Coins Continue Rolling Over, RIOT Buys More BITF

Crypto Market Update

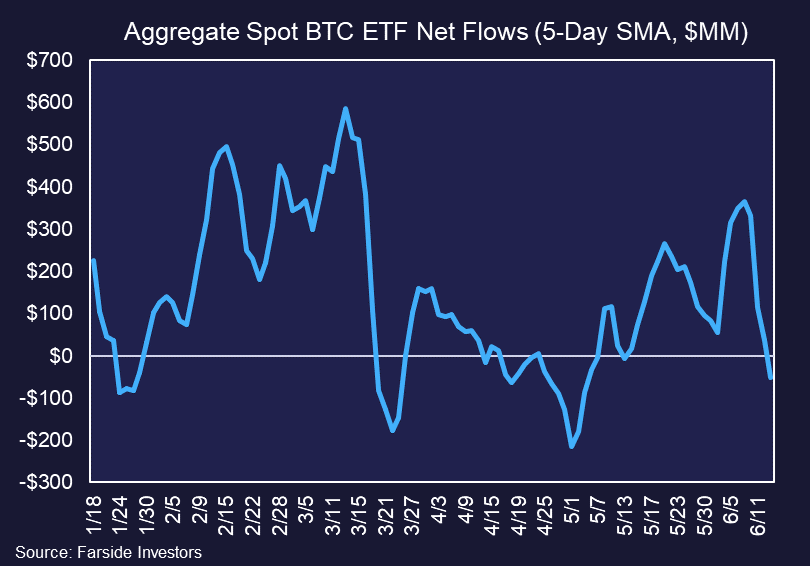

Economic data continues to soften, with today’s consumer sentiment survey coming in at 65.6, below the consensus market forecast of 72. One-year inflation expectations remain unchanged compared to last month. Rates are lower again today, but the DXY is higher due to outsized weakness in global markets. We sent out a note today recommending relative risk aversion in the immediate term as crypto continues to weaken. BTC 3.41% is trading down to $65,000, ETH 5.89% is now below $3,400, and SOL 7.25% is testing the $140 level. Crypto equities are largely following suit. Equities are broadly lower as well, with the ^SPX in the red but the QQQ -0.39% slightly in the green as large-cap tech continues to hold up well. Below, we see the change in ETF flow trend, with yesterday’s $200 million in outflows turning the 5-day moving average negative across all ETFs.

RIOT Ignores Poison Pill

Riot Platforms (RIOT -4.81% ) has increased its stake in Bitfarms (BITF -5.15% ) to 14% by purchasing an additional 1,432,063 shares for about $3.87 million, continuing its hostile takeover attempt. Last month, Riot’s $950 million acquisition bid was met with Bitfarms’ adoption of a “poison pill” strategy to prevent the takeover, which dilutes an acquirer’s stake if they exceed a 15% threshold between June 20 and September 10. Riot criticized this move and plans to nominate independent directors to Bitfarms’ board at a special shareholders’ meeting. Bitfarms’ stock recently rose 15% following an announcement of its U.S. expansion plans, while Riot’s market cap stands at $3.17 billion compared to Bitfarms’ $1 billion.

MSTR Convertible Pricing

MicroStrategy (MSTR -2.92% ) has announced the pricing for its $700 million offering of 2.25% convertible senior notes, set to close on June 17. These notes, maturing in 2032 unless repurchased, redeemed, or converted, will be sold privately to qualified institutional buyers. The conversion rate is initially 0.4894 shares of MicroStrategy class A common stock per $1,000 principal amount of notes, equivalent to about $2,043.32 per share, a 35% premium over the stock’s volume-weighted average price. The expected net proceeds of approximately $687.8 million will be used to purchase additional bitcoin and for general corporate purposes. MicroStrategy currently holds 214,400 bitcoins. The company initially aimed to raise $500 million with an additional $75 million option.

Technical Strategy

Rocket Pool experienced a huge surge to monthly highs today on above-average volume Friday, and is set to make the highest weekly close since mid-May. Despite some intra-day weakness off early highs, the act of climbing above $21.75 has successfully broken out above the minor downtrend from late May. Structurally this helps to improve the structure following its weakness in recent weeks, and RPL 1.87% managed to bottom out this week right near an area of strong support at May lows. Initial resistance targets lie near $24.50 while movement above could lead to a retest of the 50% retracement level near $30.58. Only a decline back under $18.24 would postpone the rally, but Friday’s gains look quite constructive technically speaking.

Daily Important MetricsAll metrics as of 2024-06-14 12:00:36 All Funding rates are in bps Crypto Prices

All prices as of 2024-06-14 13:51:37 Exchange Traded Products (ETPs)

News

|