Volatility Levels Paint A Bullish Picture

Key Takeaways

- Observing bitcoin's recent price action has been like watching paint dry. The 30-day realized volatility of BTC reached levels not seen since July 2020.

- Forward returns from instances of 30-day volatility dropping below 25% were almost uniformly bullish, with win ratios across different timeframes standing at an impressive 90%.

- This suggests that periods of low volatility in Bitcoin serve as floor-setting periods and tend to precede substantial upward price movements.

- We examine the difference in the relationship between Bitcoin and the S&P 500 and their respective volatility measures

- The competing force against short-term bullishness is seasonality and a potential deferral on ARK’s spot ETF decision. However, we do not view this as a reason to take risk off the table just yet.

- Both the House Financial Services and the House Agricultural Committee approved and advanced a landmark market structure bill to be voted on in the House. Despite the tough road ahead, this signals progress in addressing regulatory challenges.

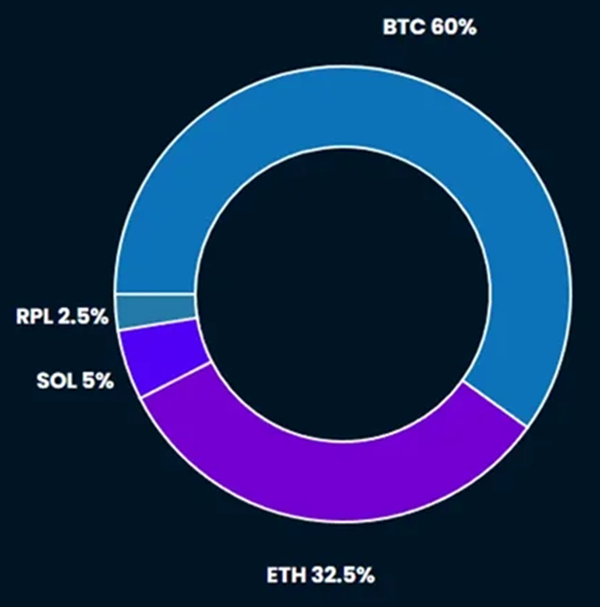

- Core Strategy – We believe that the market is currently in a “sentiment sweet spot” where both narrative-driven factors (such as the potential spot ETF, Ripple victory over the SEC, and the return of US investors) and fundamental factors (such as the upcoming halving event in a few quarters and expanding global liquidity) are bullish. Despite the majors giving back some gains in recent weeks, the risk asymmetry through year-end is skewed to the upside.

Paint Drying

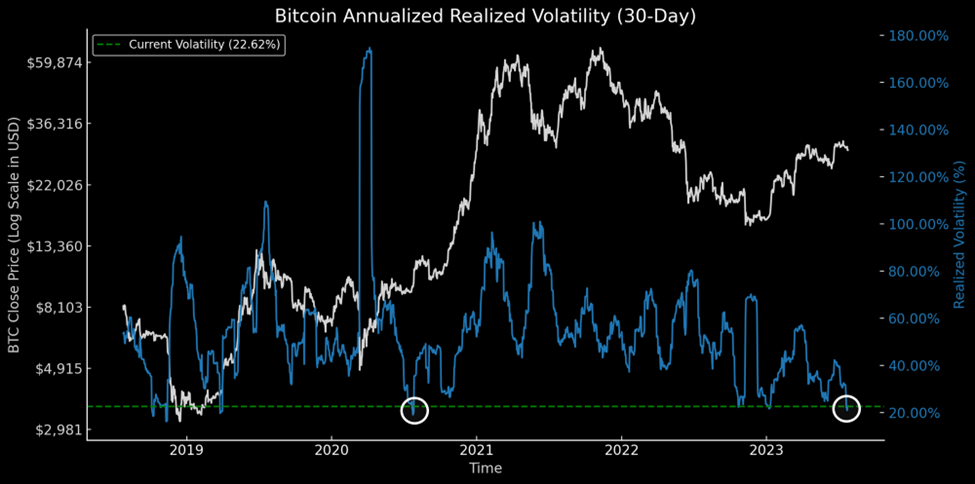

Over the past few weeks, watching Bitcoin’s price action has been akin to watching paint dry. Earlier this week, bitcoin’s 30-day realized volatility reached levels not witnessed since July 2020.

