SOL Leading Majors on Bounce, ETF Flows Mixed but Coinbase Premium Persists

Crypto Market Update

Tuesday is off to a strong start for the bulls, with robust bounces across the crypto market. Among the majors, SOL -3.36% is leading the way, approaching its 200-day moving average around $146, while ETH 2.99% has climbed back above $2,500 and BTC -0.79% has surpassed the $55k mark. Notable outperformers within the ETH 2.99% and SOL -3.36% ecosystems include AAVE -1.46% , which benefitted fundamentally from massive liquidations yesterday, with over $200 million in collateral liquidated. Additionally, SOL-adjacent tokens like RNDR and JUP are both up over 10% on the day. This recovery follows a strong 10% overnight bounce in the Nikkei 225 and bounce in USDJPY. Equities are also rebounding, with major indices up over 1%, led by the tech sector in a broad-based bounce. Rates are higher as investors presumably shift out of treasuries and back into risk assets. Although the VIX remains elevated at over 27, it is down nearly 30% from yesterday.

ETF Flows Mixed, Coinbase Premium Holds Steady

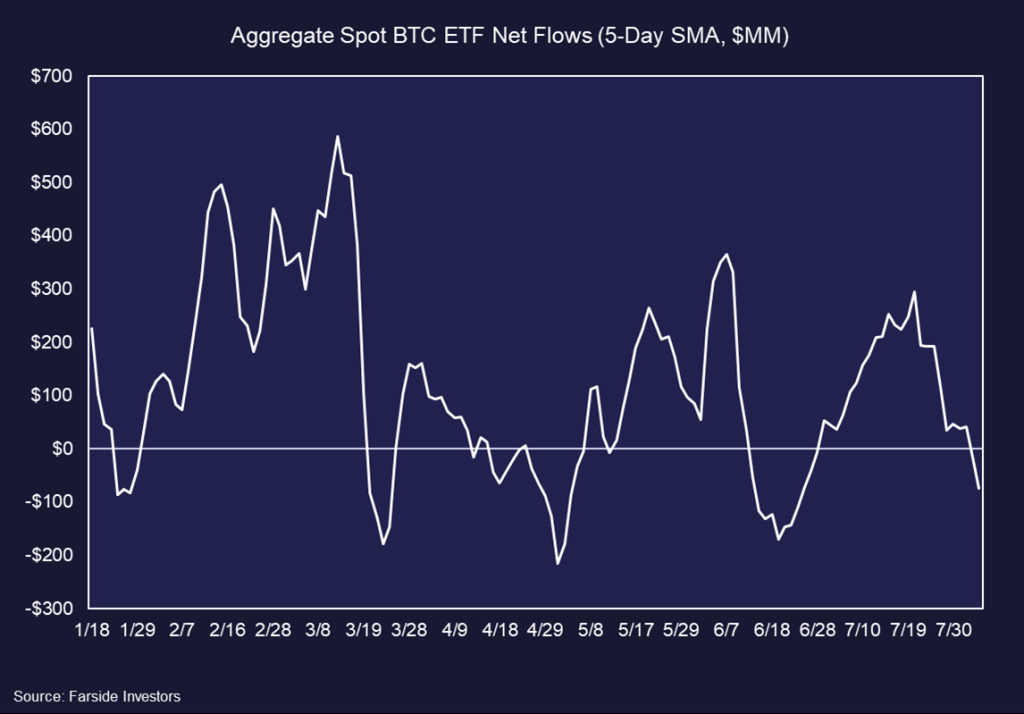

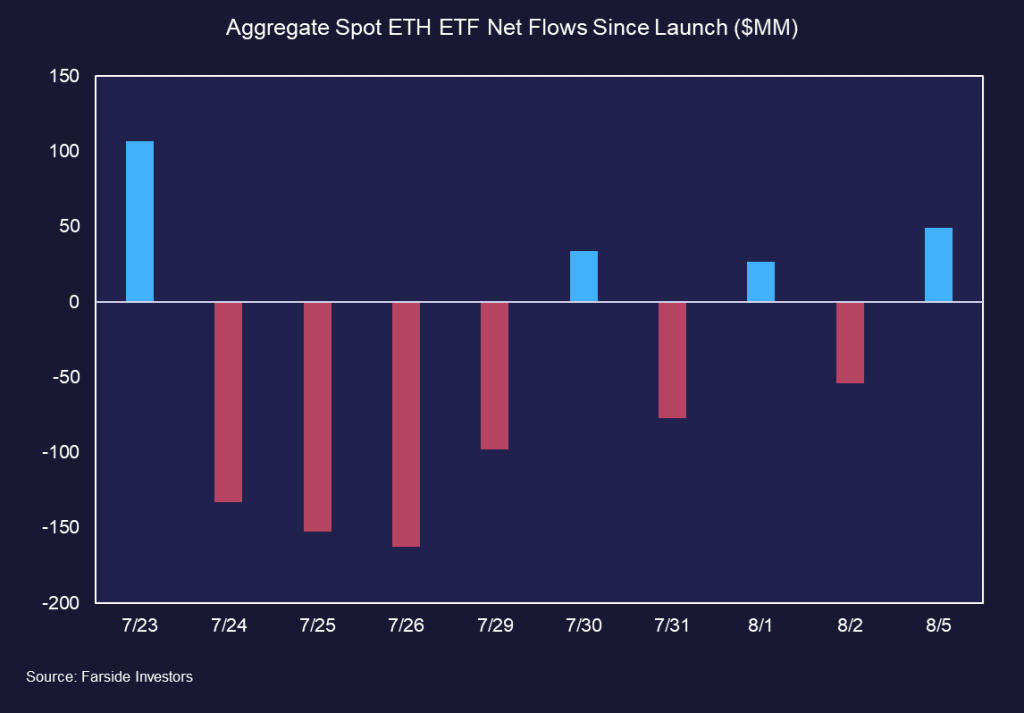

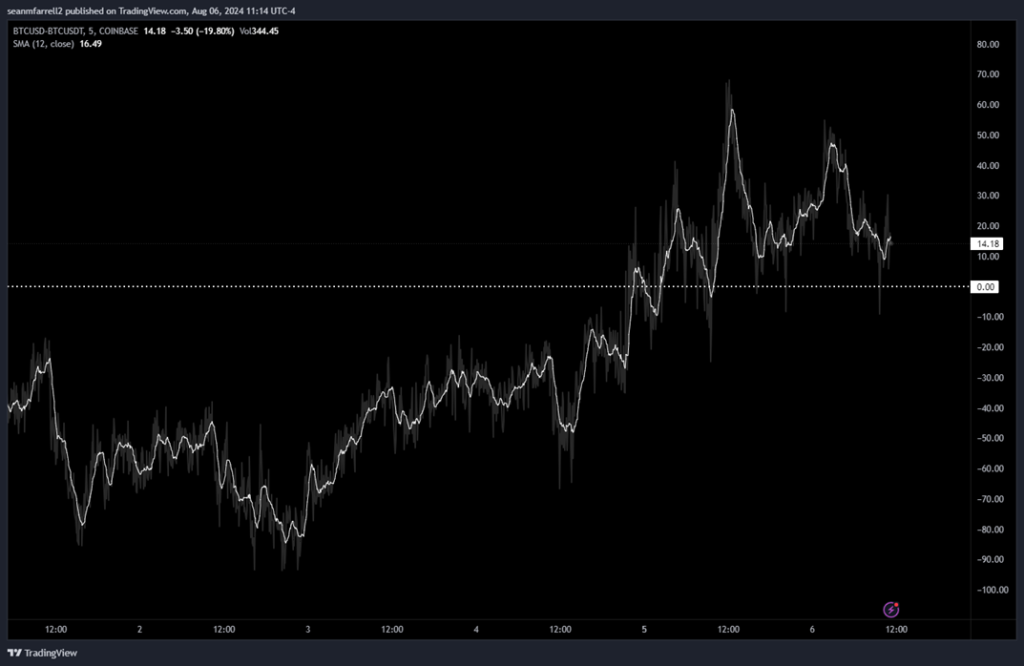

ETF flows were mixed yesterday, with Bitcoin ETFs experiencing $168 million in aggregate net outflows, including over $50 million from FBTC -1.99% and ARKB -1.65% . In contrast, BlackRock’s IBIT -1.92% saw no net flows, which is impressive given the weekend’s volatility. Ethereum ETFs, however, attracted nearly $50 million in aggregate inflows, largely driven by $47 million into BlackRock’s ETHA 1.67% . Significantly, Grayscale’s ETHE 1.70% recorded its lowest daily outflows since launch, with $47 million, marking the third consecutive trading day with outflows under $50 million. This suggests that the worst of the outflows are likely behind us. Despite these net outflows, there remains a consistent spot bid on Coinbase relative to Binance, indicating that recent flows are more reflective of Coinbase’s native volume rather than ETF-driven activity.

