Against the Ropes

Key Takeaways

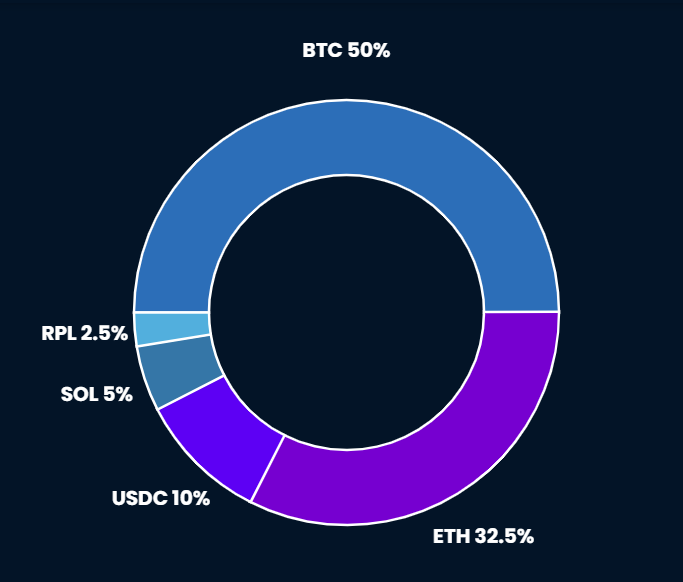

- In response to SEC lawsuits, our strategy to decrease stablecoin allocations to 10% and lower altcoin allocations from 17.5% to 7.5% proved beneficial as altcoins faced significant losses. The current crypto market shows striking divergence, with ETH and BTC dominance at its highest since April 2021.

- The Hinman emails released this week highlight historical inconsistencies within the SEC and suggest that there is an acknowledged gap in regulations as it pertains to crypto. This could serve as a regulatory tailwind.

- Despite equity markets' surge and crypto's struggle, Bitcoin's fundamental link to global liquidity remains intact, shown by its tight correlation with gold and inverse relation with the dollar. With potential weakness in the dollar, this could favor Bitcoin. Our Head of Technical Strategy predicts a technical decline in the US Dollar index, providing potential uplift to emerging markets.

- Recent decoupling of Bitcoin and domestic net liquidity could be due to the lessened impact of US macro factors on Bitcoin amid regulatory pressures or delayed crypto market response to increased market participation. Central bank activities suggest global macro factors may be more influential. Planned stimulus by the PBOC and BOJ, combined with potential Fed pause, could ease global liquidity conditions.

- Core Strategy – Despite the challenging price action and an apparent decoupling from equities, bitcoin’s correlations with gold, the dollar, and global liquidity remain intact. We think most of the damage is done and believe it is right to stay mostly allocated to majors with small allocations to alts as call options on regulatory victories. We see a near-term decline in the dollar and concurrent monetary easing from global central banks to serve as macro tailwinds for BTC and ETH. As we approach bitcoin’s 200-day moving average, we may look to put more capital to work.

Coins Face Additional Turbulence

Last week, we seized the opportunity to “buy the fear” in response to the SEC lawsuits targeting major crypto platforms Coinbase and Binance. In our Core Strategy, we decreased our allocation to stablecoins to 10% and lowered our allocation to alts from 17.5% to 7.5%. This turned out to be fortunate timing on our part, as altcoins continued to face significant losses over the weekend. Moreover, we were wise to keep some funds available for potential further market downturns, which we indeed encountered.

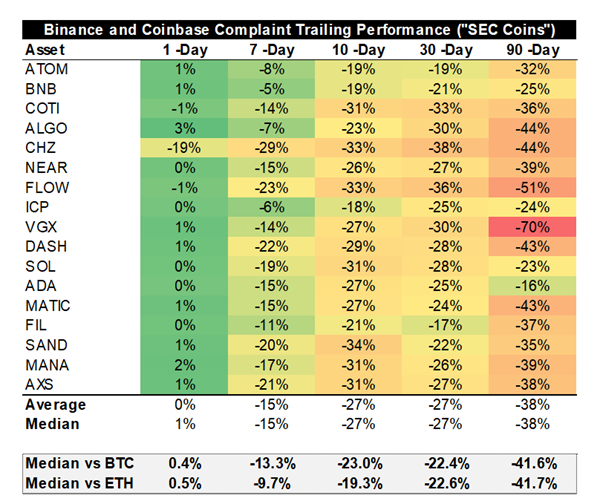

As demonstrated by the asset performance table below, regulatory pressures had an outsized effect on the assets deemed securities by the SEC in their complaints.