I shared the chart below in Wednesday’s market update. I noted that historical data indicates that such drawdowns in volatility often precede significant price movements. Recognizing the importance of this insight, we decided to delve deeper into the numbers, seeking to quantify the magnitude of these moves and understand their typical direction.

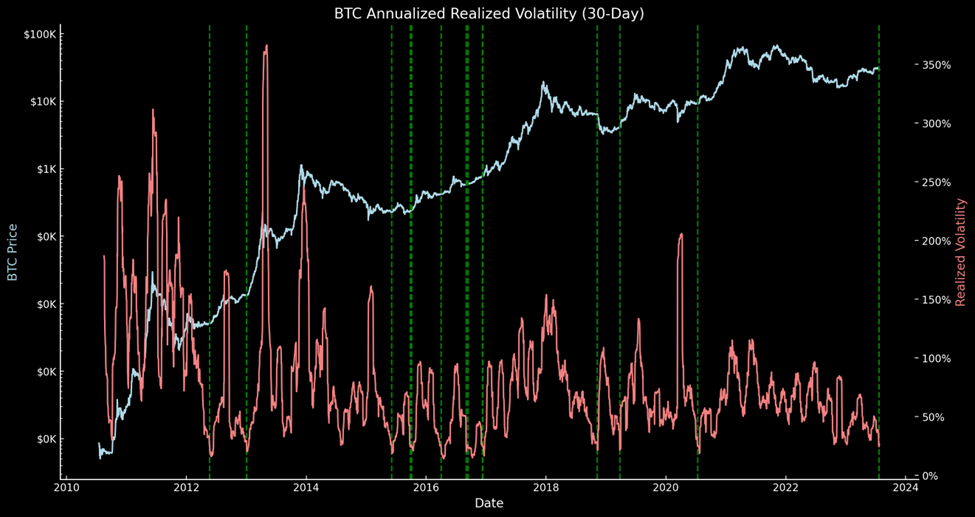

Below is the entire history of Bitcoin’s 30-day realized volatility. We marked each instance of this measure falling below 25% with a vertical green line. This level is just below the 1st decile of 30-day bitcoin volatility (32%).

Oddly, this happened quite often in the run-up to 2015 and 2016 but only twice in the last 3 years. Note that if volatility fell below 25% again within 30 days, we did not count this as another instance of crossing that threshold. In all, there have been 11 instances of volatility reaching the sub-25% zone.

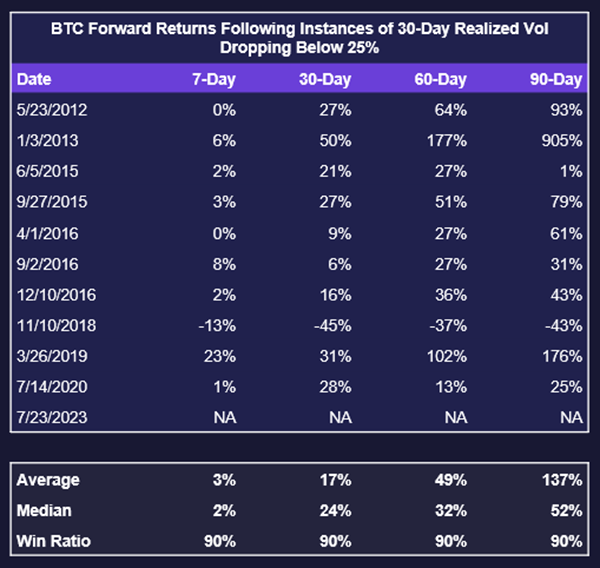

Next, we examined the forward returns from each of these 11 instances. The results were remarkably bullish, with win ratios across 7, 30, 60, and 90-day forward returns standing at an impressive 90%. To put a finer point on it, 2018 was the only instance in which near-term price action was bearish following a drawdown in volatility.

