did, markets might have priced in a higher probability of a hard landing. This would likely have pushed bonds to rally further, while risk assets would have faced a tougher road ahead.

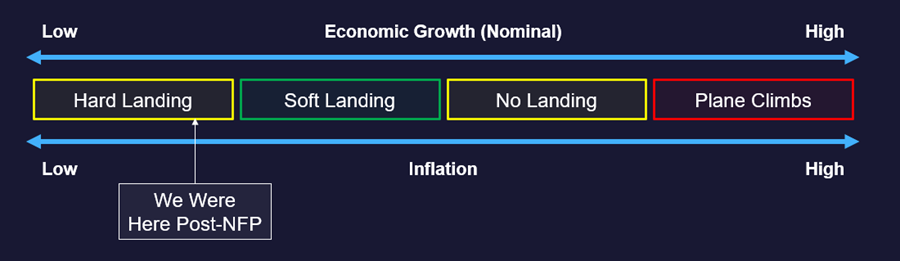

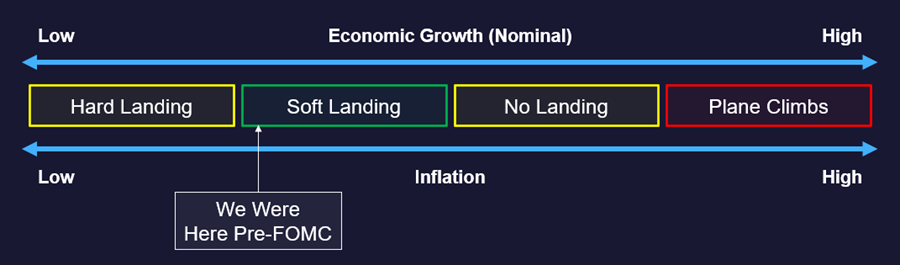

Since August, the market has been walking a tightrope between expectations of a hard landing and a soft landing. We’ve recently said that for BTC to get a sustained bid, the market would need to more fully price in either scenario.

Our money was on the latter due to the largely non-recessionary economic data. However, the market had been wary about job numbers, and our view was that it would take a combination of (1) stronger economic data to trickle in and (2) a dovish but reassuring Fed to more fully price in a soft landing.

We think that recent GDP revisions and retail sales numbers have taken care of the former, and the Fed’s actions and commentary have taken care of the latter. We could certainly see the occasional weak data print over the next couple of months, but with a Fed that is both confident in current economic growth but still willing to be supportive of markets, the risks here skew toward soft-landing.

We view the selloff in bonds as a reflection of the hard landing tail risk being priced out.

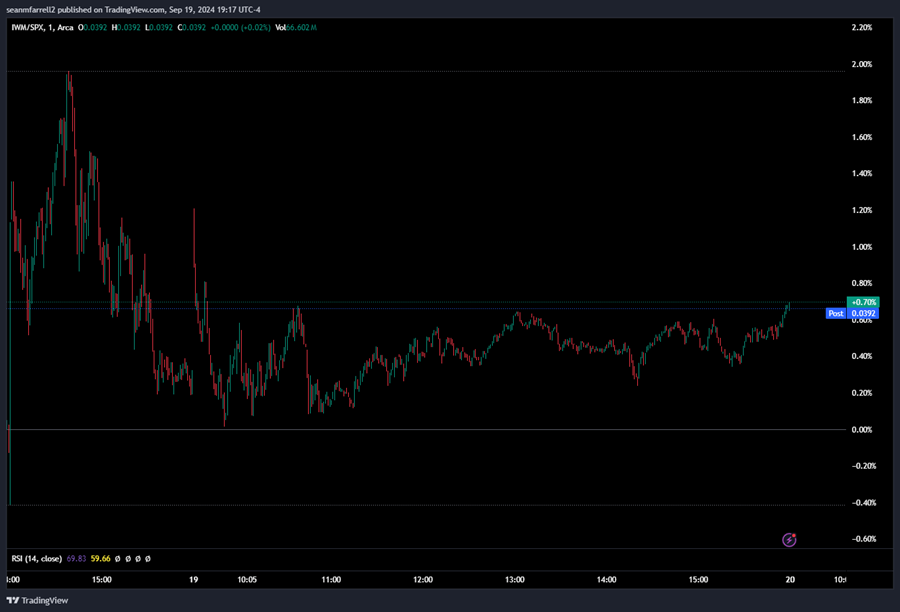

We also saw small caps rally and marginally beat SPX – a sign of soft landing pricing.

