No Man’s Land

Key Takeaways

- Implied volatilities for BTC and ETH have decreased due to low demand for speculation and hedging, primarily influenced by the market's "wait-and-see" approach regarding the uncertain outcomes of the ongoing U.S. debt ceiling standoff. Investors participating in the options market may consider capitalizing on historically cheap volatility in anticipation of potential price swings following a resolution of the debt ceiling issue.

- Last week, we indicated that the decline in crypto prices signaled a temporary peak in liquidity conditions. The breakdown in correlations between BTC, gold, and equities highlighted BTC's sensitivity to liquidity changes. As expected, BTC/Gold correlations are now strengthening, with gold following BTC's lead.

- Solana's organic user growth, with a rising number of active wallets, is a positive development for the network. Although economic activity and fees haven't seen a proportional surge, the adoption of non-financial utility applications demonstrates the broader value users find in the network. This organic expansion, combined with the potential for more application adoption, positions Solana well for future capital inflows.

- Trade Idea: The upcoming Litecoin (LTC) halving event in August presents a potential opportunity for returns based on historical buying trends leading up to the event. However, investors should exercise caution and consider de-risking ahead of the actual event due to the observed "sell the news" pattern. It is worth noting that Mark Newton has highlighted LTC's significant technical progress.

- Core Strategy: Despite our recommendation in late April to raise cash in anticipation of a near-term resolution to the debt ceiling (TGA refill = lower market liquidity) and recent negative price movements, our overall outlook for the year remains positive. If the Federal Reserve follows through with a pause, it would be a positive development for assets sensitive to liquidity conditions.

