Don’t Fight Changes in Global Liquidity Conditions (Core Strategy Rebalance)

Key Takeaways

- This week, Paxos was ordered to shut down BUSD stablecoin services on Binance, sparking concerns about additional regulatory action against stablecoin providers. Further, SEC chair Gensler proposed expanding federal custody requirements for crypto assets to include enhanced record-keeping rules and surprise examination requirements. Though the market initially viewed this news negatively, as noted last week, such regulatory actions against centralized crypto companies do not necessarily necessitate price declines.

- Cryptoassets remained resilient despite the recent surge in yields and a stronger dollar, likely due to constructive global liquidity conditions. The short-term correlations between BTC and QQQ have been declining over the past few weeks, indicating an interesting trend that deserves attention.

- The common investment advice is not to "fight the Fed," but the phrase might be better understood as "don't fight changes in liquidity conditions." The rate of change in domestic liquidity has likely bottomed, and Asia has started to pump liquidity into the global economy. These changes in global liquidity conditions, coupled with the nuances surrounding domestic net liquidity, help explain why markets for risk assets are performing better than expected and why the market setup for crypto is conducive to outperformance in the near term.

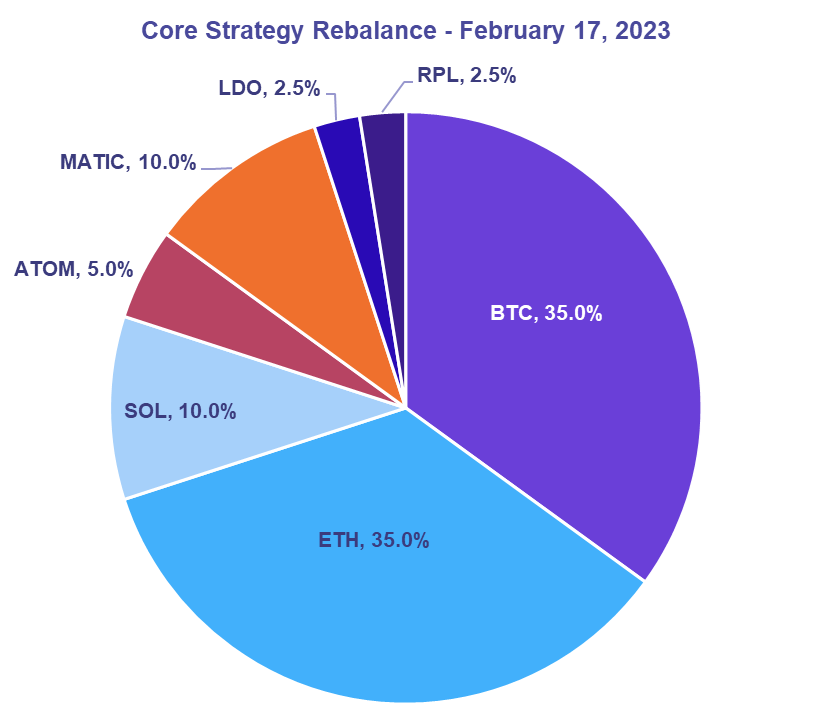

- Core Strategy - At the start of the year, we were optimistic about cryptoasset prices but cautious of risks such as forced selling from DCG and increased rates and dollar strength. Although the latter did occur, favorable global liquidity conditions left crypto largely unscathed. We are now removing stablecoins from our Core Strategy to take advantage of the current market setup.

Regulatory Threats More Bark than Bite (To Asset Prices)

Last week we discussed that more regulatory actions would be coming – and they certainly were.

- On Monday morning, Paxos was ordered to shut down its services surrounding Binance’s BUSD stablecoin on the grounds that it might be deemed a security. There were worries that there would be additional regulatory action against other centralized stablecoin issuers, but as the week progressed, it certainly appeared that this was a Binance-specific issue.

- Later in the week, SEC chair Gensler proposed expanding federal custody requirements to include crypto assets, which would require crypto exchanges to gain regulatory approval and secure certain federal or state registrations. The changes would apply to all client assets, and the amendment includes a requirement for a written agreement between custodians and advisors, as well as enhanced record-keeping rules and surprise examination requirements. The amended regulation would also require that client assets be properly segregated and held in accounts designed to protect them in the event of a qualified custodian bankruptcy or insolvency.

The market understandably viewed this news through a negative lens. However, as we noted last week, regulatory actions against centralized crypto companies are not necessarily the death knell for prices that they might seem to be. Further, the custodial regulations seem to be somewhat consumer-friendly.

