IBIT Options Approved, Stablecoin Market Cap Surpasses $170 Billion

Crypto Market Update

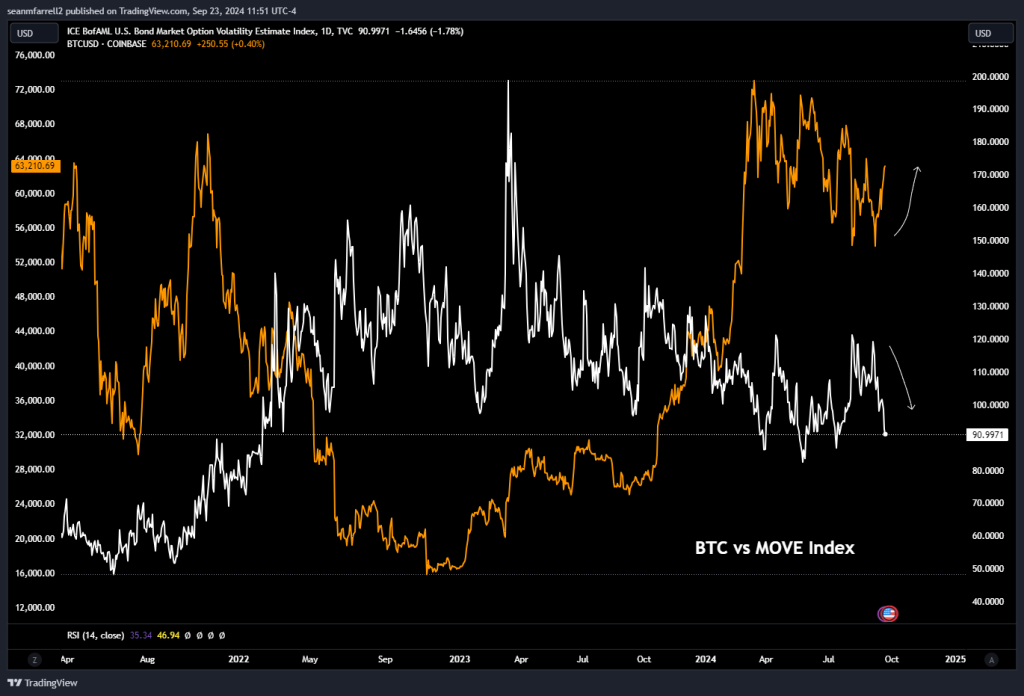

Crypto began the final full week of September trading—historically the worst time of the year for the asset class—with a positive move higher. BTC -0.98% briefly pushed above $64K during Sunday’s session, attempting to break through its 200-day moving average. Meanwhile, ETH -3.66% has quietly rallied 10% against BTC -0.98% over the past five days, now trading above $2,660, while SOL -0.61% has retreated to $144 after reaching $152 on Friday. Several altcoins have outperformed today, including AI-adjacent tokens like TAO -4.98% and NEAR -1.81% , alongside STX N/A% , AAVE -2.45% , and IMX -4.74% , each posting gains of 10% or more. This week will be shaped by a mix of growth and inflation data, with durable goods and GDP growth reports due Thursday, followed by core PCE and personal income/spending on Friday. In addition, there will be significant Fedspeak, with market participants watching closely for clues on whether the next rate hike will be 25 or 50 bps. While the DXY has ticked higher alongside rising rates, the MOVE index, which tracks bond market volatility, has fallen to its lowest level since mid-July—typically a favorable sign for crypto. Equities remain mixed, with the ^SPX gaining from strength in energy and discretionary sectors, though soft landing indicators like IWM 1.29% and KRE 1.02% are underperforming so far today.

