XRP Not Deemed a Security, Polygon Proposes "Polygon 2.0"

Market Update

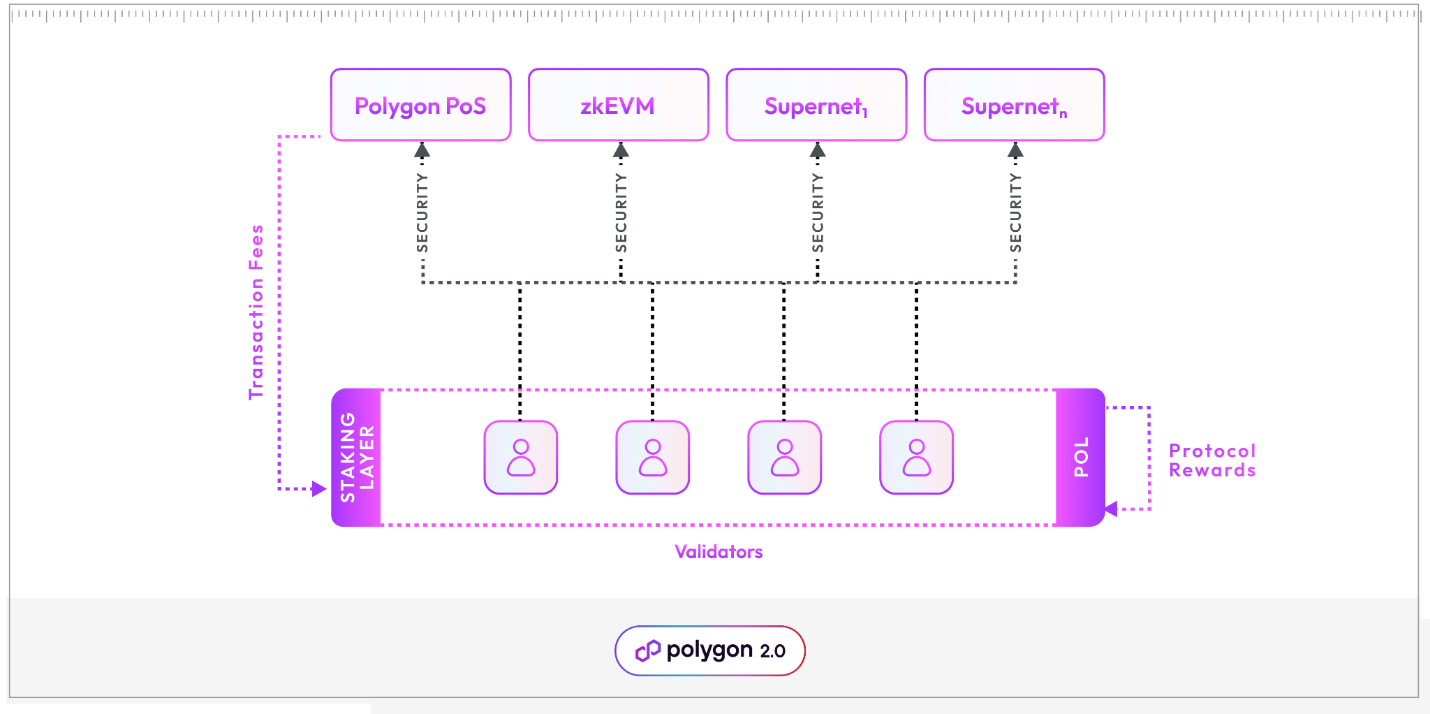

- Crypto markets are sharply rising after a judge has ruled that Ripple’s sales of $XRP do not constitute an offer of investment contracts. $XRP is up 35% following the announcement, and $BTC (+2.41%) has surpassed $31k and $ETH (+3.46%) is nearing $1,950. $MATIC (+9.80%) is outperforming today after a proposal was submitted to make MATIC a multipurpose token used to validate multiple blockchains. The proposal would have the token rebranded to $POL and would span all the Polygon protocols including Polygon PoS, zkEVM, and Supernets. The below figure shows the potential new architecture for “Polygon 2.0.” Traditional markets are rallying after this morning’s PPI data came in lower than expected, coinciding with yesterday’s soft CPI data, easing inflation fears. The $SPY and $QQQ have risen 0.51% and 0.97%, respectively while the $DXY (-0.58%) has fallen below $100 for the first time since Spring of last year.

