Lessons From the Presidential Debate and a Look Ahead to the FOMC

Key Takeaways

- Election Thoughts: This week’s price action reaffirms our view that while the election could positively impact crypto prices through a “Trump Premium,” it is unlikely to negatively impact prices via a sustained “Harris discount.”

- Fed Policy: A declining RRP facility, coupled with a volatile SOFR, could provide the Fed with sufficient support to cease Quantitative Tightening (QT) next week, alongside a likely 25 basis points rate cut.

- Altcoin Strength: Recent relative altcoin strength is encouraging, as it suggests seller exhaustion among crypto-native holders.

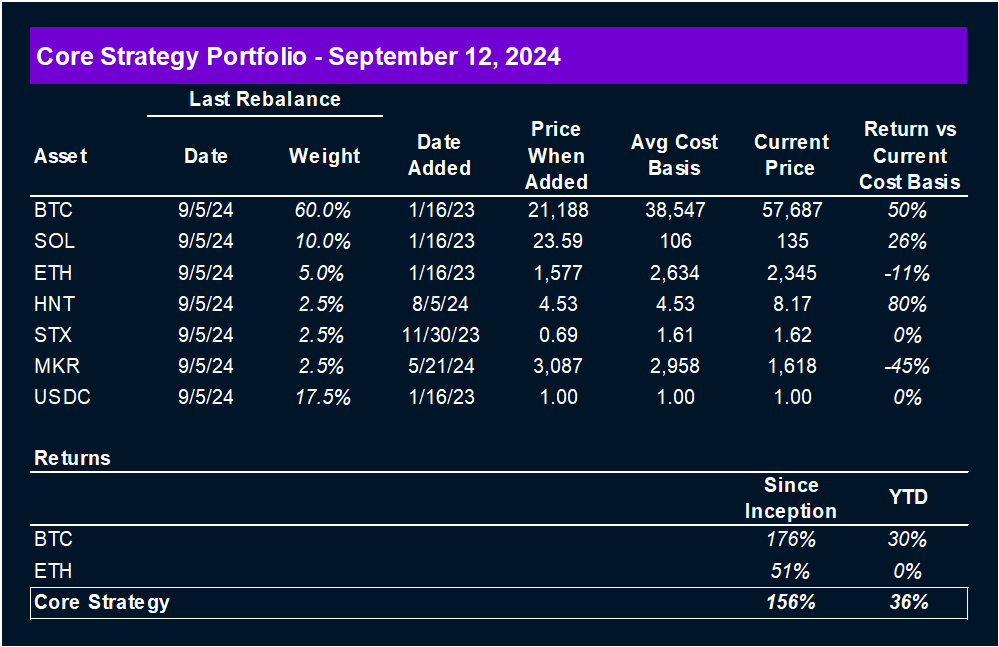

- Core Strategy: We remain optimistic about the outlook for crypto as we approach year-end, viewing a market leaning toward a soft landing as constructive for prices. However, (1) the absence of near-term catalysts, (2) the lack of market confidence around a soft landing, and (3) continued negative seasonality render it appropriate to keep some dry powder on hand. Our focus remains on the majors, with selective exposure to altcoins like HNT, MKR, and STX. As a reminder, our Core Strategy allocation model is included at the end of each note, along with our crypto equity baskets and trade recommendations.

Initial Thesis – Senate More Important Than Many Recognize

This week, we witnessed what was the first – and potentially final – presidential debate between Kamala Harris and Donald Trump. Anticipation for this event was high, with the public initially favoring Trump, as reflected in prediction markets. This preference was largely attributed to Harris’s lackluster debate track record. However, the dynamics shifted during the debate itself, with reactions in prediction markets indicating that Harris emerged as the victor, challenging initial market sentiment.

While the long-term impact on polls remains uncertain given the considerable time until election day, the verbal sparring between Harris and Trump—both of whom obviously hold divergent views on crypto—provided valuable insights on how BTC might trade in the months post-election in the event of a Harris victory.

