Buying the News

Key Takeaways

- The market's pessimism regarding Ethereum staking withdrawals proved excessive as various factors mitigated supply overhang concerns, resulting in an expected ETHBTC rally. We think this reversal could be constructive for altcoins in the near-term. Following the Shapella upgrade, most stakers only withdrew earned rewards. Ethereum now focuses on enhancing scalability, with the next hard fork including EIP-4844 to improve Layer 2 rollups.

- Recent data shows improved price action outside US market hours, hinting at increased retail investor involvement. This shift could be attributed to crypto's resilience during the March banking crisis. Additionally, Hong Kong's renewed ambition to become a crypto hub, as stated by its financial secretary, may also play a role in this change.

- March's lower-than-expected CPI and PPI figures indicate a continued disinflationary trend, suggesting the Fed's rate hikes are taking effect. Shelter costs showed relief, and the dollar declined due to soft inflation data and European tightening. This disinflationary environment and a weakening dollar could positively impact the near-term outlook for crypto.

- In recent months, Solana users have trended lower, potentially leading to underperformance relative to other high throughput networks. However, upcoming migrations to Solana, including Helium Network and Render Network, along with the launch of the Solana Saga smartphone, may renew interest and spark usage in the Solana network, creating a tailwind for the token price.

- Core Strategy – Although we are approaching our price target ranges for both BTC and ETH, we remain constructive on cryptoassets due to favorable global liquidity conditions and narrative-based tailwinds. Our Core Strategy remains unchanged this week, but we may reevaluate in the upcoming weeks, considering potential near-term pullbacks from sustained RRP utilization, debt ceiling resolution, and seasonality.

ETH Moving Shanghigher

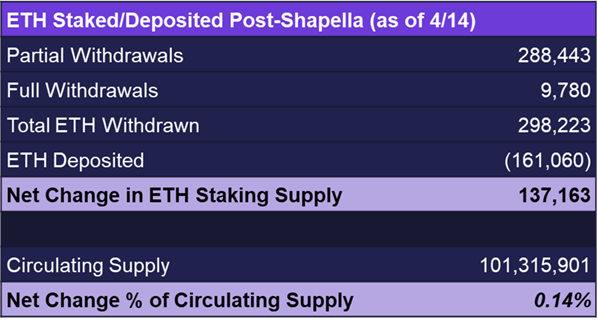

As we mentioned last week, the market was overly pessimistic regarding the supply-side effects of the upcoming Ethereum staking withdrawals. Factors such as existing liquidity for most stakers, withdrawal queue limitations, and a market that de-risked in anticipation of the Shapella upgrade all helped to reduce the likelihood of a sudden supply overhang. With this in mind, it seemed reasonable to expect an ETHBTC rally in the weeks following the successful completion of the event. While a “sell the news” event for LSD governance tokens was possible, we thought it more likely that these tokens would align with ETH’s trajectory. Based on these views, we maintained a positive stance on both ETH and LSD governance tokens. We are only a couple of days removed from the hard fork, but price action thus far seems to be aligned with this view.

Following the Shapella upgrade most market activity did not even result from validators fully exiting the Beacon Chain. Instead, the lion’s share came from stakers withdrawing and potentially liquidating only their earned rewards for securing the network over the past couple of years. By skimming their rewards rather than completely exiting their staking positions, these stakers continued to participate in network security while benefiting from accumulated staking rewards.

After successfully implementing the Shapella upgrade Ethereum developers are now focusing on significantly improving the network’s scalability. Ethereum creator Vitalik Buterin announced this priority in a livestream before the Shapella upgrade. The next hard fork, expected to occur towards the end of this year or early next year, will include EIP-4844 (proto-danksharding), which aims to dramatically enhance the scalability of Layer 2 rollups. This theme may be worth targeting for exposure in our Core Strategy down the road.

Time for Alt Season?

Bitcoin’s combination of institutional favorability, unsurpassed level of censorship resistance, and its role as a safe haven in uncertain times have contributed to its leading position in the crypto market YTD. One could also argue that removing mercenary speculators and bad actors from the market allowed the best assets to soar unencumbered by pervasive fraud and unhealthy leverage. However, now that we have experienced a prolonged surge in Bitcoin dominance and are starting to see ETHBTC roll over at this resistance level, we think it is reasonable to expect a bit of an alt season in the next couple of weeks.