Decoupling from Equities

Rates continued demonstrating relative strength on the back of a hotter-than-expected CPI report, coupled with incrementally hawkish language from Fed officials. We are not going to dive too deep into the inflation numbers this week, but from a high level, we think that the larger disinflationary trend is still intact, and one subpar print should not change the current course of the Fed.

However, interestingly, cryptoassets were able to shrug off the jump in yields and continued strengthening of the dollar.

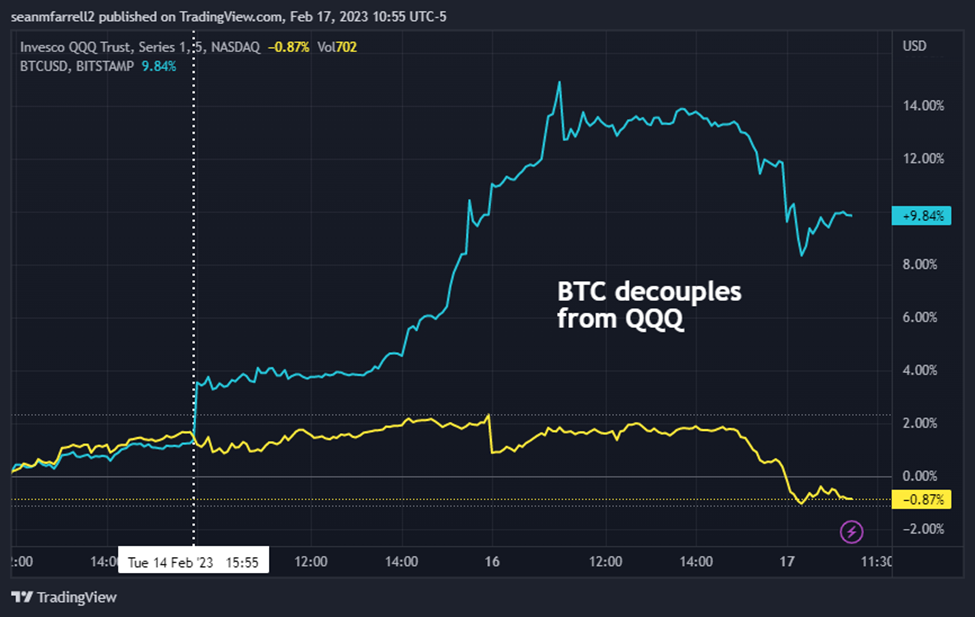

The chart below is certainly a sight for those tired of having bitcoin labeled as beta to tech stocks.

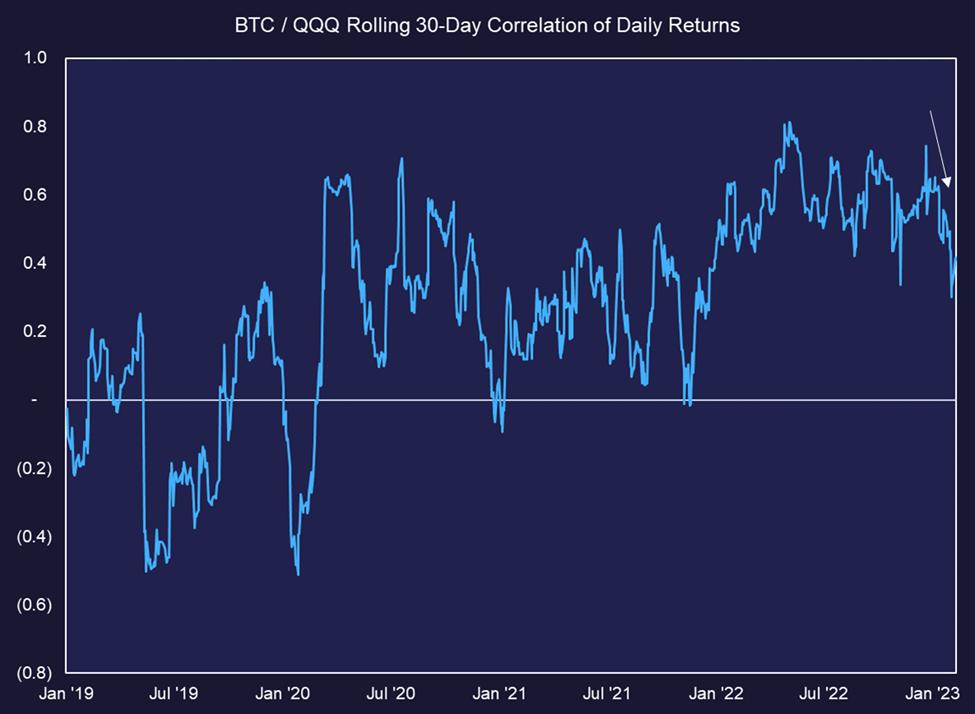

This week was obviously just one week out of many. It is unwise to call for any dramatic “decoupling” using 5 days of price action. However, if we examine recent history, we can see that short-term correlations between daily returns of BTC and QQQ have been declining over the past few weeks.

