QT, We Hardly Knew Ya

Key Takeaways

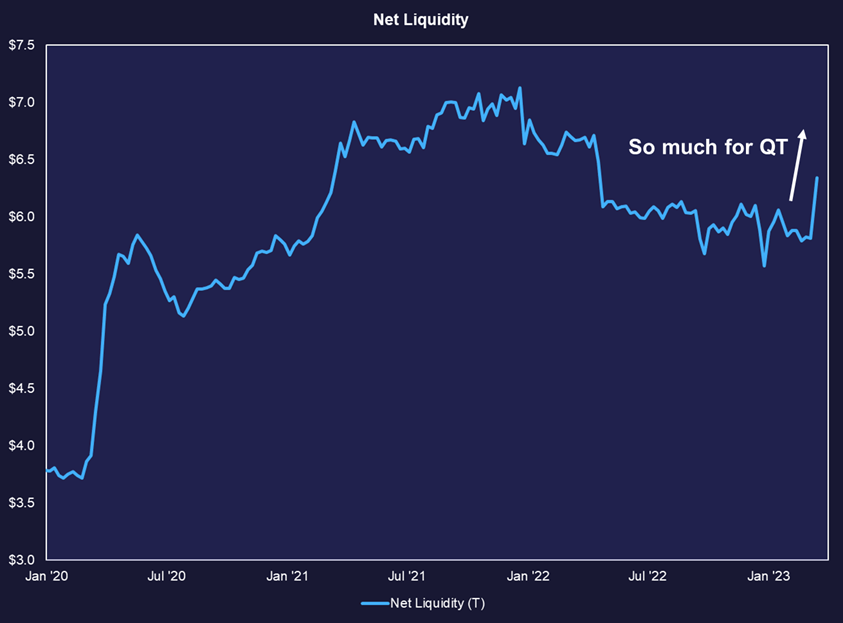

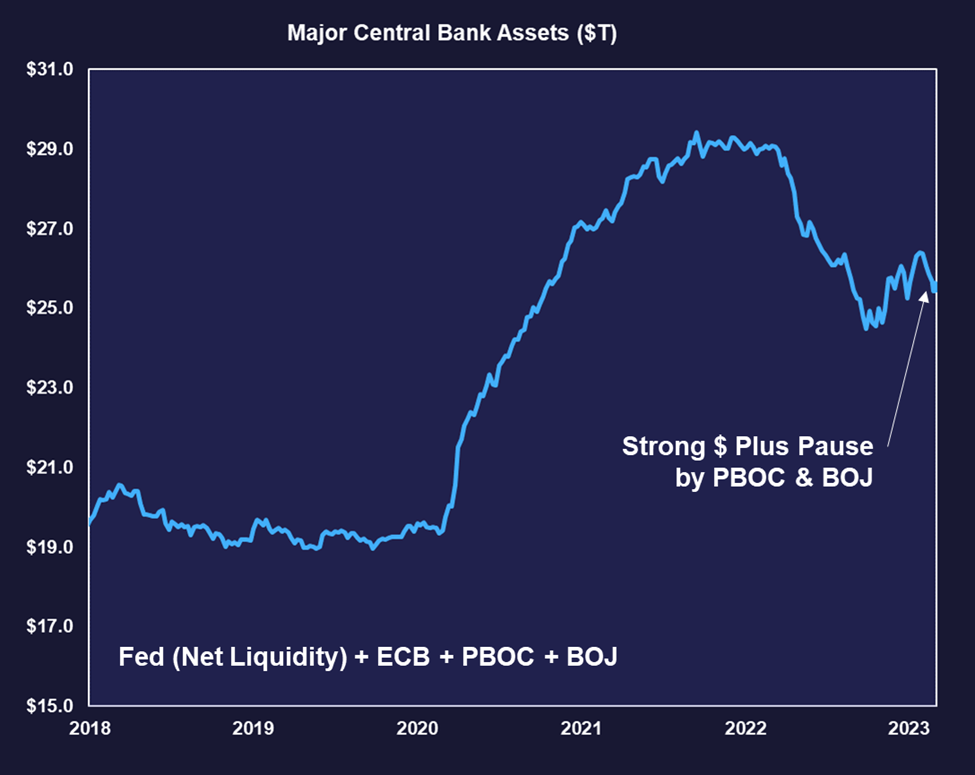

- The Federal Reserve's recent move to inject liquidity into the banking industry effectively neutralizes the impact of quantitative tightening (QT). Although some may argue that this lending program lacks the stimulus power of quantitative easing (QE), it still results in the creation of new dollars, which will enhance liquidity as banks borrow from the Fed and depositors channel their funds into securities or other banks, triggering a corresponding demand for securities to cover the new deposits.

