BTC ETFs See Another Day of Inflows, MakerDAO Rebrands to Sky

Crypto Market Update

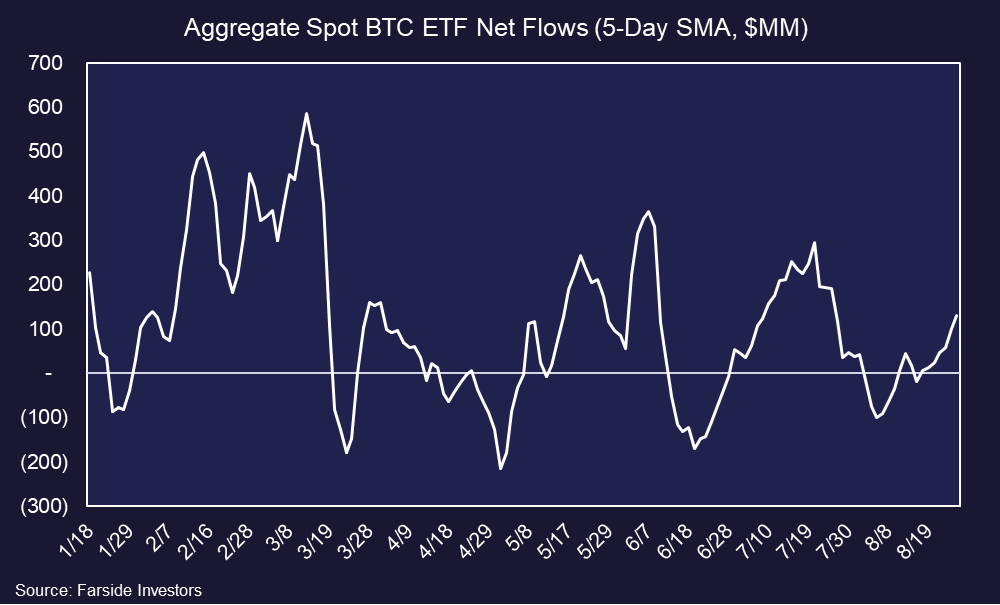

Despite a $200 million inflow into BTC ETFs yesterday, crypto prices have declined over the past 24 hours. BTC -4.11% has fallen back below $62K, ETH -3.13% is under $2,600, and SOL -3.15% is just below $155. Only a few coins are in the green today, including TON N/A% , rebounding from its recent selloff, MKR 1.76% , following its major rebrand announcement, and STX N/A% , likely benefiting from the ongoing activation of the Nakamoto upgrade. Meanwhile, the 10Y and 30Y yields are rising as the yield curve steepens, potentially driven by a stronger-than-expected consumer sentiment report. The DXY is slightly lower, and equities are mixed, with both ^SPX and QQQ -1.17% ticking up, while IWM -1.52% and KRE -4.56% lag behind.

MakerDAO Rebrands to Sky Ahead of Token Redenomination

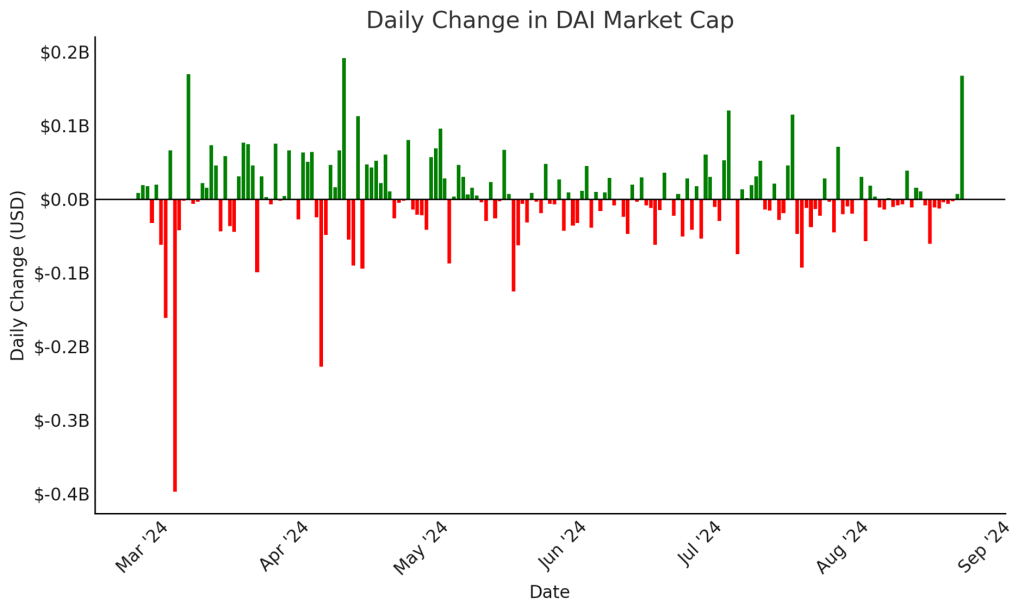

Core Strategy constituent MakerDAO (MKR) has rebranded to Sky and will launch new upgradeable tokens on September 18th as part of its “Endgame” plan. DAI stablecoin holders can upgrade to Sky Dollar (USDS) at a 1:1 ratio, while MKR governance token holders can convert to SKY at a 1:24,000 ratio. The existing DAI and MKR tokens will remain active. Sky Dollar holders can earn SKY tokens by participating in the Sky Protocol, though rewards are restricted in certain countries. MakerDAO’s SubDAOs have been rebranded to Stars, and its borrow/lend protocol, Spark, will become the first Sky Star with an upcoming SPK token airdrop. Over the past 24 hours, we have seen a sizeable increase in DAI market cap, as many users are likely looking to participate in the SKY rewards program.

Aave Looks to Integrate BlackRock’s BUIDL

In a strong example of competition driving better outcomes for consumers, MakerDAO rival Aave Labs (AAVE -1.82% ) has proposed a temperature check to update the GHO -0.01% Stability Module (GSM) by integrating BlackRock’s tokenized fund, BUIDL N/A% . BUIDL is comprised of yield-bearing USD assets such as U.S. Treasury bills. This integration aims to enhance the capital efficiency of Aave’s GHO stablecoin by facilitating 1:1 swaps between USD Coin (USDC 0.00% ) and GHO, while also allowing excess USDC to mint BUIDL shares. The proposal could generate dividends for users in BUIDL and create new yield opportunities for Aave DAO through real-world asset partnerships. The proposal is currently open for feedback from the Aave governance community before moving to a vote.

Technical Strategy

Bitcoin’s dominance chart broke out yet again last month and has steadily trended higher since 2022 nearly two years ago. This relative outperformance in Bitcoin eventually should give way to some weakness that allows for Alt-coin outperformance. However, at present, it’s important to utilize the current uptrend from January 2024 lows as well as 2022 vs. attempting to guess when this mean reversion should occur. Following the last few weeks of consolidation post breakout, it’ s likely that BTC -4.11% will continue to show dominance into October before showing much relative weakness.

Daily Important MetricsAll metrics as of 2024-08-27 16:29:55 All Funding rates are in bps Crypto Prices

All prices as of 2024-08-27 16:29:35 Exchange Traded Products (ETPs)

News

|