The divergence between the majors and alts has been striking. While majors remain comfortably higher than where they were 1 year ago (+26%), altcoins have retraced all of their gains YTD and, in aggregate, are 11% lower over the last 12 months.

Another lens through which we can view the current market divergence is in the combination of ETH and BTC dominance, which is now as the highest level since April 2021, meaning that all of the liquidity in the crypto ecosystem is flowing into these two assets.

Hinman Emails are a Small Victory

We understand the concerns raised about including SOL in our Core Strategy, considering its mention in the SEC complaints. However, we consider this a minor allocation that functions as a call option on a potential favorable outcome in the courts regarding the SEC. Our optimism stems from the ongoing Ripple case, which experienced a positive development this week.

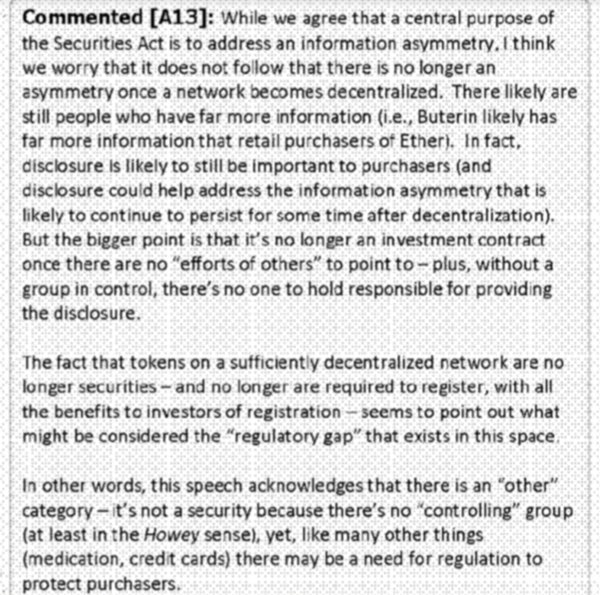

On Tuesday, Ripple Labs disclosed emails from 2018 involving William Hinman, the former Director of Corporation Finance at the SEC. These emails indicated Hinman’s suggestion that ETH did not require registration as a security. The emails were revealed as part of Ripple’s defense in the SEC lawsuit, which accuses the company of unlawfully selling unregistered XRP tokens. The emails also revealed internal discussions among SEC officials regarding the clarification of this viewpoint and a meeting with Ethereum’s founder, Vitalik Buterin.

These exchanges highlight a historical acknowledgment by SEC officials that existing securities laws, including the Howey Test, may be inadequate to regulate cryptoassets. It indicates a need for tailored regulations specifically designed for this emerging technology. Such a perspective would be beneficial for most parties involved in SEC litigation. While there is no specific date for the ruling on the Ripple lawsuit, we anticipate a decision in the upcoming months. The disclosure of these emails briefly sparked a rally among coins classified as securities in SEC lawsuits, although these gains have largely been reversed.

Paul Grewal, Coinbase’s Head of Legal, emphasized the significance of these emails on Twitter, posting the following picture, with the caption:

“The regulatory gap.” Proof from the Hinman emails of what we’ve been saying to the Third Circuit, to Congress and to the SEC itself: that the securities laws are incomplete when it comes digital assets, that securities law aren’t meant to rule over all digital assets, and that many digital assets are not securities.”

