Gox Wallet Movements Still Present a Risk, But Macro & Politics Keeps Us Allocated Here (Core Strategy Rebalance)

Key Takeaways

- Despite our view that the amount of sell pressure from Mt. Gox coins is more FUD than fact, our learnings from the past week suggest that wallet movements still pose a near-term risk to BTC.

- ETHBTC has shown strength following the recent drawdown. We expect clarity on ETF approval soon. The supply overhang for ETH is minimal, making it a favorable risk/reward option.

- The partisan nature of crypto has intensified once again, presenting an overlooked potential tailwind heading into November.

- Overall, today’s CPI print and recent softening job data create a suitable macro environment for crypto to find a near-term bottom.

- Core Strategy – We acknowledge the near-term risk to the market from the impending transfer of BTC out of the Mt. Gox estate, which could result in short-lived downside volatility. However, inflation continues to fall, economic data remains non-recessionary, and political tailwinds are intensifying, leaving us fully allocated. Given the positive macro environment and the near-term market risk, we believe it is prudent to trim some of the underperformers from the core strategy and shift relative allocation among majors from SOL to ETH.

Discussing the Supply Concerns

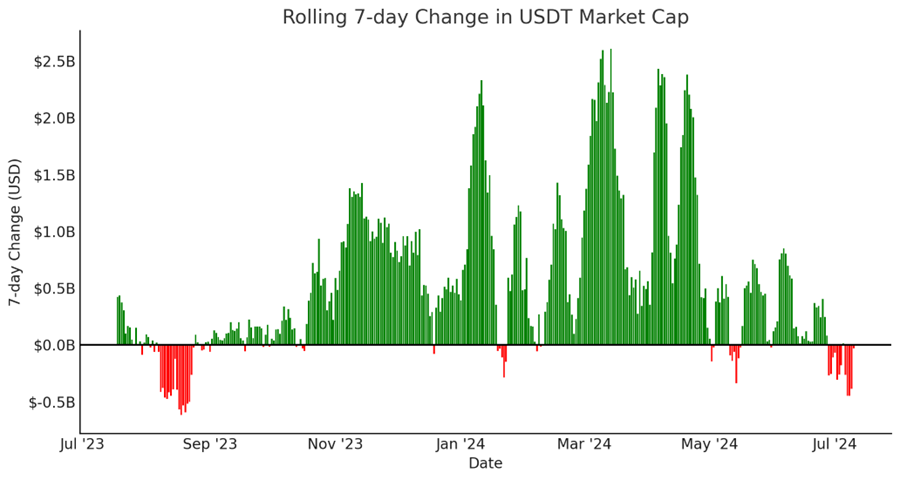

On balance, macro conditions have moved in our favor thus far in early Q3. We have received soft jobs numbers and softer ISM reports, and cooler inflation figures, which have sent rates and the DXY lower. Unfortunately, the mere reveal of imminent sales from the German BKA and the solidification of the Mt. Gox disbursement timeline were not enough to put a bottom in for bitcoin.