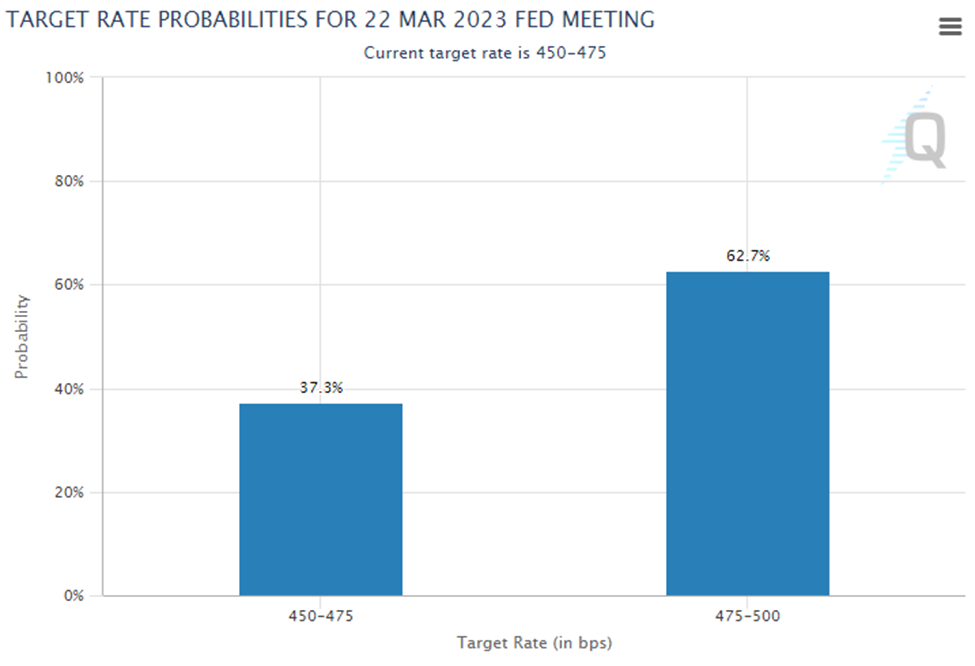

- Moreover, the recent backstop by the Fed may not provide Chair Powell with the flexibility to continue hiking rates, as some investors speculate. The utilization of the BTFP and discount window suggests a lack of liquidity and distress in the banking industry. Raising rates further could exacerbate this issue. Futures markets have reflected this sentiment by re-pricing downwards. As of Friday's close, the market predicts a 63% chance of a 25 bps rate hike at the upcoming FOMC meeting on Wednesday.