All things being equal, the resulting price action in the event of a Trump victory seems rather obvious at this point. Trump’s campaign has consistently expressed pro-crypto rhetoric and crypto was explicitly supported in the formal GOP platform. Thus, one should expect crypto markets to price in a “Trump Premium” should he win in November. There would also intuitively be a repricing higher of coins that currently have SEC-related risks attached to them and we would see things like governance tokens enter price discovery as there emerges a path for them to pass application revenues onto tokenholders in a regulatorily compliant manner.

Conversely, the scenario where Harris becomes the next president presents different, more complex considerations.

The upside for cryptoassets this liquidity cycle would certainly be lower in the event of a Harris victory, as there is no Trump Premium. However, if Harris secures the presidency and the Senate flips to a red majority—as currently projected—the subsequent presidential term should be more favorable for the crypto industry compared to the last.

The Senate’s composition is crucial, as it is responsible for approving cabinet and key agency positions tasked with regulation. Cabinet and agency candidates with views contrary to the GOP platform would be unlikely to achieve approval from the Senate.

A red Senate would also remove some of the more anti-crypto members of Congress like Senators Warren and Brown from the Senate Banking Committee majority. This committee plays a major role in regulating the financial system and thus this would have positive implications for crypto.

Confirmation Via Price Action

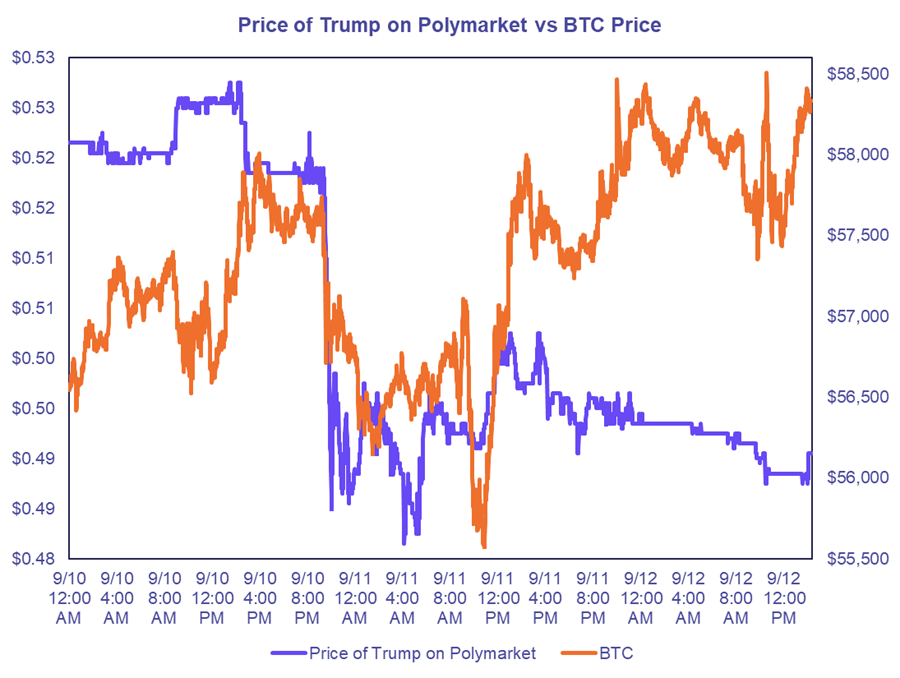

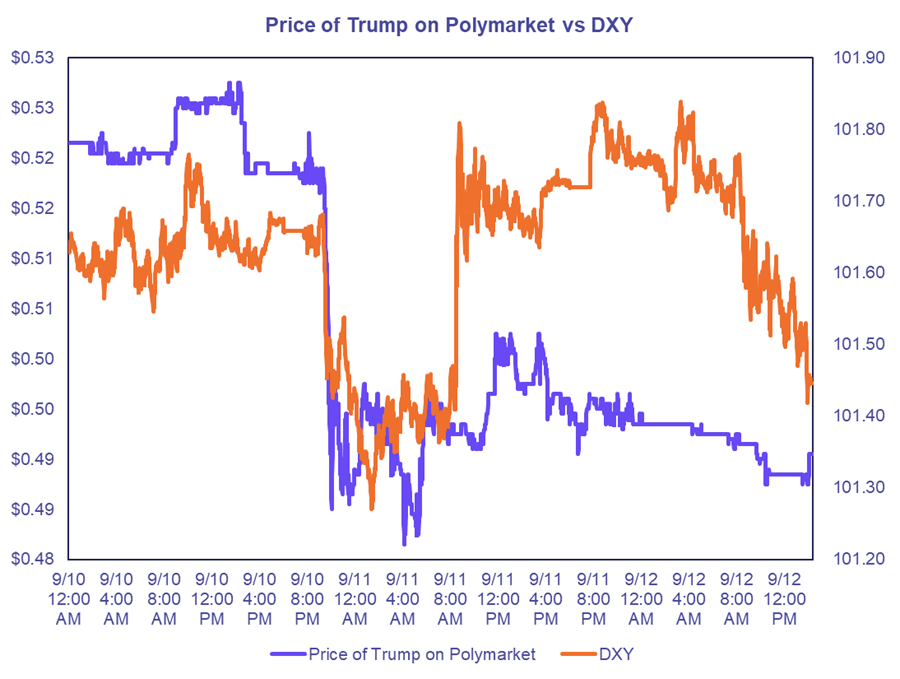

Reflecting on Tuesday’s debate, many may misconstrue the overnight weakness in crypto markets following Harris’s apparent victory as a direct result of Trump’s performance on stage. However, our analysis suggests that the weakness was more indicative of a broader risk-off environment, evidenced by declining interest rates and a weakening US dollar (DXY). This interpretation is further supported by BTC’s resilience, as it did not decline in tandem with other “Trump Trades” during the subsequent trading session.

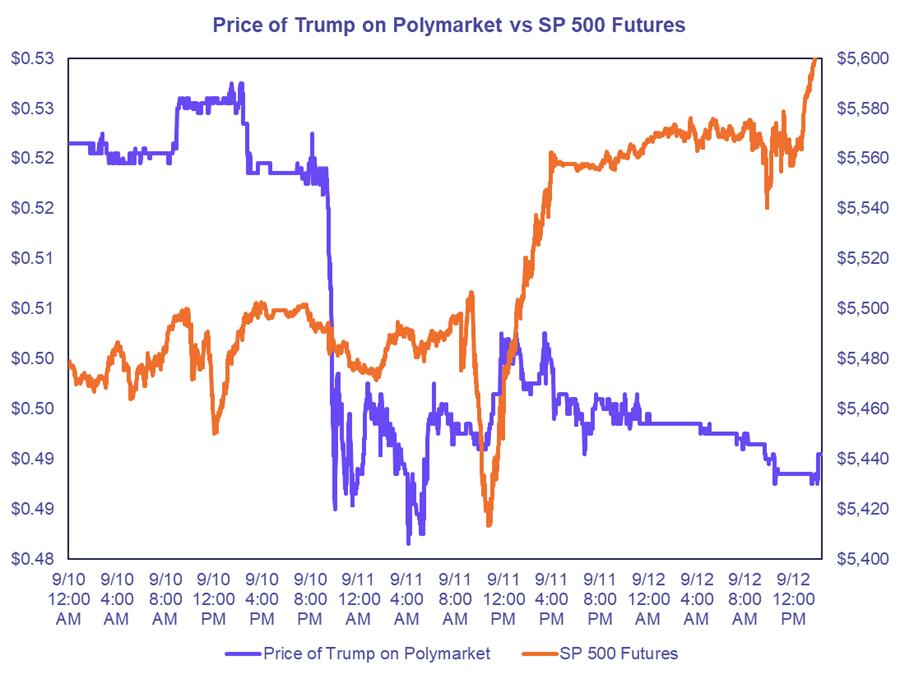

The chart below reveals that BTC experienced a sharp decline shortly after the debate began, coinciding with Trump’s decreasing win probability.