Adding BNB

With the above in mind, as promised, we think it’s time to start deploying the stablecoins in our Core Strategy into opportunities that could offer outperformance into year-end. The new addition this week is BNB.

BNB Overview

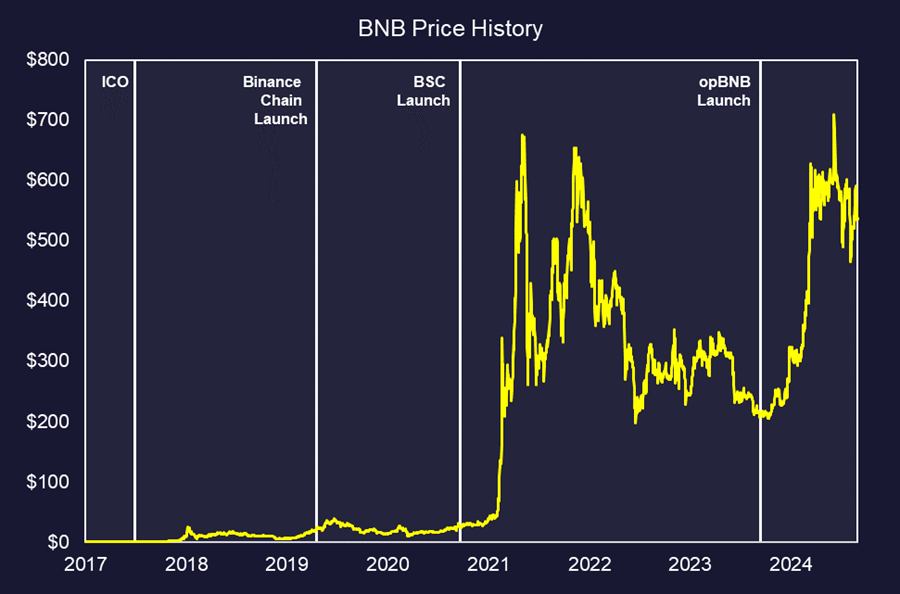

- BNB’s Initial Use (2017): BNB was initially launched via an ICO in 2017 as an ERC-20 token on Ethereum. It was used as a utility token on Binance, providing users with discounts on trading fees.

- Creation of Binance Chain (2019): Binance launched its own blockchain, Binance Chain, to enable decentralized trading, with BNB serving as the native token. The token transitioned from Ethereum to the new Beacon Chain under the BEP-2 token standard. The chain was designed to enable efficient and cost-effective on-chain trading, with voting and staking capabilities, though it had limited smart contract functionality.

- Launch of Binance Smart Chain (2020): Binance Smart Chain, now referred to as BNB Smart Chain (BSC), a modified hard fork of Ethereum (ETH), was launched. BSC, compatible with the Ethereum Virtual Machine (EVM), ran alongside the Beacon Chain, featuring faster block times (~3 seconds) and higher transactions per second (TPS) than Ethereum.

- BNB One Chain Initiative (Current): The next phase in BNB’s evolution is the BNB One Chain initiative, aiming to develop a unified multichain ecosystem. A major milestone was the launch of the layer 2 network opBNB in 2023.

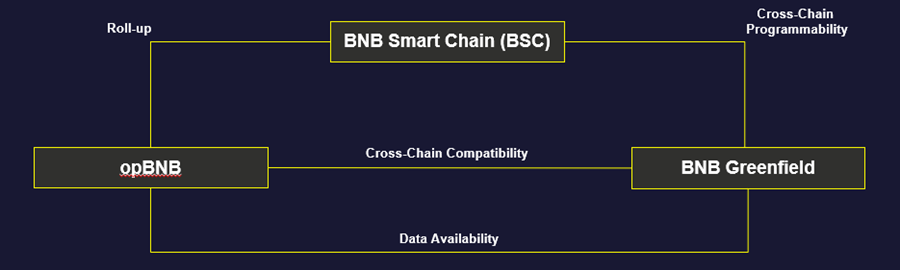

Similar to Ethereum, BNB Chain has evolved into a multi-chain ecosystem where each chain has a specific role. Its main elements are:

- BNB Smart Chain (BSC): The EVM-compatible smart contract platform and hub for DeFi activity.