Disinflation Continues & Dollar Moves Lower

In addition to Shapella, markets had a slew of data hit the tape this week. The most material data points were CPI and PPI – both surprising to the downside.

March’s CPI rose by 0.1% MoM, less than the expected 0.2%, and 5.0% YoY, slightly below the 5.1% estimate. Core CPI matched expectations at 0.4% MoM and 5.6% YoY. The moderate inflation suggests the Fed’s rate hikes are taking effect, prompting favorable market reactions. The most material component of this figure was the apparent relief in shelter costs relative to expectations as this is an element of the economy that many had expected to remain stubborn.

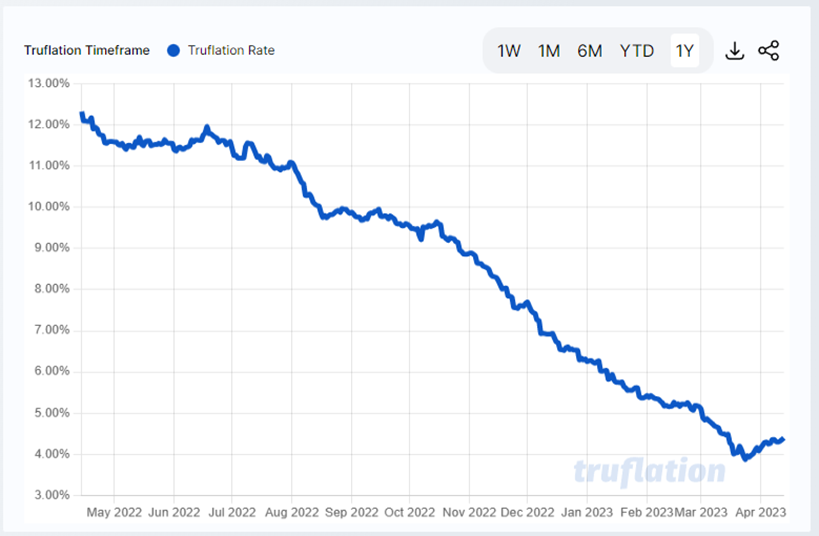

Following in CPI’s footsteps, the March 2023 PPI recorded -0.5% MoM, below expectations and February’s revised 0.0%. Core PPI reached -0.1%, dropping from +0.3% consensus. Excluding food, energy, trade, PPI was +0.1%. YoY PPI declined to +2.7%, down 220bps from February’s +4.9%. To us, this is further evidence that we are currently in a rapid disinflationary regime and the government’s data is finally starting to catch up to real time prices, as reflected in data sources such as truflation.

Of note, the cost of utilities due to rising energy prices led to a brief uptick in inflation in late March. This is something we will want to remember heading into the April CPI and PPI figures.

The dollar resumed its decline, thanks to both the soft inflation figures as well as continued tightening of the belt in Europe. Certainly, a declining dollar does not hurt the near-term outlook for bitcoin nor crypto.

Is Retail Back? Is Hong Kong?