However, concurrently, currency markets began pricing in lower US yields as the dollar weakened against other major currencies, also aligning with the movements observed in polymarket and BTC.

Additionally, S&P 500 futures also dipped around the time of the polling shift, albeit to a lesser extent, reinforcing the notion that Bitcoin’s movement was tied to the broader risk-off environment rather than a direct connection to “Trump Trades.”

For further confirmation, we examined the performance of popular equity names likely to benefit from a Trump presidency, such as FNMA (Fannie Mae) and GEO Group (GEO), relative to BTC during the following US trading session.

Both FNMA and GEO experienced significant drawdowns in the premarket session and did not fully recover, while BTC also declined due to an unexpected CPI print but managed to recover from both the post-debate and CPI-induced weaknesses.

We think that BTC only had a slight Trump Premium priced in prior to the debates, and perhaps that vanished with the drawdown during the debate. However, its recovery demonstrates that there is unlikely to be a significant Harris discount post-election if she were to win. The caveat here is of course this is one data point, but crypto’s recovery on Wednesday was impressive and surprised a lot of people and should be respected.

Stage Set for a Dovish Fed

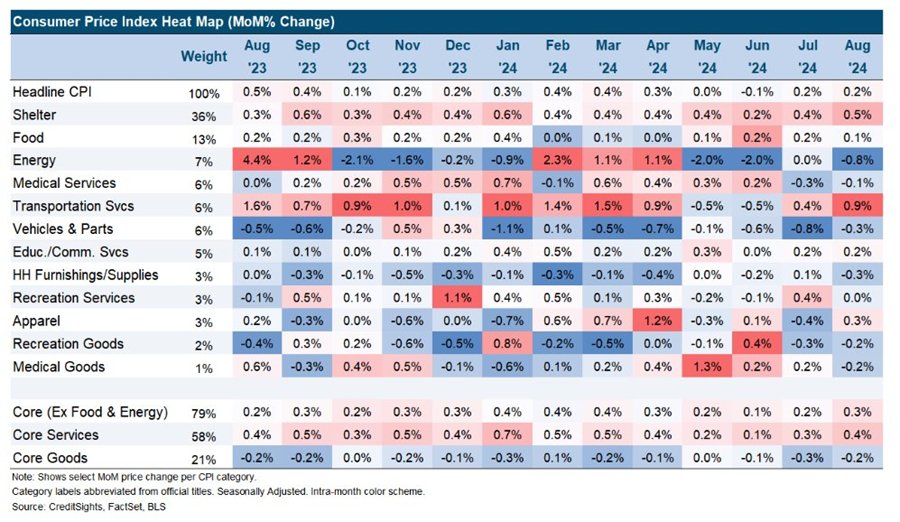

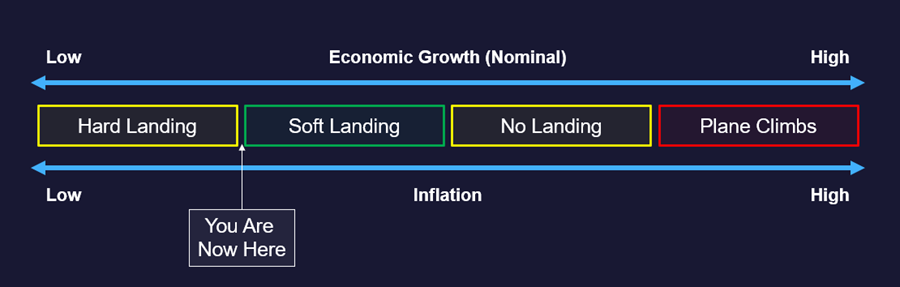

First, let’s quickly revisit our “Fed landing map,” which we have been using to determine whether the market is pricing in a hard landing, soft landing, or something else. This week, there was less data related to the jobs market, with the major data point being the Consumer Price Index (CPI).

CPI came in hotter than expected, with the majority of the upside surprise driven by rising shelter costs. Energy and goods remained largely deflationary, while items such as airfare and food away from home came in relatively hot—categories that are not necessarily inflationary in a recessionary regime.