German BKA

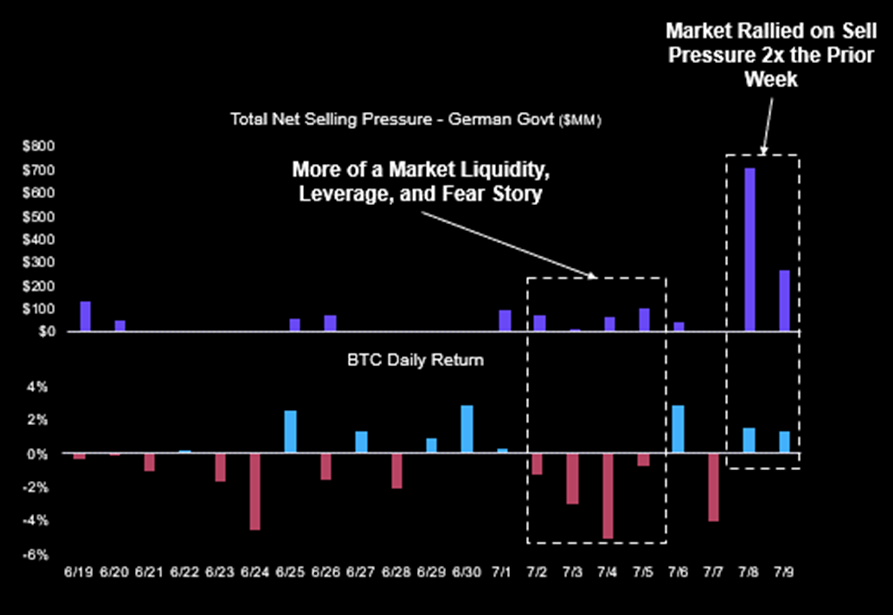

The actual movement of coins from German wallets caused massive selling from market participants. It is important to note that it wasn’t necessarily a simple supply/demand mismatch that caused the drawdown, but rather a hit to market psychology during a rather illiquid time. As shown in the chart below, the Germans started moving their coins to partner exchanges during the week of July 4th, which is intuitively a much less liquid week for all assets as many Americans are away from their desks. This sparked fear in the market, leading traders to close out positions, resulting in cascading liquidations across derivatives markets.

Fast forward to this week, and we have since rebounded considerably from the drawdown to $53.5k, as the market has absorbed the selling of the German coins quite seamlessly. This rebound occurred despite the Germans selling much more BTC than they did the week prior. In fact, on Monday alone, they sold twice as much BTC as they did all of last week. This is likely because traders were back at their desks, markets were once again liquid, the market was deleveraged, and the fear of the Germans selling had already been priced in.

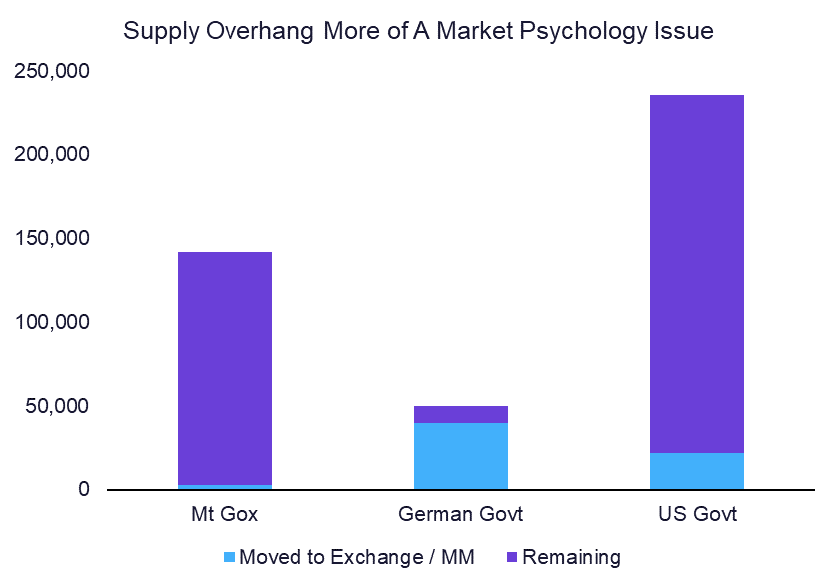

As seen in the chart below, we are almost through all of the German holdings, which is a positive sign. Further selling from this entity is unlikely to have a significant impact on asset prices.

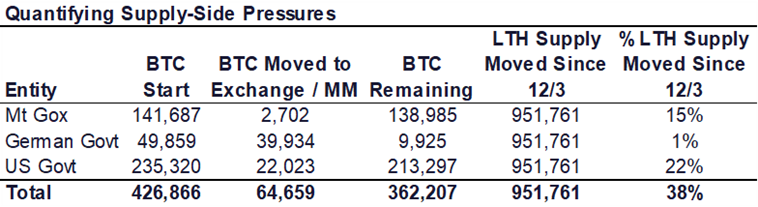

However, it is worth discussing the other two piles of BTC that the market is still concerned with – the 138k BTC possessed by the Mt. Gox trustee and the 213k BTC in the possession of the US government.

