ETH as a Security, BRC-20 Token Standard

Market Update

- Mixed payroll and wage growth figures released today are reflected in Friday's trading session thus far. U.S. payrolls rose more than expected (225k) with a gain of 311k in February, while the unemployment rate pushed higher to 3.6%. Monthly wage growth printed 0.2% (vs 0.3% consensus), correlating to a 4.6% increase from a year ago. $SPX (+0.4%) and $QQQ (+0.5%) opened lower before trading slightly above yesterday's close on the ambivalent news, while digital asset markets are also rebounding after bleeding down yesterday. $BTC and $ETH are trading at 6.3% and 6.5% discounts over the past day. Altcoins have generally performed poorly over the past week, with Huobi ($HT) experiencing a 90% flash crash in the past day. Justin Sun has responded by opting to cover losses caused by the volatility and setting up a $100m liquidity fund improve $HT liquidity depth.

- The NYAG, Letitia James, has filed a lawsuit against the cryptocurrency exchange KuCoin for violating securities and commodities laws in the state. The complaint alleges that Kucoin offered access to Terra (LUNA) and TerraUSD (UST), which were previously claimed by the Securities and Exchange Commission (SEC) as securities, and that Ethereum (ETH), the second-largest cryptocurrency by market capitalization, is also a security. The lawsuit further targets KuCoin for misrepresenting itself as an exchange when it acted as a securities and commodities broker-dealer. More importantly, the suit argues that ETH is a security because users can earn financial rewards by holding (and staking) the token since it transitioned to PoS consensus, relying on users to stake ETH to keep the network running. The more ETH a user stakes, the more rewards they can potentially earn. The NYAG's classification has contradicted that of the CFTC, which has long maintained that bitcoin and ether are commodities.

- Following the surge in popularity of ordinal inscriptions, ordinals enthusiasts created "BRC-20," an experimental way to classify, mint and transfer fungible satoshis using the Ordinals protocol. The surge has seen Ordinal inscriptions reach a new single-day peak of about 32k, according to Dune. Domo, a pseudonymous on-chain data enthusiast, launched the BRC-20 implementation and meme-inspired tokens like Doge, Pepe, and even Meme itself have been deployed since. Although some Bitcoin maximalists have criticized the Ordinals protocol, it has excited many creators and collectors about the expanding possibilities around the original blockchain network.

Daily Technical Strategy

Mark L. Newton, CMT

Head of Technical Strategy

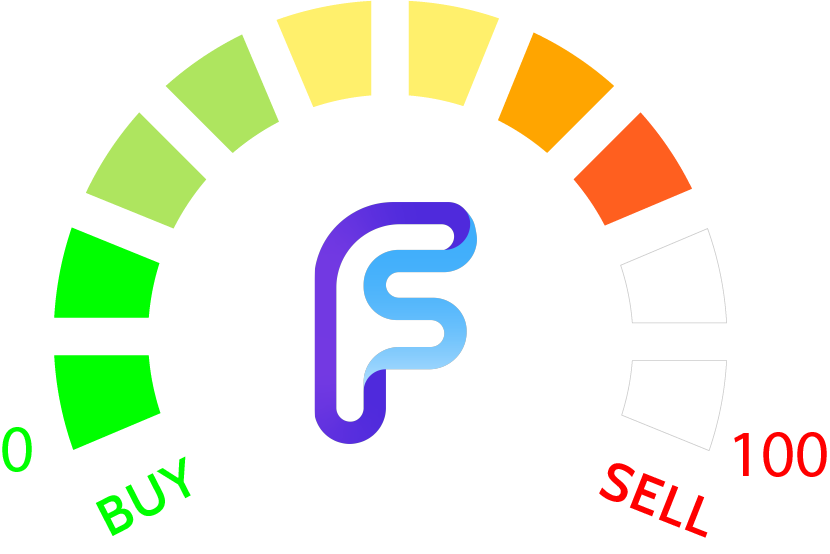

Following a greater than 35% correction in the last 20 days, Polygon looks to be closing in on a very attractive area of support to buy dips. Daily $MATICUSD charts since last May show the uptrend channel that has marked highs and lows of this trend since bottoming last June 2022. Its peak last month at $1.56 came within 5 cents of a 50% retracement of its entire high to low range from December 2021. Recent consolidation over the last three weeks has caused momentum to get close to oversold levels, while price has neared the bottom of this uptrend channel which intersects at 0.90. Overall, MATIC looks appealing at current levels as the risk/reward has improved measurably on its correction. Technically the first meaningful area of upside resistance lies at $1.26-$1.33, with movement above leading to a retest of last month's highs just above $1.56. While this might seem unlikely given the extent of the momentum drawdown in recent weeks, further downside looks marginal for Polygon and should create a buying opportunity into next week. Intermediate-term resistance if/when $1.56 is exceeded lies near $1.91 in 2023.