- BNB Greenfield: A decentralized storage network, integral to the One BNB vision. Greenfield enables users to manage and monetize their own data in a personalized marketplace, focusing on valuable, real-time information.

- opBNB: A high-performance EVM-compatible optimistic rollup optimized for DApps with high transaction demands, such as fully on-chain games.

Centralization is a Major Risk, But the Trend is Encouraging

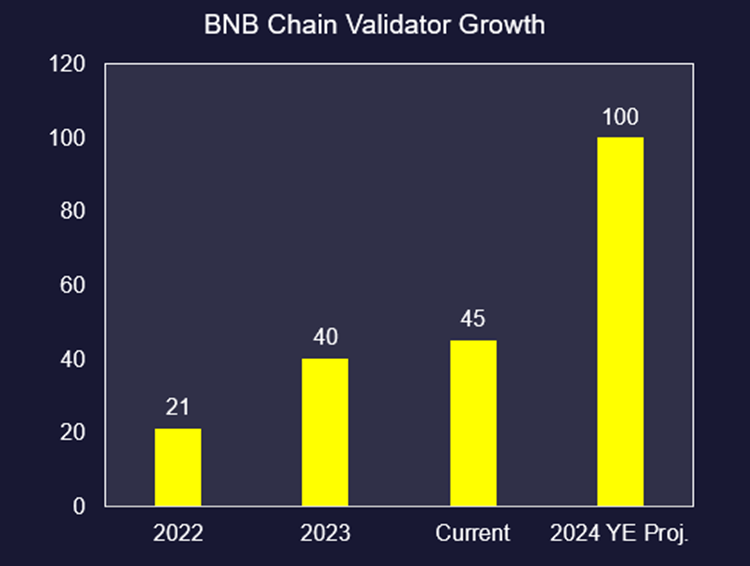

BNB uses a Proof-of-Staked Authority (PoSA) consensus mechanism, combining elements of Delegated Proof of Stake (DPoS) and Proof of Authority (PoA) to validate network transactions. This hybrid system enables faster block times compared to Ethereum, albeit with a trade-off in decentralization.

In PoSA, validators hold both an economic and reputational stake. To become a validator, one must stake at least 2,000 BNB and be recognized as a trusted node within the network. Non-validators can delegate their BNB to validators they trust.

Validators are chosen based on the amount of BNB they and their delegators have staked. The top validators with the most staking form the active validator set, which proposes and votes on blocks, while others remain in a standby set. Validators can be removed through slashing, a penalty for misbehavior, or being offline.

A potential downside of PoSA is the risk of centralization if the validator pool is not diverse enough, which could lead to collusion among validators. The ecosystem expanded its validator set from 21 to 40 in 2023, to 45 in 2024, and aims to expand the validator set to 100 by the end of the year.

Deflationary Supply

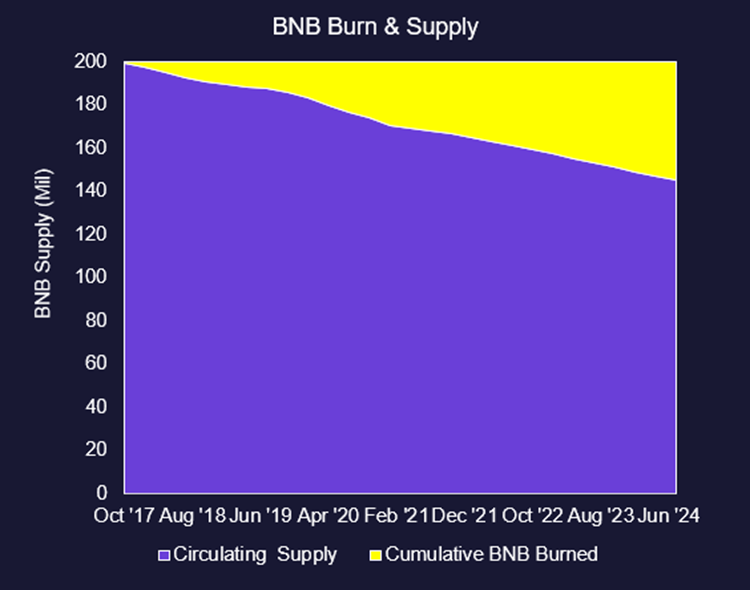

Unlike many crypto assets, BNB’s supply is non-inflationary, and validators earn rewards solely from transaction and commission fees without inflation-based incentives. The initial total token supply for BNB was 200 million tokens and will remain deflationary until supply reaches 100 million. BNB executes this through a series of burning mechanisms:

- Auto-Burn: A mechanism that automatically burns varying amounts of BNB every quarter, depending on the token’s price and the number of blocks generated on BNB Chain during that quarter.