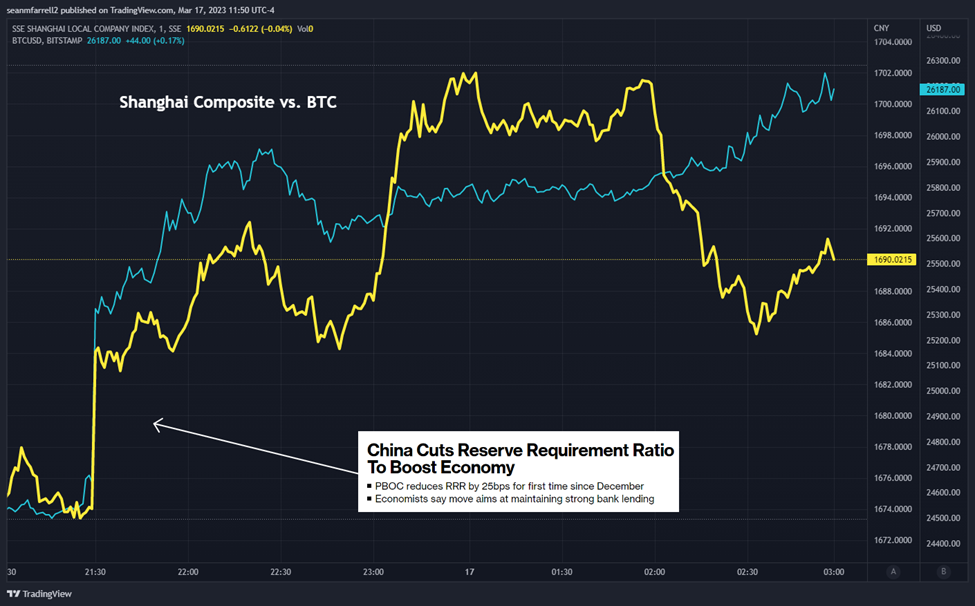

- The PBOC has lowered the reserve requirement ratio (RRR) by 25 basis points for all banks, except those with a 5% reserve ratio, to maintain ample liquidity and support China's economic recovery. This move is intended to boost credit growth, lower funding costs, and encourage lending by banks, which will increase global liquidity conditions. The BTC price rose along with the Shanghai Composite Index after this announcement.

- The strengthening correlation between BTC and gold, coupled with the ongoing banking crisis, suggests that some investors may be turning to Bitcoin as an alternative investment. The current 30-day correlation between Bitcoin and gold is higher than the correlation between Bitcoin and the Nasdaq 100

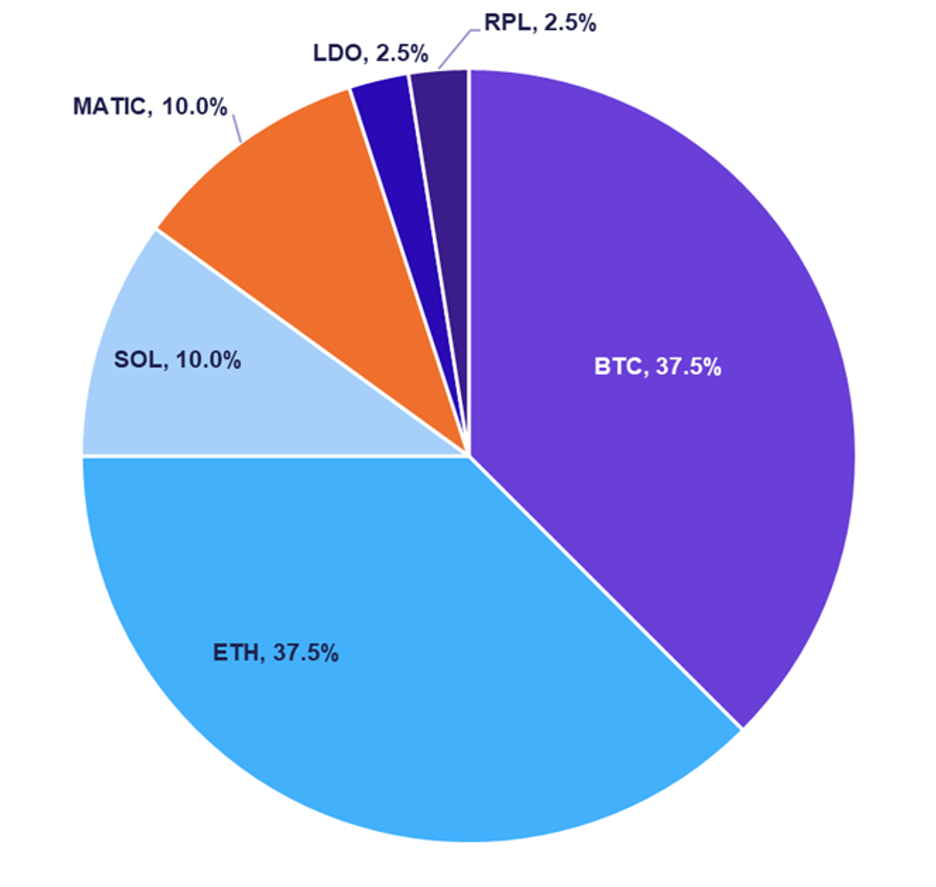

- Core Strategy – Despite ongoing banking concerns, the risk asymmetry in 1H remains to the upside, as liquidity conditions for risk assets should remain favorable, buoyed by global liquidity increasing. Investors are increasingly turning to BTC and gold as alternative ways to store wealth during periods of inflation or increased risk, with BTC's rising dominance potentially leading to sustained altcoin rallies down the road.