Fed Pause

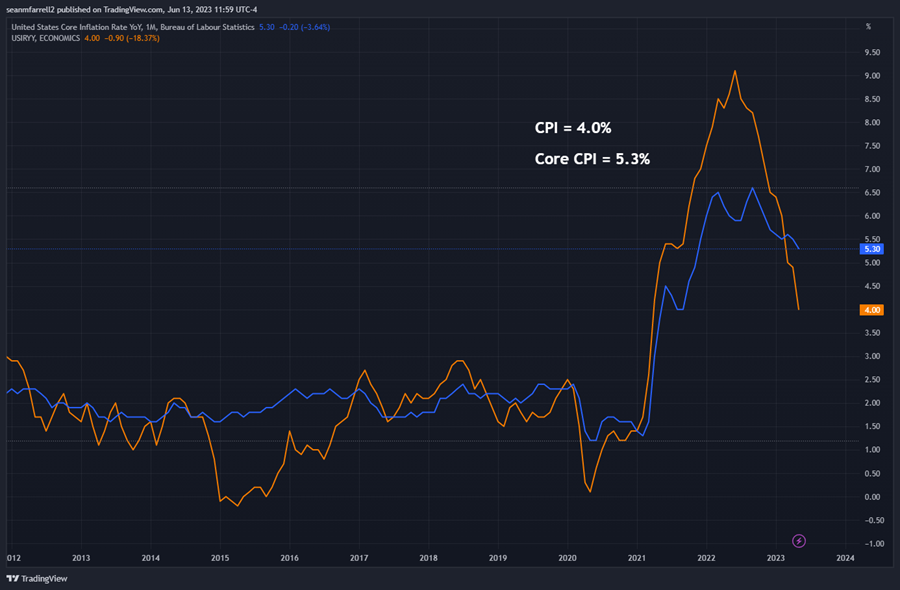

The big news in macro-land this week was the release of the latest CPI figures and the subsequent FOMC meeting.

The May CPI report revealed that headline inflation increased by 0.1% month-over-month and 4% year-over-year, showing a continued easing of inflationary pressures. It is important to note that core inflation remained somewhat elevated, rising by 0.4% monthly and 5.3% annually. The main drivers of CPI were surging rent prices and increases in used car and truck prices.

This was enough to allow the Fed to finally lay down their weapons and hold rates constant, pausing at Wednesday’s FOMC meeting.

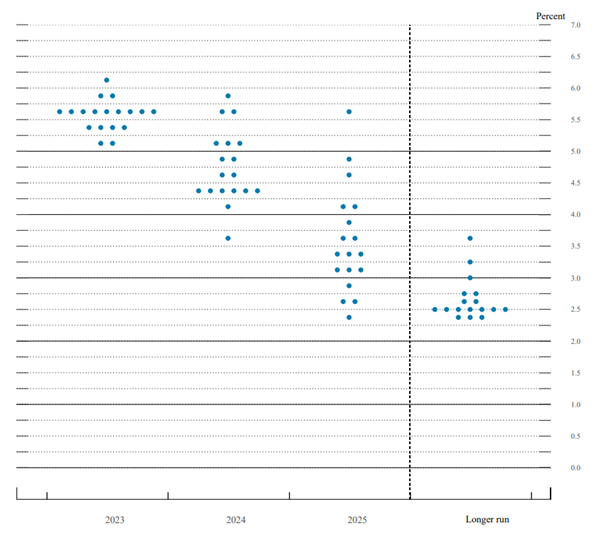

While markets liked the initial decision, there was some trepidation over the revised “dot plot,” which showed a terminal rate 50 bps higher than the previous dot plot, sending mixed signals to investors. Our base case is that this dot plot is the Fed’s attempt at a “hawkish pause,” but assuming that inflation stays on its current course, we think it’s unlikely that we see any additional hikes this year.

The Great Decoupling (Sort Of)

A common occurrence during the last bull market was people complaining that bitcoin, designed as the ultimate hedge against monetary debasement was simply acting as a leveraged bet on tech stocks.

Now, with equities soaring, and crypto floundering, we are starting to field the exact opposite complaint. Such is human nature.