Mt. Gox

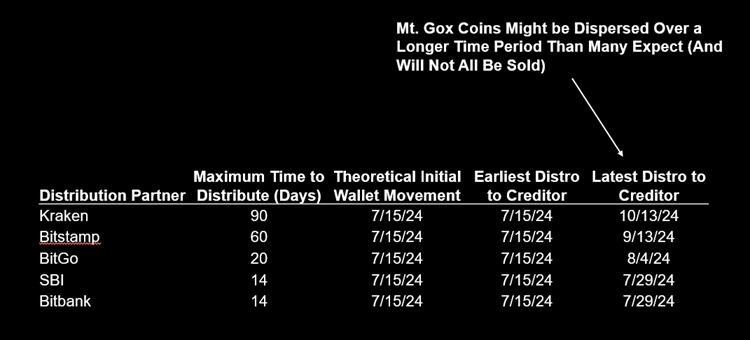

The Mt. Gox coins are numerous and have an approaching deadline to be repaid to creditors in kind. Reports and recent wallet movements give us some confidence that most of the coins will be moved this month, with a final deadline of October 31st to be paid out to the creditors.

When considering the impact of these coins on the market, there are a few important differences between the Mt. Gox supply and the German and US government supply:

- Categorically Different Distribution Purpose: The Mt. Gox coins are not guaranteed sell pressure, unlike the government coins. We have stated that we view the potential sell pressure from Mt. Gox coins as more FUD than fact. This is different from the BTC seized in various criminal investigations by government entities, which are being liquidated to raise cash for the BKA and the DOJ.

- Sophisticated and Mostly Long-Term Investors: The creditors receiving the BTC from the Mt. Gox estate are generally sophisticated investors who know how to hedge their positions, understand macro cycles, and have had a liquid claims market to sell into for quite some time. If these investors wanted to cash in on a massive gain, they could have done so a while back. Thus, if there are many coins liquidated from creditors, any sales from these parties are likely to be done in a measured way.

- Uncertain Timing of Actual Distribution: Mt. Gox reportedly has differing agreements with their exchange partners. Once the Mt. Gox trustee distributes the BTC to the exchange partners for final distribution to creditors, those partners have different agreements on the timeframe to make the creditors whole. Repayments are being handled by five exchanges with varying distribution timelines: Kraken (90 days), Bitstamp (60 days), BitGo (20 days), and both SBI VC Trade and Bitbank (14 days). These are the maximum timelines each party has agreed to meet, not necessarily the projected timeframe for distribution to customers. This means that the actual supply from Mt. Gox could enter the public float steadily over a longer timeframe.

Given the learnings of the past week, we think it is right to expect a similar market reaction once the coins start to move from the trustee wallets to partner exchanges. However, this is tough to predict, and in our view would garner a similar reaction to the German sales – they would be scooped up with relative ease. To be clear, we still maintain that the actual selling from Mt. Gox creditors is unlikely to be as severe as many expect. Nonetheless, if one is approaching the market more tactically, a wallet-movement-driven drawdown is something worth managing leverage/risk around.