It might not “technically” be QE, but QT is Over

A common refrain among Bitcoin advocates has been “short the banks, long BTC.” Over the past couple of weeks, we have seen the closest manifestation of this trade since the inception of the Bitcoin network.

There remain apparent concerns about the health of the US banking system, specifically related to the duration mismatch issues plaguing traditional banking institutions and depositors’ resulting willingness (or lack thereof) to hold their uninsured deposits in regional banks.

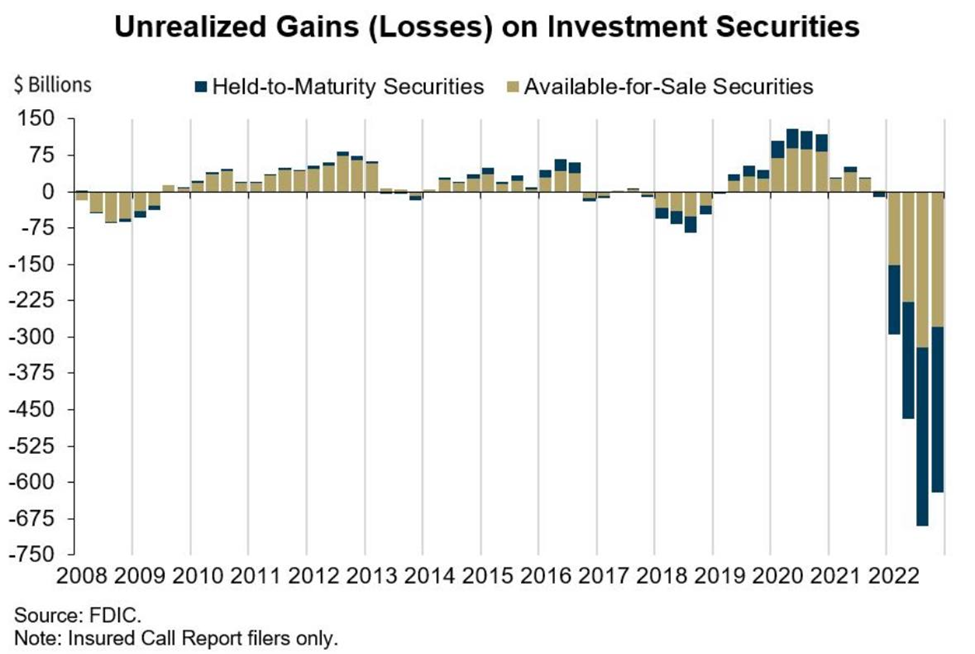

Silicon Valley Bank (SIVB) realized a loss on their securities available for sale due to purchasing too many low-yielding, long-dated bonds for their liquid portfolio and needing to roll their book into higher-yielding assets.

Unrealized Gains Losses on Bank Balance Sheets:

Now, with the understanding that the FDIC will back any deposits with a bank that is qualitatively deemed a “systemic risk,” we are witnessing reasonable trepidation around keeping deposits at non-GSIB banking institutions. The equity markets broadly continue to be weighed down by these fears of systemic banking failures.

The Fed has responded to this banking crisis by creating a new Bank Term Funding Program (BTFP) to offer loans of up to one year to banks and other institutions with high-quality collateral as security. The Treasury Department is providing up to $25 billion from its Exchange Stabilization Fund as a backstop for any potential losses from the funding program. The Fed has also eased the conditions at the discount window to make it more attractive for banks needing operating funds to borrow from the Fed.

