SEI Token Launches, Potential Grayscale Decision Friday

Market Update

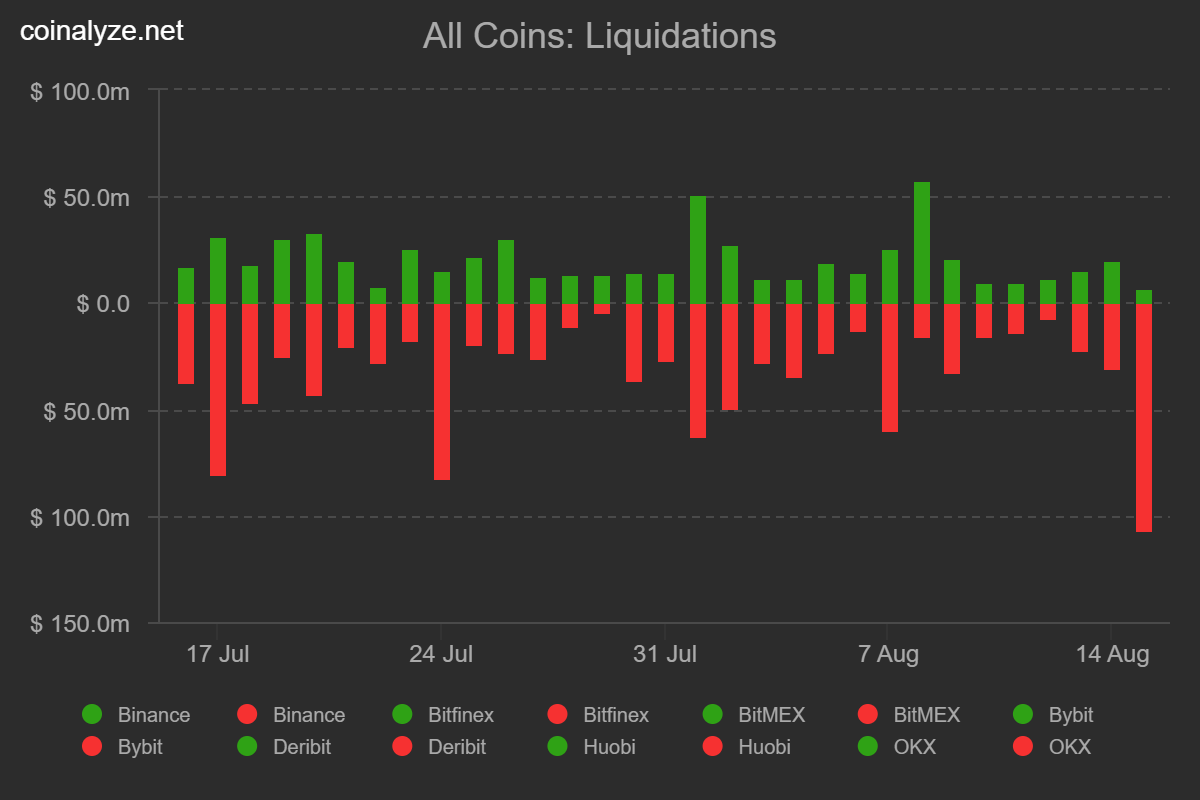

- On Tuesday, major equity indices saw a decline attributed to global economic concerns, particularly centered around China, and cautionary statements from Fitch regarding further potential downgrades in ratings for U.S. banks. Despite these apprehensions, July's U.S. retail sales data defied expectations, registering a 0.7% monthly increase, surpassing economists' expectations of 0.4%. This outcome underscored the enduring strength of the U.S. consumer. Interestingly, the day witnessed relatively stable rates, which could be attributed to the conflicting influences of robust domestic data and sluggish global economic indicators. The crypto market continued to move sideways until alts sold off around 3 pm EST, prompted by long liquidations amounting to over $84 million. Both BTC and ETH faced a minor dip but generally adhered to their established trading ranges of recent weeks. However, other altcoins experienced more noticeable declines, with major Layer 1 tokens trading 2-3% lower. Notably, the day's standout performer was RUNE, surging by 14% within the last 24 hours and achieving a remarkable 60% increase over the past week. This upswing could be attributed to the introduction of Thorchain's novel lending protocol, allowing users to borrow against their BTC and ETH holdings.

