USDC Issuer Restructures, Crypto ETPS See Weekly Outflows

Market Update

- Bitcoin is extending its slide lower, down 1.0% today and 11.9% weekly to trade at $25.8k. Ethereum is underperforming, losing 2.5% over the last day to trade near $1.6k. Investors expecting a decision on the Grayscale vs. SEC case today were disappointed yet again as no opinions were released. The next possible decision day is this Friday. Nearly 70% of the top 100 tokens are in double digit losses over the past week, with every token in the red except KAS (+2.1%) and RUNE (+9.6%). THORChain’s RUNE has benefited from the release of a lending product that allows users to lend L1 assets to ThorChain and borrow USD denominated debt with no liquidations, interest, or expiration. Kaspa’s KAS has been one of the stronger performing tokens this year, rising 691% so far. The project claims its GHOSTDAG protocol allows it to be the fastest, most decentralized, and fully scalable L1 on the market. Risk-on markets continue to face headwinds from a strong dollar, which is on track to gain for the 6th straight week, up 4% in the same period. Short term rates continue to press higher, with the US 2-year at 5.04%. Longer term rates also remain elevated, with the 10-year and 30-year bonds currently trade at 4.33% and 4.4% respectively.

- Coinbase has acquired a minority stake in Circle Internet Financial and dissolved the Centre Consortium, which used to issue the USDC stablecoin. As a result, Circle will now be the sole issuer of USD, and will take over Centre's governance and operational responsibilities. The revenue generated from the interest on the dollar reserves backing USDC tokens will now be equally shared between Coinbase and Circle. This move solidifies the relationship between the two companies, as Circle has been closely tied to Coinbase through the consortium they founded in 2018. The USDC stablecoin will expand to be available on more blockchains, increasing its accessibility. USDC is currently the second-largest stablecoin by market capitalization after Tether. This type of stablecoin is backed by fiat reserves, like U.S. dollars, and can be redeemed for their equivalent value. Coinbase's revenue structure has evolved, with interest from USDC reserves playing a significant role. This announcement clarifies the partnership between Coinbase and Circle, which had previously been less clear.

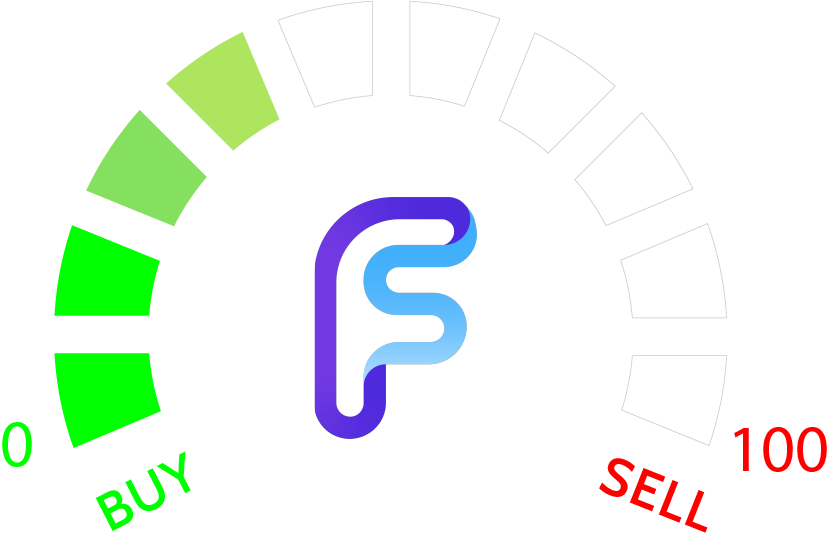

- Amid a crypto market downturn and SEC indecision on a Bitcoin ETF, CoinShares reports that institutional investors withdrew $55 million from crypto ETPs in the past week, attributing the sell-off to disappointment with the SEC's lack of action and concerns about an overhyped market. The decline affected not only Bitcoin but also altcoins like Ethereum, with low trading volumes exacerbating the impact. Ripple stood out with continued institutional inflows, while the recent flash crash in prices aligned with the reported data. Despite the bearish sentiment, CoinShares anticipates increased trading volumes due to upcoming events, as institutional investors await clarity on a Bitcoin ETF and stable market conditions.

Daily Technical Strategy

Mark L. Newton, CMT

Head of Technical Strategy

Avalanche is growing ever so close to bottoming out following its break of former lows from June 2023. Many might see that as a technical break of support. However, this falls in line with a symmetrical five-wave decline which began back in January this year which has produced a series of lower lows and lower highs as part of this ongoing five-wave decline. The most recent peak on 7/10 marked the beginning of the final wave to this decline, and likely could find a bottom in the coming 1-2 weeks, despite the technical pattern appearing to be broken. DeMark-based exhaustion is now apparent on both daily and weekly charts, which adds to the likelihood of an upcoming low for AVAX and then a subsequent rebound in the month of September. Overall, AVAX looks attractive at current levels near $10 and would be even more appealing from a risk/reward perspective on further weakness down to $8.50-$9. Overall, recent weakness looks to likely stabilize and reverse back higher in the near future.

