ETHE Discount Shrinking, ETP Flows Remain Strong

Market Update

- Despite underwhelming retail sales data, positive earnings reports are driving equity markets upward. The increase in advance retail sales for June was a mere 0.2% month-over-month, falling below economists' predicted 0.5% increase. Nevertheless, the QQQ index has seen a 60 bps rise, and the SPX index a 52 bps increase. Cryptoassets are diverging from equities, not mirroring the rally spurred by solid earnings. At present, most cryptoassets are on a downward trend, with $BTC dropping below $30k and $ETH below $1.9k. This decline can be partially attributed to the surge in short-term rates and the bounce in the US Dollar Index ($DXY) to back over 100. Amid this landscape, one of the few winners is $SUI, a high-throughput blockchain network that has recently seen an increase in usage, up 8% on the day.

- As regulatory risks are being reevaluated, the discount for the Grayscale Ethereum Trust ($ETHE) is narrowing, in line with the trend seen with $GBTC. Although there are no current applications for an Ethereum ETF, there is a growing belief that the recent Ripple ruling, which declared XRP as a non-security, suggests that Ethereum would not be treated as a security by the courts. In theory, this development sets the stage for a future Ethereum ETF if sufficient demand exists. The current discount of ETHE to its net asset value (NAV) has decreased to 39% from around 46% just last week. Given the Ripple ruling and the potential for ETF-related momentum, we maintain a positive outlook on GBTC and recommend considering ETHE as well, as its performance is likely to correlate with that of GBTC moving forward.

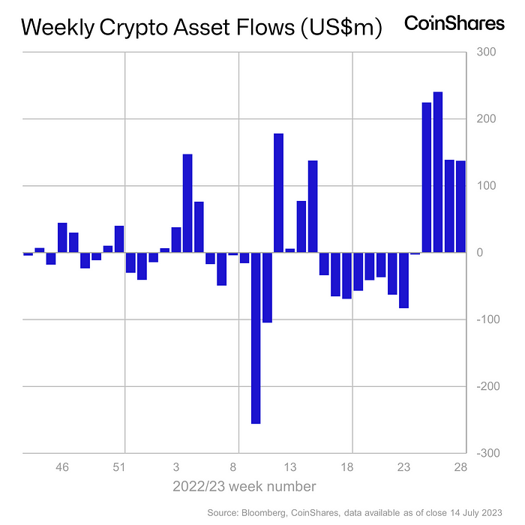

- According to data compiled by Coinshares, the interest in crypto exchange-traded products (ETPs) grew for the fourth consecutive week. Last week, digital asset investment products received a significant inflow of $137 million, contributing to a total of $742 million in inflows over the past four weeks. This marks the longest stretch of consecutive inflows since Q4 2021. Most of these inflows were driven by Bitcoin, which accounted for $140 million or 99% of the total. Conversely, short Bitcoin investment products experienced outflows for the 12th straight week, totaling $3.2 million. In a surprising turn of events, Ethereum, despite its recent price appreciation, witnessed outflows of $2 million last week, establishing itself as the asset with the highest outflows year-to-date. However, altcoins such as Solana, Polygon, and Litecoin saw minor inflows ranging from $0.3 million to $0.5 million each. While speculative demand alone does not prove a bull market, this supports the idea that retail investors are reassessing regulatory risks following BlackRock's ETF application and last week's victory for Ripple and are possibly considering crypto as a "catch-up trade" due to being under-allocated to equities for the better part of this year.

Daily Technical Strategy

Mark L. Newton, CMT

Head of Technical Strategy

Tuesday’s strength is helping to lift Hedera Hashgraph to the highest levels since early May on a day when many cryptocurrencies have been losing ground. Daily charts show Tuesday’s surge which is exceeding highs of the past five days on above-average volume. The move above $0.52 also helps to surpass the former high closes from late June, which structurally make $HBAR much more attractive. Gains look likely up to $0.063 initially, then $0.075 which would help this test former peaks made in late March which also line up with a Fibonacci-based 61.8% price retracement. Overall, this looks favorable as a bullish risk/reward to move higher into early August, and momentum is positively sloped and has not reached overbought levels. Support to buy dips lies at $.050.

Daily Important Metrics

All metrics as of July 18, 2023 1:33 PM

All Funding rates are in bps

Crypto Prices

| Symbol | Market Cap | Last Price | Daily Change | Year to Date | Relative to BTC YTD |

BTC BTC | $579B | $29,772 | ↓ -0.92% | ↑ 80% | |

ETH ETH | $227B | $1,889 | ↓ -0.41% | ↑ 58% | ↓ -22% |

ADA ADA | $11B | $0.3036 | ↓ -2.17% | ↑ 23% | ↓ -57% |

SOL SOL | $10B | $25.38 | ↓ -2.66% | ↑ 156% | ↑ 77% |

MATIC MATIC | $6.9B | $0.7422 | ↓ -3.71% | ↓ -2.62% | ↓ -82% |

DOT DOT | $6.2B | $5.14 | ↓ -1.90% | ↑ 18% | ↓ -61% |

LINK LINK | $3.7B | $6.91 | ↓ -0.86% | ↑ 24% | ↓ -55% |

NEAR NEAR | $1.4B | $1.45 | ↑ 1.02% | ↑ 14% | ↓ -65% |

DOGE DOGE | $0.0000 | $0.0000 | ↓ -3.93% | ↓ -100% | ↓ -180% |

Exchange Traded Products (ETPs)