- Grayscale may receive a verdict on its case against the SEC this coming Friday. Scott Johnsson of Van Buren Capital noted that U.S. District Courts often settle cases in August, prior to the arrival of new law clerks. Moreover, 30 of the 32 cases in both March 2021 and 2022 were settled within 160 days post-oral testimony. Considering that Grayscale presented its case on March 7, a decision is likely imminent. Only a few cases from March, including Grayscale's, remain unresolved. Johnsson highlighted that the court typically announces decisions on Tuesdays and Fridays. Since no decision was made today, and given that this week falls within the usual timeline for a court decision, there's a high chance Friday will bring news of the verdict. As a reminder, a win for Grayscale would be a significant catalyst, potentially bolstering the likelihood of a spot ETF approval and possibly even hastening it. Such a victory would likely lead to a substantial rally for the trust products GBTC 7.05% and ETHE 5.93% .

- Sei Labs has unveiled the Sei Blockchain mainnet following a testnet phase that saw participation from 7.5 million distinct wallets and processed over 400 million transactions. This blockchain is designed specifically for efficient digital asset trading. Sei boasts high transaction speed, handling up to 20,000 transactions in less than 500 milliseconds in its testing phase, outpacing competitors such as Solana, which processes 10,000 transactions in 2.5 seconds. Constructed initially using the Cosmos SDK, Sei underwent a two-year overhaul to refine its infrastructure. At its mainnet launch, 30 to 40 primarily independent validators will support the Sei network. Over 250 teams, including SushiSwap, are gearing up to launch on mainnet, with some planning to craft novel contracts using a specialized smart contract language. As of today's launch, SEI is trading at a $1.7 billion market cap. It is a fairly rich valuation for a public mainnet launch but compares favorably to other high-speed L1 competitors, such as APT 1.21% at $6.8 billion, SUI at $5.6 billion, and SOL at $13.2 billion.

Daily Technical Strategy

Mark L. Newton, CMT

Head of Technical Strategy

Polygon's pattern this year seems to be following the technical playbook with regards to an Elliott-wave style five-wave decline following last year's three-wave bounce. If this comes to fruition, then prices should ultimately dip down under early June lows at $0.5059 before any meaningful low is at hand. The technical structure thus far since February 2023 has resembled four waves out of a possible five which adhere to traditional wave structure. Thus, until evidence of this existing six-month downtrend showing some trend improvement and MATIC getting back above $0.9424 (which would turn trends bullish, invalidating this thinking) than further weakness during this seasonally difficult month looks possible before MATIC can bottom. This could result in an initial break of June lows that causes a retest or slight undercut of last year's trough at $0.3162, but would represent a very attractive buying opportunity in the weeks/months ahead if/when this occurs. Breaks of $0.505 should cause investors to set alerts near former lows, as this should represent a good level of support from a risk/reward basis in the weeks to come.

Daily Important Metrics

All metrics as of August 15, 2023 10:09 AM

All Funding rates are in bps

Crypto Prices

| Symbol | Market Cap | Last Price | Daily Change | Year to Date | Relative to BTC YTD |

BTC BTC | $568B | $29,190 | ↓ -0.66% | ↑ 76% | |

ETH ETH | $220B | $1,827 | ↓ -0.89% | ↑ 52% | ↓ -24% |

ADA ADA | $9.9B | $0.2826 | ↓ -2.84% | ↑ 14% | ↓ -62% |

SOL SOL | $9.7B | $23.95 | ↓ -4.34% | ↑ 142% | ↑ 66% |

MATIC MATIC | $5.9B | $0.6378 | ↓ -6.13% | ↓ -16% | ↓ -93% |

DOT DOT | $5.8B | $4.81 | ↓ -3.65% | ↑ 11% | ↓ -66% |

LINK LINK | $3.8B | $7.03 | ↓ -5.19% | ↑ 27% | ↓ -50% |

NEAR NEAR | $1.2B | $1.28 | ↓ -4.14% | ↑ 0.77% | ↓ -75% |

DOGE DOGE | $0.0000 | $0.0001 | ↑ 0.00% | ↓ -100% | ↓ -176% |

Exchange Traded Products (ETPs)

| Symbol | Premium to Nav | Last Price | Daily Change | Year to Date | Relative to BTC YTD |

| GBTC | ↓ -24% | $19.66 | ↓ -2.29% | ↑ 137% | ↑ 61% |

| BITW | ↓ -50% | $12.46 | ↓ -1.74% | ↑ 132% | ↑ 56% |

| ETHE | ↓ -36% | $11.06 | ↓ -2.64% | ↑ 132% | ↑ 56% |

| BTCC | ↑ 0.13% | $5.34 | ↓ -0.74% | ↑ 76% | ↑ 0.03% |

News

QUICK BITS

CoinDesk Sei Mainnet is Live After Testnet Sees More Than 7.5M Wallets Created The trading focused layer 1 blockchain is backed by Jump Crypto and Flow Traders. |