ETF Inflows, Stablecoin Market Cap Records Another ATH

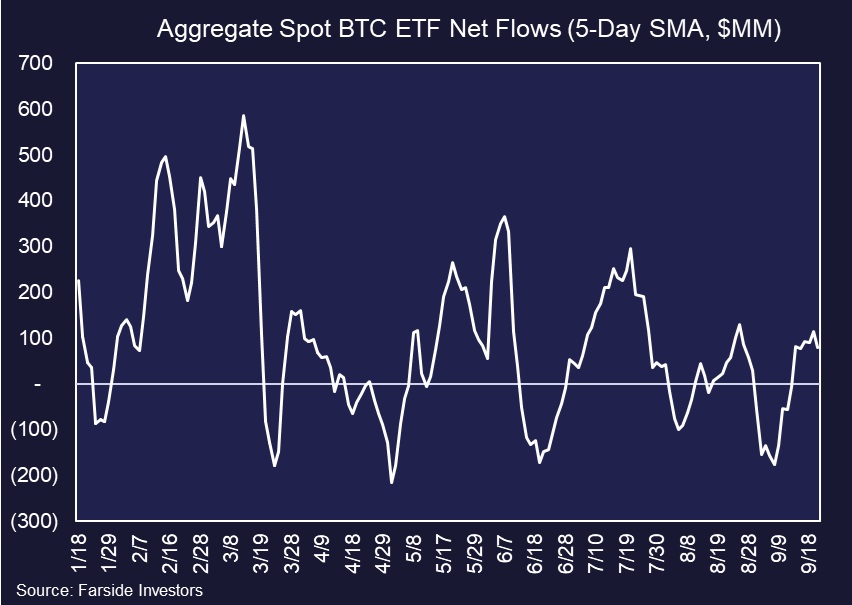

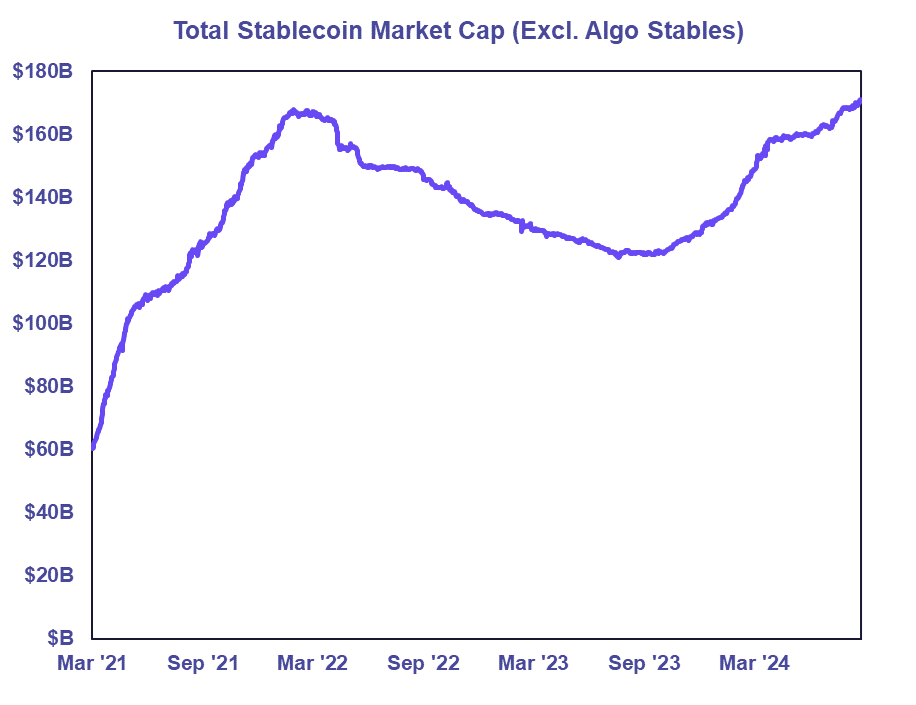

Last week, Bitcoin ETF inflows slowed midweek following the FOMC press conference but resumed into the weekend, with all spot ETFs collectively amassing nearly $400 million in net inflows. The current 5-day moving average now sits at just over $90 million. In contrast, spot ETH ETFs experienced another week of net outflows, totaling approximately $26 million across all funds. However, Thursday and Friday saw two consecutive days of inflows, albeit in the single-digit millions. Meanwhile, the stablecoin market cap continues to trend higher, with net aggregate inflows across all stablecoins reaching $955 million for the 7 days ending Sunday, September 22nd (source: DefiLlama). The total stablecoin market cap, excluding algorithmic stablecoins, surpassed $170 billion for the first time on Friday.

IBIT Options Approved by SEC

The SEC has granted approval to list and trade options on the iShares Bitcoin Trust (IBIT 5.53% ). Nasdaq ISE will handle the listing and trading of these options, with the SEC fast-tracking the approval process. The SEC highlighted that these options will provide investors with improved risk management and hedging opportunities. However, the options will not go live until further approvals are secured from the OCC and CFTC. This approval is expected to boost liquidity for spot Bitcoin ETFs, potentially attracting larger investors. Additionally, we may see the launch of new covered call ETFs, appealing to investors seeking income alongside their exposure to BTC price movements.

Technical Strategy

Ethereum has managed to successfully turn higher vs. Bitcoin on a short-term basis, breaking out of a one-month downtrend, and ETHBTC is now trading at the highest levels since early September. This looks to be a short-term development only, but DeMark exhaustion was present on the ETHBTC ratio on daily charts last week coinciding with the short-term low, not unlike what also happened in early August. Unfortunately, no weekly signals are present, and the larger downtrend on three-month charts hits near 0.045, directly above. Overall, a brief reprieve in Ethereum outperformance vs. Bitcoin looks to be happening which might last another 3-5 days. However, barring any meaningful intermediate-term progress, it looks right to likely sell into this, expecting a stalling out and a resumption in Bitcoin relative strength vs. Ethereum into/through October.

Daily Important MetricsAll metrics as of 2024-09-23 15:56:18 All Funding rates are in bps Crypto Prices

All prices as of 2024-09-23 12:11:42 Exchange Traded Products (ETPs)

News

|