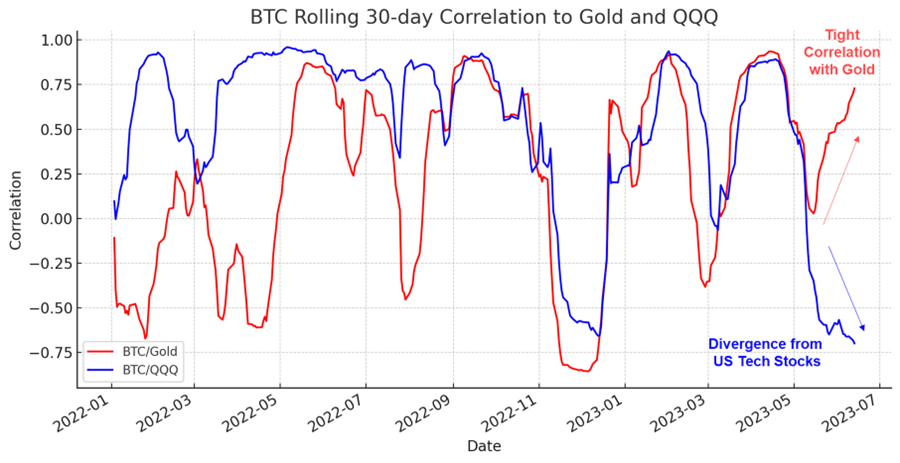

Below we see that while bitcoin has strayed from its link with the Nasdaq, it remains tightly correlated with gold. This might be a function of tech stocks moving on their own fundamentals as opposed to being driven by global liquidity conditions, as has been the case over the past few years.

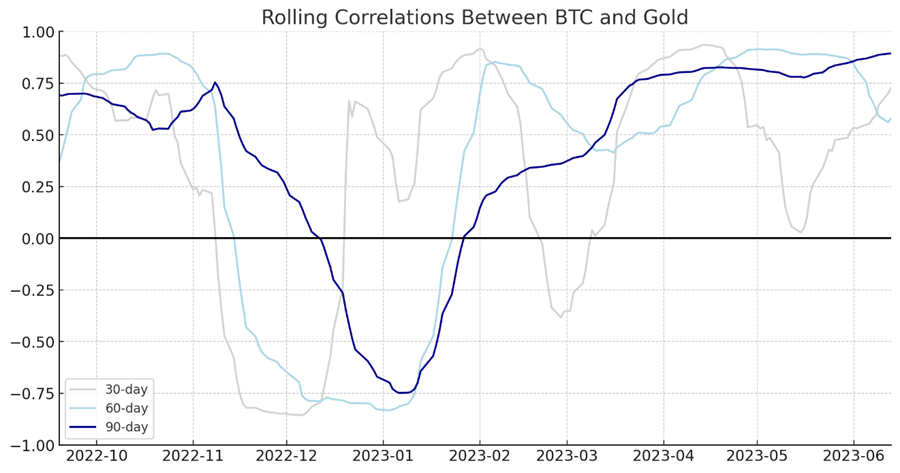

Below is a more granular view on the current relationship between analog gold and the digital version.

