Coinbase Premium Encouraging Sign for ETH, ONMD Buys BTC for Corporate Treasury

Crypto Market Update

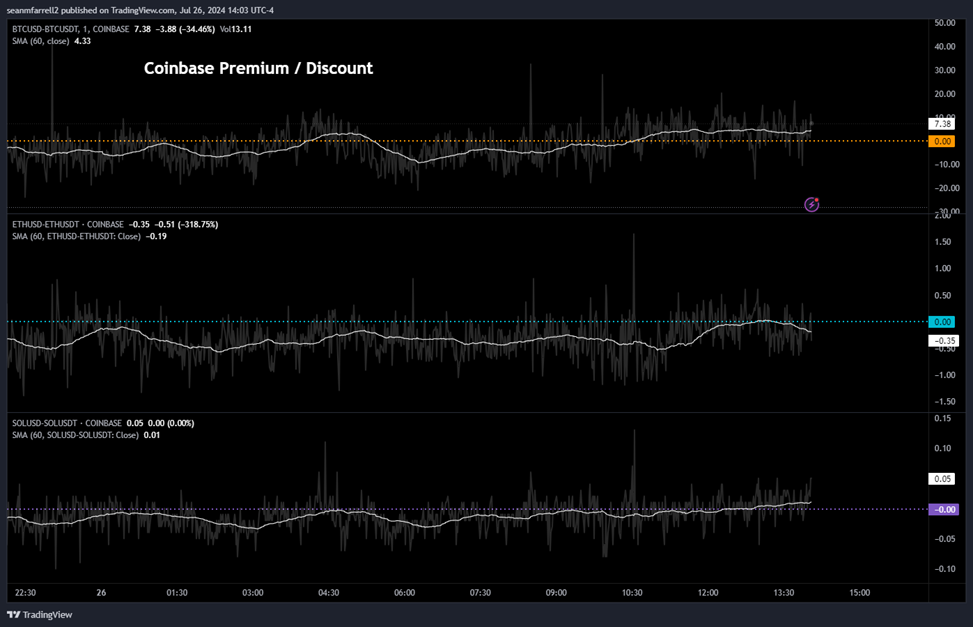

After another day of sizeable outflows from ETHE -4.72% , the Grayscale-issued ETF now retains just 85% of the AUM it began with on Tuesday. However, crypto has rallied strongly since the US market closed yesterday, with BTC -1.09% briefly moving above the $68k level, ETH -2.08% rebounding sharply to $3,250, and SOL -2.34% revisiting $184. Among larger-cap tokens, SOL beta names including RNDR and JUP have outperformed over the past 24 hours, in line with continued SOL strength. Crypto equities have also rebounded, buoyed by rising token prices and lower rates. The Coinbase discount has turned into a premium for BTC today, indicating a possible resumption in inflows, while ETH has periodically traded at a premium, suggesting that ETHE outflows might be more muted today compared to earlier in the week. Core PCE came in this morning at 0.18%, just 0.01% above the consensus estimate, presumably serving as enough support for the market to skew dovish into next week’s FOMC as Fed fund futures probability of 50 bps cuts in September edged higher. Both major equity indices are up about 1% thus far today, with broad-based participation as all sectors are in the green, along with another strong day of performance from small caps.

ONMD Buys Bitcoin with Proceeds from Private Placement

The adoption of BTC in corporate treasuries continues with OneMedNet Corporation (ONMD 57.36% ), a provider of regulatory-grade real-world data solutions for the healthcare sector, completing a $4.6 million private placement with institutional investors, including Off the Chain Capital and Discovery Capital Management. The funds are allocated for working capital, corporate purposes, and notably, $1.8 million for purchasing bitcoin. This company certainly has risks to consider, such as its potential delisting should it not receive approval on its petition with the SEC on a listing compliance plan. However, this treasury strategy could bring more liquidity to its shares, bolster the recovery story for the company, and help it chart a path forward. Regardless, this is yet another example of a recurring trend of corporations adopting a hard money approach for its balance sheet. ONMD rallied nearly 20% on market open, and is now trading approximately 8% above yesterday’s market close.

More Government Pensions Allocate to BTC

The State of Michigan Retirement System has disclosed ownership of 110,000 shares in the ARK 21Shares Bitcoin ETF, currently valued at $7.4 million, according to a 13F filing with the SEC. While the ownership is relatively small percentage-wise, it marks a beginning for the pension fund. Michigan is the third pension entity to invest in spot bitcoin ETFs, following the State of Wisconsin Investment Board and Jersey City. In May, Wisconsin reported holding significant shares in BlackRock’s IBIT -2.72% and Grayscale’s GBTC -2.74% , valued at nearly $100 million and $64 million, respectively. Jersey City Mayor Steven Fulop announced that the city plans to allocate a portion of its pension fund to spot bitcoin ETFs, with the investment process expected to conclude by the end of summer.

Technical Strategy

CFX -3.39% 15% advance today has brought this to new 4-day highs and looks to be making a strong statement that lows likely could be in place following the steep drop from March. The rally back on 7/14 managed to exceed its one-month decline, giving some hints that higher prices should start to materialized. The retest of its breakout pivot over the last week looks to be complete, and gains up to test 0.1950 looks likely initially, which adjoins a larger trend from April peaks. While volume will need to start showing more evidence of matching some of the high levels which were seen during declines in recent months, getting back above 0.1950 will be the first test from a price perspective, allowing CFX to begin a push back to first real resistance at 0.30-0.33 over the next month. Overall, this looks like an appealing risk/reward given that CFX’s decline successfully held 2023 lows and unless that level is broken, prices likely are beginning to bottom out.

Daily Important MetricsAll metrics as of 2024-07-26 12:08:26 All Funding rates are in bps Crypto Prices

All prices as of 2024-07-26 15:00:15 Exchange Traded Products (ETPs)

News

|