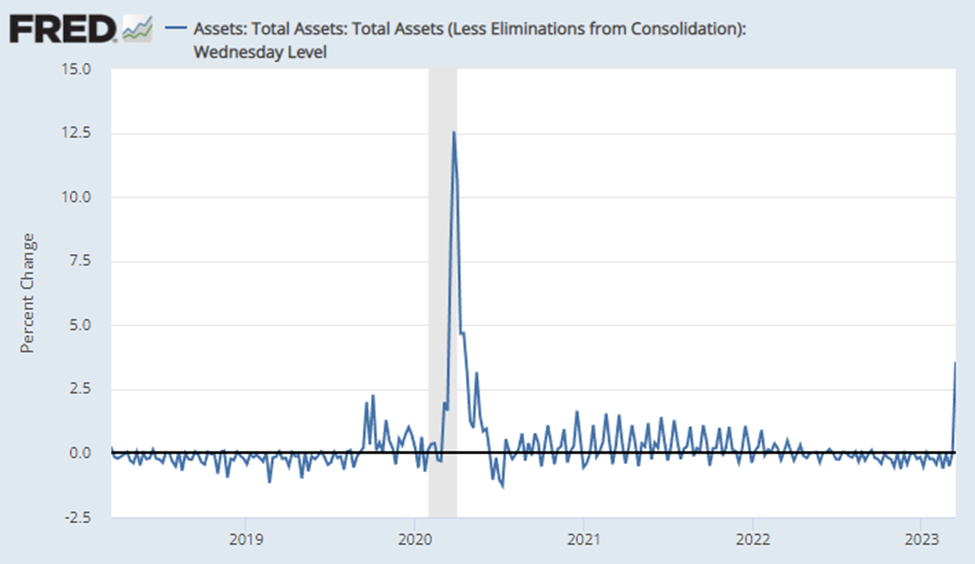

The early results demonstrated a definite need for liquidity from the banking industry, as banks borrowed $153 billion from the Federal Reserve’s discount window in the week to March 15, which is a new record high, surpassing the previous high of $111 billion reached during the 2008 financial crisis. Banks also borrowed $11.9 billion from the BTFP.

This resulted in the highest weekly relative increase in assets on the Fed balance sheet since early 2020.

Our clients know the rationale behind our bullish perspective on crypto this year. Consumer prices are broadly trending lower, peak-tightening occurred last year (on a rate-of-change basis), and global liquidity conditions have been more favorable than many anticipated. We also felt comfortable that most of the “forced selling” from market participants exiting the ecosystem were behind us.

Well, this action by the Federal Reserve certainly adds to our bullish rationale. This latest cash injection by the Fed essentially erases the work done by QE to date. Couple this with the fact that investors are starting to move out of the RRP, and we have witnessed domestic liquidity increase dramatically this past week.

Some argue this lending operation is not stimulative since it is not QE.

The Fed is not buying treasuries hand-over-fist and forcing investors to search for yield farther out on the risk curve. That is a fair argument. However, the net result of this operation is still the creation of new dollars.

Banks will borrow from the Fed to pay out depositors. Those depositors will take those dollars and either deposit them at a bank that will need to purchase securities to back those deposits, or they will take their cash to a brokerage and purchase securities.

In short, we view this lending program by the Fed as net-stimulative for capital markets.