- Google Play has shifted its stance on incorporating digital assets into apps listed on its store. They announced yesterday that they will now allow developers to integrate things like NFTs into games and apps. The policy change will enable unique features for developers, such as NFT loyalty programs or digital ownership of in-game assets. Companies choosing to integrate tokenized assets will need to clearly state in the Play Console that blockchain elements are included in the app. Additionally, all Google Play apps must continue meeting the marketplace’s gambling requirements, meaning games cannot incorporate features such as “loot boxes” or lotteries. Users can expect to see some preliminary changes implemented towards the end of the summer, and then the policy will be fully unveiled later this year.

- Alex Mashinsky, the co-founder of Celsius, was arrested on Thursday after the collapse of the crypto lender sparked an investigation by the US Department of Justice. Mashinsky, along with others, were charged with various crimes, including securities fraud, commodities fraud, wire fraud, and conspiracy to manipulate Celsius’ token. In addition to the criminal charges against Mashinsky and other executives, Celsius was sued separately by the SEC, CFTC, and FTC. The SEC lawsuit alleges that Celsius committed securities fraud, while the CFTC lawsuit alleges Celsius is guilty of commodities fraud and failing to register as a Commodity Pool Operator. In regards to the FTC lawsuit, Celsius reached a settlement permanently banning the company from handling consumer assets and includes $4.7 billion in fines. The fines will be suspended to permit Celsius to return any remaining assets to creditors involved in the bankruptcy proceedings.

Daily Technical Strategy

Mark L. Newton, CMT

Head of Technical Strategy

$ETHBTC looks to be bottoming, and Thursday's gains to multi-day highs should allow for the start of outperformance in Ethereum to Bitcoin in the days and weeks to come. Daily $ETHBTC charts show some encouraging signs of stabilization recently following nearly a one-month slide lower throughout the month of June. Movement up above 0.064 looks likely in the days ahead, which should drive ETHBTC up to 0.071 which is the first real area of importance. On any successful move over 0.071, this would argue for a much larger rally, which at present, can't be projected right away. Overall, this week's price action makes it right to favor Ethereum over Bitcoin, and higher prices look likely for ETHBTC.

Daily Important Metrics

All metrics as of July 13, 2023 12:17 PM

All Funding rates are in bps

Crypto Prices

| Symbol | Market Cap | Last Price | Daily Change | Year to Date | Relative to BTC YTD |

BTC BTC | $599B | $30,856 | ↑ 1.16% | ↑ 86% | |

ETH ETH | $234B | $1,947 | ↑ 3.41% | ↑ 62% | ↓ -24% |

ADA ADA | $11B | $0.3161 | ↑ 9.32% | ↑ 28% | ↓ -58% |

DOGE DOGE | $9.7B | $0.0692 | ↑ 6.86% | ↓ -1.36% | ↓ -88% |

MATIC MATIC | $7.5B | $0.8032 | ↑ 10% | ↑ 5.39% | ↓ -81% |

DOT DOT | $6.5B | $5.37 | ↑ 4.02% | ↑ 24% | ↓ -63% |

LINK LINK | $3.6B | $6.64 | ↑ 6.68% | ↑ 20% | ↓ -67% |

NEAR NEAR | $1.3B | $1.41 | ↑ 5.21% | ↑ 11% | ↓ -75% |

SOL SOL | $671 | $0.0000 | ↑ 0.00% | ↓ -100% | ↓ -186% |

Exchange Traded Products (ETPs)

| Symbol | Premium to Nav | Last Price | Daily Change | Year to Date | Relative to BTC YTD |

| GBTC | ↓ -26% | $20.45 | ↑ 3.81% | ↑ 147% | ↑ 60% |

| BITW | ↓ -55% | $11.75 | ↑ 0.51% | ↑ 119% | ↑ 33% |

| ETHE | ↓ -44% | $10.46 | ↑ 4.91% | ↑ 120% | ↑ 33% |

| BTCC | ↑ 0.25% | $5.69 | ↑ 2.15% | ↑ 88% | ↑ 1.53% |

News

QUICK BITS

The Block Google Play allows users to earn crypto assets in apps and games Google opens the door to more blockchain-powered smartphone app innovation. The post Google Play allows users to earn crypto assets ... |