This is an interesting dynamic that we think our commentary below will speak to.

What Are We Fighting?

A common phrase amongst investors is to never “fight the Fed.” Leaving aside the nuances involved with fighting the Fed, this is generally sound advice, as evidenced by last year’s carnage across most asset classes.

However, given that asset prices have largely held up well over the past several months in the face of a seemingly determined Fed, one must ask themselves what that phrase really means.

Does the Fed have a button that they press to make numbers go down? In the abstract sense, yes, but in reality, they merely have levers they can pull to affect the rate of change in liquidity conditions in the market.

Thus, instead of saying “don’t fight the Fed” perhaps a more apt phrase might be “don’t fight changes in liquidity conditions.” These changes in liquidity conditions have been at the core of our relative bullishness thus far this year.

Further, crypto is a special animal. It is not confined to a single economy and is particularly sensitive to changes in global liquidity.

As it stands:

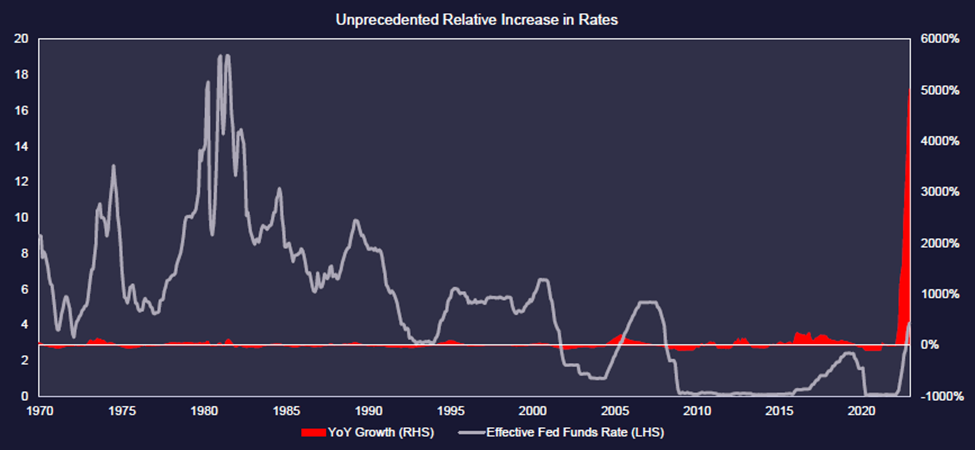

The rate of change in domestic liquidity has likely bottomed. This doesn’t mean the terminal rate won’t go higher or stay there for longer, but the greatest shock to the system has already been observed.