A Nosedive in Volatility

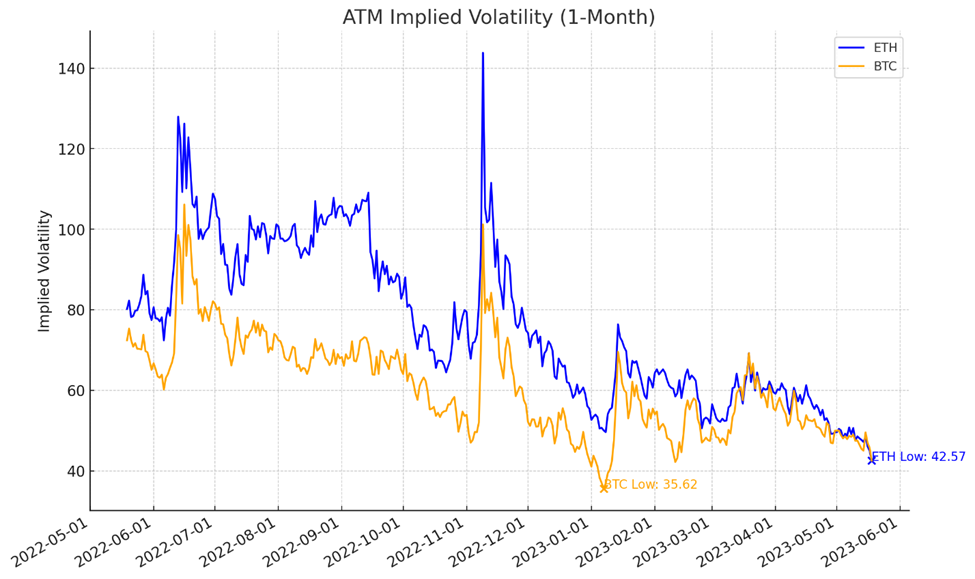

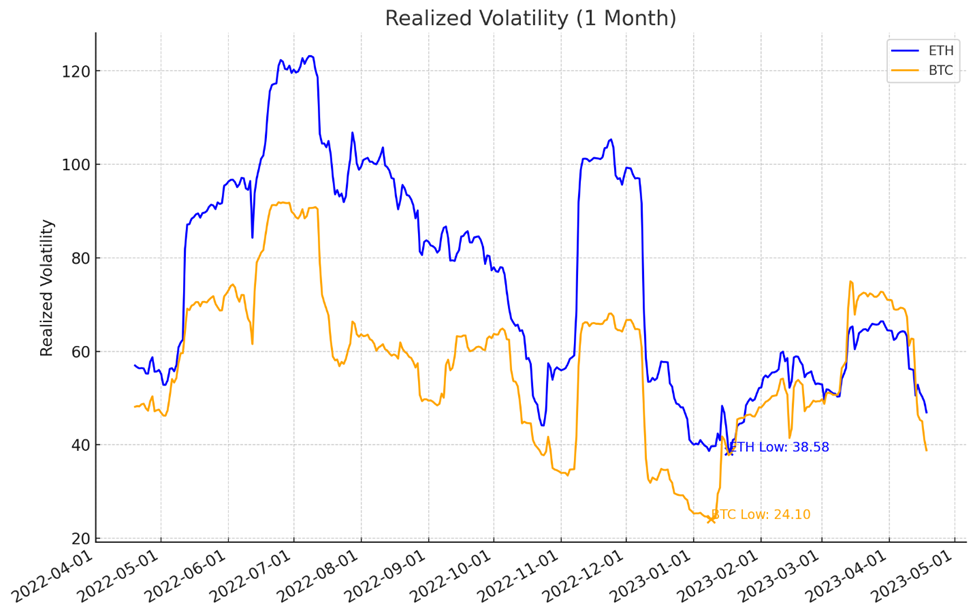

Equities are not the only asset class undergoing a noticeable decline in volatility. Both Bitcoin and Ethereum are following a similar path. Over the past two months, there has been a significant decrease in the implied volatilities of these blue chip cryptoassets, especially following the fallout from the Silicon Valley Bank (SVB) crisis and the subsequent rally in prices following the Federal Reserve’s intervention.

The sense of stagnation in Ether, with its price hovering around $1,800 for several months, is reflected in its volatility pricing. Currently, Ethereum’s one-month implied volatility is at its lowest point in the past year. While Bitcoin’s implied volatility hasn’t quite reached its one-year low, it is clearly moving in that direction. This has left much of the market feeling like it is stuck in no man’s land.

From a historical standpoint, the realized volatilities of both BTC and ETH are also on a downward trajectory. Although neither metric is currently at an all-time low, the current trend suggests that they may reach that point soon.

This move towards lower volatility in these major assets signals a broader shift in market dynamics.

Why are markets so quiet?

In short, markets are quiet due to the low demand for speculation and hedging. Several factors contribute to this, including the seasonal pattern often referred to as ‘sell in May and go away.’ Additionally, there may have been some marginal turnover among market participants in the US following continuous aggressive commentary against cryptocurrencies from US banking regulators.

However, we believe the main reason for the current sluggish markets is the ongoing standoff over the debt ceiling. The market is in a ‘wait-and-see mode,’ observing the potential outcomes of the debt ceiling impasse.

The possibilities range from a technical default by the US, which could spur a short-lived narrative trade resulting in a Bitcoin price spike, to a resolution of the debt ceiling issue leading to a massive treasury issuance. We think the latter could pull liquidity out of the private market and generally be detrimental for risk assets.

The uncertainty of the outcome is likely deterring many from taking a firm stance in either direction. The standstill in the market reflects this apprehension, demonstrating the far-reaching implications of the debt ceiling standoff on asset volatility.

Bottom Line as it pertains to volatility: Bitcoin and Ether’s volatility is decreasing significantly due to low demand for speculation and hedging, largely influenced by the market’s “wait-and-see” approach towards the uncertain outcomes of the ongoing U.S. debt ceiling standoff. Investors who participate in options market might want to take advantage of historically cheap volatility to hedge their portfolios or go long volatility ahead of a debt ceiling decision.

