The Path Forward (Core Strategy Rebalance)

Key Takeaways

- Our year-end outlook remains in-tact, with no significant changes to our medium/long-term views.

- Monday's market activity showed promising signs that suggest a potential bottom has been reached – those signs include a strong Coinbase Premium, high volumes and decent retraces, negative funding, and a strong ISM Services number.

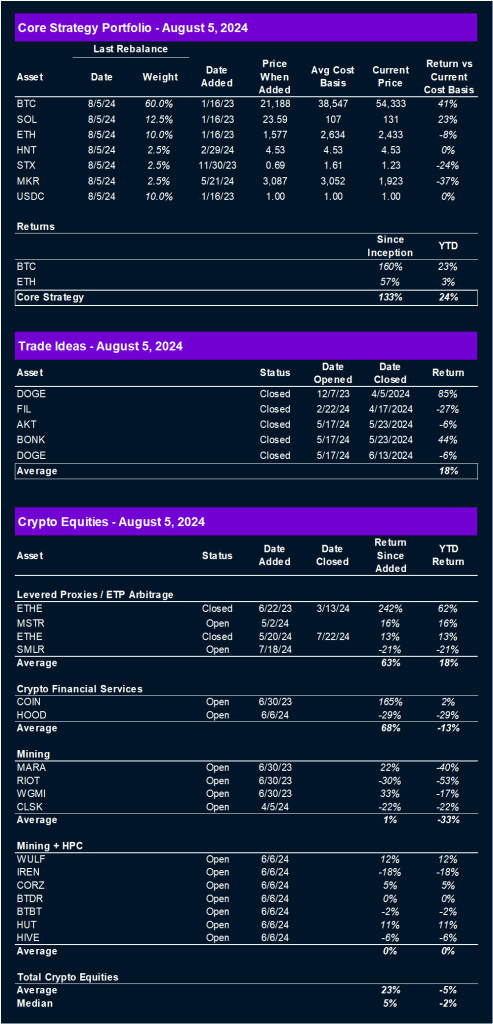

- Core Strategy – We think it’s right to lean into the majors, with a favorable lean toward SOL over ETH. We also are trimming some of the underperforming alts and adding back HNT to the portfolio following impressively strong performance on Monday. Further, while encouraged about today’s data, we think it’s right to keep some dry powder on hand over the next couple of weeks.

What Happened

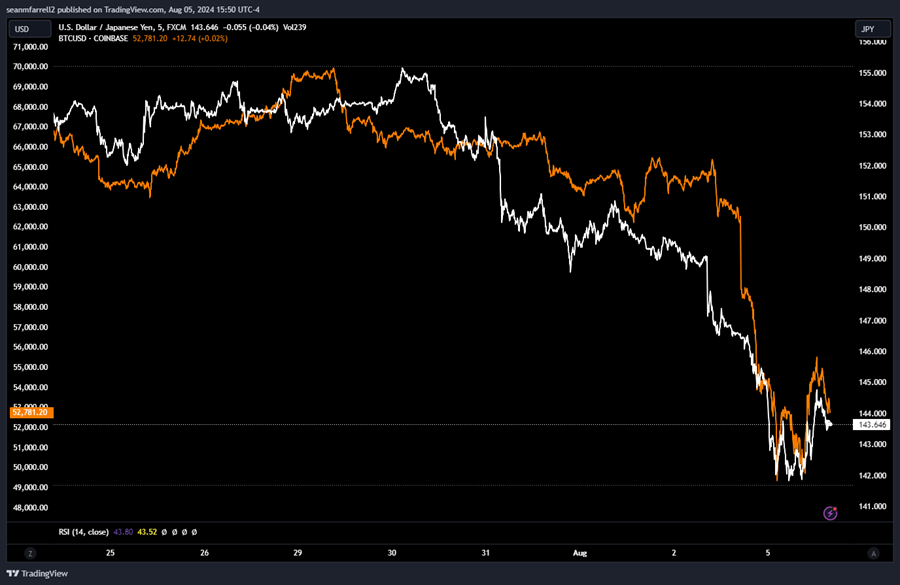

We won’t spend time diving deeply into the events of the past few days as most are likely already familiar. In short, concerns about a potential domestic recession were ignited last Friday following a weak jobs report. This caused the dollar, particularly the USDJPY, to decline, triggering an unwinding of the yen carry trade and leading to widespread deleveraging across global markets. During such a global margin call, investors often sell what they can when they can to meet their obligations. Crypto, which remains open for business 24/7, makes it an accessible source of liquidity during trying times.

For those speculating whether this marks a cycle top, it’s important to clarify that we do not see it as such.

The current market dynamics reflect systematic deleveraging across risk assets, influenced by political uncertainty (tightening presidential race), geopolitical tensions (escalating Middle East conflict), economic concerns (potential Fed policy error), and heightened volatility in FX markets (surprise BOJ rate hike causing yen carry trade unwind).

Crypto cycles should be analyzed through the lens of global liquidity. In the short term, prices might be influenced by leveraging/deleveraging, but in the medium to long term, factors like real interest rates, banking reserve levels, fiscal flows, and dollar strength/weakness play a more significant role.

Now, we will discuss (1) positive things we saw on Monday, (2) signals we are looking for to give us more confidence in a longer-term low, and (3) how we would recommend positioning here.

The Good

We observed several positive developments on Monday. Most notably, the price action and Coinbase premium that appeared after the US cash market opened. When the Majors (BTC, ETH, and SOL) trade at a premium on Coinbase compared to Binance, it often signals strong demand in the US spot market, likely from institutional investors. For BTC and ETH, this could indicate robust ETF flows, which we will confirm tomorrow.

