ETH ETFs Post First-Day Inflows, Fold to Go Public Via SPAC

Crypto Market Update

Rates are broadly lower, with a notably stronger rally at the front end of the curve as the market appears to be taking potential rate cuts over the next couple of FOMC meetings more seriously. Despite significant weakness in equities today, the crypto market is looking relatively healthy, with BTC 2.95% and many altcoins in the green. BTC 2.95% briefly rallied above $67k but has since drifted back down to $66k, possibly catalyzed by a headline mentioning that Bitstamp creditors would be receiving their BTC 2.95% on Thursday. ETH 4.14% has fared less well than BTC 2.95% today, following what we would consider a rather successful first day of spot ETF trading, currently trading near $3400. Meanwhile, SOL 6.41% moved briefly back above the $180 level but is now trading just below it once again. The DXY is lower today, driven by strong outperformance in the JPY. While the ^SPX and QQQ 1.03% are experiencing sizeable drawdowns, IWM 1.04% continues to outperform, only down a few basis points.

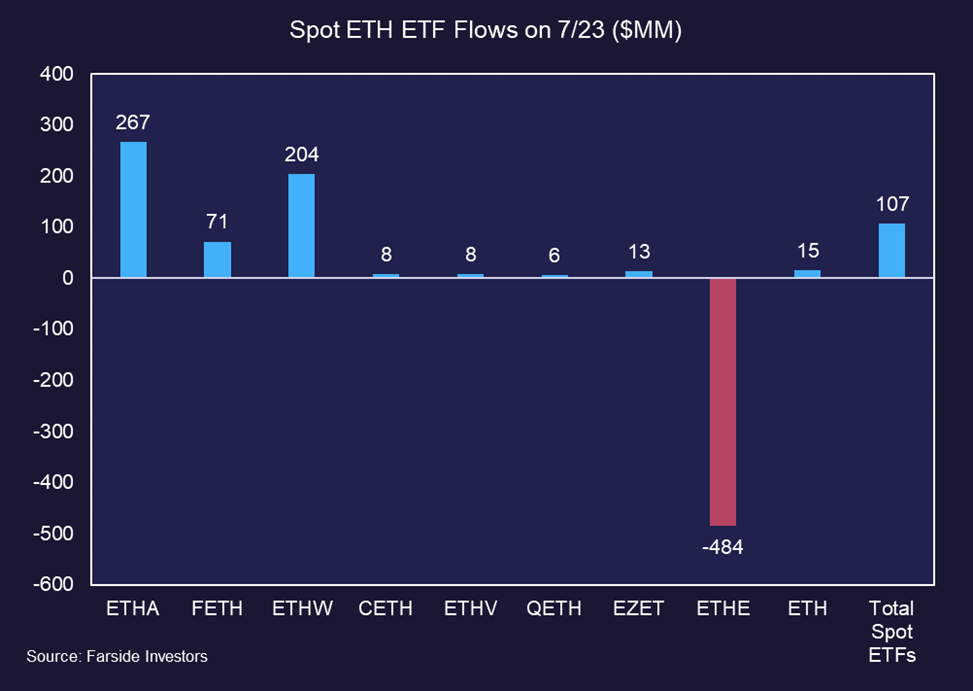

ETH ETFs Post Net Inflows on Debut

The newly launched ETH 4.14% ETFs saw over $1 billion in trading volume on their first day, with net inflows of $107 million. This volume is about 20% of what Bitcoin ETFs achieved on their debut, and net inflows about 16%. Outflows were from Grayscale’s ETHE -0.59% , which saw an exodus of $484 million. The BlackRock’s ETHA -0.57% and Bitwise’s ETHW had the highest inflows at $267 million and $204 million, respectively. Outflows for ETHE -0.59% were expected. Outflows for GBTC -0.26% peaked after seven trading days, which is likely what the market is expecting here. Any slowing in outflows before that is likely a bullish surprise.

Fold to Go Public Via SPAC

Fold, a Bitcoin financial services company founded in 2019, offers products like Bitcoin cashback debit cards and rewards on bill payments. It has processed over $2 billion in transactions and holds over 1,000 Bitcoin in its treasury. Fold is set to go public through a merger with FTAC Emerald Acquisition Corp. (EMLD), a SPAC, valuing Fold at $365 million. Post-transaction, Fold will remain listed on NASDAQ with its management team continuing to lead. The transaction, expected to close in Q4 2024, aims to expand Fold’s Bitcoin-integrated financial services. While this is a SPAC merger as opposed to an IPO, it is nonetheless an encouraging sign for the space that the appetite in the public market for crypto-linked equities is growing.

RIOT Acquires Block Mining for $92.5 Million

RIOT 5.24% has acquired Block Mining, Inc. for $92.5 million, paid through $18.5 million in cash and $74 million in Riot stock. This acquisition immediately adds 60 MW of operational capacity with the potential to expand to 110 MW by year-end and over 300 MW in the future. Block Mining brings an experienced management team and two operational sites in Kentucky, enhancing Riot’s geographic diversification and exposure to new energy markets. The acquisition also increases Riot’s self-mining hash rate by 1 EH/s, with potential growth to 16 EH/s by the end of 2025, supporting Riot’s strategic goal of reaching 100 EH/s. This continues the recent trend of consolidation within the mining industry.

Technical Strategy

Following an encouraging day of trading for the ETH 4.14% spot ETF, Ethereum itself remains largely range-bound and has shown precious little evidence of pushing higher or lower in recent weeks. Price remains near levels where this closed back on 7/15 after a sharp rally off the lows from early July. The short-term trend remains bullish as part of the neutral four-month sideways consolidation which began back in March of this year. Upside looks possible to $3775, while downside support is found near July lows just above $2800. Until there is clear evidence of this consolidation being broken, it’s proper to label charts of both BTC 2.95% and ETH 4.14% shown here as being in consolidation which eventually should give way to an upside breakout. Dips in price, should they occur into August, likely could provide support initially near $3200. However, it will take a daily close above the high close from late May at $3892 to provide some conviction about an upside breakout.

Daily Important MetricsAll metrics as of 2024-07-24 12:00:30 All Funding rates are in bps Crypto Prices

All prices as of 2024-07-24 11:37:19 Exchange Traded Products (ETPs)

News

|