- Pioneer Burn: A program that counts all BNB accidentally lost by new or careless BNB Chain users as part of the quarterly burns. The project team reimburses users for accepted cases.

- Gas Fees Burn: In accordance with BEP-95, 10% of all gas fees incurred on BNB Smart Chain are burned automatically. The remaining 90% is rewarded to validators and stakers.

L1 Performance

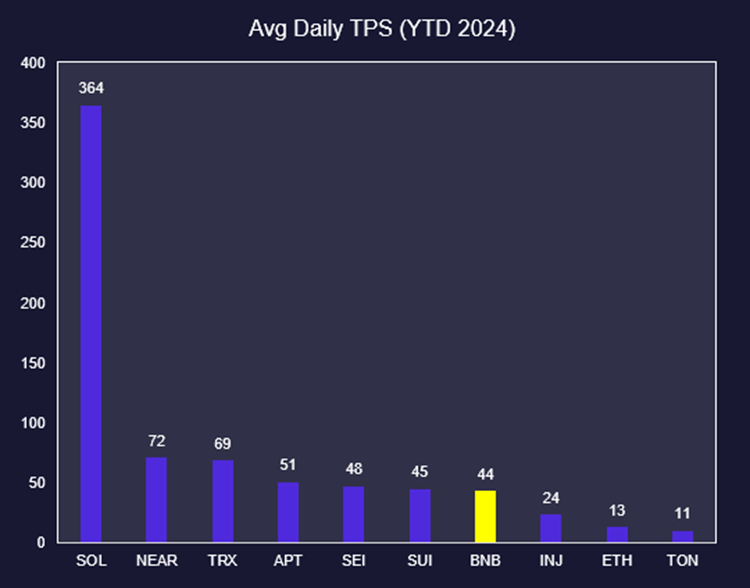

BNB Chain ranks in the middle of the pack regarding transaction costs and throughput compared to other L1s, though it falls well short of the transactions per second (TPS) seen on Solana, the leading monolithic blockchain.

However, when comparing BNB to Ethereum, which also aims to scale through a modular (layered) approach, BNB’s performance stands out more prominently. Year-to-date, BNB Chain has delivered 3.4x the TPS of Ethereum.

opBNB Performance

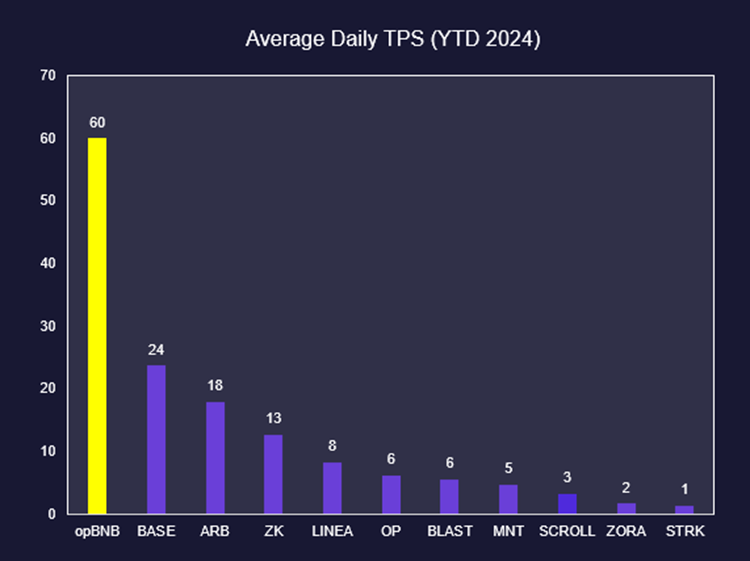

BNB developers are actively working to bring more L2 solutions to BNB Chain as part of the One BNB initiative. Currently, however, opBNB accounts for the majority of L2 activity on the BNB network.

When compared to Ethereum’s L2s, opBNB has realized higher TPS than all the major Ethereum L2 leaders, including Arbitrum, Base, and Optimism, while also offering these services at a lower cost.