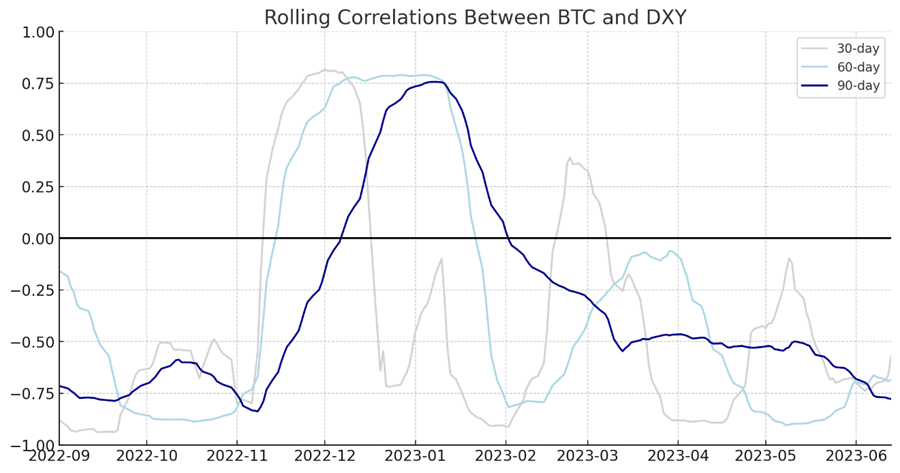

Bitcoin also remains tightly (inversely) correlated with the dollar. This reflects a persistent relationship with liquidity conditions.

Understanding the fact that, despite the challenging price action, bitcoin retains its fundamental ties to global liquidity, we must view any weakness in the dollar as conducive for forward price action. Our Head of Technical Strategy offered his opinion on the near-term outlook for the dollar, noting that it appears to be rolling over. His comments below:

The recent break of early June lows makes it increasingly likely that the US Dollar index (DXY) has begun a technical decline which could lead to lower prices in the weeks ahead.

Momentum has rolled over to bearish using common technical gauges like MACD, and the uptrend from early May was just violated in the last two weeks.

Technically speaking, I’m anticipating a test and break of April/May lows in DXY, which might lead to a tailwind to the Emerging market (EM) trade.

Downside targets for DXY lie in the high $90’s, and I expect gains in Yen, Euro and Pound Sterling in the weeks to come.

Global Liquidity Update

Another interesting divergence that we have noticed appear over the past couple of weeks has been between domestic net liquidity and bitcoin. Over the past few years, increases in net liquidity have led to concurrent increases in bitcoin price. However, since the start of this month, as we experienced the movement of capital from the RRP back into the market (more on this below), net liquidity has moved substantially higher, while bitcoin has continued to falter.

What does this decoupling mean? There are a couple of possible explanations: (1) the US macro setup has been less important to bitcoin than the global macro setup due to recent regulatory pressures, or (2) the positive tailwinds of this increase in market participation has yet to trickle into the crypto market.

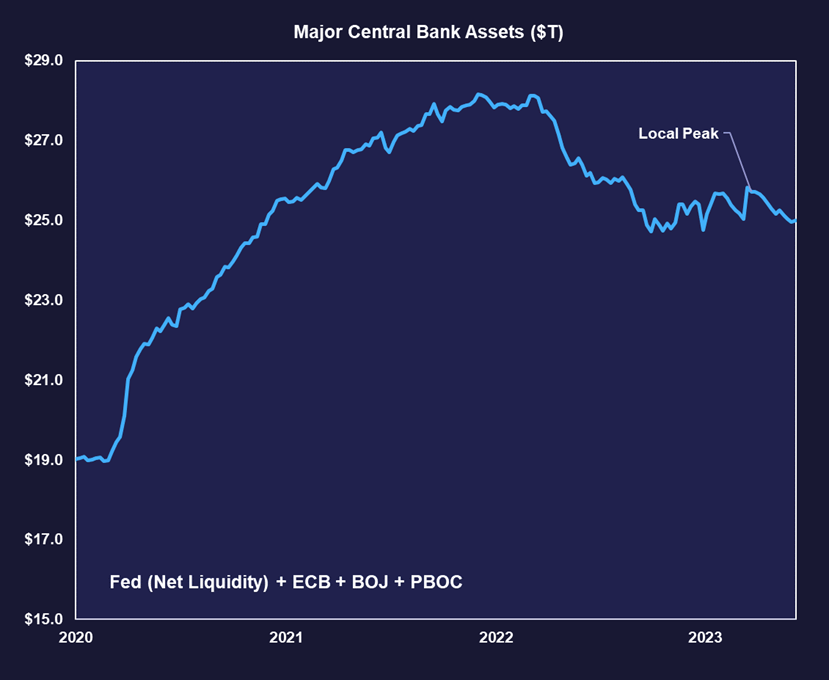

The chart below, demonstrating that global central bank assets achieved a local peak at the end of March, coinciding with the YTD peak in crypto prices, suggests that (1) is more likely the answer.