US Government

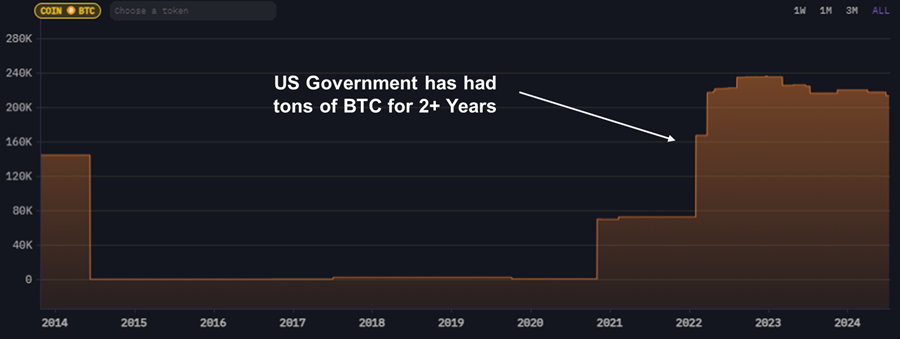

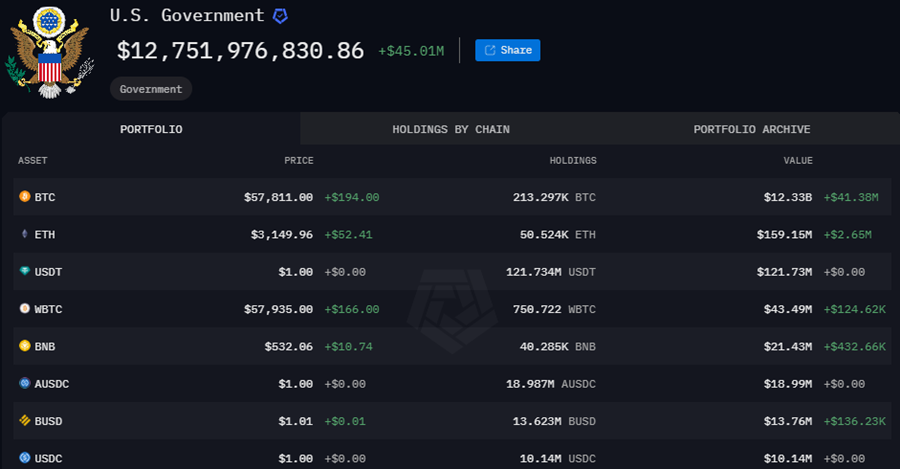

The US government is the third entity presenting a BTC supply overhang to the market. Their stack is much larger than the other two but is also quite different. These 200k+ coins have been procured over various criminal proceedings from multiple parties, unlike the German government, which seized their recently sold BTC from a single criminal investigation. Therefore, it is less likely that the sales from the US government will be “chunky.”

The US government has also had a considerable amount of BTC in their possession for a while and, to our knowledge, does not have a time limit to liquidate their holdings. Thus, it seems imprudent to position around any potential sales from this entity.

To summarize our views on the supply concerns:

- The recent drawdown is partially about supply and demand from the specific German government sales but more specifically due to the market structure and psychology around a large seller moving their coins to exchanges.

- The German government coins are almost entirely sold, have been sold with ease, and therefore pose minimal risk to the market.

- The Mt. Gox coins are likely to spark a short-lived negative reaction from the market when moved to exchange partners. However, similar to the German coins, we do not view this supply as causing a long-term imbalance in the order books, absent changing macro conditions and a fall in market demand.

- The US government coins are a large sum, but due to their origin from various criminal proceedings and their lack of predictability, it seems imprudent to reduce risk in anticipation of these sales.

There is Always a Source of Supply for the Market

While over the long term, the BTC story is largely about scarcity and growing demand for an asset with a fixed supply, it is important to consider that, in the shorter term, there will always be sources of float for the market.