Strong ETF inflows were instrumental in stabilizing the market following the German government-induced selloff in late June and early July. A repeat of strong inflows after a leverage wipeout would be encouraging.

Additionally, we witnessed a significant rebound in prices, recovering much of the losses with high trading volumes. As of 6 PM ET, BTC volumes on Coinbase were the second highest YTD, potentially surpassing previous records by market close.

High volumes mean that a lot of coins changed hands, indicative of capitulation.

Moreover, funding rates have been declining, often entering negative territory, signaling that long leverage has been reduced and the risk of long liquidations has diminished (while short liquidation risk increases, favoring bulls).

Lastly, a strong ISM Services PMI reading this morning should alleviate immediate recession fears and concerns over a potential Fed policy error. Although one could argue that the manufacturing and services PMI readings suggest a two-tiered economy, with manufacturing softening while the services sector remains robust, we do not believe this will dominate market sentiment.

Macro Risks That Remain

The primary risks we foresee include:

- Residual systematic deleveraging.

- Potential consequences of escalating tensions in the Middle East.

The chart below illustrates the close correlation between USDJPY and BTC. If USDJPY continues to fall, we could see further downside volatility in BTC. The degree of this volatility will depend on the extent of the remaining yen carry trade unwind, which is challenging to quantify. Therefore, we will need to let price be our guide.

What We Will Be Watching

Given the above, our focus will be on:

- The overnight price action of USDJPY, BTC, and their interaction. A bounce in USDJPY or decoupling from BTC would indicate a lower risk of continued global deleveraging.

- The persistence of the Coinbase premium and ETF flows. Continuation of the Coinbase premium and strong ETF inflows would significantly boost market confidence.

- BTC’s ability to reclaim the mid-to-high $50k range. The marginal cost of production for BTC miners is roughly $50k, so maintaining a price above this level would reduce the urgency for miners to sell, positively impacting supply dynamics.

- Instances of short liquidations. A market often needs to trap short sellers to confirm that bulls are in control. An increase in short liquidations would help confirm that sellers are exhausted.

These are some key elements that will guide our assessment of market risk in the coming days.

How We Think One Should Position

A severe market drawdown offers a unique opportunity to reassess one’s current allocation and identify assets that performed well during the recovery phase. Given the persistent risks outlined previously, we believe it’s prudent to raise cash by divesting some underperforming altcoins in our core strategy, specifically OP, IMX, and RON. We continue to favor the majors, with our preferred allocation as follows: BTC (62.5%), SOL (12.5%), ETH (10.0%). Additionally, we suggest selecting a few altcoins with strong fundamental theses and/or those that demonstrated robust price action on Monday.

Rationale for Favoring SOL Over ETH: While SOL experienced a significant drawdown over the past seven days, comparable to the broader altcoin market, its rebound was notably strong. The durability of this recovery will depend on the macro risks discussed earlier. Should we navigate past the Yen and geopolitical risk hurdles, SOL appears poised for outperformance. The bounce off intraday lows for SOLBTC was particularly indicative of this potential.

Rationale for Adding Back HNT: HNT is a DePIN asset we’ve favored for some time due to its solid fundamentals. For an in-depth analysis, refer to our strategy note from February 29th. Despite HNT’s recent underperformance, possibly due to a structural seller, its recent price action suggests this overhang may have lifted, making it a compelling candidate for reintroduction to our portfolio.

Rationale for Keeping MKR and STX: MKR and STX offer reliable beta exposure to their respective platforms, ETH and BTC. Both assets have compelling fundamental stories: Stacks with the upcoming Nakamoto upgrade and Maker with the Maker End Game initiative. These developments are difficult to overlook, reinforcing our decision to maintain exposure to these names.

Rationale for Removing OP, IMX, and RON: The primary reason for excluding these assets is their consistent underperformance, coupled with a lack of imminent catalysts. Additionally, we believe it’s necessary to consolidate the portfolio and focus on assets with clearer upside potential.

Rationale for Adding USDC: Despite the encouraging price action today and our intact medium-to-long-term thesis, we recommend maintaining a measured approach. Holding USDC provides liquidity, allowing us to capitalize on potential opportunities should additional downside volatility arise.

To Summarize Changes to Core Strategy:

- Sell: OP, IMX, RON

- Keep: BTC, SOL, ETH, STX, MKR

- Add: HNT, USDC

To Summarize:

- Year-End Outlook Unchanged: Our overall forecast for the year-end remains consistent, with no significant changes to our medium/long-term views. If your investment horizon extends beyond 1-2 months, we hold strong conviction that the current market conditions present a great buying opportunity.

- Positive Signals from Monday: Monday’s market activity showed promising signs that suggest a potential bottom has been reached.

- Measured but Opportunistic Short-Term Approach: We advise keeping some dry powder handy over the next couple of weeks. We would like to see crypto maintain its strength in an overnight session and seek confirmation that USDJPY has stabilized before making any aggressive moves.

Tickers in this report: BTC 0.98% , ETH 0.86% , SOL 1.80% , HNT 3.64% , STX N/A% , MKR 1.23% , MSTR 1.04% , SMLR, COIN 3.07% , HOOD 0.59% , MARA 0.16% , RIOT -3.33% , WGMI -4.53% , CLSK -2.04% , WULF -3.62% , IREN -7.62% , CORZ -3.84% , BTDR -1.89% , BTBT -2.38% , HUT -1.90% , HIVE -3.23%