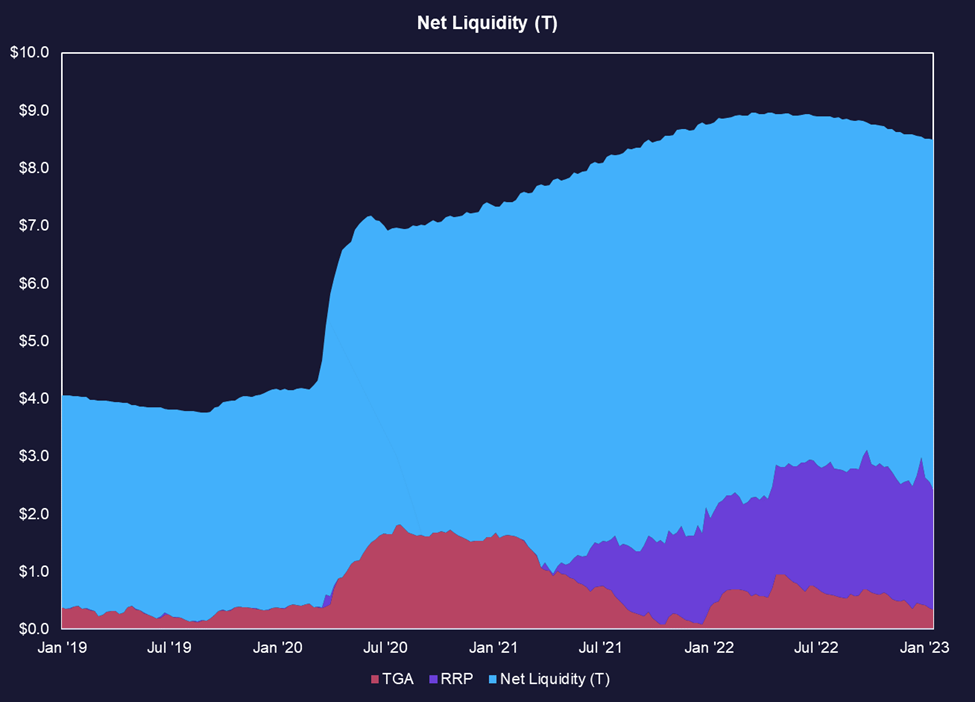

Net liquidity is more important than total Fed balance sheet assets. As we have alluded to in prior notes, the debt ceiling impasse has led us to a situation in which the treasury will not be able to issue new debt for the next couple of months and thus needs to draw on its bank account with the Fed to pay its bills. Further, in concert with our point above, a Fed that is slowing its tightening process could lead to an observable decrease in bond market volatility. Lower bond market volatility could very well result in capital being pulled from the $2 trillion reverse repo facility and consequently increase domestic net liquidity. We refer you to our note from late January for additional information on the topic of the RRP, TGA, and net liquidity.

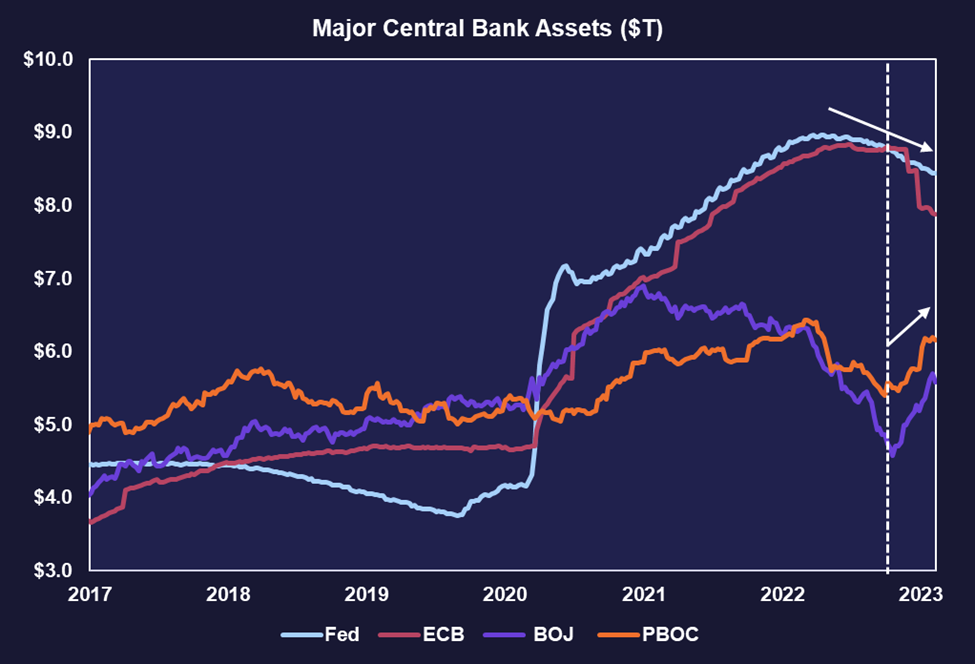

Asia has capitulated. As noted above, crypto is particularly sensitive to changes in global liquidity. At the start of the bear market, the Fed was in the driver’s seat for dictating global liquidity conditions. They were hiking rapidly while the rest of the world was playing catch-up. Now that the Fed has arrived at the point where they are at least thinking about pausing, their power over markets is still strong but comparatively muted. Meanwhile, the struggling Chinese economy has started to pump liquidity into their economy while the Bank of Japan continues to purchase bonds hand-over-fist.

Below we can see the two competing forces in the global economy – east (increased liquidity) vs. west (decreasing liquidity).

