$5 Billion in Quarterly Options Expiry, MicroStrategy Continues Bidding

Market Update

- Equities and crypto markets are drifting lower amid continued pressure from rising yields. The 10-year Treasury is higher by 8 bps, topping 4.5%, corresponding with a rise in DXY, which tends to move inversely to crypto prices. Markets have continued to move lower after interpreting the Fed as higher for longer last week. The S&P is on track for its second losing month in a row and worst monthly performance since December (-4%). $BTC is down 4.2% in the last week, retracing to $26.1k today after last week’s rally to $27.4k. $ETH is trading at $1.58k while the $ETHBTC pair has reclaimed .06 at writing. Given the headwinds from the dollar and rising interest rates, bullish investors will be hoping for tame inflation numbers from this Friday’s PCE and University of Michigan Inflation expectations. They will also be watching whether the U.S government can avoid a shutdown that would pause all nonessential functions if Congress fails to reach a funding deal by October 1st. Crypto markets will likely continue to trade primarily on shifts in macro and liquidity conditions, barring any unexpected industry-specific catalyst.

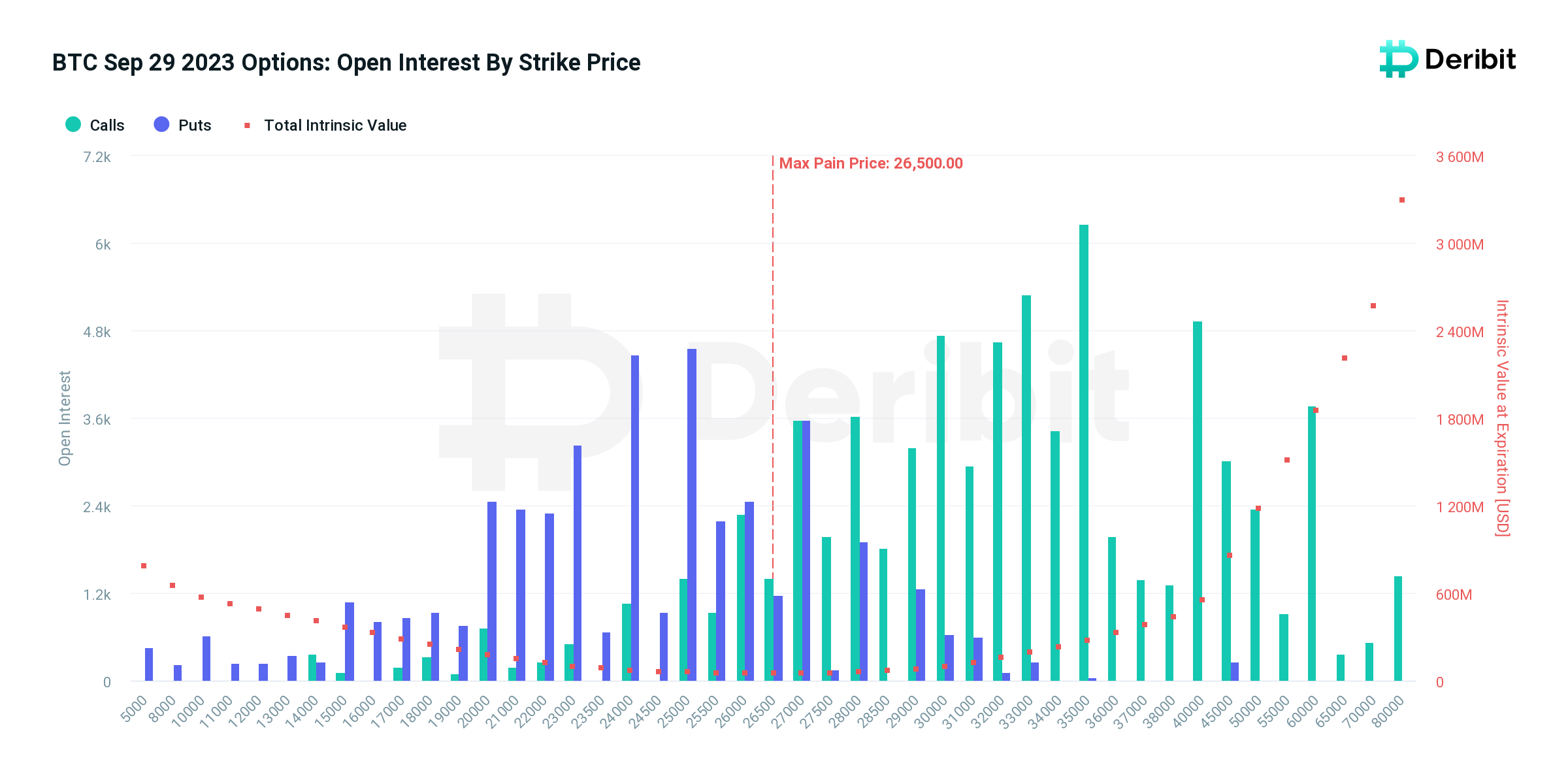

- Traders will be eyeing nearly $5 billion in Derbit options that are set to expire this Friday. Given that quarterly expiries tend to see the highest amount of volume, they are likely to influence price action ahead of settlement. The ‘max pain’ level, where options buyers stand to see the most significant losses upon expiration, sits near current levels at $26.5k for $BTC and $1.65k for $ETH. Many theorize that writers or sellers of options aim to maintain prices close to the maximum pain threshold as the expiration date approaches to inflict the maximum losses. This is achieved by buying and selling activities involving the underlying asset in both the spot and futures markets. Another significant factor contributing to the significance of quarterly settlements is the hedging actions undertaken by market makers or entities responsible for enhancing liquidity within the order book.