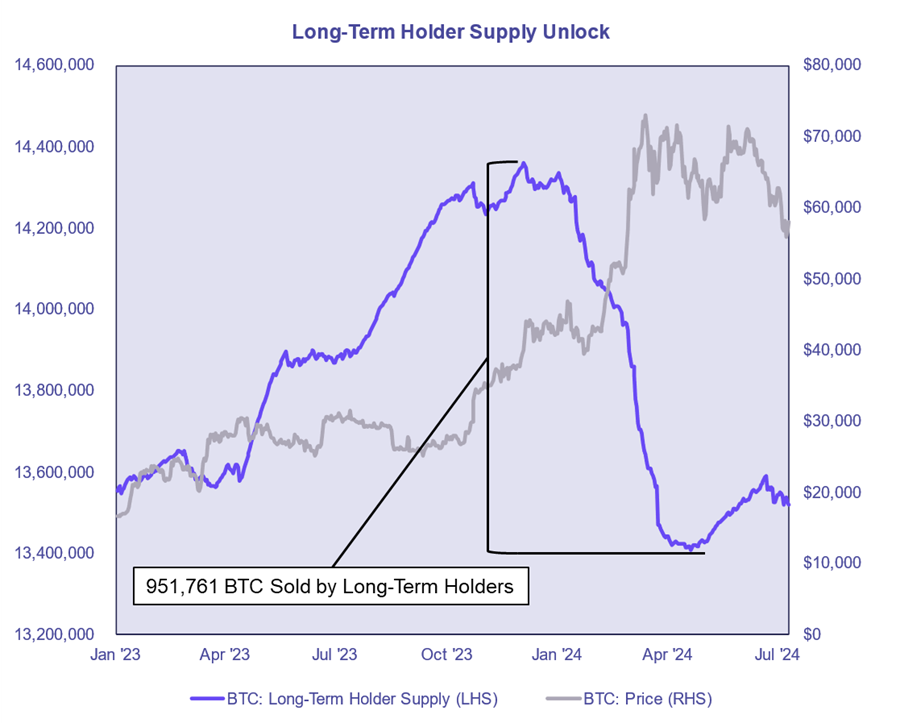

Long-term holder positions from December through today illustrate this point. Every crypto cycle follows a similar rhythm: smart money piles in at the bottom of the cycle, holds their positions until the market exhibits strength, and then sells into that strength.

Below, we see the long-term holdings of BTC investors who started to exit their positions in the Q1 rally. In just over three months, nearly 1 million BTC that had been held for five months or longer moved on-chain, with the vast majority likely being sold into the market. A significant portion of this was unlocked GBTC.

When the supply overhang discussed above is juxtaposed with this massive movement of coins, it becomes clear that it is less about the supply overhang and more about investor psychology and demand.

ETH: A Good Risk/Reward Here

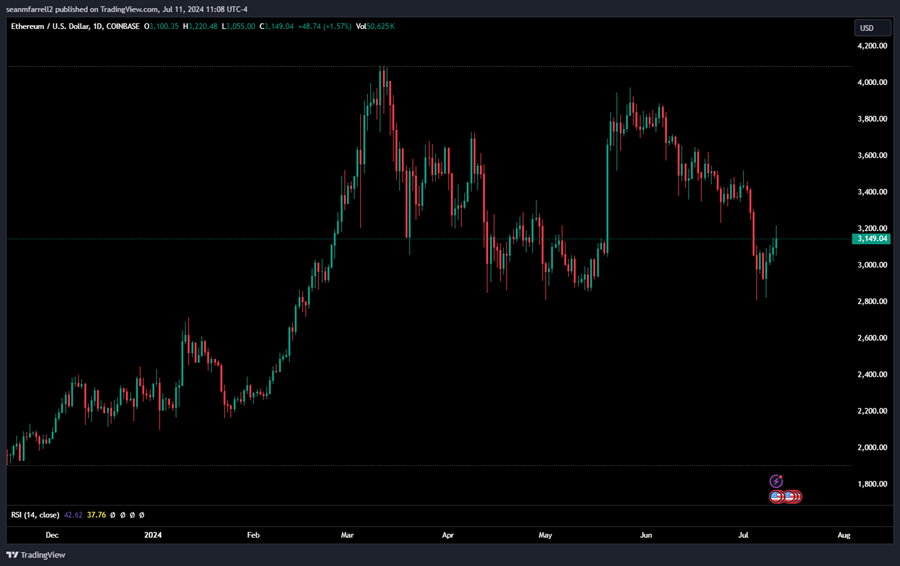

As we have frequently discussed lately, the S-1s for the ETH ETFs are expected to be approved within the next 1-2 weeks. Of course, there is always the risk that the SEC drags its feet, but this is our estimate based on the information provided to us.