Update on Macro Correlations

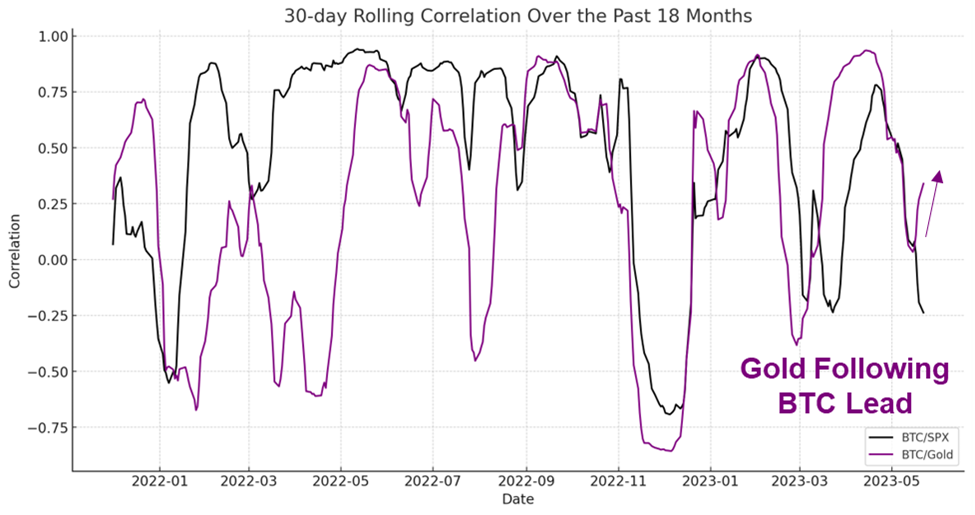

Last week, we analyzed the deteriorating relationship between BTC, gold, and equities. Our analysis suggested that the declining prices in the crypto market were indicative of a temporary peak in global market liquidity.

We also posited that other assets sensitive to liquidity conditions could experience a similar trend. Generally, when there are no unique or idiosyncratic factors at play, crypto, being the asset class, most influenced by liquidity conditions, tends to lead equities and gold in both upward and downward price trends.

Notably, we have observed the correlation between gold and BTC strengthening as gold prices gradually declined over the past week.

Once the debt ceiling fiasco is resolved, it will be important to consider the lead/lag relationship that we believe exists among BTC, gold, and equities. If a debt ceiling resolution occurs and subsequently leads to a decrease in private market liquidity, it is likely that BTC will reach its local bottom before gold and equities.

Bottom Line as it pertains to macro correlations: Last week, we indicated that the decline in crypto prices signaled a temporary peak in liquidity conditions. The breakdown in correlations between BTC, gold, and equities highlighted BTC’s sensitivity to liquidity changes. As expected, BTC/Gold correlations are now strengthening, with gold following BTC’s lead.

Solana Users Go Parabolic

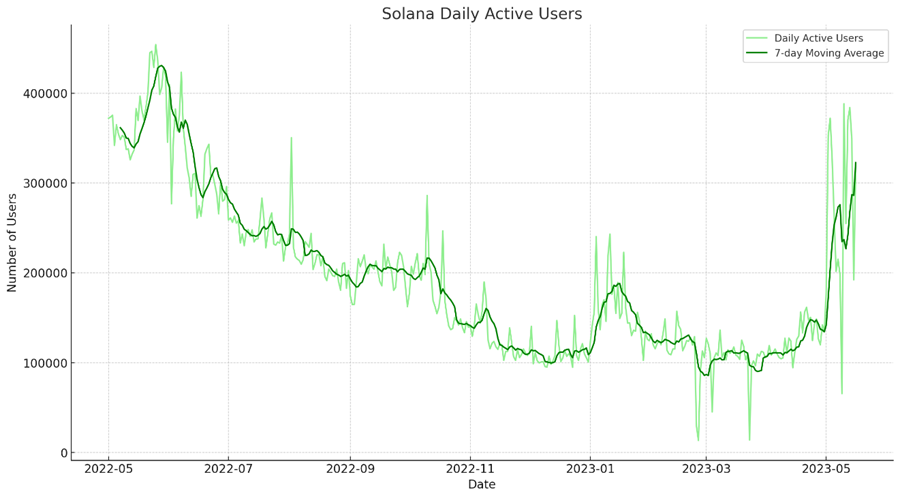

Recently, we have discussed some potentially positive developments related to Solana, the demise of which was greatly exaggerated. In recent weeks, we have finally started to see users returning to the ecosystem, as indicated by the number of daily active users, represented by unique wallets initiating a transaction.

