ETH ETFs Reveal Fees, Potential Consolidation in Mining Industry

Crypto Market Update

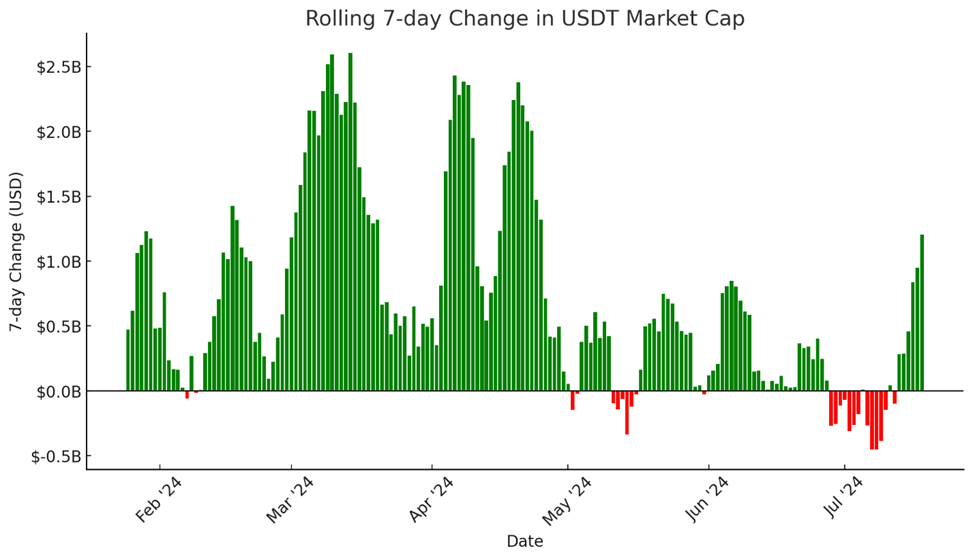

The crypto market moved higher in the early morning hours and is now consolidating post-US market open. BTC once again challenged the $65k level and is currently sitting just below it, following the ninth consecutive day of net inflows for BTC ETFs. ETH is showing outsized strength, likely due to ETF issuers filing their final documents yesterday afternoon, with the ETF launch expected on Tuesday (more on this below). Meanwhile, SOL is still working on breaking through the $160 level, with several SOL beta names outperforming this morning. This includes WIF, a Q1 darling that is starting to come back to life, and JUP, the leading DeFi platform on Solana. Stablecoin flows continue to suggest rising animal spirits. Of note, the USDT market cap has increased by over $1.2 billion, the most since April. Rates are moving higher this morning, despite a big miss on expected initial jobless claims, leading to a bounce in the DXY. Major equity indices are recovering today following a chip-induced drawdown yesterday, with small caps continuing to demonstrate outperformance relative to large caps. Gold, often viewed as a bellwether for major crypto rallies, is also resuming its push higher this morning.

ETH ETF Issuers Submit Final Documents and Reveal Fees

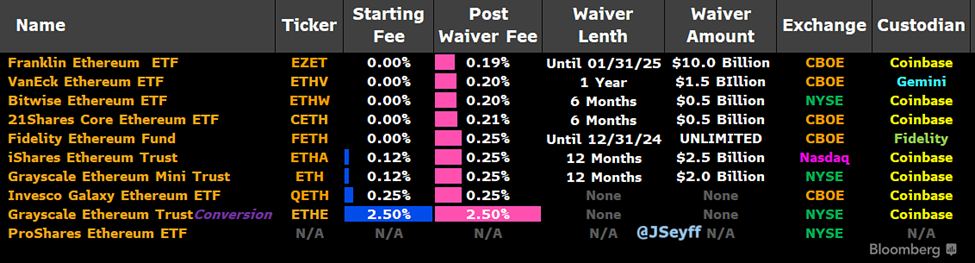

Prospective ETF issuers have submitted their final documents to the SEC, which are expected to be approved by Monday. BlackRock has set its fee at 0.25% for its spot Ethereum ETF, with a waiver reducing it to 0.12% for the first year or up to $2.5 billion in assets. Other firms, including 21Shares, Bitwise, Grayscale, Invesco Galaxy, VanEck, and Franklin Templeton, have announced fees ranging from 0.19% to 0.25%, with various temporary waivers. Grayscale has set a notably higher fee at 2.5% (10 times more expensive than its competitors) for its Ethereum Trust but aligned its mini trust fee at 0.25%. The SEC has approved 19b-4 forms for eight spot Ethereum ETFs, with trading expected to begin on Tuesday.

State Street Interested in Stablecoins

According to Bloomberg, State Street is exploring ways to settle payments on the blockchain, potentially creating its own stablecoin and deposit token. These initiatives, still under wraps, align with its recent efforts to integrate digital assets into its traditional financial operations. The company is also evaluating participation in digital-cash consortia and exploring settlement options through its investment in the blockchain payment startup Fnality. This move comes as other traditional financial firms like PayPal, Visa, Mastercard, and JPMorgan Chase explore similar blockchain-based payment solutions. State Street, already providing services for crypto ETFs, is focusing on tokenizing assets and recently partnered with Galaxy Asset Management to develop digital assets ETFs. While there is no indication of which chain they would look to build on, this further cements stablecoins as one of the killer use cases for crypto rails.

CIFR Considering Sale

Also according to Bloomberg, Cipher Mining (CIFR) is considering a potential sale after receiving takeover interest due to the rising demand for data centers driven by the AI boom. The U.S.-based Bitcoin mining company is collaborating with advisers to assess buyer interest. Although deliberations are in the early stages and there’s no certainty of a sale, this rumor marks the second potential mining deal in less than a month. CleanSpark’s (CLSK) agreed to buy GRIID Infrastructure (GRDI) for $155 million just a few weeks ago. Cipher, which went public in 2021 via a SPAC merger, has not commented on the matter.

Technical Strategy

Given the upcoming ETH ETF launch, it’s interesting to see the ETHBTC chart starting to show a bit more evidence of stabilization and higher relative momentum within its downtrend which has persisted since September 2022. As shown below, the ETHBTC ratio has continued to favor Ethereum underperformance vs. Bitcoin for nearly two years, but that possibly could be changing. Following a sharp period of outperformance in May of this year, the last two months have seen this ratio hold up near the highs of this prior monthly gain. To have confidence of a larger period of outperformance, ETHBTC will require a breakout of the downtrend near 0.056. However, i sense that this could be approaching in the weeks/month ahead and it’s worth keeping a close eye on. Movement to new monthly highs in ETHBTC should help spur on some intermediate-term outperformance in Ethereum over Bitcoin that seems to be approaching.

Daily Important MetricsAll metrics as of 2024-07-18 12:00:24 All Funding rates are in bps Crypto Prices

All prices as of 2024-07-18 14:49:44 Exchange Traded Products (ETPs)

News

|