These findings suggest that periods of low volatility tend to serve as periods of floor-setting and precede significant moves higher.

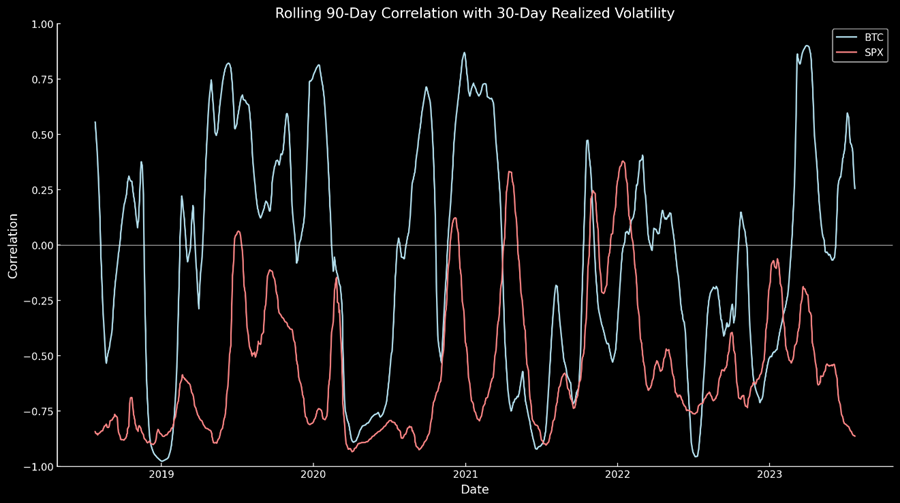

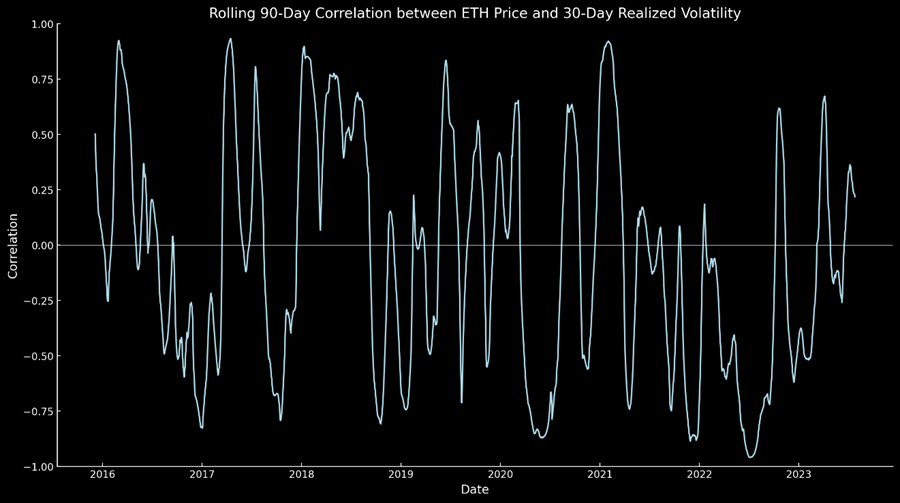

This aspect of Bitcoin and its trading behavior often goes underappreciated. In the realm of equities, low volatility regimes are commonly associated with steadily rising prices, increased risk-taking, and a rise in downside risk. The VIX, referred to by many as the “Fear Index,” reflects this inverse correlation, as spikes in the VIX often coincide with equities moving lower. However, our analysis challenges this conventional wisdom by suggesting that increased volatility in Bitcoin yields favorable investor returns.

The chart below showcases the rolling correlations between each asset and its 30-day realized volatility. While neither asset shows a perfect correlation with its volatility, a noticeable divergence emerges. The S&P 500 tends to be inversely correlated with its volatility measure, whereas Bitcoin oscillates between a high positive correlation and a high negative correlation.