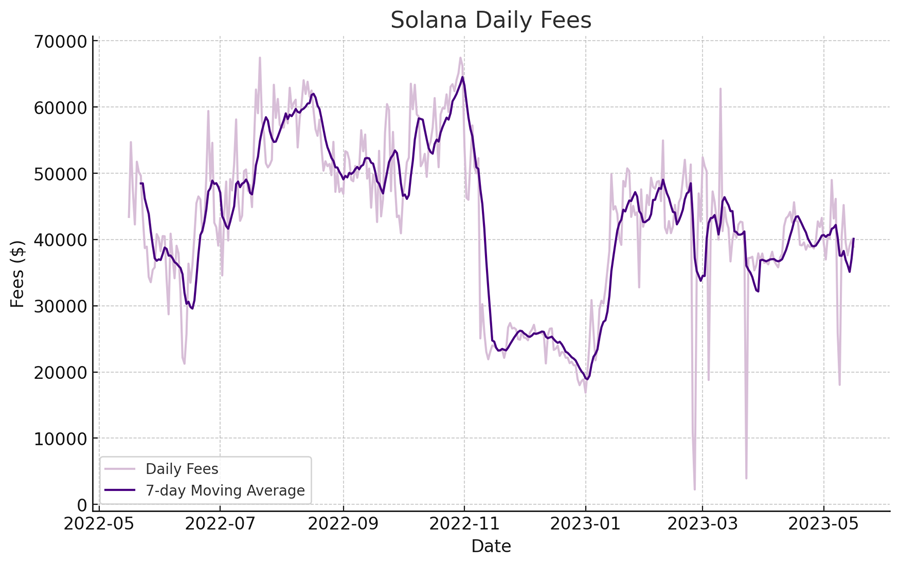

However, we must acknowledge that the increase in network usership has not necessarily been accompanied by a significant uptick in economic activity. As observed, fees have generally remained flat over the same time period as the spike in users.

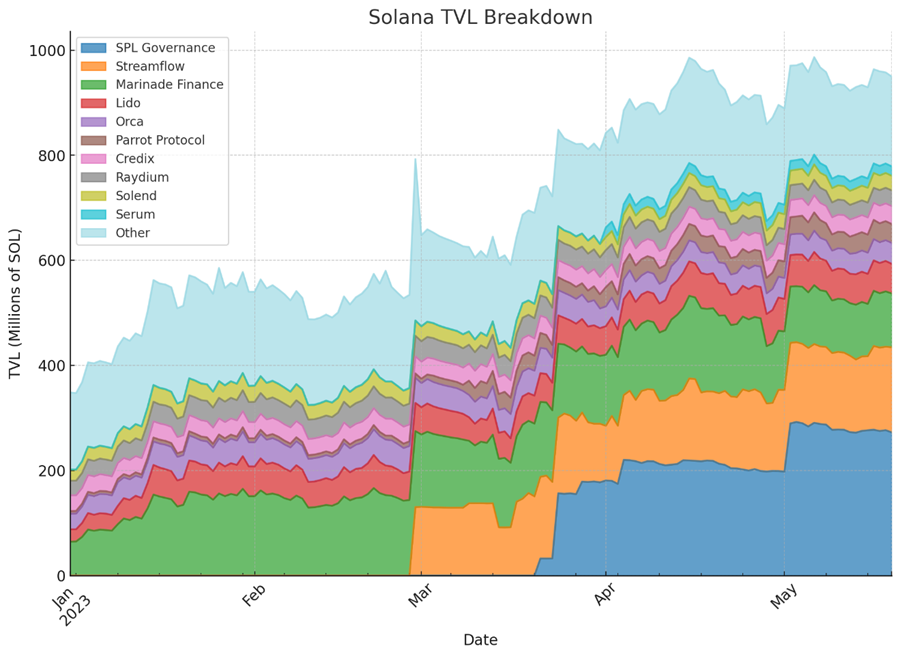

Total Value Locked (TVL) data aligns with this observation. While there has been a clear and sizable increase in TVL since the start of this year, the majority of the TVL growth can be attributed to SOL governance tokens and Streamflow. These appear to have grown largely due to their recent inclusion in TVL metrics found on DefiLlama, the default data source for TVL. Furthermore, the Streamflow TVL includes a number of projects that have a significant number of unvested tokens, which skews the TVL data to the upside.

To us, the key takeaway here is that, despite the increase in usership, Solana has not seen the capital influx that typically coincides with such a trend. This naturally raises curiosity about what is driving the increase in wallet activity on the Solana network.