The good news is that of the four major central banks, two (PBOC and BOJ) have plans to resume a stimulative approach to monetary policy at some point this year.

- Regarding PBOC policy Bloomberg reported this week that Chinese policymakers are “considering a broad package of stimulus proposals, which include support for areas that include real estate and domestic demand, according to people familiar with the matter.”

- In a similar tune, Reuters reported that the “BOJ is expected to maintain ultra-loose monetary policy this week and its forecast for a moderate economic recovery, as robust corporate and household spending cushion the blow from slowing overseas demand, sources said. The central bank also may signal that inflation is overshooting its forecasts, which would heighten the chance of an upgrade in its price projections at a quarterly review of its estimates due in July.”

These actions, combined with a Fed pause, could lead to further easing of global liquidity conditions.

RRP Balance Decreasing = Good for Asset Prices

Over the past few weeks, we became incrementally less bearish about the ongoing TGA rebuild due to a couple of reasons: (1) the fed pause with the backdrop of equity market rally would likely bring some capital off of the sidelines (back into reserves) and (2) short-term rates remain competitive with the overnight rate and therefore the marginal bid for new treasuries should come from RRP (liquidity neutral).

It is tough to say which factor above is powering the most recent move of capital out of the RRP, but it appears that the decreases have been substantial enough to weather any treasury-driven storm thus far.

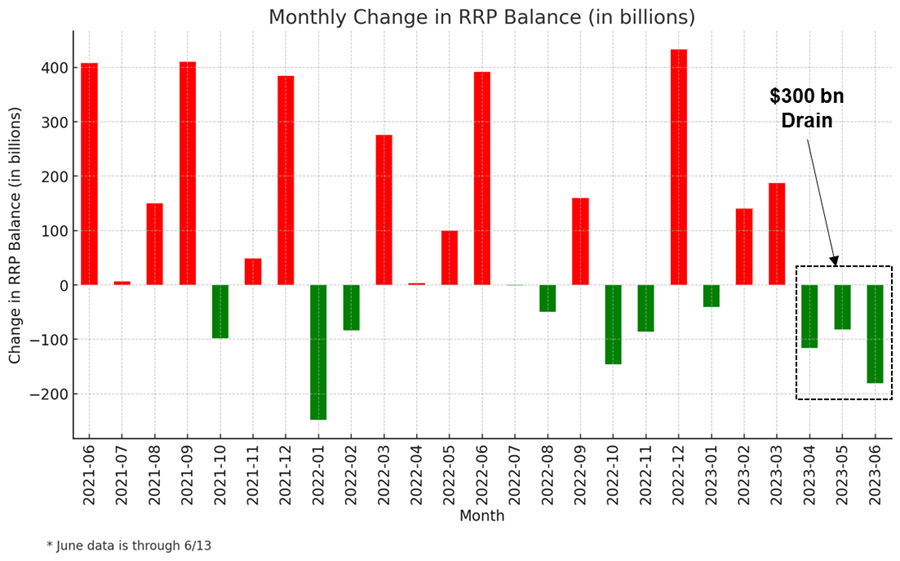

Below we see that the RRP has been drained of $300 billion since the start of April. We will be interested to see if this trend persists through the end of the month, as the RRP balance is known to increase at the end of each quarter as funds deleverage around quarter-end reporting dates.

Core Strategy

Despite the challenging price action and an apparent decoupling from equities, bitcoin’s correlations with gold, the dollar, and global liquidity remain intact. We think most of the damage is done and believe it is right to stay mostly allocated to majors with small allocations to alts as call options on regulatory victories. We see a near-term decline in the dollar and concurrent monetary easing from global central banks to serve as macro tailwinds for BTC and ETH. As we approach bitcoin’s 200-day moving average, we may look to put more capital to work.

Tickers in this Report: BTC 5.92% , RPL, SOL, ETH 10.21% , XRP