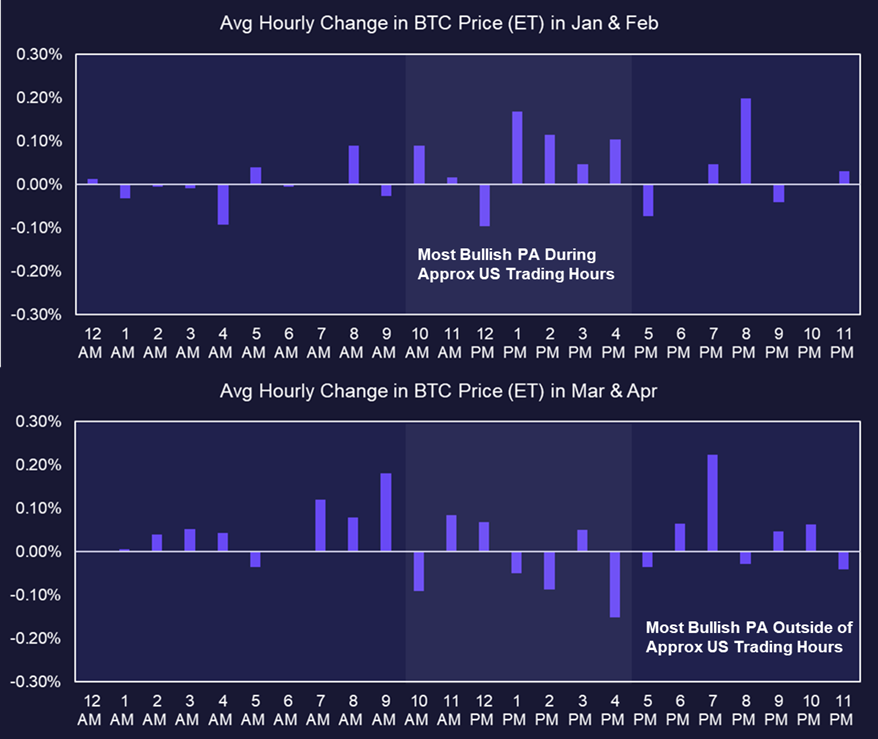

Several weeks ago, prompted by the change in global liquidity and the tailwind that it presented cryptoassets, we examined the hourly performance of BTC and determined that most of the activity and outperformance occurred during standard equity market hours in the US. While interesting, we concluded that this was likely due to the makeup of investors being mostly whales and institutions who prefer to trade during the most liquid hours (usually US market hours) regardless of their location. We noted that regional trading differences are often more reflective of small retail trader participation, who are less immediately responsive to changes in central banking policies.

Having anecdotally noted a change in market behavior, we revisited this exercise this week and found that the data did correspond with our intuition that we have been witnessing more constructive price action outside of US market hours.

Note that each label below represents the end of each period. For example, 4pm represents the time from 3pm-4pm. Data is through April 12th.

Clearly, there is a stark difference between each period. As noted above, bullish price action in January and February was clearly concentrated in US market hours while the period from March 1st onward has clearly witnessed the strongest price action in US and Asian pre-market hours. In short, we think this signifies increased participation from retail investors. The people who place trades before and after their day jobs are the ones who are less likely to be active during the US trading session.

It is entirely possible that this was catalyzed by the events in the banking system that transpired in early March. While the strongest catalyst remains increasing global liquidity conditions, it is likely that many saw the price action in January and February as a signal that the crypto was not dead, and its resilience in the face of the banking crisis offered an opportunity to buy the dip. Of course, the rationale is mostly speculation and the change in market dynamic is tough to exactly diagnose. At the very least, this is a change that is worth being cognizant of for those trading and looking for the best entry/exit opportunities throughout the day.

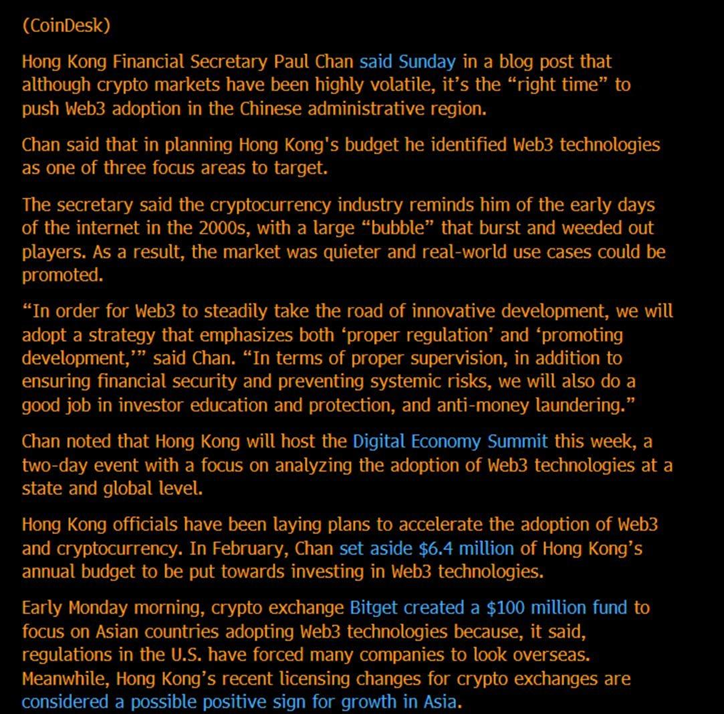

One other possibility that would be extremely constructive for the entire industry is the return of retail investors out of Hong Kong. As noted above, some of the more bullish price action has transpired during Asian premarket and market hours. This corresponds with an apparently legitimate resurgent appetite from Hong Kong to become a crypto hub.