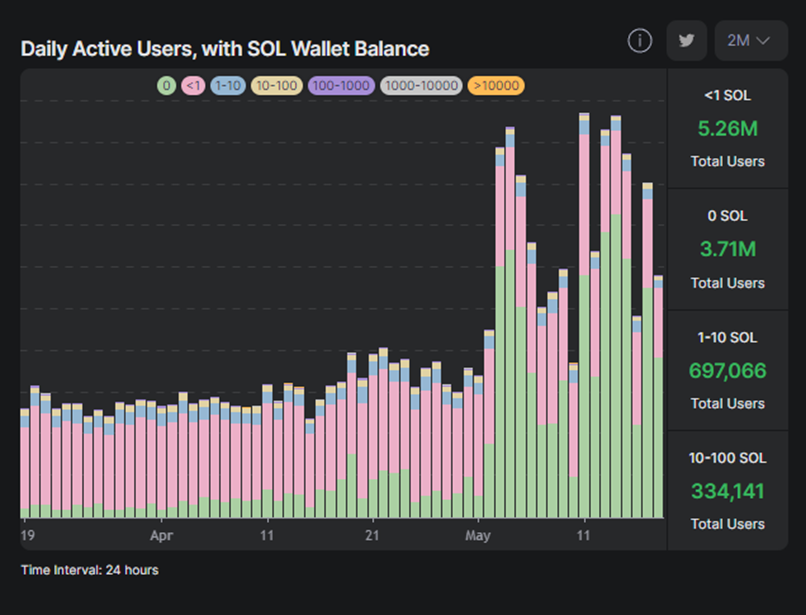

Below, we can observe that the majority of wallets driving the recent surge in activity hold relatively small amounts of SOL. This suggests that these users are utilizing the network without speculating on the underlying token that powers it.

A constructive interpretation of this data is that it indicates the presence of applications on Solana that offer non-speculative use-cases. Users are likely turning to these applications for their utility rather than solely engaging in trading, borrowing, or lending activities.

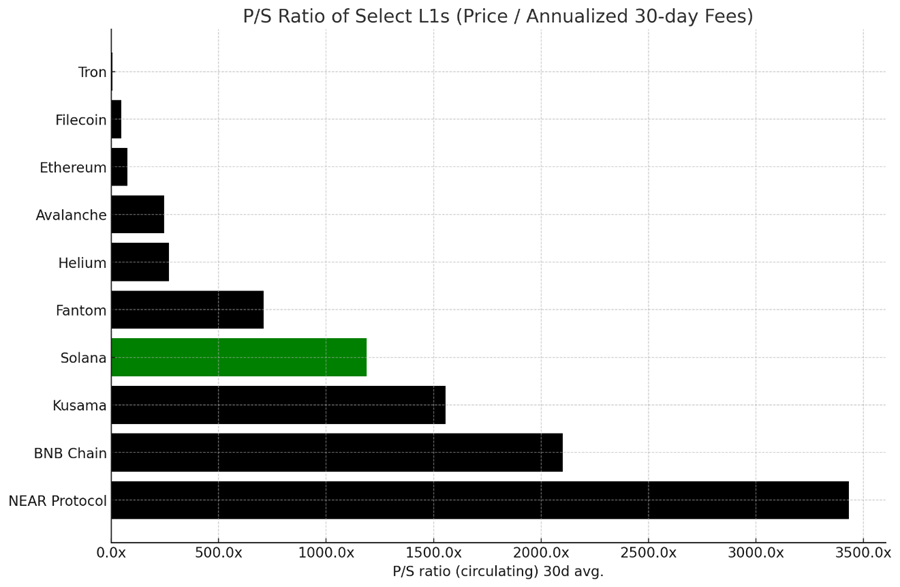

Solana is still relatively overvalued compared to the economic spend generated by users on the network. Native tokens of other networks are trading at much lower multiples of fees paid to validators. However, the higher the organic user growth, the higher the multiple one should consider when valuing a network based on fees.

If our assumption is correct that organic application adoption is happening at a faster rate than current economic activity indicates, once capital enters the network on a larger scale, it should lead to more sustainable capital and a rapid catch-up in fees compared to peer networks.

Bottom Line on Recent On-Chain Activity on Solana: Solana’s organic user growth, with a rising number of active wallets, is a positive development for the network. Although economic activity and fees haven’t seen a proportional surge, the adoption of non-financial applications demonstrates the broader value users find in the network. This organic expansion, combined with the potential for more application adoption, positions Solana well for future capital inflows.

