Caution in the Near-term Still Warranted, Q4 Setup Remains Compelling (Core Strategy Rebalance)

Key Takeaways

- Hard Landing Pricing: Weak economic data has shifted the crypto market toward hard landing expectations, increasing short-term risks for crypto but raising the likelihood of Fed rate cuts and cessation of QT.

- Bitcoin vs. Real Yields: Bitcoin has decoupled from falling real yields, while gold has held up better, signaling either a lagging BTC rally or the start of broader risk-off moves.

- Bond Market Volatility Increasing: The MOVE index increased to nearly 120 again this week, posing a risk to market liquidity.

- Consumer Resilience: Despite mixed manufacturing data, the services sector and consumer strength remain encouraging, supporting a positive outlook for crypto heading into Q4.

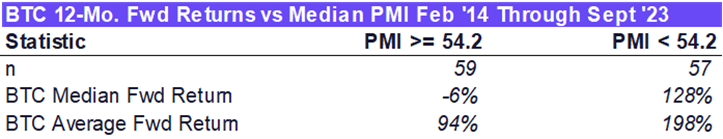

- PMI Accumulation Zone: Historically, weak PMI data correlates with strong forward Bitcoin returns.

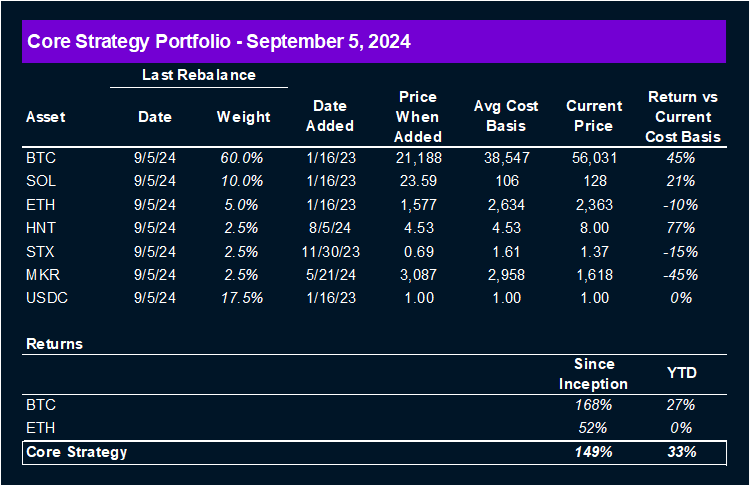

- Core Strategy – We remain optimistic about the outlook for crypto as we approach year-end, viewing a market leaning toward a soft landing as constructive for prices. However, given the near-term risks highlighted in this week’s note, along with ongoing negative seasonality, we are raising additional cash in our Core Strategy by reducing relative allocations to ETH and SOL. Our focus remains on the majors, with selective exposure to altcoins like HNT, MKR, and STX. As a reminder, our Core Strategy allocation model is included at the end of each note, along with our crypto equity baskets and trade recommendations.

This Week’s Economic Data Skews Toward Hard-Landing

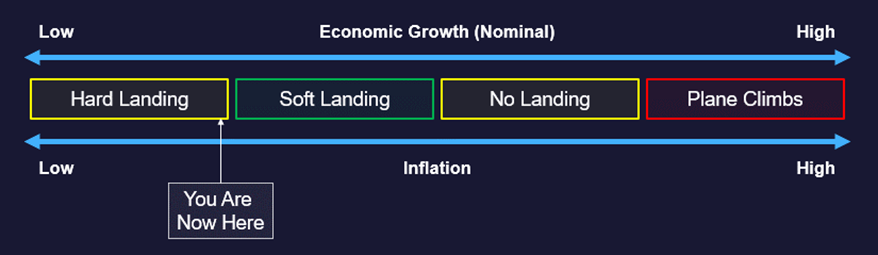

For this week’s note, we will begin by revisiting our market map for the near-term outlook on crypto. Over the past few months, the market has oscillated between expectations of a hard landing, soft landing, and no landing. However, since Powells’s speech at Jackson Hole, market outcomes have narrowed, leaving only the two scenarios furthest to the left—hard landing and soft landing. Both scenarios are cyclically favorable for crypto, though the hard landing carries short-term downside risk.