- MicroStrategy has added 5,445 more bitcoins to its holdings, spending approximately $147 million at an average price of $27,053 per bitcoin. This purchase boosts its total bitcoin holdings to around 158,245 bitcoins, currently valued at about $4.1 billion, with an average acquisition cost of roughly $29,582 per bitcoin, including fees and expenses. This follows MicroStrategy's previous acquisition of 12,800 bitcoins for approximately $361 million in June and August. Michael Saylor, the CEO of MicroStrategy, has consistently championed Bitcoin as the digital equivalent of gold and a crucial treasury reserve asset. The company entered the Bitcoin market in August 2020 with its first purchase and has since maintained a strategy of accumulating Bitcoin, frequently using debt to fund these acquisitions.

Daily Technical Strategy

Mark L. Newton, CMT

Head of Technical Strategy

Lido remains within a two-month selloff as part of a larger seven-month decline from February 2023 which has resulted in a 50% absolute decline from its highs of just over $3.20. The deterioration into last week's close resulted in a minor break of the minor rally from early September, suggesting a pullback to new 2023 lows is likely underway. Downside technical support targets lie near $1.338 which would represent a 61.8% alternate Fibonacci projection of the initial decline from February-May 2023. While daily charts have begun to show some minor positive momentum divergence in recent weeks, the recent break of $1.55 points to further declines in the weeks to come. To have conviction that $LDO has bottomed, it's important for prices to make at least one weekly close back over $1.64. this would successfully exceed the minor downtrend from July, arguing for a rally back to test initial resistance near $2.00, then $2.40-$2.45. While not expected, any decline under 1.33 would postpone a bottoming process and suggest weakness down to $1.20 or with very strong support near late 2022 lows near $0.90.

Daily Important Metrics

All metrics as of September 25, 2023 12:52 PM

All Funding rates are in bps

Crypto Prices

| Symbol | Market Cap | Last Price | Daily Change | Year to Date | Relative to BTC YTD |

BTC BTC | $512B | $26,241 | ↓ -1.29% | ↑ 58% | |

ETH ETH | $191B | $1,589 | ↓ -0.20% | ↑ 33% | ↓ -26% |

DOGE DOGE | $8.6B | $0.0610 | ↓ -0.87% | ↓ -13% | ↓ -71% |

ADA ADA | $8.6B | $0.2450 | ↓ -0.11% | ↓ -0.74% | ↓ -59% |

SOL SOL | $8.1B | $19.54 | ↑ 0.23% | ↑ 97% | ↑ 39% |

DOT DOT | $5.0B | $4.06 | ↑ 0.52% | ↓ -6.54% | ↓ -65% |

MATIC MATIC | $4.8B | $0.5176 | ↓ -0.88% | ↓ -32% | ↓ -90% |

LINK LINK | $4.2B | $7.47 | ↑ 4.89% | ↑ 34% | ↓ -24% |

NEAR NEAR | $1.0B | $1.11 | ↓ -0.21% | ↓ -13% | ↓ -71% |

Exchange Traded Products (ETPs)