Trade Idea: Litecoin Halving Revisited

On March 3rd, we presented a trade idea regarding Litecoin’s upcoming halving event, which occurs approximately every four years. The previous halvings led to significant price appreciation prior to the event. It was suggested at that time that it might have been a good opportunity to take advantage of this potential catalyst. De-risking around mid-June was also advised, considering the historical “sell the news” dynamic that typically occurs one to two months before the halving.

As of now, LTC has yet to experience substantial gains leading up to the anticipated halving, which is about 80 days away. The recent SVB calamity caused a sharp drawdown in LTC, but it has since fully recovered. We believe that over the next few weeks, this trade idea may gain momentum.

Our head of Technical Strategy Mark Newton noted the technical setup looks rather constructive. From his daily note last week:

“Litecoin’s 5%+ gains are serving to break out above the ongoing short-term downtrend from last month that likely jumpstarts the rally back to test April highs. As daily LTC 1.70% chart shows, while trends have been negative since mid-April, this remains in a larger uptrend from late last year. Following the initial drawdown into an area of strong support near the 61.8% Fibonacci retracement of its high to low range, LTC 1.70% made higher lows into early May which directly coincided with an area of intermediate-term trendline support. Initial resistance lies near $103.35 which lines up with April highs, and above that level would represent a breakout of the three-month triangle pattern since February. Overall, gains look likely in the weeks ahead, and only a violation of $75 would serve to postpone this rally.“

Despite the delay in materialization, given the volatility in the majors and a lack of trading opportunities in the market, it is believed that the LTC halving trade should garner momentum in the coming weeks.

Note: Some reading this will wonder why LTC wouldn’t be included in our Core Strategy. In short, there are trades, and there are allocation strategies. The former is more ephemeral and requires more precision around entry and exit points. Further, as is the case with Litecoin, the names we include in our Core Strategy will usually have a long-term investment thesis that we think is worth paying attention to. It is our opinion that Litecoin will certainly stick around but is by no means destined to be the future of money or payments. After all, it wasn’t too long ago that the founder of Litecoin sold his bag on his acolytes at the top of a roaring bull market.

Bottom Line as it relates to LTC halving trade: The upcoming Litecoin (LTC) halving event in August presents a potential opportunity for returns based on historical buying trends leading up to the event, but investors should be cautious and consider de-risking around mid-June due to the historical “sell the news” pattern. As noted by Mark Newton, LTC has made significant technical progress.

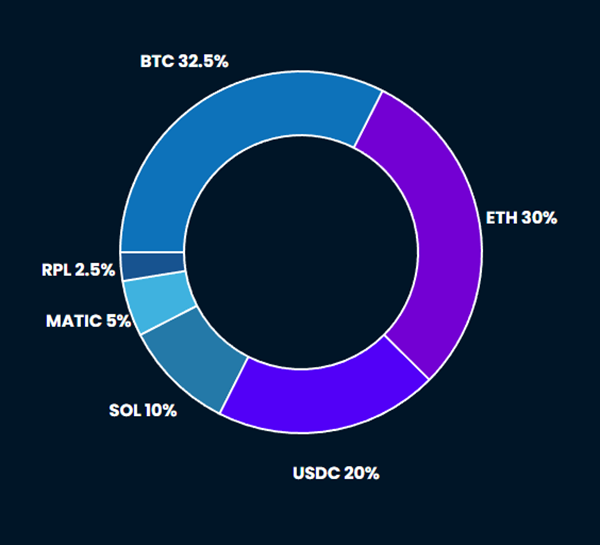

Core Strategy

Despite our recommendation in late April to raise cash in anticipation of a near-term resolution to the debt ceiling (TGA refill = lower market liquidity) and recent negative price movements, our overall outlook for the year remains positive. If the Federal Reserve follows through with a pause, it would be a positive development for assets sensitive to liquidity conditions.

Tickers in this report: BTC, RPL, MATIC, SOL -9.26% , ETH, LTC 1.70%

Articles Read 1/2

Enjoyed the read? Subscribe now for unlimited access!

Get invaluable analysis of the market and stocks. Cancel at any time.

Already have an account? Sign In dd0140-635e94-3b45b3-3879da-8b5d5d

Already have an account? Sign In dd0140-635e94-3b45b3-3879da-8b5d5d