We believe this difference arises from the nature of the S&P 500 as a mature and diversified index that gradually moves higher over elongated periods, with bear markets being more condensed and sudden, resembling a “stairs up, elevator down” type of market. In contrast, the crypto market’s relatively smaller size can lead to rapid “elevator rides” in both upward and downward directions. This dynamic may explain why Bitcoin behaves differently from traditional equities concerning its relationship with volatility.

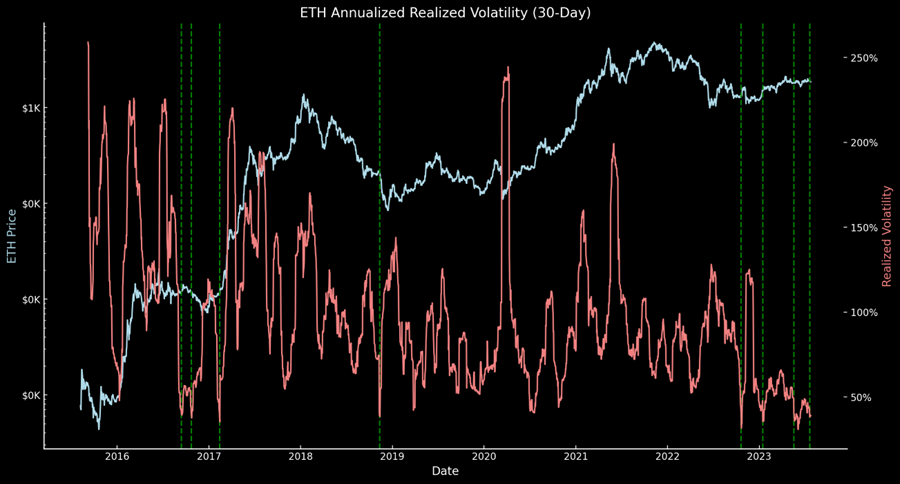

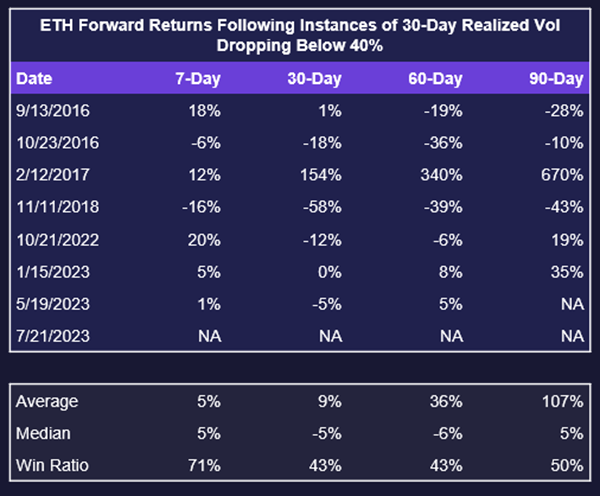

Analyzing the relationship between ETH and its volatility is somewhat more challenging due to its shorter price history compared to Bitcoin. Moreover, historically, ETH has been known to have a high beta to Bitcoin, meaning it tends to be more volatile than Bitcoin.

Since ETH has never quite reached the 25% volatility threshold, we decided to use a slightly higher mark of 40% below its 10th decile volatility (54%) as our reference point. We found that ETH’s realized volatility has reached this level a total of 8 times, including the most recent occurrence this week.

However, when examining the forward returns from these instances, we discovered a mix of results. The win ratios for the 30 and 60-day forward returns were below 50%. Still, it’s essential to note that the more recent forward return data appears more constructive than the data provided during the first year of ETH’s existence. This observation suggests that Ethereum’s price behavior may have evolved over time, influencing its relationship with volatility differently than in its early stages.

Further, based on the same rolling correlation analysis that we applied above, the broader relationship between ETH and its volatility is quite like that of BTC and its volatility.

