Buying Fear (Core Strategy Rebalance)

Key Takeaways

- This SEC’s lawsuits against crypto firms were anticipated, with Coinbase having received a Wells Notice months prior. If Congress doesn't create crypto market oversight legislation soon, we should expect these lawsuits to provide much-needed regulatory clarity.

- The SEC's asset listings as securities seem arbitrary, with notable omissions like XRP and ETH, potentially indicating the SEC's strategic considerations and views on decentralization.

- While not foolproof, prices often reach a bottom (long-term or tactical) when they fail to react to negative news, a phenomenon known as "bottoming on bad news." This week, we have witnessed the growing momentum of the SEC crackdown, yet crypto prices are shrugging these developments off.

- Our short-term outlook on market liquidity impacts from the TGA rebuild is incrementally less bearish than a month ago. If short-term rates remain competitive with SOFR (Secured Overnight Financing Rate), bill issuance should have a minimal effect on liquidity. Moreover, a pause from the Federal Reserve might stimulate a capital shift from money market funds into riskier assets.

- As humans, we have a natural tendency to recognize patterns, which explains why adjusting allocations based on reliable seasonal trends is understandable. However, it's worth noting that the historical performance of BTC during the months of June and July has been surprisingly impressive, contrary to popular belief.

- Core Strategy – Since our last rebalance, the Core Strategy outperformed BTC by a small margin. ETH and RPL were winners, while MATIC weighed down performance. Changes to the strategy include reducing exposure to SOL and MATIC due to legal concerns, decreasing stablecoin allocation, increasing BTC allocation, maintaining ETH weighting, and keeping RPL allocation unchanged based on ongoing growth and regulatory developments.

SEC Empties the Chamber

It’s only Wednesday, but the SEC has pulled out the big guns. Conveniently following the release of a rather comprehensive crypto oversight bill by the House Financial Services Committee on Friday, the SEC dropped their mightiest hammer to date on the crypto industry.

On Monday, the SEC took legal action against Binance, accusing the exchange of offering unregistered securities to the public. The SEC’s lawsuit alleged that Binance had failed to register as a clearing agency, broker, and securities exchange. Additionally, there were accusations concerning the commingling of user funds and the implementation of inadequate financial controls at the exchange (If we had to guess, there will likely be follow-up on this from the DOJ). The SEC further claimed that several tokens, SOL, ADA, MATIC, COTI, ALGO, FIL, ATOM, SAND, AXS, and MANA, should be classified as securities.

Continuing their aggressive actions, on Tuesday, the SEC unleashed its authority on Coinbase with similar allegations. However, it is worth noting that, unlike the Binance case, there were no accusations regarding poor controls (a huge difference). Nevertheless, in line with the Binance lawsuit, the SEC identified SOL, ADA, MATIC, FIL, SAND, AXS, CHZ, FLOW, ICP, NEAR, VGX, DASH, and NEXO as tokens classified as securities.

Some Quick Thoughts on This Week’s Regulatory Actions

- Not a Surprise – To reiterate, for those just joining the fold, these SEC lawsuits were not a surprise. They were well-telegraphed. In fact, Coinbase was rather transparent about the fact that they had received a Wells Notice several months ago.

- Not Legislation – It’s important to note that the SEC can only file a lawsuit; it does not possess the authority to make legal determinations. If both companies opt not to settle outside of court (as they have indicated), it is likely that a protracted legal battle will ensue, potentially taking years to conclude. In the meantime, operations are expected to continue as usual while the matter remains unresolved.

- Road to Clarity – If Congress fails to enact legislation pertaining to oversight of the crypto markets before these lawsuits are resolved, these cases will ultimately bring much-needed clarity to the space. Although Coinbase may experience some difficulties, and the court rulings may not entirely align in their favor, the regulations governing this emerging asset class will be more clearly defined (For instance, how does one treat a gas transaction as a securities transaction?).

- Important Omissions – Notably, the SEC’s selection of assets listed as securities appears somewhat arbitrary. However, it is worth highlighting the omission of XRP, whose issuing company is currently embroiled in legal battles with the SEC, as well as ETH, the largest PoS asset and the second-largest overall cryptoasset. This may imply a couple of things: (1) The SEC may have avoided including XRP to prevent potential complications in their concurrent case against Ripple, and (2) they may consider ETH decentralized enough to classify it as a commodity (a viewpoint we share).