The drawdown from last week effectively erased the entire pre-ETF rally from late May, so it is fair to say that there is not a lot of upside priced in.

Additionally, following the drawdown, the ETH/BTC ratio showed impressive strength. It is always helpful to observe which assets or asset pairs perform well post-leverage rinse.

Furthermore, there is no identifiable supply overhang for ETH like there is for BTC, except for the $160 million in ETH currently in the possession of the US government. This is small compared to the amount of BTC they own.

Thus, we are inclined to view this as a favorable time to add exposure to ETH.

Political Tailwinds into Year End Likely Underpriced

Personal Note: We understand that our clients have a broad array of political views. As analysts, we strive to remain objective and apolitical. As the election approaches and crypto regulation becomes increasingly pertinent to our analyses, political commentary may become more frequent than usual. Please do not interpret any such commentary as endorsements of any wider political ideology.

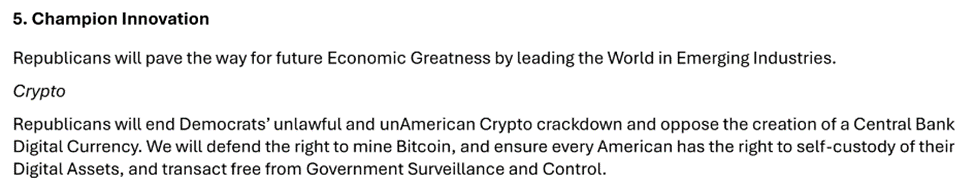

While there were signs earlier in the year that crypto might have transitioned to becoming bipartisan in nature, recent developments, such as the SEC’s recent lawsuit against Consensys, suggest that the partisan nature of crypto regulation is stronger than ever. While there are younger Democrats in Congress who have come out in support of fair regulation of crypto and creating an environment in which the industry can innovate and attempt to cement itself free of regulation by enforcement, it is undoubtedly the GOP that has made itself into the decidedly preferred party for crypto industry proponents. The latest development on this front was the release of the GOP platform, in which a supportive stance toward crypto was mentioned. The specific topics listed were:

- Preventing a CBDC

- Defending the right to mine Bitcoin

- Ensuring the right to self-custody

- Allowing citizens to transact free from government surveillance and control

This is certainly a much different tone than that of the current Democratic party. A GOP-led White House and/or Senate would likely result in a new SEC chair and increase the probability of stablecoin and market structure legislation passing into law, which would massively reduce regulatory risk for crypto. This would likely bring a new cohort of investors into the space who are currently reluctant to spend the time getting the sign-off from their internal risk departments.

Those who have not been living under a rock are certainly familiar with the current standings in the presidential race. It is certainly still early, with months to go, but at present, former President Trump has a rather commanding lead in early polls, and importantly, in prediction markets.

This is a tailwind that investors are likely to come around on as we approach November, and it is likely that if polls continue to trend in the direction that they are right now, prices are likely to benefit into the general election.

Macro Conditions are Favorable for Crypto

The challenging aspect of the crypto market recently has been that, due to idiosyncratic factors, crypto has largely decoupled from macro trends. Being long here implies that macro trends will continue to sway in our favor and that the crypto-specific factors plaguing prices will wane. Given today’s CPI print, recent soft jobs data, the move in the DXY, rate expectations, and the performance of macro-sensitive assets like small caps, we are inclined to view a higher likelihood of this outcome than not.

Balancing Risks

Thus far, we have concluded that:

- The supply overhang concerns are less about a longer-term supply/demand imbalance and more related to market structure and investor psychology.

- The soft CPI print on Thursday confirmed that macro conditions continue to work in our favor.

- There are massive potential political tailwinds for crypto in the near term.

- However, there remains downside risk from the movement of coins from the Mt. Gox trustee to partner exchanges.