For that reason, it seems we have moved from hard landing pricing to the edge of soft-landing pricing, as evidenced by indices like RSP and IWM finally receiving a bid on Wednesday.

Crypto has yet to see a significant bid, although it is holding up fairly well. This is likely because more convincing evidence of a soft landing is needed before the crypto flows return in force.

A key piece of the soft-landing narrative will come in the form of the FOMC meeting next week, as the market is anxious to understand just how dovish the Fed will be in the face of a cooling labor market.

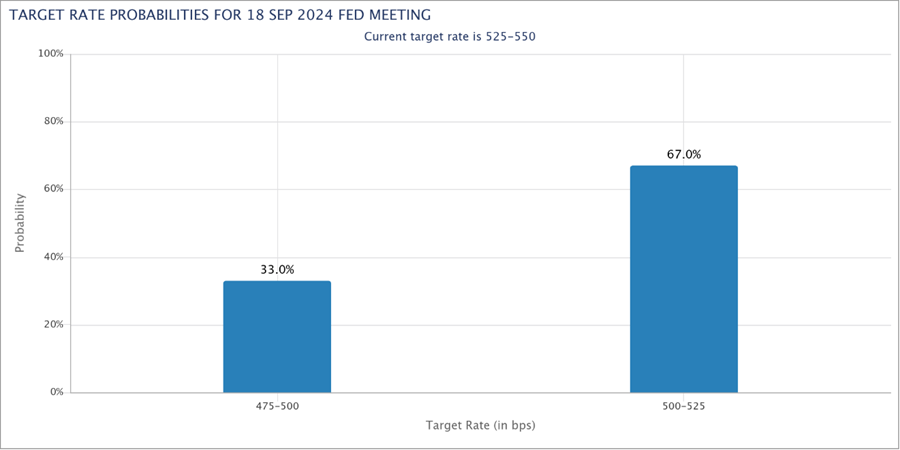

25 or 50 bps? It Might Not Matter

Last week we advised clients about the possibility of additional downside following soft jobs numbers on Friday. That did transpire as envisaged, and the futures market moved to pricing in 50 bps of cuts at the next meeting. However, following this week’s hotter-than-expected CPI, the futures market regressed to 25 bps.

The Fed is currently in a predicament: if they “start small,” the pace of cuts might be too slow to stem an actual deterioration of the US consumer, but if they cut too much too quickly, this could signal a panicked view to the market.

We posit that there is another scenario the Fed could undertake next week that would be hugely positive for markets but is being overlooked by many investors. The Fed could cut 25 bps and cease QT (or provide clear direction on QT cessation, which would likely have a similar positive impact). This would allow the Fed to provide dovish support to markets while still cutting only 25 bps. Then, Powell could provide forward guidance that brings the idea of 50 bps of rate cuts into the picture – this would stem the possible market panic around a future “double cut.”