Market Bottoms on Bad News

Initial Reaction = Turmoil

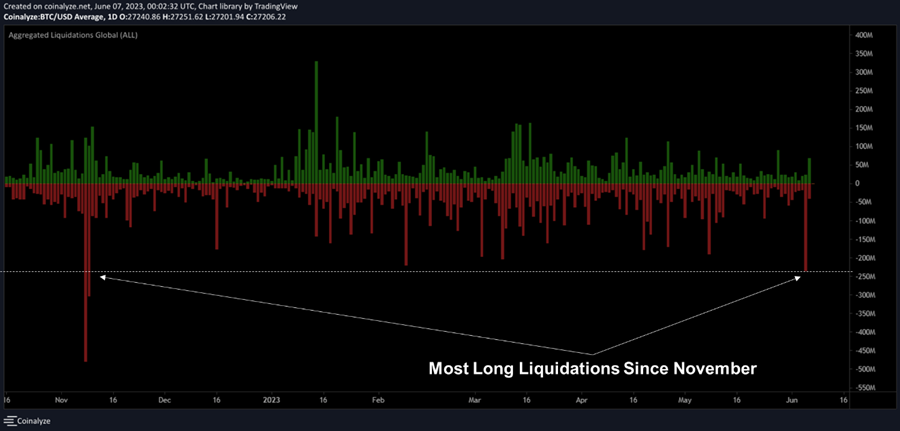

While this event has been well-telegraphed and widely anticipated for some time, the markets were initially taken aback by the developments. The market experienced a significant decline on Monday, directly attributed to the initial Binance lawsuit. The chart below illustrates the sharp and aggressive nature of Monday’s move, with the highest volume of futures and perps liquidations recorded since November.

Tuesday = Markets Shrugged

However, when the Coinbase lawsuit was announced, it became apparent that there was a shortage of sellers in the market. This lack of downward momentum resulted in some short covering, followed by strong price action that persisted until the end of the day.

As a result, the losses incurred on Monday were completely offset, effectively reversing the negative impact of the previous day’s trading session. After the dust cleared, despite the regulatory actions initiated by the SEC, the overall prices of cryptoassets remained relatively stable compared to their levels from a week earlier.

Bottom line as it relates to this week’s price action: While not foolproof, prices often reach a bottom (long-term or tactical) when they fail to react to negative news, a phenomenon known as “bottoming on bad news.” This week, we have witnessed the growing momentum of the SEC crackdown, yet crypto prices appear to be shrugging these developments off.