Daily Important Metrics

All metrics as of August 22, 2023 1:10 PM

All Funding rates are in bps

Crypto Prices

| Symbol | Market Cap | Last Price | Daily Change | Year to Date | Relative to BTC YTD |

BTC BTC | $503B | $25,829 | ↓ -1.09% | ↑ 56% | |

ETH ETH | $199B | $1,655 | ↓ -4.99% | ↑ 38% | ↓ -18% |

ADA ADA | $9.2B | $0.2615 | ↓ -3.34% | ↑ 5.94% | ↓ -50% |

SOL SOL | $8.7B | $21.27 | ↓ -7.72% | ↑ 115% | ↑ 59% |

DOT DOT | $5.5B | $4.51 | ↓ -4.25% | ↑ 3.76% | ↓ -52% |

MATIC MATIC | $5.3B | $0.5693 | ↓ -5.63% | ↓ -25% | ↓ -81% |

LINK LINK | $3.3B | $6.13 | ↓ -7.38% | ↑ 10% | ↓ -46% |

NEAR NEAR | $1.1B | $1.13 | ↓ -5.58% | ↓ -11% | ↓ -67% |

DOGE DOGE | $0.0000 | $0.0001 | ↑ 0.00% | ↓ -100% | ↓ -156% |

Exchange Traded Products (ETPs)

| Symbol | Premium to Nav | Last Price | Daily Change | Year to Date | Relative to BTC YTD |

| GBTC | ↓ -27% | $17.08 | ↓ -0.76% | ↑ 106% | ↑ 50% |

| BITW | ↓ -49% | $11.08 | ↓ -1.67% | ↑ 106% | ↑ 50% |

| ETHE | ↓ -34% | $10.17 | ↓ -3.51% | ↑ 114% | ↑ 58% |

| BTCC | ↑ 0.10% | $4.73 | ↓ -1.15% | ↑ 56% | ↑ 0.19% |

News

QUICK BITS

CoinDesk Mantle Stakes $66M of Ether on Lido as Part of Treasury Management Strategy Layer 2 network Mantle has staked 40,000 ether (ETH) on staking protocol Lido after it passed a governance vote on treasury management earlier this month. |

MARKET DATA

Decrypt.co Degen Traders Still Bullish on Friend.tech, Shows Aevo Trading Activity Traders are putting on hefty bids that point to continued bullishness surrounding to the newly launched Friend.tech app. |

CoinDesk Friend.Tech Hype Sees Base Surpass Rival Layer 2 Blockchains in Average Transactions per Second Base, the layer 2 blockchain backed by Coinbase (COIN), averaged a record high of 15.88 transactions per second (TPS) over the past 24-hours, beating Ethereum a... |

Decrypt.co ‘Disappointing’ ETF Decisions By SEC Blamed for Bitcoin Outflows Amid a widespread crypto sell-off and SEC stalling, CoinShares reports that institutional investors sold $55 million worth of Bitcoin in the past week. |

FUNDRAISING AND M&A

Decrypt.co Coinbase Buys Stake in Circle, Dissolving USDC Issuer Centre Circle will now be the only issuer of the USDC stablecoin. |

Coin Telegraph Oman launches $370M crypto mining center: Report The mining facility comes as part of a plan to accelerate the digitalization of Oman’s economy, which is mainly depend... |

PRODUCT UPDATES AND PARTNERSHIPS

CryptoSlate EDX Markets partners with Anchorage Digital for clearinghouse custody service EDX Markets, an institutional crypto exchange launched on June 20, 2023, has announced its partnership with Anchorage Digital as the custody provider for its up... |

HACKS, EXPLOITS, AND SCAMS

Coin Telegraph Friend.tech denies report that database of over 100K users was ‘leaked’ Friend.tech has hit back at a report which suggested that its API “leaked” personal data of its users. ... |

Reports you may have missed

The crypto market declined overnight, with BTC 6.69% dropping from $63k to $61k, SOL 13.00% from $150 to $145, and ETH 4.00% dipping below the $3k mark once again. The likely cause of the drawdown was upward pressure on the DXY 0.00% and a lack of follow-through in flows. Among the few outperformers of the day were RUNE 16.31% , the native token of the cross-chain swapping protocol Thorchain, and Ethereum Classic (ETC 6.44% ), possibly driven by...

Risk assets are starting the week on a strong note after a week marked by dovish data and the US Treasury's accommodating refunding schedule. Despite today's bounce in interest rates, the DXY remains relatively flat. Major equity indexes are showing slight gains, with healthcare and technology stocks leading the way. In the crypto market, assets are generally on the rise, with the recent rally broadening to other areas of the...

On Tuesday, major equity indices saw a decline attributed to global economic concerns, particularly centered around China, and cautionary statements from Fitch regarding further potential downgrades in ratings for U.S. banks. Despite these apprehensions, July's U.S. retail sales data defied expectations, registering a 0.7% monthly increase, surpassing economists' expectations of 0.4%. This outcome underscored the enduring strength of the U.S. consumer. Interestingly, the day witnessed relatively stable rates, which could...