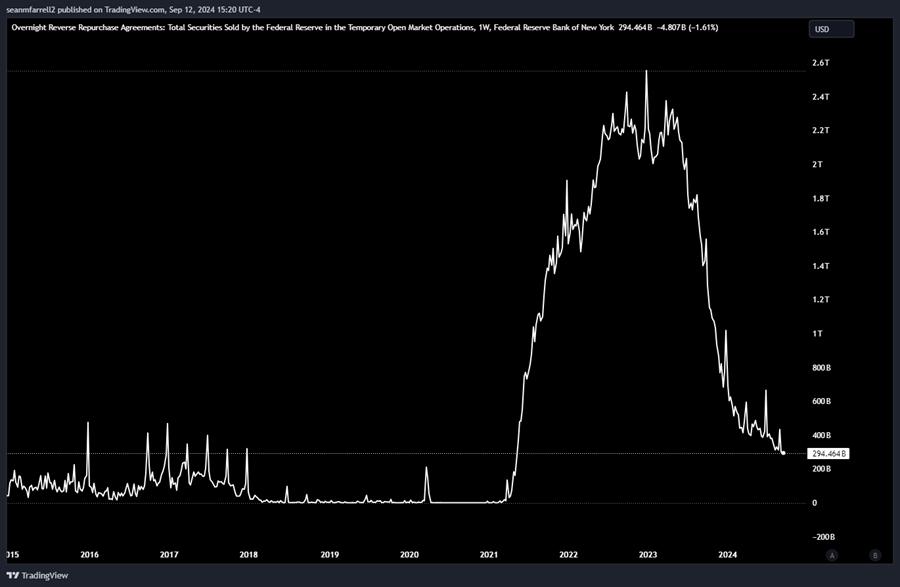

Why is this in the cards now? Let’s examine the ON RRP facility, which the Fed uses to gauge the level of ample banking reserves in the banking system. The balance has started to reaccelerate lower in recent weeks, now below $300 billion. The Fed aims to have “ample reserves” in the banking system, but this level is not exact, requiring them to use other tools to estimate when banking stress might be approaching. The ON RRP has been a preferred measure of excess liquidity.

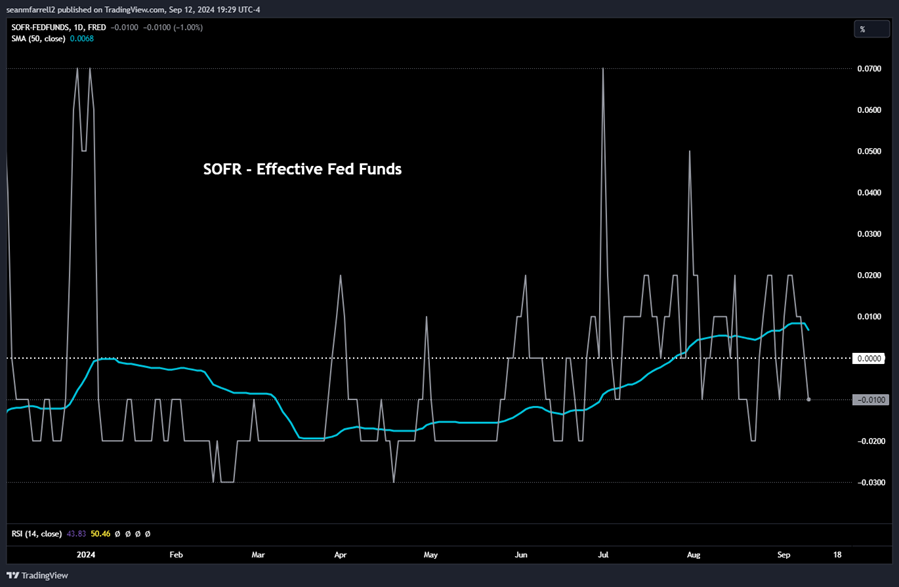

Another tool they can consider is the Secured Overnight Financing Rate (SOFR)—the benchmark interest rate for borrowing cash overnight using U.S. Treasuries as collateral. Generally, this rate is steady and at or below the effective Fed funds rate. However, in recent weeks, SOFR has demonstrated rising volatility and has periodically risen above the Fed funds rate. This could be a nothing burger, but it might also represent an increase in demand for borrowing among banks and a lack of willingness from banks to lend to other banks. To put it more bluntly – this could be a sign that the ample reserves regime for banks is behind us.

The combination of a more volatile SOFR and a declining RRP, may be sufficient for the Fed to move toward stopping QT next week. Such a move would bolster liquidity conditions and certainly be conducive for crypto prices.

Reasons to Stay Encouraged: Relative Altcoin Strength and Impending Positive Seasonality

Despite exercising caution in the immediate term, we remain optimistic about crypto prices through the end of the year. Two key charts suggest that could be nearing the return of animal spirits.