(Partially) Bullish Update on the TGA Rebuild

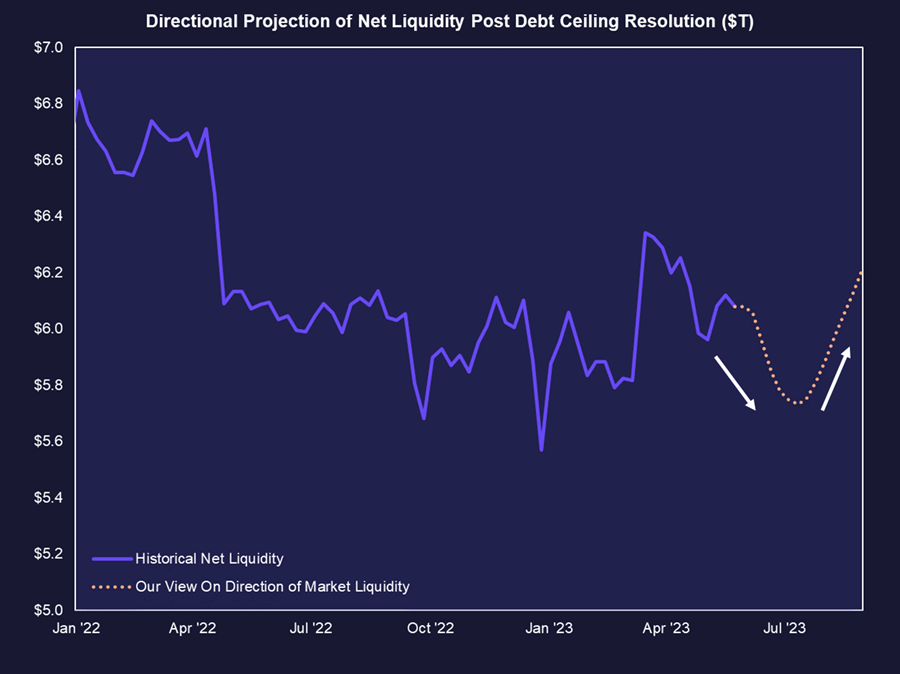

We took some chips off the table a little over a month ago in anticipation of potential headwinds from the impending debt ceiling agreement and the consequential headwinds it could pose to market liquidity and risk assets.

As we discussed last week, we now find a compelling case for a more optimistic outlook regarding the Treasury General Account (TGA) rebuild. This is primarily due to two factors: (1) the expected pause by the Federal Reserve next week and (2) the attractiveness of short-term rates compared to the overnight rate offered in the Reverse Repurchase Agreement (RRP) and the willingness of MMFs to be the marginal buyer of new bills.

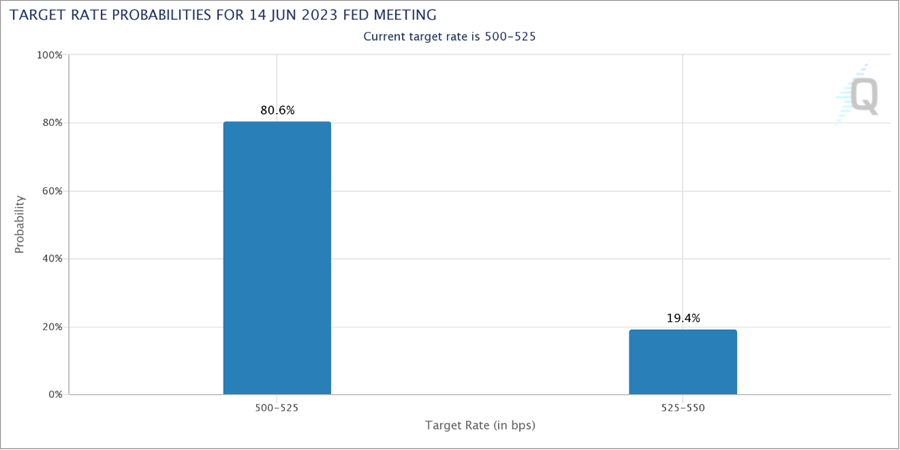

Regarding the Fed pause, barring an unforeseen, astronomically hot CPI print next week, the FOMC meeting is likely to result in holding the Fed Funds target rate constant. This is good news for liquidity-sensitive assets and should entice some of the capital currently tied up in MMFs (capital on the sidelines) to get involved in the market.

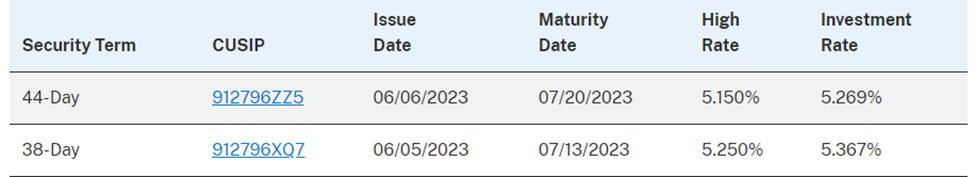

At the same time, we have seen some initial signs of how the new bill issuances from the Treasury will be funded. We have seen the first of the Treasury’s bill auctions post-debt ceiling agreement. Yesterday, it sold 44-day bills at 5.15%, 10 bps above the overnight rate.

Below is the illustration we provided a few weeks ago that spoke to our view on how the Treasury securities would be funded (bank reserves = lower liquidity, MMF withdrawing from the RRP = liquidity neutral).

We expected an initial hike in market rates before the RRP started to drain, but preliminary indications point toward demand from MMFs to harvest even a small spread above the overnight rate.