The Block Hedge funds are showing robust confidence in crypto, PwC says Traditional hedge funds with current crypto investments plan to either maintain or increase exposure, according to a report from PwC. ... |

MARKET DATA

Bitcoinist Crypto Crime Hits Record Lows, But Ransomware Threat Looms Large: Study Crypto scams have experienced a significant decline of 77% in the first half of 2023, plummeting from a staggering $3.3 billion to $1.1 billion, as shown in a r... |

NewsBTC Fund Manager Vanguard Increases Stake In Bitcoin Mining Stocks To $600 Million Bitcoin mining is a topic that keeps popping up recently on the news concerning the crypto industry. And Vanguard, one of the world’s largest investment firms, ... |

DOSE OF DEFI

CryptoPotato Will MATIC Become POL? New Polygon Proposal Sets Ambitious 2.0 Roadmap Once approved, the MATIC token will be renamed to POL. |

CRYPTO INFRASTRUCTURE

Bitcoin.com Bank of China Expands Digital Yuan Testing to SIM Cards and NFC Payments The state-owned financial institution Bank of China has revealed a partnership with China Unicom and China Telecom in order to test SIM cards and near-field com... |

The Block Wallet Pay enables Bitcoin, Tether and Toncoin payments on Telegram Users will be able to make payments to merchants using Tether, Toncoin and Bitcoin directly within the Telegram app. The post Wallet... |

REGULATION

CryptoPotato S. Korean Regulator to Demand Clear Disclosures on Firms’ Crypto Holdings From 2024 The FSC said the reliability of the information disclosed in the white papers of companies that develop and issue crypto assets cannot be guaranteed. |

FUNDRAISING AND M&A

The Block Binance Labs commits $15 million to buzzy F2P startup Binance Labs, the $9 billion venture arm of the crypto exchange giant, announced that it’s committing $15 million to Xterio, a web3 gaming startup. ... |

CryptoPotato Blockchain Infrastructure Startup Artela Raises $6 Million in Seed Round, Led by Shima Capital [Press Release – Fremont, United States, July 12th, 2023] Artela’s team is on a mission to extend the boundaries of decentralized applications Artela is announc... |

Reports you may have missed

As outlined in this weekâs Core Strategy note, our âBuy in Mayâ thesis was kept intact following the Fedâs announcement of tapering QT and a dovish FOMC meeting, helping yields begin to roll over. This morningâs non-farm payrolls data has helped fuel further yield deterioration with a large downside surprise of 175k payrolls vs. 238k expected, and the unemployment rate ticking up to 3.9% (3.8% exp.). The US10Y (-1.68%) briefly...

We are finally starting to see some relief in interest rates and the DXY 0.00% following yesterday's FOMC meeting and the Treasury's quarterly refunding announcement. BTC 6.54% has rebounded from yesterday's low of $56.5k and is now trading just above $59k, while ETH 4.32% is attempting to break through $3k resistance. SOL 4.95% has outperformed, gaining 10% compared to BTC yesterday and is now trading just below $140. The market is showing decent breadth...

Risk markets were selling off before today's FOMC meeting where it was unanimously voted to keep interest rates steady. The Fed announced it would be reducing the speed of its balance sheet taper from $60 billion per month to $25 billion per month, a larger than expected reduction. Following the announcements and Chair Powellâs comments, yields turned sharply lower with the US10Y falling 9 basis points while equity indices rose....

We are witnessing a continuation of the recent weakness in crypto markets today, with BTC 6.54% now testing $60k, ETH 4.32% just below $3k, and SOL 4.95% dipping under $130. The broader altcoin market is experiencing even more pronounced declines, with very few names posting a green candle today. The market was pushed lower in the overnight hours following a disappointing debut from the Hong Kong ETFs (more on that below). However, this...