Greenfield

Greenfield is a decentralized storage network within the BNB Chain ecosystem, designed for real-time, “hot” data that can be directly accessed by smart contracts on BNB Smart Chain (BSC) and opBNB. It allows developers to store non-structural data like files and images and seamlessly integrate it into decentralized applications. Since its inception, BNB Greenfield has stored over 5 TB of data (Source: Greenfieldscan).

The One BNB Vision

The “One BNB” vision is a multi-chain strategy currently supported by the BNB Foundation that integrates BSC, opBNB, and Greenfield to create a unified ecosystem for scalable, cost-efficient decentralized applications.

BSC ensures security and liquidity, opBNB provides high transaction throughput with low fees, and Greenfield manages real-time data storage. This interconnected framework enables DApps to operate fully on-chain, reducing reliance on centralized, off-chain components. Fully on-chain DApps enhance transparency, trust, and security, as all data and logic are recorded on the blockchain, making them resistant to censorship and manipulation.

BNB Ecosystem User Numbers

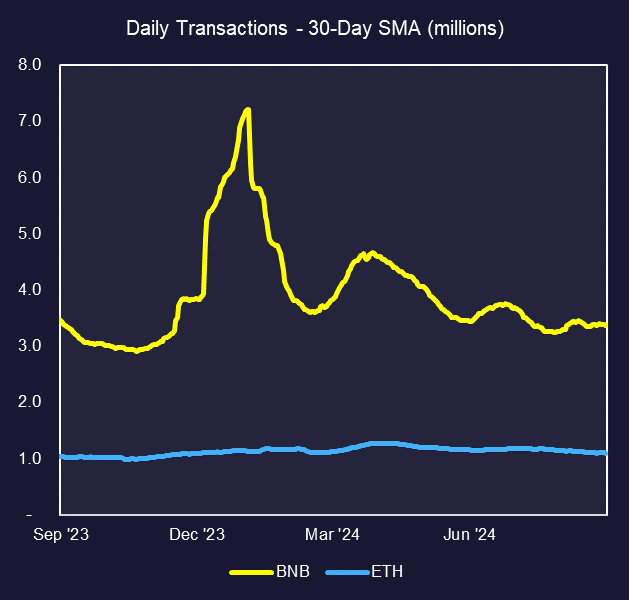

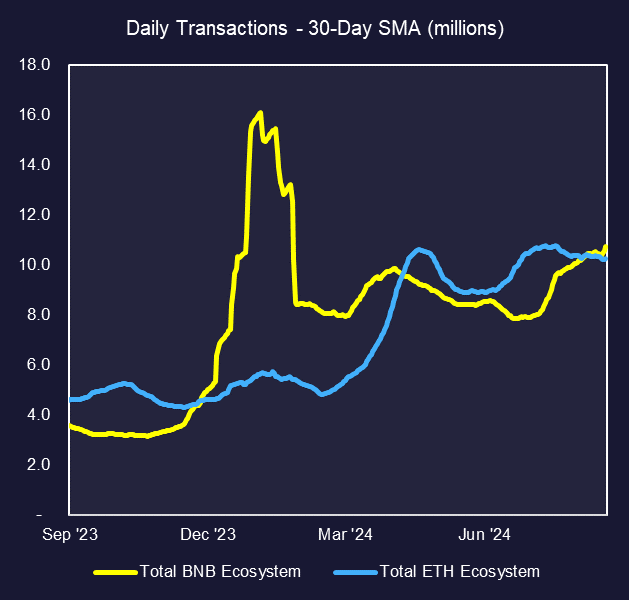

From a chain activity standpoint, BNB Chain has consistently shown higher transaction volumes on its L1 compared to Ethereum.

Since the launch of opBNB, daily transactions have been steadily increasing, though they remain below the total transaction activity seen across Ethereum’s L2s in aggregate. However, when evaluating the combined ecosystem activity, the BNB Chain ecosystem has periodically surpassed Ethereum’s.

Major Risks Mitigated

Although BNB is now the native token of a smart contract platform and has distanced itself from Binance’s exchange operations, concerns have persisted regarding its historical ties to Binance. Investors feared that any legal or regulatory actions taken against the exchange could present downside risks to the token.

Additionally, there was apprehension that BNB’s value might have been artificially supported or used as collateral by Binance, potentially triggering a collapse similar to what occurred with FTX and FTT.