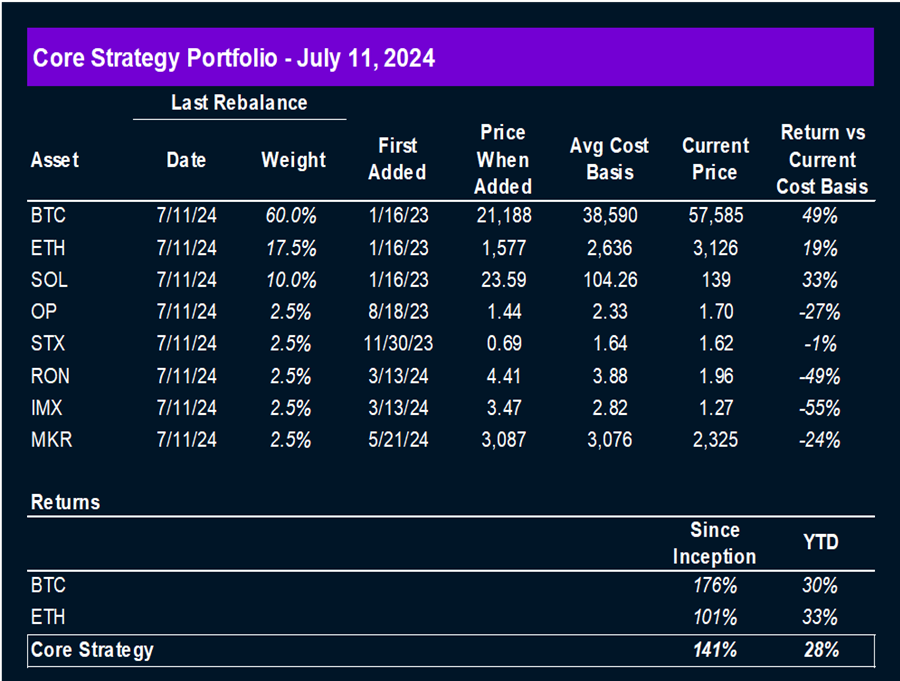

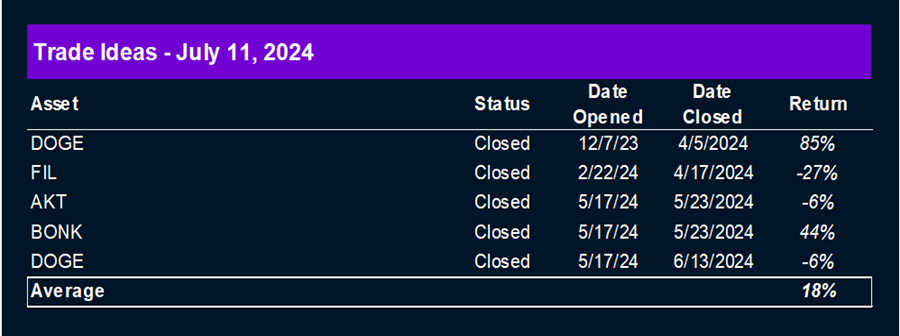

Therefore, we are inclined to take this opportunity to sell some of our underperformers out of the core strategy, slightly increase the absolute allocation towards ETH, and additionally shift our SOL/ETH ratio more towards ETH in the near term.

Eliminations

- HNT: We are still quite excited about the future of HNT. They recently introduced the concept of external subDAOs to their platform, allowing external projects to apply to become a subnetwork on top of the HNT platform, thus accruing more value to the HNT token. Unfortunately, we have not seen much of a market response to this development. Additionally, HNT has not performed as beta to SOL since its addition to the core strategy back in Q1. Thus, we are inclined to remove it for now, likely to be revisited at a later date.