REGULATION

CoinDesk FDIC Crypto Warning Underlines U.S. Banking Agencies' Arm’s-Length Policy The U.S. Federal Deposit Insurance Corp. added crypto as one of five broad categories this year in its annual risk report, a snapshot of the dangers the banking... |

Coin Telegraph US lawmakers press SEC and FINRA on Prometheum's broker-dealer approval Members of the House Financial Services Committee questioned the “timing and circumstances” of FINRA approving Prometh... |

FUNDRAISING AND M&A

Decrypt.co Zepeto, Jump Crypto Raise $13 Million for ZTX Metaverse on Arbitrum South Korea's leading metaverse platform Zepeto is betting big on NFTs with its ZTX joint venture with Jump Crypto, which led the seed round. |

CoinDesk Dinari Raises $7.5M for Decentralized Stock Trading Platform Backers for the dShares platform, which will be available ex-US, included a Susquehanna subsidiary. |

MINING

Coin Telegraph Perfect storm for undervalued ASICs: Blockstream plans $50M raise to buy miners Blockstream intends to buy and store ASIC mining hardware ahead of Bitcoin’s halving in 2024. Bloc... |

WEB 3.0

Decrypt.co Helium Mobile Debuts Crypto Wireless Network in Miami—For $5 a Month Powered by the Helium network, the hybrid mobile carrier takes its first public steps with a cheap unlimited plan and crypto token rewards. |

Reports you may have missed

MARKET COMMENTARYINVESTORS WELCOMED THIS MORNING’S SLIGHTLY SOFTER THAN EXPECTED CPI DATA AND A LARGE DOWNSIDE MISS ON U.S. RETAIL SALES, ALLEVIATING INFLATION CONCERNS AND HELPING TO PROPEL STOCK INDICES TO NEW INTRADAY ALL-TIME HIGHS. The SPY 1.14% and QQQ 1.54% have gained over 1% to surpass $528 and $451, respectively, while US treasury rates have turned significantly lower, with the US10Y dropping below 4.34%. Crypto is responding in similar fashion with BTC 6.67% ...

Tornado Cash Developer Sentenced to 5 Years in Prison, LayerZero Succeeding Against Sybils

CRYPTO MARKET COMMENTARYAPRIL PPI CAME IN MIXED THIS MORNING, WITH A LARGE UPSIDE SURPRISE IN MOM READINGS (0.5% VS. 0.3% EXP.) AND YOY METRICS LARGELY IN LINE WITH EXPECTATIONS. The upside in the MoM reading was offset by March figures being revised downwards. Yields initially spiked upon the data release but have turned negative across the curve. Equities are showing mild gains as attention shifts towards tomorrow’s CPI data release. The SPY 1.14% has gained 0.17% and the QQQ 1.54% has gained 0.31%. Crypto assets are...

CRYPTO MARKET COMMENTARYBITCOIN REBOUNDED OVER THE WEEKEND, WITH PRICES FULLY RECOVERING FROM FRIDAY'S DRAWDOWN BY MONDAY MORNINg. BTC 6.67% is now trading just below $63k. Meanwhile, both ETH 3.66% and SOL 13.57% have lagged, trading at $3950 and $146, respectively. Altcoin flows seem to have shifted towards memecoins, which are outpacing the rest of the market today, with gains exceeding 5% from BONK 9.11% , DOGE 17.20% , and PEPE. This interest in memecoins likely stems from...

MARKET COMMENTARYA PRETTY SIZEABLE MISS IN TODAY'S CONSUMER SENTIMENT SURVEY REVERSED MOST OF THE GAINS EXPERIENCED IN THE CRYPTO MARKET OVER THE PAST 24 HOURS. Consumer sentiment came in at 67.4, well below market expectations of 77.2. 1Y inflation expectations came in at 3.5%, well above the market forecast of 3.2%. We saw the DXY 0.00% turn sharply higher on the move, and most risk assets sold off. BTC 6.67% fell from...