Seasonal Headwinds Approach

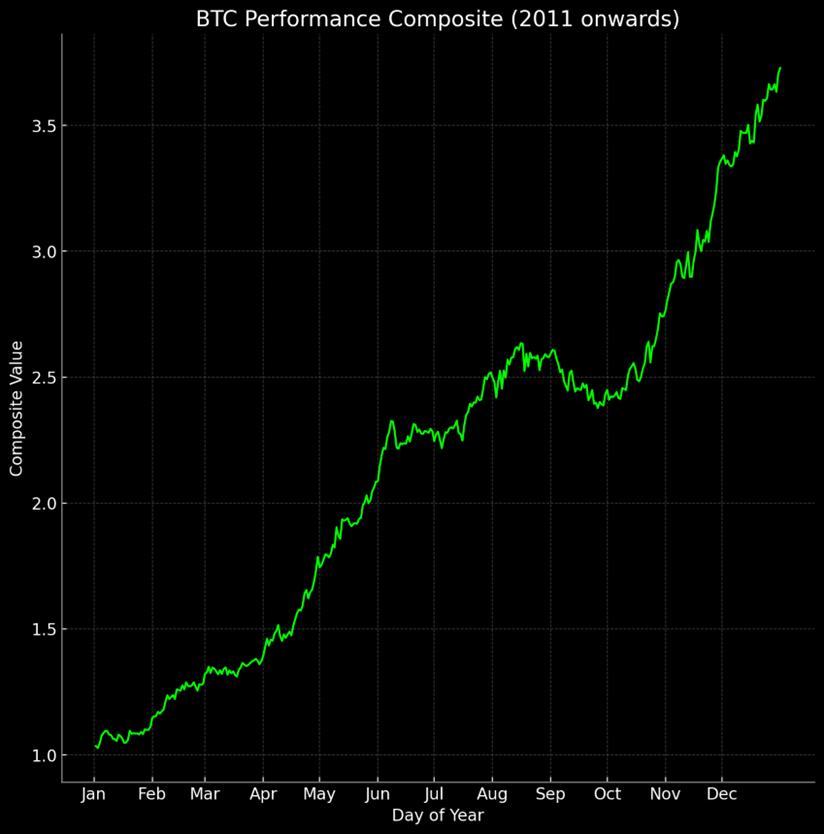

Below, you’ll find a composite chart displaying the average Bitcoin price action over the calendar year. This chart calculates the average return for each day of the year since the network’s inception and indexes this average 365-day performance to 1.