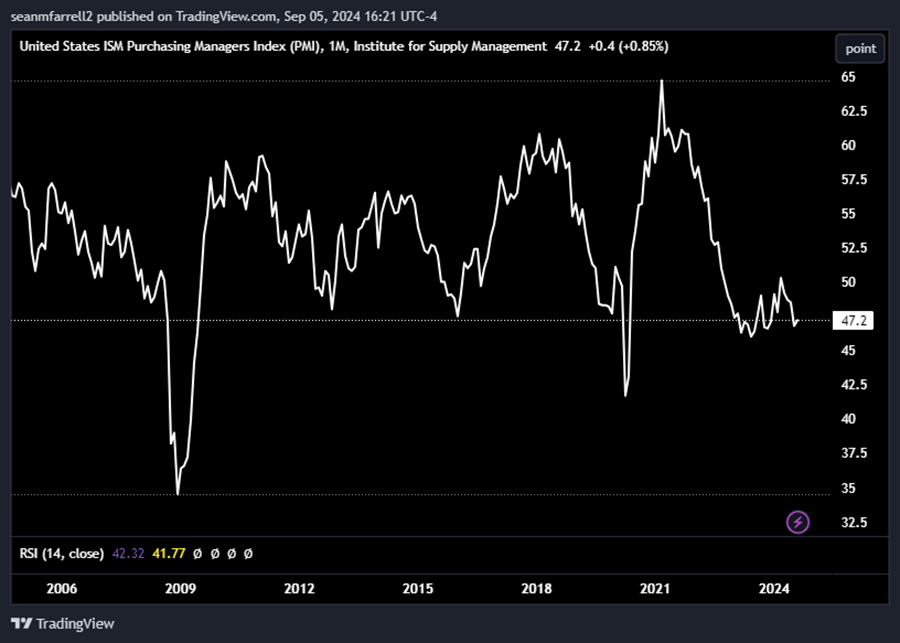

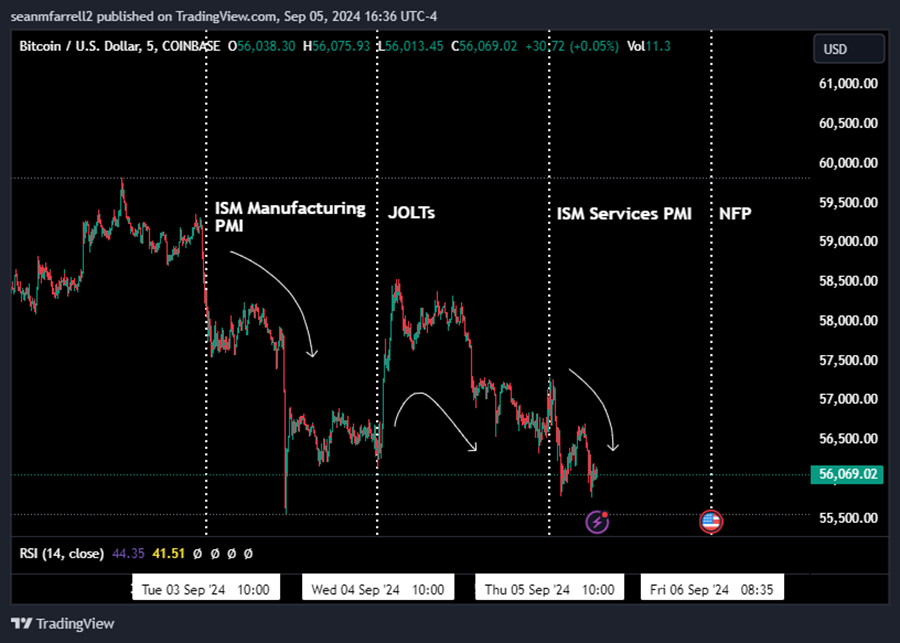

This week, we received a subpar ISM Manufacturing report. The ISM Manufacturing PMI came in at 47.2, lower than the expected 47.9, indicating a contractionary environment. The most disappointing subcomponent was the new orders figure, which posted 44.6, well below market expectations of 47.2.

This led the crypto market, along with broader risk assets, to shift toward hard landing pricing, as concerns about a potential Fed policy error grew among investors.

On Wednesday, the JOLTs report posted a weaker-than-expected number, showing approximately 7.7 million job openings, significantly below the forecasted 8.1 million.

Thursday’s ISM Services PMI, however, met expectations, coming in at 51.5, slightly above the forecast of 51.1, and staying in expansionary territory. Earlier that morning, ADP payroll data also disappointed, with only 99,000 jobs added compared to the expected 145,000, a miss of over 30%, likely superseding the positive ISM report.

Taken together, it has been a tough week for crypto, as the market continues to increasingly price in the hard landing scenario.