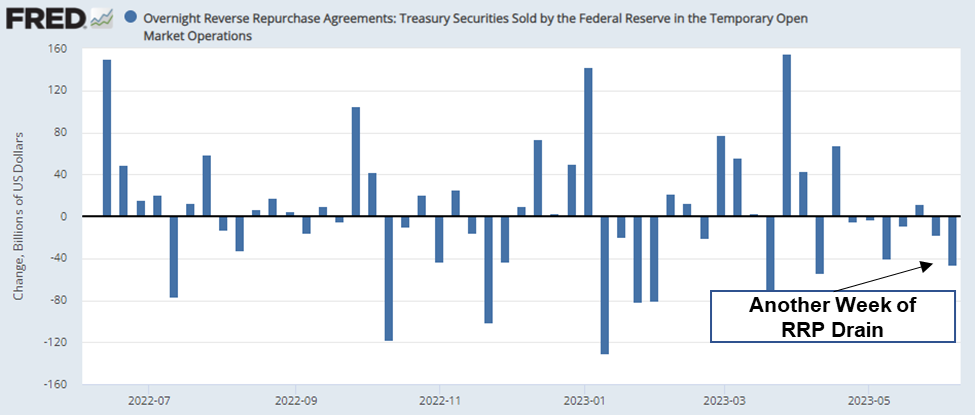

As we see below, we witnessed another week of a decreasing RRP, likely due to MMFs moving their holdings from the RRP to purchase these treasuries and funding the Treasury’s bank account.

Thus, based on the limited market activity observed thus far, as long as short-term market rates continue to remain competitive with the Secured Overnight Financing Rate (SOFR), the issuance of Treasury bills should have minimal adverse effects on market liquidity.

Bottom Line on our updated outlook on market liquidity: Our short-term outlook on market liquidity impacts from the TGA rebuild is less bearish. If short-term rates remain competitive with the Secured Overnight Financing Rate, Treasury bill issuance should have a less negative effect on liquidity. Moreover, a pause from the Federal Reserve might stimulate a capital shift from money market funds into riskier assets.

Does the Market Actually Sell in May and Go Away?

Another factor to consider, which may not be explicitly stated but often influences bearish sentiments, is the concept of seasonality. You might be familiar with the saying, “sell in May and go away.” This carries some extra weight when considering the strong start we’ve had this year. There’s a common belief that crypto tends to underperform during the summer. But rest assured, that’s a bit of a misconception.

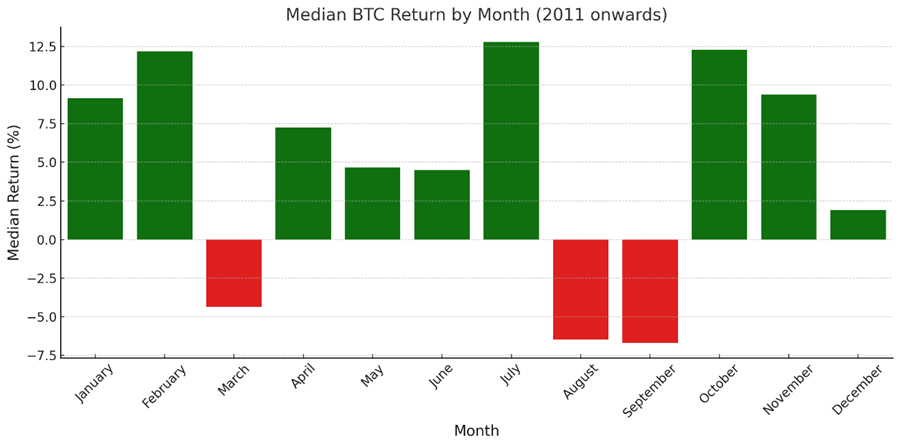

If we look at the median returns since 2011, it’s clear that the worst-performing months have been March, August, and September by a wide margin. However, the other months have actually shown positive median returns.

So, when it comes to the summer, it’s a bit of a mixed bag. June and July tend to perform well, while the other half of the summer doesn’t fare as favorably.