In our view, recent developments, which align with previous investor concerns, have likely mitigated Binance-related risks:

- The leverage unwinds of 2022 provided evidence that BNB was either not being lent against by Binance and/or it did not present a systemic risk to the broader crypto ecosystem.

- Regulatory action materialized in June 2023, when the SEC filed a complaint against Binance, alleging the exchange had been operating as an unregistered exchange, broker, and clearing agency since July 2017.

- Legal action followed in November 2023, when Binance’s CEO, CZ, pleaded guilty to violating U.S. anti-money laundering laws. As part of the plea agreement, CZ agreed to step down as CEO and received a four-month prison sentence, which is expected to be completed by the end of September 2024 (more on this below).

Additional Thoughts

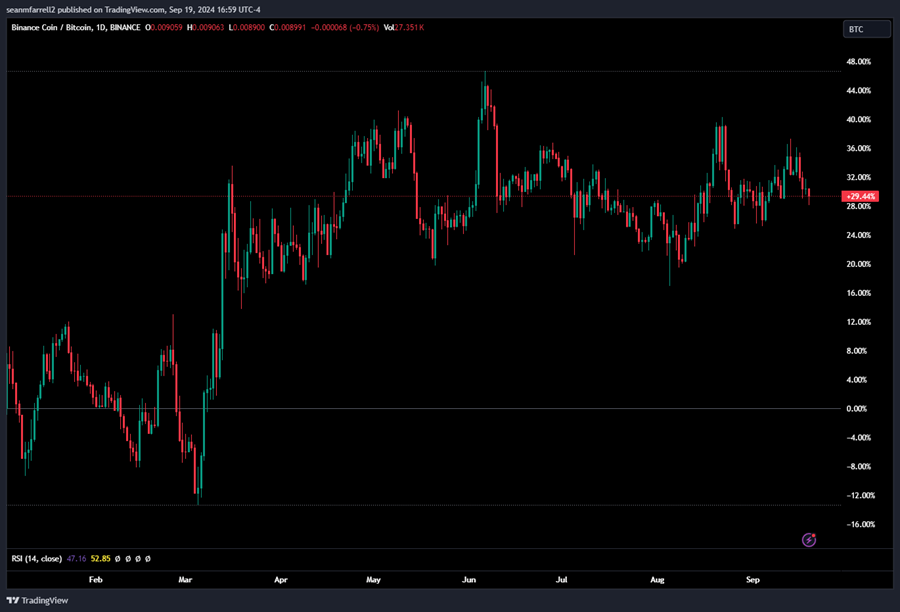

BNB has held up very well in the face of the Bitcoin chop over the past six months and is one of the few alts that has held positive gains against BTC for the year-to-date period (SOL being the other major one). This is likely due to a combination of its consistent usage, the strides made in their modular scaling path, and its deflationary supply schedule.

Additionally, I would be remiss if I didn’t mention the impending catalyst for BNB, which is the release of CZ from prison in 10 days on September 29th.

It’s possible that this is both a positive narrative for BNB and a fundamental driver as well, as he will be a free man with billions to spend on crypto-assets.

Frankly, with that wallet size, this could be a tailwind for the entire space heading into Q4.

Other Changes to Core Strategy

In addition to adding BNB we are also increasing relative weight for SOL and STX as both have provided reliable avenues for BTC beta thus far this cycle.

In addition, Stacks continues to progress on their Nakamoto upgrade.

Core Strategy

As we approach year-end, we remain optimistic about the crypto outlook, seeing the market’s lean toward a soft landing as constructive for prices. With the hard landing risk fading after the Fed’s dovish but reassuring stance, we believe now is the right time to deploy some of the dry powder in our Core Strategy. Our focus remains on the majors, with selective exposure to altcoins like HNT, MKR, STX, and this week’s new addition, BNB. As a reminder, our Core Strategy allocation model, along with crypto equity baskets and trade recommendations, is included at the end of each note.

Tickers in this report: BTC 0.80% , SOL 1.00% , ETH -0.29% , HNT -17.99% , STX N/A% , MKR -2.56% , BNB 0.42% , USDC 0.01% , MSTR 3.27% , SMLR, COIN 1.24% , HOOD 0.60% , MARA 6.40% , RIOT 5.22% , WGMI 1.62% , CLSK 6.19% , WULF 0.32% , IREN 2.43% , CORZ 4.14% , BTDR -18.11% , BTBT 1.25% , HUT 2.49% , HIVE 1.42%