| Symbol | Premium to Nav | Last Price | Daily Change | Year to Date | Relative to BTC YTD |

| GBTC | ↓ -21% | $18.66 | ↓ -1.27% | ↑ 125% | ↑ 67% |

| BITW | ↓ -45% | $11.80 | ↓ -0.30% | ↑ 120% | ↑ 61% |

| ETHE | ↓ -28% | $10.64 | ↓ -3.01% | ↑ 124% | ↑ 65% |

| BTCC | ↓ -0.10% | $4.80 | ↓ -1.03% | ↑ 58% | ↑ 0.01% |

News

QUICK BITS

Coin Telegraph Tether reportedly shuts USDT redemption for some Singapore customer groups Tether in its email said they found Cake DeFi to be controlled by “another corporation that resides in Singapore,” and... |

CryptoSlate TechCrunch founder Arrington steps down from new Celsius board over constitution disagreement Arrington Capital founder Michael Arrington stepped down from his position as a board member of the new company that will take over the operations of bankrupt c... |

Coin Telegraph Chainlink downplays worries after users notice quiet change to multisig Chainlink critics have reiterated concerns about the oracle networks’ supposed centralization after a subtle adjustmen... |

MARKET DATA

Coin Telegraph Vitalik wallet sends 400 ETH worth $600K to Coinbase A wallet associated with Ethereum co-founder Vitalik Buterin has been flagged sending 400 ETH worth $600,000 to Coinba... |

CoinDesk Crypto Traders Brace for Nearly $5B Bitcoin and Ether Options Expiry Options are derivatives that give the purchaser the right to buy or sell the underlying at a pre-determined price at a later date. Quarterly options settlements... |

AMBCrypto Arbitrum Foundation takes custody of unclaimed ARB incentives Six months after reward distribution, millions of ARB tokens are yet to be in the hands of the owners. Now, Arbitrum has no other option than to take this drast... |

Coin Telegraph MicroStrategy buys $147M worth of Bitcoin, now holds 158K BTC MicroStrategy bought the latest Bitcoin stash at an average price of $27,053 per BTC, or 9% lower than the average pur... |

REGULATION

Bitcoin.com Crypto Exchange Bybit Suspending Services in UK to Comply With New Regulations Cryptocurrency exchange Bybit is suspending services in the U.K. next month in order to comply with the new rules set by Britain’s top financial regulator, the ... |

HACKS, EXPLOITS, AND SCAMS

Decrypt.co Mixin Platform Suspends Deposits, Withdrawals After $200M Security Breach Initial reports from PeckShield suggest that Mixin lost millions in various cryptocurrencies including Bitcoin, Ethereum, and DAI. |

Reports you may have missed

As outlined in this weekâs Core Strategy note, our âBuy in Mayâ thesis was kept intact following the Fedâs announcement of tapering QT and a dovish FOMC meeting, helping yields begin to roll over. This morningâs non-farm payrolls data has helped fuel further yield deterioration with a large downside surprise of 175k payrolls vs. 238k expected, and the unemployment rate ticking up to 3.9% (3.8% exp.). The US10Y (-1.68%) briefly...

We are finally starting to see some relief in interest rates and the DXY 0.00% following yesterday's FOMC meeting and the Treasury's quarterly refunding announcement. BTC -0.21% has rebounded from yesterday's low of $56.5k and is now trading just above $59k, while ETH -0.36% is attempting to break through $3k resistance. SOL -0.95% has outperformed, gaining 10% compared to BTC yesterday and is now trading just below $140. The market is showing decent breadth...

Risk markets were selling off before today's FOMC meeting where it was unanimously voted to keep interest rates steady. The Fed announced it would be reducing the speed of its balance sheet taper from $60 billion per month to $25 billion per month, a larger than expected reduction. Following the announcements and Chair Powellâs comments, yields turned sharply lower with the US10Y falling 9 basis points while equity indices rose....

We are witnessing a continuation of the recent weakness in crypto markets today, with BTC -0.21% now testing $60k, ETH -0.36% just below $3k, and SOL -0.95% dipping under $130. The broader altcoin market is experiencing even more pronounced declines, with very few names posting a green candle today. The market was pushed lower in the overnight hours following a disappointing debut from the Hong Kong ETFs (more on that below). However, this...