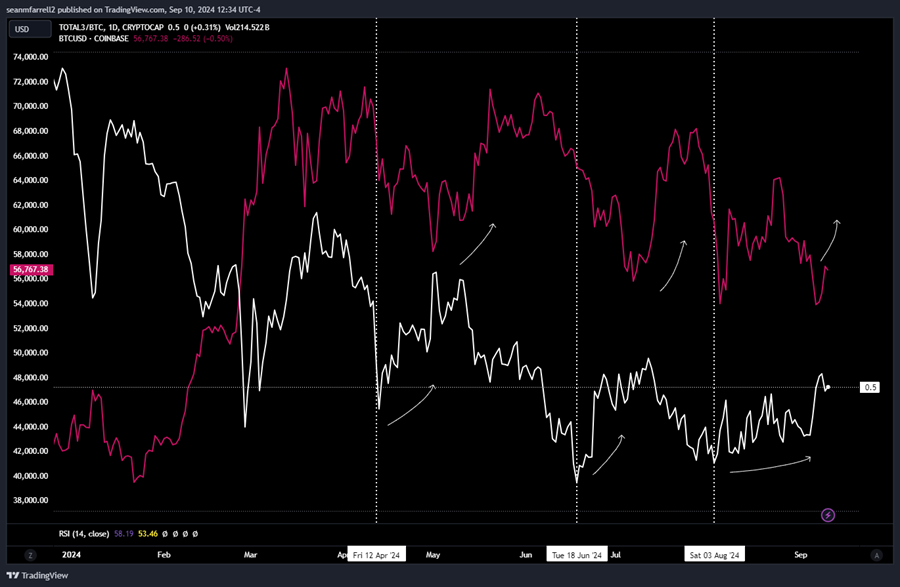

The first chart examines the altcoin market capitalization relative to BTC market cap and this ratio is compared to BTC’s price.

Contrary to what might be expected, altcoins have held up remarkably well amid recent industry price weakness, indicating possible seller exhaustion since Tokyo Black Monday. The bottoming of the aggregate altcoin market cap to BTC market cap ratio signals that a bottom for BTC and the overall market could be near.

This ratio bottomed out before the two tactical BTC rallies observed in May and July, reinforcing our positive outlook.

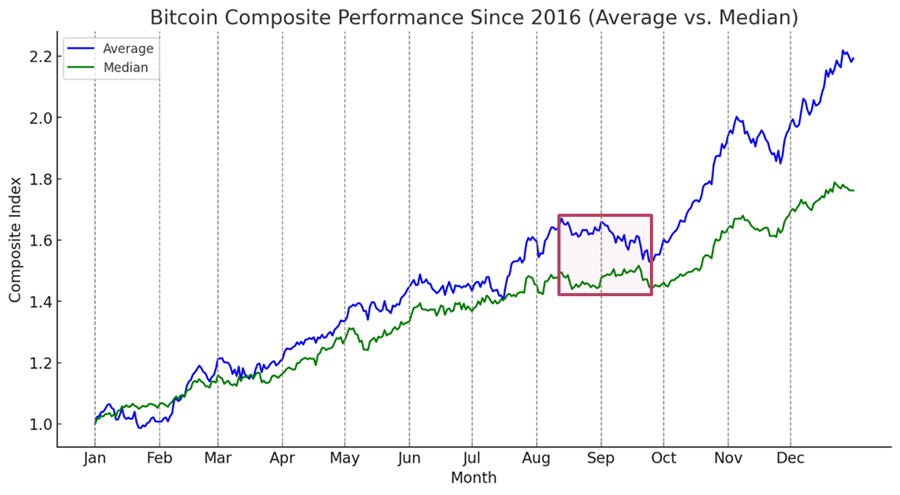

The second chart to consider is the composite performance chart for BTC, which we have referenced frequently over the past few months.

As we approach the halfway mark of September—historically the toughest month for BTC—the daily composite performance data indicates that the negative seasonality typically experienced during this period is set to conclude by late September.

This critical juncture being just around the corner provides another reason to remain optimistic and be ready to deploy any remaining dry powder when the moment is right.