All eyes are now on tomorrow’s Non-Farm Payroll (NFP) report. A softer-than-expected NFP number could prompt a strong risk-off reaction. Based on this week’s JOLTs and ADP data, we would not be surprised if tomorrow’s NFP number is relatively soft, which could lead to further downside in crypto in the near term.

The silver lining is twofold: (1) A weak NFP print cements expectations for a 50-basis point rate cut by the Fed at the next FOMC meeting and perhaps accelerates discussions around ending quantitative tightening (QT), and (2) underlying data remains encouraging (will discuss further below), and a dovish Fed heading into the election, combined with fiscal profligacy, should pave the way for a constructive Q4 for crypto.

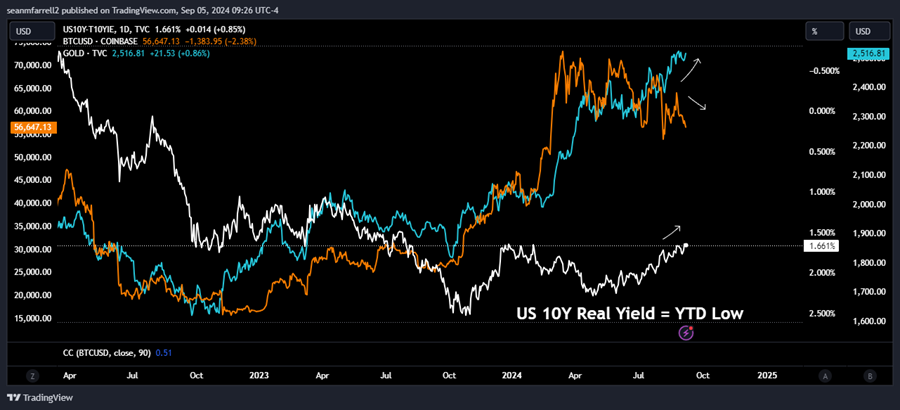

Real Yields and BTC Decoupling

Over the past few months, the U.S. Dollar Index (DXY) has fallen amid rising rate cut expectations and softening economic data.

Treasury yields have rallied, and real yields are now at their lowest levels this year. Despite these favorable conditions, Bitcoin has decoupled from its typical relationship with real yields, while gold has held up well. We believe this is because gold, though it also benefits from rising liquidity conditions, is perceived as less risky than Bitcoin in the current environment. Gold’s advantage is further supported by rising geopolitical uncertainty.

This disconnect between real yields, gold, and Bitcoin points to two potential outcomes: (1) a catch-up trade for Bitcoin, or (2) Bitcoin serving as the first mover in a broader risk-off move lower in the coming weeks.

For a positive catch-up trade to occur, confidence in a soft landing must grow, driven by the combination of a dovish Fed and strong economic data.

A broader risk-off move is more likely if current conditions persist.

We must also consider that we won’t have an FOMC meeting for another two weeks, and key economic releases, like GDP, retail sales, and durable goods orders, won’t be out until later this month, putting some distance between now and a when the market can gain confidence in the soft-landing scenario.

Bond Market Volatility Rising

Adding to the uncertainty is the recent spike in bond market volatility, as tracked by the MOVE index (the VIX for the bond market). While elevated volatility can signal a buying opportunity, the best time to act is when volatility starts to decline. In the immediate term, rising bond market volatility presents a risk to liquidity conditions, as volatile bonds increase collateral risks in the financial system, leading to reduced lending and market liquidity.