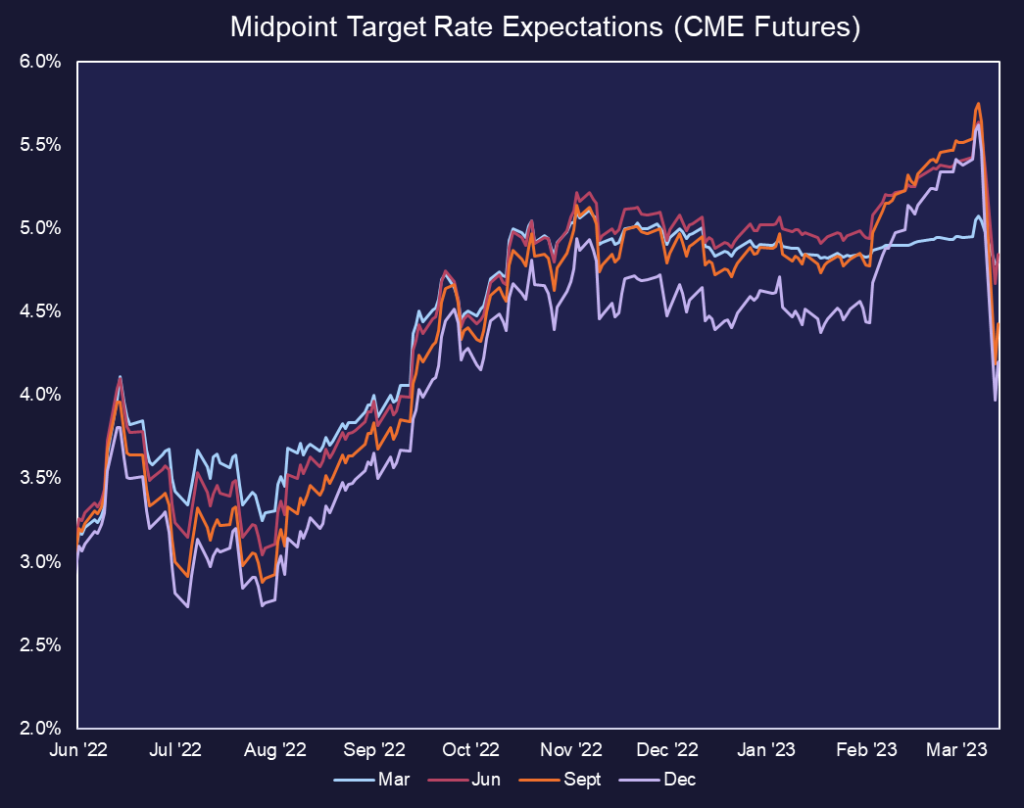

Rate Expectations Moved Sharply Lower

Further, we are not convinced that this backstop by the Fed gives Jay Powell the room he needs to continue hiking, as some investors believe it does. The fact that the BTFP and discount window are being used proves illiquidity and distress in the banking industry. Continuing to raise rates exacerbates this issue.

The futures market reflects as much, having violently repriced once again, this time in a downward trajectory.

At the close of business on Friday, the market is pricing in a 63% probability of 25 bps at the FOMC meeting on Wednesday.

China Still Easing

As discussed in prior notes, we witnessed a pullback in global liquidity in March as the PBOC tightened for several weeks straight, siphoning liquidity from the market.

However, to no one’s surprise, the country attempting to reopen from a complete shutdown realizes it must maintain a stimulative approach to markets for the foreseeable future. In concert with this premise, the PBOC lowered the reserve requirement ratio (RRR) for all banks this week by 25 basis points, effective March 27.

Lowering the RRR frees up more funds for banks to lend, boosting credit growth and stimulating economic activity. It is also intended to reduce funding costs for businesses and improve the level of services for the real economy. The reduction in the RRR reflects the PBOC’s intention to make its policy “precise and forceful” this year to support the economy, keeping liquidity reasonably ample and lowering funding costs for businesses.

We witnessed BTC launch higher at the Asia market open, rising in sync with the Shanghai Composite Index.

Correlation With Gold Increasing

With all of the above being considered, it is still our view that liquidity conditions for the rest of 1H should remain favorable for risk assets, buoyed by easing global liquidity conditions. However, the Damocles sword hanging over the market seems to be drawing another cohort of bitcoin investors into the fold.

BTC is generally viewed through the lens of a liquidity sink and a risk-on asset that benefits from easy monetary conditions. However, its ultimate purpose is to serve as an alternative financial system and a censorship-resistant way to store wealth and transact. This is a major reason why it was billed as “digital gold” many years ago.

Investors often turn to gold during periods of secular inflation or during periods of increased risk. Naturally, given the ongoing calamity in the banking system, we have seen gold do quite well.

The “left-curve” way to think about this trade is: banking crisis = buy gold.

Interestingly, we have also witnessed strengthening correlations between BTC and gold. The current 30-day correlation between gold and bitcoin sits at 0.5.

This is higher than the 30-day correlation of BTC to the Nasdaq 100, which sits at 0.3, and does not appear to be climbing as conclusively as the correlation between bitcoin and its analog counterpart.

Dominance Increasing is Great for Altcoins

Bitcoin dominance continues to rise this year, now nearing 47%, a level not seen by the market since June 2022, which was during the market downswing. There are two big reasons to be happy about this fact:

- Bitcoin is widely known to be the preferred method of exposure to crypto by macro funds. It is clearly benefitting from both the easy global liquidity conditions as well as the narrative surrounding banking industry concerns. It is possible that we are starting to see institutions take positions in BTC.

- The higher bitcoin dominance goes, often the more sustained any subsequent altcoin rally is. Bitcoin is often the preferred onramp for capital into crypto, and as a bitcoin rally subsides, alts will siphon off a portion of that liquidity, leading to strong rallies in smaller-cap tokens.

Core Strategy

Despite ongoing banking concerns, the risk asymmetry in 1H remains to the upside, as liquidity conditions for risk assets should remain favorable, buoyed by global liquidity increasing. Investors are increasingly turning to BTC and gold as alternative ways to store wealth during periods of inflation or increased risk, with BTC’s rising dominance potentially leading to sustained altcoin rallies down the road.

Tickers mentioned in this report: BTC -2.72% , ETH -5.16% , SOL, MATIC, LDO, RPL, ^SIVB