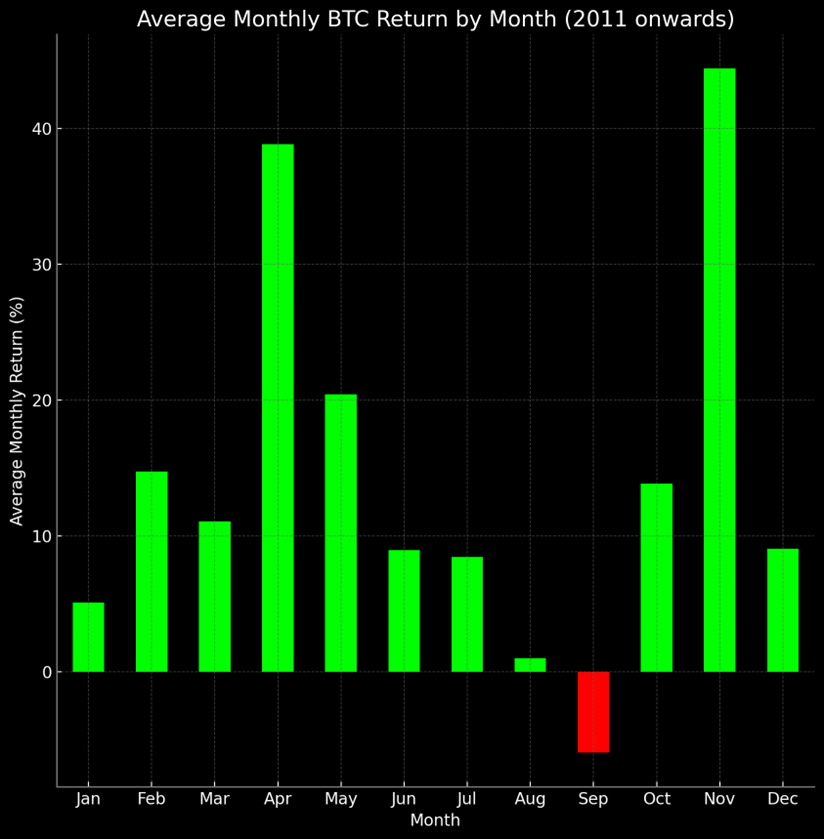

As we examine the chart, it becomes evident that the only consistent period of weakness for Bitcoin occurs from mid-August through September. It’s important to remember that seasonality is an imperfect measure of risk, so we should take it with a grain of salt. However, patterns are patterns, and it’s crucial to acknowledge them, even if there’s no identifiable root cause.

Further, we can see that, on average, September is the only month that has posted negative returns for Bitcoin. Thus, while it will be tough to take risk off the table, given the possibility of a positive ruling for grayscale or a potential ETF approval, it may be prudent to assess reducing exposure in a few weeks. But we will cross that bridge when we get to it.

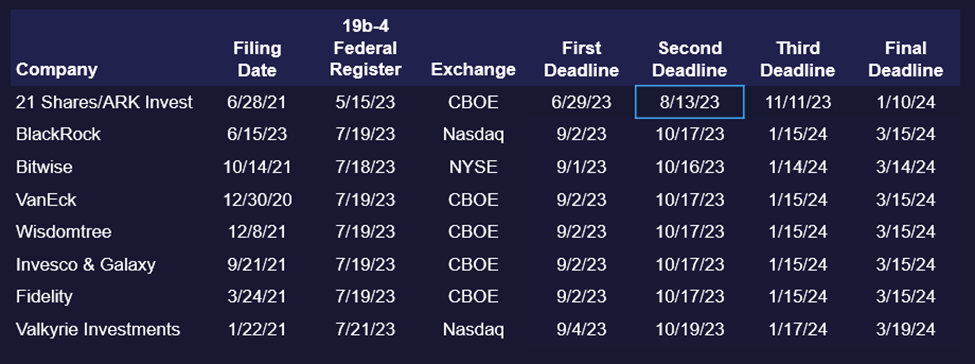

In thinking through what possible catalysts could cause some near-term price risk, there is ARK’s spot bitcoin ETF deadline that is approaching in a couple of weeks. We think there is a strong likelihood that the SEC will defer any decision on this ETF to the third or final deadline dates listed below. In that event, there is a world in which the market interprets this news as a negative headwind for the ETF to get the green light, and we end up seeing some weaker price action. However, it is important to remember that an ARK deferral does not mean that the ETF is denied.

Small Wins

The House Agriculture Committee has advanced a bill aimed at revamping the way crypto markets are regulated in the U.S. This move comes on the heels of the House Financial Services Committee’s approval of the same bill yesterday.

Entitled the ‘FIT for the 21st Century Act’, the bill addresses significant market structure issues. If passed, it could resolve many of the regulatory challenges currently facing the industry and further reduce regulatory risk within the U.S.

Though the bill is likely to face considerable opposition in the Senate, it stands a good chance of passing the House. This is a significant advancement, especially given the low expectations for meaningful legislation this year.

Furthermore, during the review by the House Financial Services Committee, the bill, which enjoys the support of Republican leadership, unexpectedly won backing from several Democrats. This bipartisan support may stem from recent criticisms of the SEC’s perceived failures and its apparent lack of clear jurisdiction, as highlighted by the Ripple case.

Core Strategy

We believe that the market is currently in a “sentiment sweet spot” where both narrative-driven factors (such as the potential spot ETF, Ripple victory over the SEC, and the return of US investors) and fundamental factors (such as the upcoming halving event in a few quarters and expanding global liquidity) are bullish. Despite the majors giving back some gains in recent weeks, the risk asymmetry through year-end is skewed to the upside.

Tickers in this report: BTC, ETH, SOL -1.08% , RPL