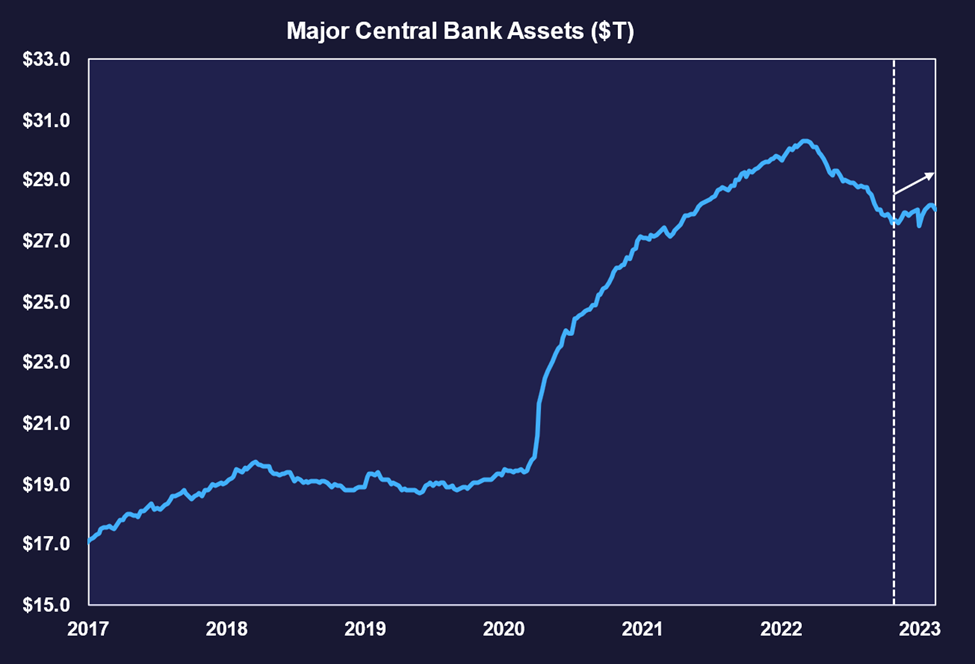

Aggregating these figures, we can see that the slowing west coupled with the liquidity injections in the east has resulted in net global liquidity starting to increase.

Interestingly, this inflection transpired around the same time that markets began reacting more robustly.

Couple these changes in global liquidity conditions with the nuances surrounding domestic net liquidity, and we can start to understand why markets for risk assets are performing as well as they are, and why we think the market setup for crypto, especially for the rest of 1H, is conducive for outperformance.

Core Strategy Rebalance

Entering the year, we were more bullish than most on cryptoasset prices for the year but wanted to remain cognizant of both (1) the idiosyncratic risk of additional forced selling from DCG as well as the (2) possibility of markets adjusting to increased hawkishness from the Fed after a considerable rally and decrease in rates.

As we have previously noted, idiosyncratic risks seem to be on the back burner for the time being as DCG is wrapped up in a bankruptcy process.

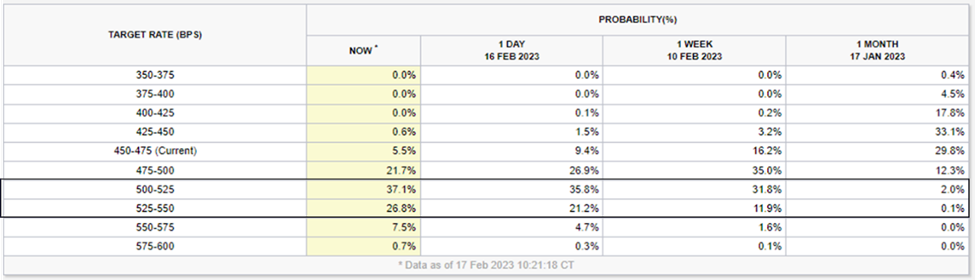

Further, we actually did realize a hawkish adjustment from the market over the past several weeks. Below are the target rate probabilities for the December FOMC meeting. One month ago, the market placed a 0.1% chance of being in the 525-550 range at the end of this year. As of today, that probability has increased to 26.8%.

However, it is evident that the constructive global liquidity conditions discussed above left crypto somewhat unscathed by this hawkish market adjustment. We think the recent strength in yields paints a more constructive picture for risk assets in the near term, as the path of least resistance is likely lower.

Taking all of this into account, we are removing any allocation to stablecoins in our Core Strategy to best take advantage of the current market setup.

This list is not exhaustive, but we think that it will be worth revisiting our overall view on crypto market risk based upon the following:

- A near-term debt ceiling agreement.

- Incremental hawkish behavior from the PBOC or BOJ.

- Hawkish acceleration from the Fed substantially beyond what both the Fed officials and the market are contemplating.

Tickers mentioned in this report: USDC, BUSD, QQQ -0.05% , BTC -1.53% , ETH -2.48% , MATIC, LDO, RPL, ATOM 47.97% , SOL