HNT Strength Persists Following $200k Burn, Broder Crypto Market Falls on Mixed Econ Data

Crypto Market Update

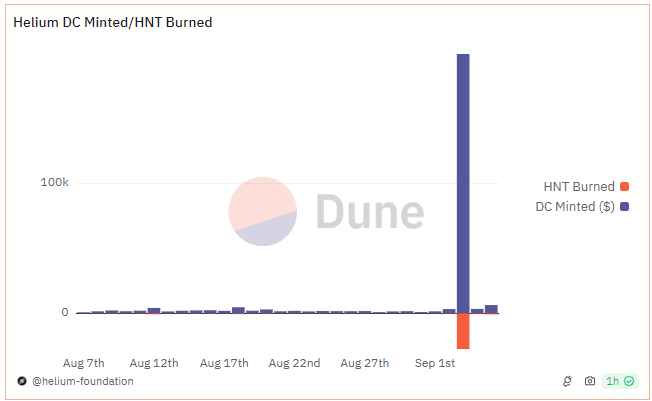

Jobless claims came in consistent with recent trends, while the ADP report fell well below market expectations, posting 99k jobs versus the 145k expected. Meanwhile, the ISM Services PMI showed another expansionary figure this month, continuing its divergence from ISM Manufacturing PMI. This initially provided a bounce in yields and risk assets, but over the past few hours, yields have started to roll over again while major equity indices tumble. Crypto markets are following traditional risk assets, with BTC 3.27% dropping below $56k—its lowest level since Tokyo Black Monday. ETH 5.11% is also down, trading below $2,400, and SOL 7.12% is once again testing the $130 level. The standout performer of the day is HNT 10.42% , which continues to rally due to strong momentum from the Helium Mobile carrier offload program, through which hotspot owners are now being compensated. Monday saw $200k worth of HNT burned for data credits, marking the largest single-day burn in over a year.

Synthetix Launches Its Own Blockchain on Optimism Superchain

Synthetix (SNX 3.71% ), a leading DeFi protocol, is launching its own blockchain, SNAXchain, built on Optimism’s (OP 4.95% ) Superchain infrastructure. This is part of Synthetix’s ongoing expansion across multiple chains and Layer 2 solutions. SNAXchain will serve as a neutral hub for governance and protocol decisions. The development is supported by Conduit for infrastructure and Wormhole for cross-chain messaging. Optimism’s Superchain uses optimistic rollups on Ethereum, aiming to reduce transaction costs and enhance interoperability. SNAXchain is launching alongside a governance epoch for Synthetix, with council nominations taking place via the new chain. Optimism’s ecosystem includes other chains like Base, Mode, and Zora.

EigenLayer Announces Second Stakedrop Season

EigenLayer has announced its second season of “stakedrop,” where 86 million EIGEN tokens will be distributed to stakers, node operators, and ecosystem contributors. This follows the first stakedrop in April and is set to begin on or before September 17th, targeting participants active between March 15th and August 15th. Of the 86 million tokens, which represent 5% of the 1.67 billion fully diluted token supply, 70 million are allocated to stakers based on their pro-rata ETH staked. The remaining tokens are designated for contributors like AVSs, rollup providers, and community members. Notably, EigenLayer’s total value locked (TVL) has almost halved from $20 billion in June, reflecting a broader trend in the liquid restaking sector. While EigenLayer tokens are not yet tradable, futures markets are valuing the protocol a projected fully diluted valuation of $4.5 billion.

Technical Strategy

Following a difficult couple months for Bitcoin Miners, the Valkyrie Bitcoin Miners ETF (WGMI N/A% ) is trading near a very important area of support which was created back in January of this year. Following two successful retests of this trendline extending from 1/19 lows, WGMI has managed to pullback to test this area again following a roundtrip from peaks established back in July. Technically, it’s thought that the entire area from August lows at $14.68 up to $15 have importance for WGMI, creating an attractive risk/reward. However, it’s necessary to stabilize here right away and begin to trade higher, which might prove difficult in absence of any catalysts. $20 is the first meaningful area on the upside, while any move under $14.68 would change the trend to bearish for WGMI, inviting a pullback to test $11.20. At present, it looks right to respect this trendline, but with the knowledge that failure to turn up quickly to test $20 and a downturn under $14.68 would postpone any advance into this Fall. Overall, WGMI looks to be close to meaningful support, so this area looks important to keep a close eye on in the weeks ahead.

Daily Important MetricsAll metrics as of 2024-09-05 16:12:03 All Funding rates are in bps Crypto Prices

All prices as of 2024-09-05 13:33:26 Exchange Traded Products (ETPs)

News

|