Risk-Off Move Ahead of Jobs Data, Prediction Markets Shift Towards Trump

Crypto Market Update

September is off to a bumpy start for markets. The ISM manufacturing PMI came in at a contractionary 47.2, below the expected 47.9, pushing treasuries higher while equities and crypto dipped. Defensive sectors are leading equities as the price action clearly signals a shift to risk-off sentiment. This week is pivotal, with key data releases including JOLTs job openings on Wednesday and the Non-Farm Payrolls (NFP) and unemployment rate on Friday. The market’s interpretation of interest rate cuts hinges on the broader economic context—if job data continues to soften without tipping into recessionary territory, it could support a Goldilocks or soft landing scenario. However, should the data suggest a sharper slowdown, investors may begin to price in a higher probability of a hard landing. Meanwhile, BTC -1.27% has dropped to below $58k after a brief rally on Sunday, ETH -2.17% is down to $2,450 and SOL -4.62% testing the $130 level. The DXY is inching higher, maintaining its recent rebound even as rates fall, and the VIX has surged 16%, reaching its highest level since mid-August.

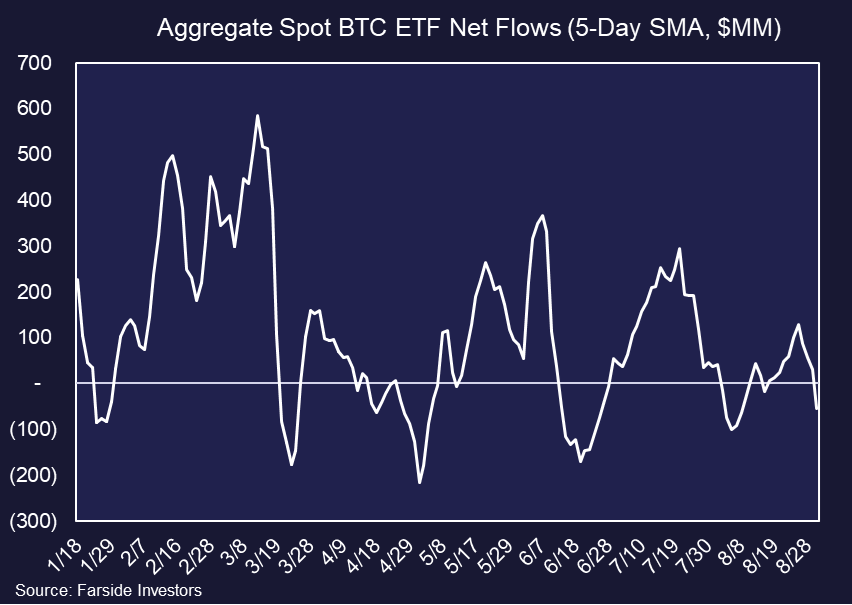

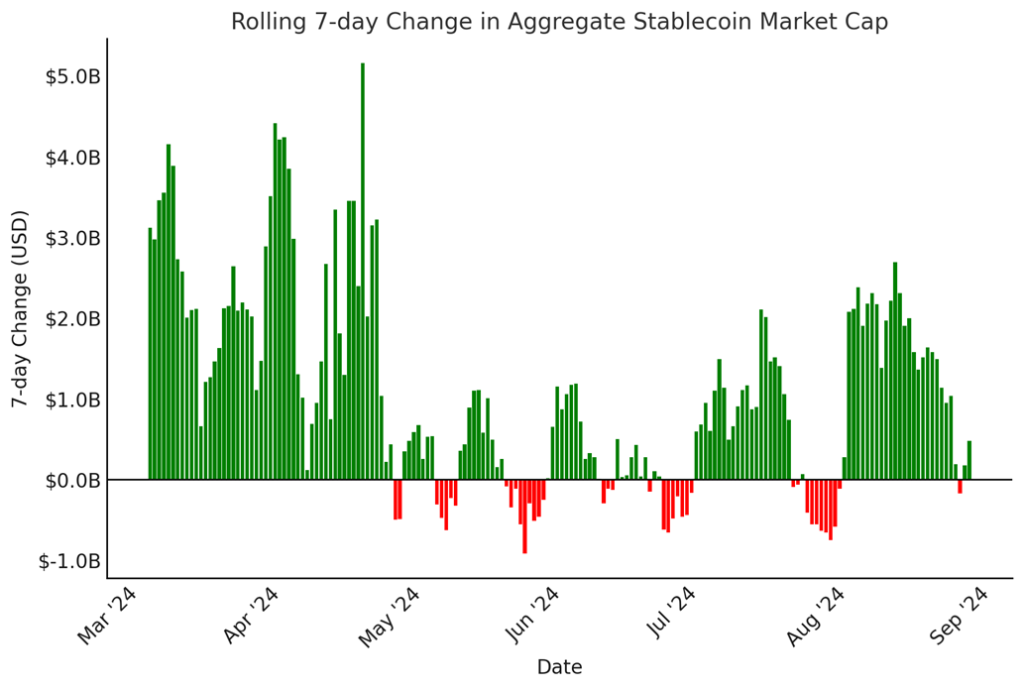

Flows Slow / Turn Negative

Early last week and the week prior, the flows picture appeared encouraging, with net inflows into BTC ETFs, robust inflows into stablecoins, and a sustained premium on Coinbase. However, over the past several trading days, BTC ETFs have experienced outflows, with the 5-day moving average turning negative after Friday’s close. While stablecoins haven’t shown significant outflows, the pace of capital inflows has noticeably slowed, as illustrated in the chart below. Additionally, BTC on Coinbase has generally been trading at a discount to BTC on Binance, indicating that U.S. investors are net sellers in the crypto market.

Several Prediction Markets / Polls Show Trump Gaining Ground

Over the weekend, Presidential Candidate Trump regained a lead over Vice President Kamala Harris on Polymarket. This is the second time Trump has pulled ahead in their presidential election prediction market. Coincidentally, Trump’s rise also aligns with his lead in Nate Silver’s probability model, a well-known election forecasting tool. However, it’s worth noting that PredictIt, another major election betting market, has not mirrored this shift toward Trump in recent days. As a reminder, this is significant for crypto prices, given the GOP’s supportive stance on crypto and the Democrats’ ongoing regulation-by-enforcement approach.

Technical Strategy

Monero has been able to successfully buck the bearish tide across the crypto space Tuesday and could be set to break out of its consolidation pattern since June. Today’s gains have reached the highest levels on a daily closing basis since mid-June, making it important to revisit given this above-average relative strength. Any daily close back over 176 should help jump-start its momentum even more, allowing for a rally back to 258 then 290-308 area. Overall, XMR 6.80% looks like an attractive risk/reward given its short-term strength as part of its sideways range since 2022.

Daily Important MetricsAll metrics as of 2024-09-03 15:58:05 All Funding rates are in bps Crypto Prices

All prices as of 2024-09-03 14:59:18 Exchange Traded Products (ETPs)

News

|