Positive Regulatory News for STX, Germans Almost Out of BTC

Crypto Market Update

Today’s Producer Price Index (PPI) came in at 0.2%, above the consensus forecast of 0.1%, initially sending rates higher, but that move was quickly faded. Rates and the DXY moved more decisively lower following the release of the latest consumer sentiment survey, which came in at 66, below the market forecast of 68.5. In equity markets, we are seeing a continuation of the rotation trade, with IWM outpacing the SPX for a second consecutive day. Crypto markets are in the green as the German government hastily reduces their holdings. BTC 0.95% has reclaimed $58k, while ETH 0.92% is attempting to move back above $3150, and SOL 4.30% is trading just under $140. ETH 0.92% beta names such as MKR -1.19% and LDO 1.87% are outperforming on the day, likely due to positioning ahead of possible movement on the ETF front. Additionally, STX N/A% is up nearly 5% following news that the SEC is dropping a long-running investigation into the token.

Good News for STX

The SEC has ended its investigation into Hiro Systems, formerly known as Blockstack. This investigation was initiated following Hiro’s 2019 Regulation A offering of Stacks (STX N/A% ) tokens, which were initially treated as securities. According to Hiro, the SEC’s latest action is the result of successfully arguing that the launch of the Stacks 2.0 blockchain and efforts to decentralize the Stacks ecosystem mean that STX N/A% tokens no longer qualify as securities under the Howey test, as there was no central managerial role expected to drive returns for token holders. This led to the SEC dropping the investigation, providing regulatory clarity and allowing Hiro to focus on expanding Bitcoin’s Layer 2 solutions without the ongoing burden of securities regulations. This is great news for STX N/A% , as it reduces regulatory risk for both developers and users. It may also result in greater liquidity for the token, as more exchanges provide access to it in regions that are more scrutinous towards projects being investigated by the SEC.

Germans Almost Out of BTC

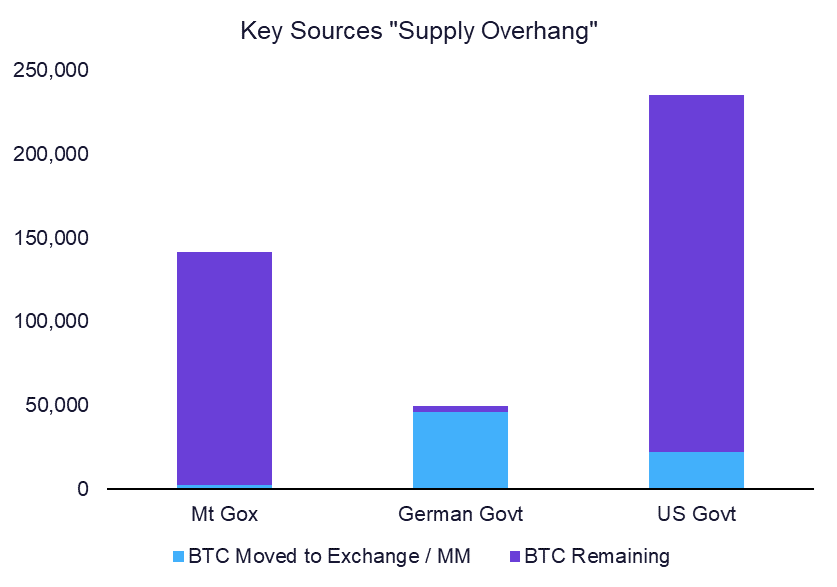

The German state of Saxony is nearing the end of its Bitcoin liquidation, having transferred all but 3,846 BTC 0.95% , worth approximately $221 million, to various crypto exchanges and brokers as of Friday morning. This is less than 8% of the original 50,000 BTC 0.95% it began selling three weeks ago. At the current pace, the Germans could exhaust their BTC 0.95% supply by the end of the day today or early next week. It is important to note that partner exchanges often send a portion of BTC 0.95% back to the German government’s cold wallets toward the end of each trading day, presumably due to not being able to fill OTC orders at the desired price or size. This is certainly a positive for the market as it demonstrates the ease with which the market is able to absorb quick influxes of supply, and it could reduce the impact when the Gox coins start to move on-chain. For more information regarding our thoughts on how to approach the sources of supply overhang from the Germans, Mt. Gox, and the US government, please see yesterday’s weekly strategy note, in which we describe our views in more depth.

Technical Strategy

Following a steep 40% correction over the last couple of months, Bitcoin Cash has shown a few signs of stabilizing which might lead to an oversold bounce. As shown, prices fell to test the area right near prior peaks from Summer 2023 which intersected near $329. The decline in BCH 2.57% took the shape of two sharp corrective declines which were nearly equal in price points lost since early April. Today’s bounce has been helpful in moving back to multi-day highs. However, at $352, this hits the current downtrend from early June and is not yet strong enough to claim an upside breakout has been achieved. Moreover, the area at the early May lows at $399 will prove to be the more important area to surpass, and when that happens, than a rally back to near $500 can get underway. At present, any failure to get above $399 might result in a final pullback under $200 into August. However, BCH looks interesting as a risk reward given this recent decline but will need to show more strength to be convincing of a larger low in place.

Daily Important MetricsAll metrics as of 2024-07-12 12:00:22 All Funding rates are in bps Crypto Prices

All prices as of 2024-07-12 18:39:47 Exchange Traded Products (ETPs)

News

|