- LDO: While unfortunate, the SEC lawsuit seems to have put a lid on any LDO rally in the near term. It has continued to show weakness relative to BTC, ETH, and other ETH-adjacent alts. It’s important to note that should the political landscape shift in the crypto industry’s favor as we approach November, we could see a strong rebound in LDO. This is something we will monitor closely.

Core Strategy

We acknowledge the near-term risk to the market from the impending transfer of BTC out of the Mt. Gox estate, which could result in short-lived downside volatility. However, inflation continues to fall, economic data remains non-recessionary, and political tailwinds are intensifying, leaving us fully allocated. Given the positive macro environment and the near-term market risk, we believe it is prudent to trim some of the underperformers from the core strategy and shift relative allocation among majors from SOL to ETH.

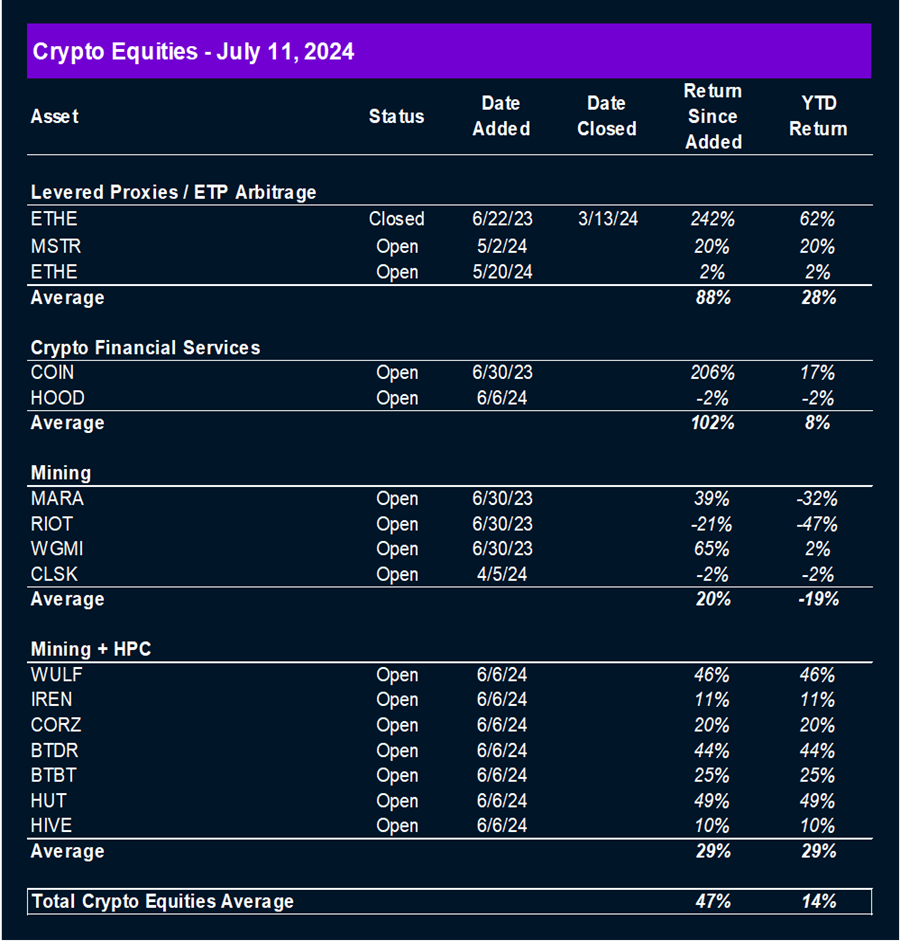

Tickers in this Report: BTC -6.52% , ETH -6.21% , SOL -5.61% , OP -6.78% , STX -5.91% , HNT -5.21% , RON N/A% , IMX -6.10% , MKR -2.33% , ETHE N/A% , MSTR -3.91% , ETHE N/A% , COIN -5.73% , HOOD, MARA -9.06% , RIOT -7.17% , WGMI N/A% , CLSK, WULF, IREN, CORZ, BTDR, BTBT, HUT, HIVE -8.72%