CORZ Exercises CoreWeave Option

Core Scientific announced that CoreWeave has exercised its option for an additional 112 MW of infrastructure, expanding their total contracted high-performance computing (HPC) infrastructure to 382 MW across five sites. This new agreement increases the potential cumulative revenue to over $6.7 billion over the next 12 years. Core Scientific plans to modify its infrastructure, funded by CoreWeave, with operations expected within 18 months. The company is also seeking additional sites to expand its HPC hosting capacity beyond the initial 500 MW, enhancing its position as a major data center operator in the U.S. CORZ 3.52% is up over 11% on the day thus far, outperforming most other miners on the news. Notably, CORZ 3.52% will report earnings tomorrow after the market close.

Technical Strategy

BONK has made an encouraging price reversal today that gives some optimism that a near-term technical low has been established. Monday’s decline managed to sweep under prior June 2024 lows and volume rose to five-month highs. This looked to be a sign of flushing out weak longs before prices managed to recover to regain prior June lows of $.000018 in today’s session. The ability to push higher to a three-day high close looks important towards signaling a likely low, and rallies look likely up to $.0000236 initially, then $0.0000313 before this finds much resistance. To have confidence of an intermediate-term low in place BONK -1.55% would require a move back over $0.00003391 which appears premature at this time. Overall, the pattern appears largely neutral since March 2024, but the recent pullback towards the lows of this larger range makes this attractive from a risk/reward perspective.

Daily Important MetricsAll metrics as of 2024-08-06 16:07:37 All Funding rates are in bps Crypto Prices

All prices as of 2024-08-06 13:37:17 Exchange Traded Products (ETPs)

News

|

Reports you may have missed

AI Miners Continue Outperformance, CB Premium Remains Muted Despite Flows Increasing

CRYPTO MARKET UPDATE The crypto market has been consolidating over the past 12 hours following Bitcoin’s first daily close above its 200-day moving average since last August. BTC -0.79% is hovering just below $64K, while ETH 2.99% is holding above $2,600, and SOL -3.36% remains strong above $150. SEI -2.63% , one of the high-performance L1s that rallied significantly in Q1, is leading the market today, following a similar path to SUI -8.01% . Other notable outperformers...

CRYPTO MARKET UPDATE Crypto began the final full week of September trading—historically the worst time of the year for the asset class—with a positive move higher. BTC -0.79% briefly pushed above $64K during Sunday's session, attempting to break through its 200-day moving average. Meanwhile, ETH 2.99% has quietly rallied 10% against BTC -0.79% over the past five days, now trading above $2,660, while SOL -3.36% has retreated to $144 after reaching $152 on Friday....

CRYPTO MARKET UPDATE In stark contrast to the recent BLS job number revisions, the government revised its Q2 GDP estimate higher this morning to 3%, leading to a jump in rates and the DXY. However, this data also apparently boosted confidence in the soft landing trade, as rate-sensitive indices like IWM are outpacing ^SPX 0.42% and QQQ 0.47% . Chip-adjacent stocks are also performing well, spurred by another earnings beat from NVDA 4.83% , benefiting...

CRYPTO MARKET UPDATE This morning's big news came from the BLS, which revised payrolls down by 818k for the 12 months ending in March. In response, the DXY turned negative as yields fell and market confidence in upcoming Fed cuts grew. Price action continues to suggest that the market views a soft landing as possible, with risk assets rallying in tandem with Treasuries. BTC -0.79% spiked to $60k following the U.S....

Articles Read 1/2

Enjoyed the read? Subscribe now for unlimited access!

Get invaluable analysis of the market and stocks. Cancel at any time.

Already have an account? Sign In fa7978-1dfbf6-2a93c6-975792-a9a586

Already have an account? Sign In fa7978-1dfbf6-2a93c6-975792-a9a586