Core Strategy

We remain optimistic about the outlook for crypto as we approach year-end, viewing a market leaning toward a soft landing as constructive for prices. However, (1) the absence of near-term catalysts, (2) the lack of market confidence around a soft landing, and (3) continued negative seasonality render it prudent to keep some dry powder on hand. Our focus remains on the majors, with selective exposure to altcoins like HNT, MKR, and STX. As a reminder, our Core Strategy allocation model is included at the end of each note, along with our crypto equity baskets and trade recommendations.

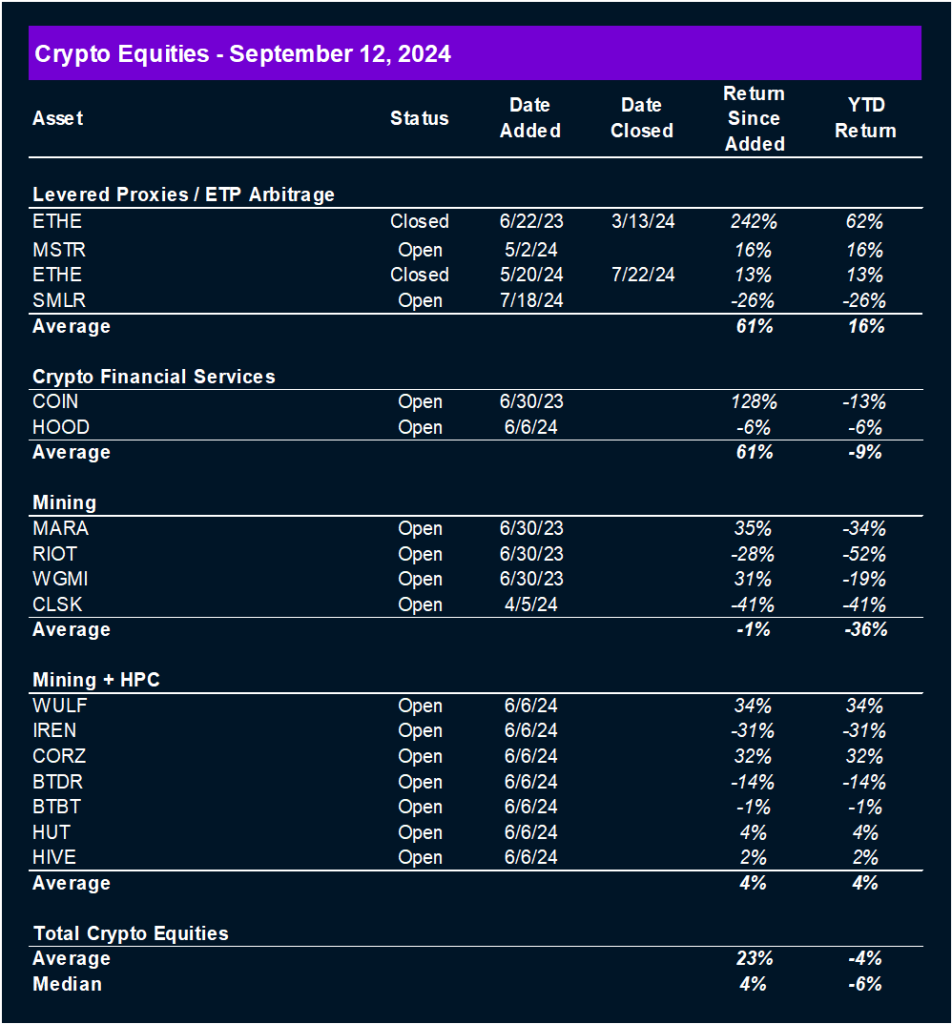

Tickers in this report: BTC 7.52% , SOL 14.24% , ETH 13.07% , HNT -1.78% , STX N/A% , MKR 11.03% , USDC 0.01% , MSTR 8.76% , SMLR, COIN 13.50% , HOOD 5.89% , MARA 6.58% , RIOT 3.94% , WGMI -0.87% , CLSK 1.16% , WULF 2.44% , IREN -2.77% , CORZ 0.50% , BTDR 2.03% , BTBT 7.14% , HUT -6.17% , HIVE 3.15%