This week, the financial secretary of Hong Kong adamantly declared a desire to invest in and support the emerging industry. There is certainly the possibility of this promise not having any real meat on its bones, especially given Mainland China’s influence over HK and their outwardly hostile stance toward the industry. However, if the change in market dynamics is a product of HK retail getting back into the mix, it will be an extremely beneficial development for the industry.

How Recent Migrations Could Renew Solana Interest

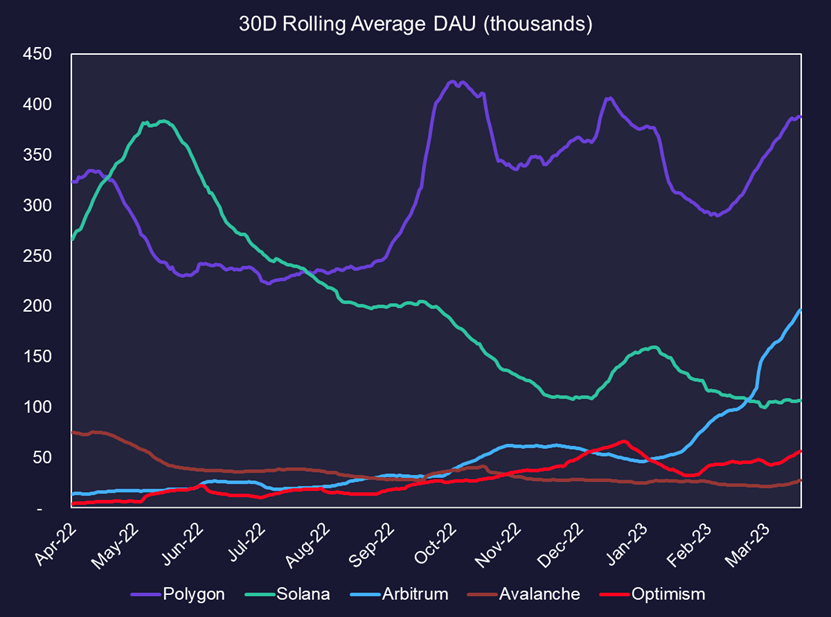

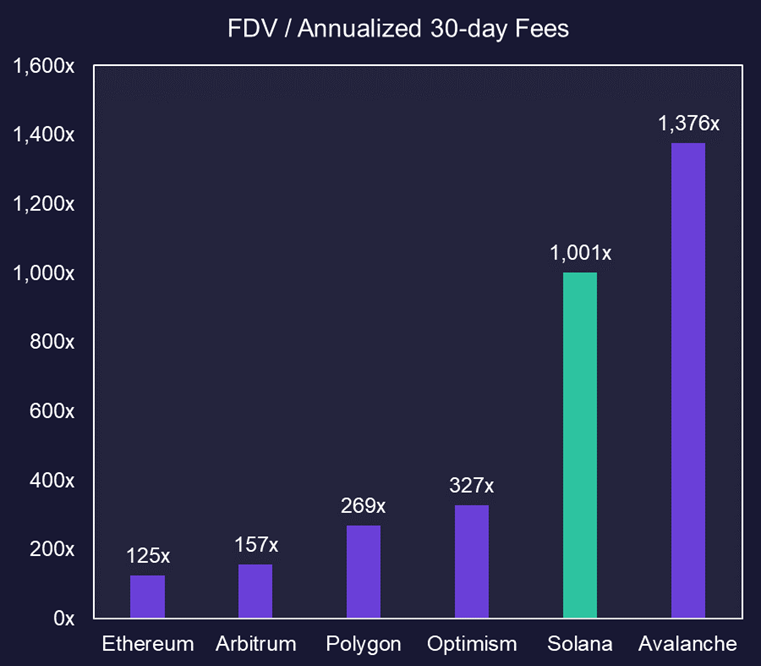

A couple of weeks ago, while discussing the bullish case for Polygon, we examined the relative fundamentals of various competing high throughput networks, all vying for the same user base. We observed that Polygon’s closest competitor in the first half of 2022 was Solana, but their relationship significantly diverged following the FTX implosion and the potential halo effect that may have impacted the ecosystem.