| Symbol | Premium to Nav | Last Price | Daily Change | Year to Date | Relative to BTC YTD |

| GBTC | ↓ -27% | $19.93 | ↑ 0.05% | ↑ 140% | ↑ 61% |

| BITW | ↓ -48% | $13.31 | ↓ -0.08% | ↑ 148% | ↑ 68% |

| ETHE | ↓ -40% | $11.54 | ↑ 4.24% | ↑ 143% | ↑ 63% |

| BTCC | ↓ -0.10% | $5.45 | ↓ -0.55% | ↑ 80% | ↑ 0.15% |

News

QUICK BITS

The Block US law enforcement seizes tens of millions from Deltec-tied accounts The accounts were flagged to law enforcement because they did not include sufficient know-your-customer information. The post US la... |

Decrypt.co SEC Accepts Valkyrie Bitcoin ETF Proposal for Official Review The financial services firm has adopted ‘BRRR’ as the ticker for its ETF, the second application after BlackRock to be accepted by the regulator. |

MARKET DATA

CoinDesk Arkham's Token Debuts at $0.75 After Being Sold for $0.05 in Binance Launchpad Blockchain analytics firm Arkham Intelligence's native token (ARKM) is trading at $0.74 with a $107 million market cap after it was issued to beta testers and B... |

The Block Cathie Wood’s Ark Invest sells more Coinbase shares worth $26 million Cathie Wood's Ark Invest sold more shares of Coinbase on Monday worth $26 million as the fund manager is taking profits. The post C... |

CoinDesk Levered Bullish Longs Getting Liquidated as Bitcoin Market Softens CoinGlass data shows that in the last 24 hours, $116.38 million worth of futures bets were liquidated, with $85.68 in bullish long positions. |

DOSE OF DEFI

The Block Synthetix is targeting a Q4 launch for Perps V3 and Infinex: Kain Warwick Synthetix founder Kain Warwick argued that Synthetix building a front end called Infinex could help Perps V3 take on centralized exchanges. ... |

REGULATION

Decrypt.co Coinbase CEO to Meet House Democrats, Discuss Crypto: Report As part of the exchange’s bid for regulatory clarity, Brian Armstrong reportedly plans to meet the New Democrat Coalition. |

Decrypt.co SEC Chair Gensler 'Disappointed' in Ripple Court Ruling on Retail Investors The head of the U.S. securities regulator also spoke about SEC’s recent enforcement actions on the cryptocurrency markets. |

FUNDRAISING AND M&A

Decrypt.co Futureverse Raises $54 Million From 10T, Ripple Labs for Metaverse Push The startup, which previously combined several smaller projects into one brand, is keen on an open metaverse and AI-powered gaming. |

The Block CoinFund to back early crypto startups with fresh $158 million: Bloomberg The raise is 26% higher than CoinFund intended after originally aiming for $125 million. The post CoinFund to back early crypto star... |

The Block DeFi mortgage startup PWN raises $2 million in funding PWN plans to roll out a DAO to give its community control over DeFi mortgage financing, as well as other accessibility improvements. ... |

WEB 3.0

Coin Telegraph Vitalik Buterin shares account abstraction challenges in Ethereum: EthCC Vitalik Buterin explained how an account abstraction extension called “paymasters” can allow users to pay for gas fees... |

Reports you may have missed

As outlined in this weekâs Core Strategy note, our âBuy in Mayâ thesis was kept intact following the Fedâs announcement of tapering QT and a dovish FOMC meeting, helping yields begin to roll over. This morningâs non-farm payrolls data has helped fuel further yield deterioration with a large downside surprise of 175k payrolls vs. 238k expected, and the unemployment rate ticking up to 3.9% (3.8% exp.). The US10Y (-1.68%) briefly...

We are finally starting to see some relief in interest rates and the DXY 0.00% following yesterday's FOMC meeting and the Treasury's quarterly refunding announcement. BTC 6.03% has rebounded from yesterday's low of $56.5k and is now trading just above $59k, while ETH 3.93% is attempting to break through $3k resistance. SOL 4.18% has outperformed, gaining 10% compared to BTC yesterday and is now trading just below $140. The market is showing decent breadth...

Risk markets were selling off before today's FOMC meeting where it was unanimously voted to keep interest rates steady. The Fed announced it would be reducing the speed of its balance sheet taper from $60 billion per month to $25 billion per month, a larger than expected reduction. Following the announcements and Chair Powellâs comments, yields turned sharply lower with the US10Y falling 9 basis points while equity indices rose....

We are witnessing a continuation of the recent weakness in crypto markets today, with BTC 6.03% now testing $60k, ETH 3.93% just below $3k, and SOL 4.18% dipping under $130. The broader altcoin market is experiencing even more pronounced declines, with very few names posting a green candle today. The market was pushed lower in the overnight hours following a disappointing debut from the Hong Kong ETFs (more on that below). However, this...