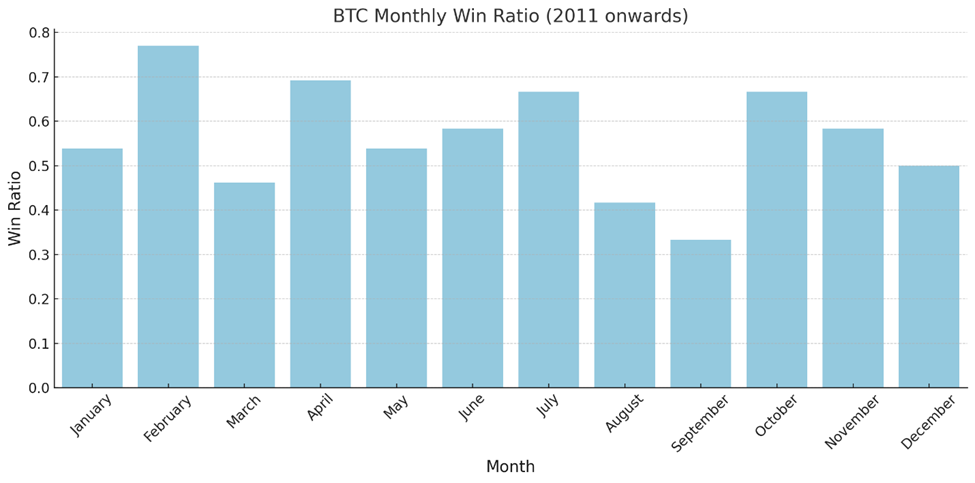

Furthermore, Bitcoin’s win ratios for June and July are impressive, with July ranking among the top three. Historically, holding BTC throughout the first half of summer has proven to be a profitable trade.

Bottom line as it pertains to seasonality-driven bears: As humans, we have a natural tendency to recognize patterns, which explains why adjusting allocations based on reliable seasonal trends is understandable. However, it’s worth noting that the historical performance of BTC during the months of June and July has been surprisingly impressive, contrary to popular belief.

Core Strategy (Rebalance)

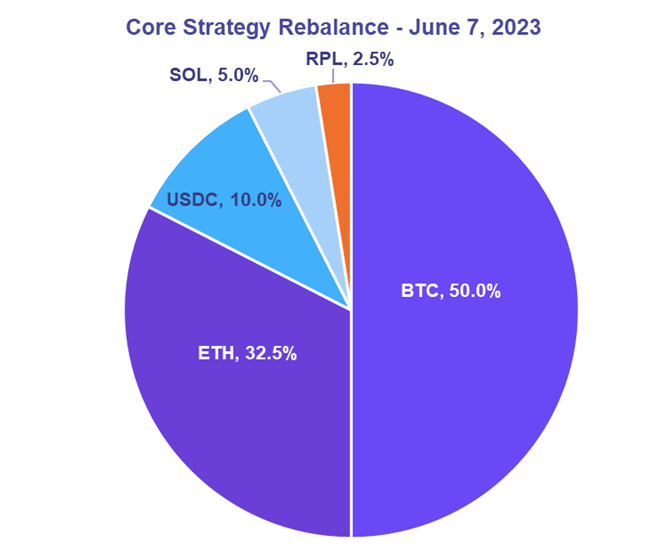

Since our last rebalance, the Core Strategy has slightly edged out BTC. The winners were ETH and RPL, while MATIC weighed on performance. As of today, there are a few changes to our Core Strategy:

- As you might have noticed, a couple of the names included in our current allocation were mentioned in the pair of lawsuits: SOL and MATIC. For that reason, although we still see value in both projects, largely based on the developer and user communities growing around both networks, we are reducing our exposure to them, removing MATIC altogether. SOL, we believe, has greater potential as an asset, and therefore we are making the qualitative decision to keep it in the Core Strategy.

- We have made a tactical decision to decrease our allocation to stablecoins, as we see this as an advantageous time to add risk (in the right place) to the strategy while maintaining some cash sidelined in the event of short-term volatility.

- We are increasing our allocation to BTC and maintaining our weight on ETH as the flight to quality continues for the foreseeable future.

- Regarding RPL, we have maintained our current weighting. This decision is based on the continued growth observed in minipools within the ecosystem. Additionally, the recent regulatory actions targeting centralized staking further emphasize the importance of liquid staking going forward.

Tickers in this report: BTC ETH MATIC SOL 1.07% RPL ADA COTI MANA SAND AXS 0.83% ALGO FIL CHZ FLOW -0.59% ICP NEAR 0.14% VGX DASH -17.58% NEXO