The Good News: Underlying Data Still Suggests Soft-Landing in Play

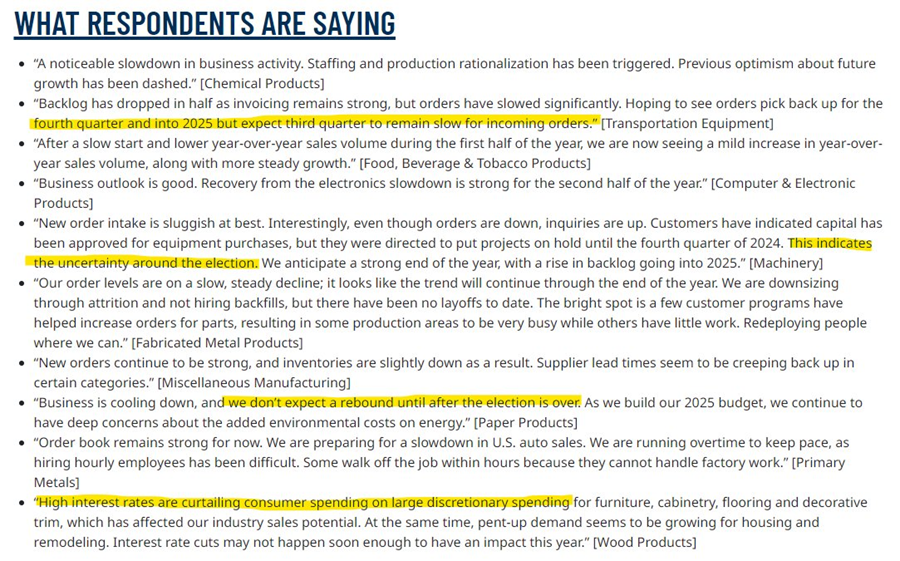

Now for the positive news: If we read between the lines of the ISM Manufacturing PMI report, it’s clear that not all respondents are uniformly pessimistic about the U.S. consumer. Those with a negative outlook cited two primary reasons for their concerns: (1) election uncertainty, and (2) higher interest rates limiting financing options. Both of these risks are set to resolve in the next couple of months. Interest rates are likely to come down, and the election will take place, reducing uncertainty.

On the services side of the economy, which is less sensitive to interest rates and industrial policy, the expansion continues. Thursday’s ISM Services PMI is a positive signal for the resilience of the U.S. consumer.

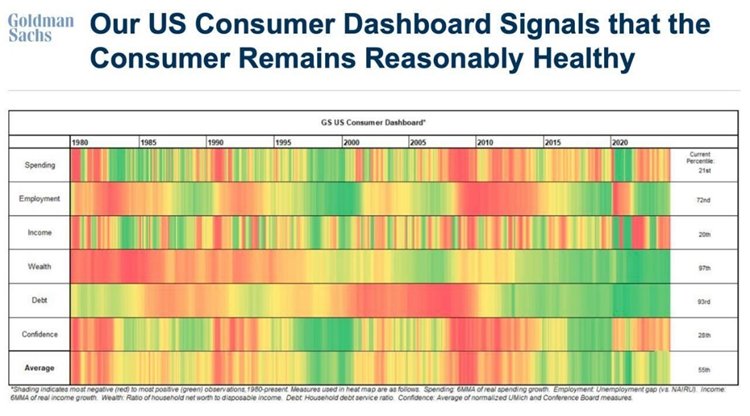

Goldman Sachs echoes this sentiment, noting that while some consumer variables are weakening, the overall picture remains healthy.

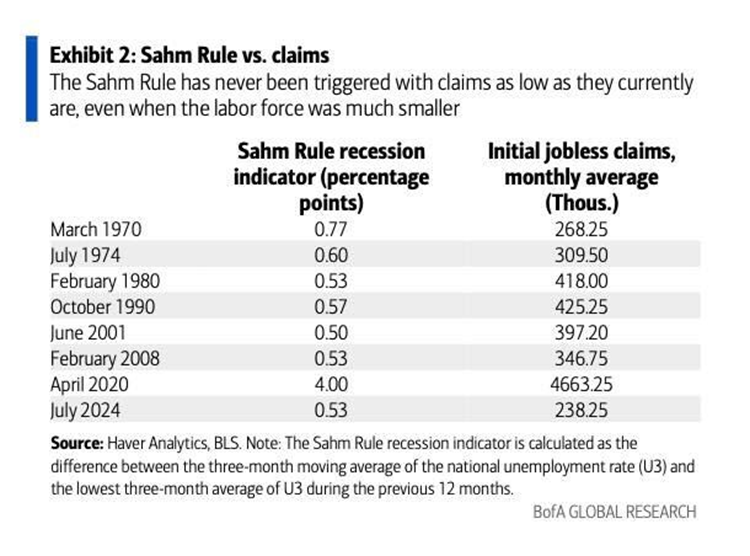

There has also been significant discussion around the unemployment rate and the Sahm Rule, which often precedes recessions. However, BofA’s analysis highlights that the rising unemployment rate may be more reflective of an expanding labor force rather than a sudden influx of unemployed workers. While this can stress the economy, it does not necessarily signal an imminent recession.