Considering the user trend depicted above, Solana’s relative valuation compared to other peers has become quite frothy. Nevertheless, we remain positive about the Solana ecosystem and expect the network to make a strong comeback.

This week, there seems to be a shift towards increased Solana usership. This is attributed to both the migration of two sizable projects to Solana and the launch of a smartphone specifically designed for the Solana network:

- Helium Network (HNT) – The Helium Network, a $400 million FDV decentralized wireless network, uses blockchain technology to incentivize hotspot deployment. The network is migrating from its native blockchain to the Solana blockchain due to Solana’s faster transaction times, lower fees, and enhanced flexibility. The migration is scheduled for April 18th.

- Render Network (RNDR) – The Render Network, a $900 million FDV decentralized graphics rendering platform, enables users to leverage distributed GPU resources for rendering tasks. Render Network is in the final stages of voting to migrate from the Polygon blockchain to the Solana blockchain. The proposed migration is motivated by Solana’s accelerated transaction times, lower costs, and coding flexibility, which would support Render Network’s new burn-and-mint equilibrium (BME) model. The initial community snapshot vote passed with 68% support, suggesting the final vote, expected within a few weeks, should pass as well. The exact date for the potential migration remains unspecified.

- Saga Phone – Solana Mobile is launching its first Android device, the Solana Saga, available for order starting May 8th. The Solana Saga is a newly launched Web3 smartphone designed to provide users with a seamless Web3 experience on their mobile devices. The device features its own Solana app store, allowing users to access dApps without traditional app store limitations. Key features of the Solana Saga include a focus on security, with a built-in seed vault for securely storing private keys and the use of the Qualcomm secure execution environment to protect users’ assets. The phone is expected to attract crypto users and offers a selection of dApps at launch, such as Audius, Dialect, and Mango Markets.

We believe that, in aggregate, these events could spark renewed interest and usage of the Solana network over the next few months. The migration of two relatively well-known networks will likely create a wealth effect on Solana, as nearly $1 billion in FDV will integrate with Solana DeFi. As for the Saga’s launch, it is uncertain whether it will actively compete with other phones or simply become the preferred device for private key management. However, it could generate buzz and promote more experimentation with crypto-enabled mobile apps.

Regardless, these developments underscore the core reasons why SOL remains part of our Core Strategy. In addition to their unique, monolithic approach to building a public blockchain, there is a dedicated core of developers and users who persistently push the network forward, iterate on the software, and introduce new applications to the platform. We may see SOL catch up to other altcoins in the short term due to these ecosystem tailwinds.

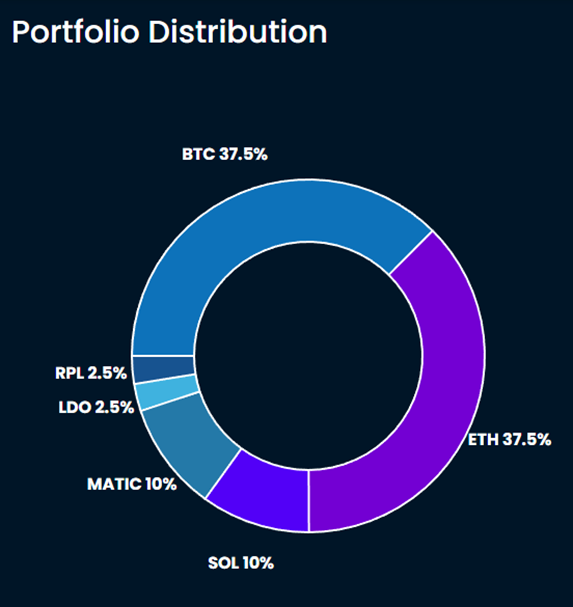

Core Strategy

Although we are approaching our price target ranges for both BTC and ETH, we remain constructive on cryptoassets due to favorable global liquidity conditions and narrative-based tailwinds. Our Core Strategy remains unchanged this week, but we may reevaluate in the upcoming weeks, considering potential near-term pullbacks from sustained RRP utilization, debt ceiling resolution, and seasonality.

Tickers in this Report: BTC -2.72% , RPL, LDO, MATIC, SOL, ETH -5.16% , HNT, RNDR