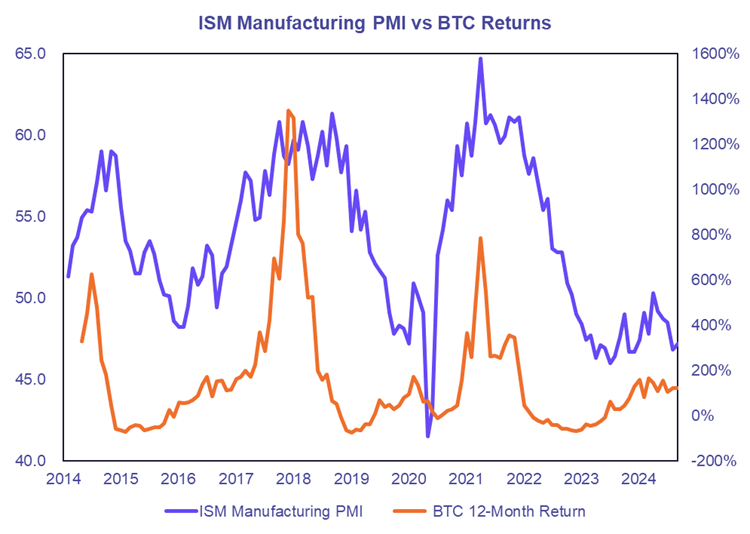

Longer-Term: The Time to Accumulate is When PMI<54

Finally, it’s worth taking a step back and considering the most recent manufacturing PMI number from a cyclical perspective and its relationship to crypto prices. Historically, there is a positive relationship between PMI and Bitcoin. The time to become cyclically bearish on crypto is when the economy is overheating and monetary conditions tighten, but we are far from that point now.

Data shows that Bitcoin’s forward returns are significantly higher when the PMI is below its historical median. From February 2014 through September 2023, the median PMI was 54.2. The table below highlights that 12-month forward returns when PMI is below this level are much stronger compared to when the PMI is on the more expansionary side of the range. While these returns may not materialize immediately, for investors with a longer-term horizon (greater than 1-2 months), this presents an attractive accumulation opportunity.

Core Strategy

We remain optimistic about the outlook for crypto as we approach year-end, viewing a market leaning toward a soft landing as constructive for prices. However, given the near-term risks highlighted in this week’s note, along with ongoing negative seasonality, we are raising additional cash in our Core Strategy by reducing relative allocations to ETH and SOL. Our focus remains on the majors, with selective exposure to altcoins like HNT, MKR, and STX. As a reminder, our Core Strategy allocation model is included at the end of each note, along with our crypto equity baskets and trade recommendations.

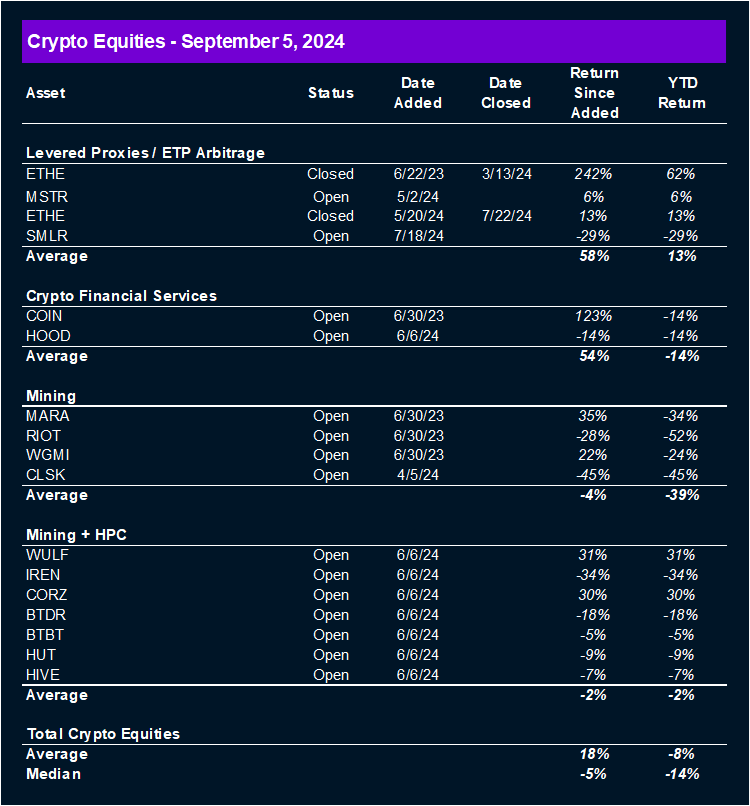

Tickers in this report: BTC -0.54% , SOL 1.25% , ETH 0.55% , HNT -2.32% , STX N/A% , MKR -0.33% , USDC 0.00% , MSTR -2.92% , SMLR, COIN -2.76% , HOOD -4.53% , MARA 6.51% , RIOT -4.81% , WGMI -5.43% , CLSK -4.69% , WULF -9.62% , IREN -7.44% , CORZ -5.45% , BTDR -3.27% , BTBT -6.18% , HUT -2.90% , HIVE -5.70%