Daily Important Metrics

All metrics as of March 10, 2023 12:10 PM

All Funding rates are on bps

Crypto Prices

| Symbol | Market Cap | Last Price | Daily Change | Year to Date | Relative to BTC YTD |

BTC BTC | $385B | $19,953 | ↓ -7.09% | ↑ 20% | |

ETH ETH | $173B | $1,410 | ↓ -7.63% | ↑ 18% | ↓ -2.77% |

ADA ADA | $11B | $0.3114 | ↓ -1.35% | ↑ 26% | ↑ 5.70% |

MATIC MATIC | $9.0B | $1.03 | ↓ -3.61% | ↑ 35% | ↑ 14% |

DOGE DOGE | $8.6B | $0.0649 | ↓ -8.95% | ↓ -7.47% | ↓ -28% |

SOL SOL | $6.8B | $17.63 | ↓ -2.63% | ↑ 78% | ↑ 58% |

DOT DOT | $6.4B | $5.47 | ↓ -4.23% | ↑ 26% | ↑ 5.38% |

LINK LINK | $3.2B | $6.17 | ↓ -5.72% | ↑ 11% | ↓ -9.27% |

NEAR NEAR | $1.5B | $1.76 | ↓ -6.03% | ↑ 39% | ↑ 18% |

Exchange Traded Products (ETPs)

| Symbol | Premium to Nav | Last Price | Daily Change | Year to Date | Relative to BTC YTD |

| GBTC | ↓ -36% | $11.63 | ↓ -1.40% | ↑ 40% | ↑ 20% |

| BITW | ↓ -52% | $8.70 | ↓ -0.68% | ↑ 62% | ↑ 42% |

| ETHE | ↓ -48% | $7.22 | ↓ -1.30% | ↑ 52% | ↑ 31% |

| BTCC | ↑ 0.24% | $3.67 | ↓ -1.34% | ↑ 21% | ↑ 0.68% |

News

MARKET DATA

CoinDesk Huobi’s HT Token Suddenly Falls 93%, Then Rebounds Just as Quickly Huobi’s HT token, the native token of the cryptocurrency exchange, momentarily dropped 93% on Thursday for reasons that are unclear. |

CRYPTO INFRASTRUCTURE

Decrypt.co People Are Minting 'BRC-20' Meme Tokens on Bitcoin via Ordinals Ordinal inscriptions hit a new daily peak Thursday after someone figured out how to mint a form of "fungible tokens" on Bitcoin. |

THOUGHTS AND OPINIONS

Decrypt.co Voltz Labs CEO: DeFi Innovation Is Moving Offshore Because of US Regulatory Severity Voltz Labs Co-founder and CEO Simon Jones talks to Decrypt's Jason Nelson at ETH Denver about using DeFi for interest rate swaps, the unfriendly regulatory envi... |

REGULATION

CoinDesk New York Attorney General Sues Crypto Exchange KuCoin, Alleges Ether Is a Security The New York Attorney General's office sued Kucoin on Thursday, alleging it offered unregistered securities and commodities. |

The Block US DoJ appeals billion-dollar Binance.US acquisition of Voyager assets After New York's bankruptcy court approved Binance.US' plan to purchase Voyager's assets, the DoJ is making an effort to block the billion-dollar deal. ... |

FUNDRAISING AND M&A

Fundstrat AI Robot US digital asset fund, venture capital firm to raise $100 million for two new blockchain funds [1/2] Representation of virtual cryptocurrency Bitcoin is placed on U.S. Dollar banknotes in this illustration taken November 28, 2021. |

NFTS

Decrypt.co Starbucks Serves Up Its First Premium NFTs at $100 a Pop After its free NFTs garnered significant value, the Polygon-based Starbucks Odyssey platform is dropping its first paid collectible. |

HACKS, EXPLOITS, AND SCAMS

The Block Hedera confirms hackers stole tokens from DEXs, exploiting a bug in ‘smart contract service’ The core team at Hedera reported that the attackers targeted liquidity pools on multiple decentralized exchanges (DEXs) to steal assets. ... |

CoinDesk DeFi Protocol Tender.fi Hacker Returns $1.6M Following Chainlink Oracle Glitch A white hat hacker that targeted DeFi protocol Tender.fi has returned $1.6 million that was stolen on Tuesday, receiving a 62.15 ether ($85,000) bug bounty inst... |

Reports you may have missed

As outlined in this weekâs Core Strategy note, our âBuy in Mayâ thesis was kept intact following the Fedâs announcement of tapering QT and a dovish FOMC meeting, helping yields begin to roll over. This morningâs non-farm payrolls data has helped fuel further yield deterioration with a large downside surprise of 175k payrolls vs. 238k expected, and the unemployment rate ticking up to 3.9% (3.8% exp.). The US10Y (-1.68%) briefly...

We are finally starting to see some relief in interest rates and the DXY 0.00% following yesterday's FOMC meeting and the Treasury's quarterly refunding announcement. BTC 1.81% has rebounded from yesterday's low of $56.5k and is now trading just above $59k, while ETH 2.30% is attempting to break through $3k resistance. SOL 2.19% has outperformed, gaining 10% compared to BTC yesterday and is now trading just below $140. The market is showing decent breadth...

Risk markets were selling off before today's FOMC meeting where it was unanimously voted to keep interest rates steady. The Fed announced it would be reducing the speed of its balance sheet taper from $60 billion per month to $25 billion per month, a larger than expected reduction. Following the announcements and Chair Powellâs comments, yields turned sharply lower with the US10Y falling 9 basis points while equity indices rose....

We are witnessing a continuation of the recent weakness in crypto markets today, with BTC 1.81% now testing $60k, ETH 2.30% just below $3k, and SOL 2.19% dipping under $130. The broader altcoin market is experiencing even more pronounced declines, with very few names posting a green candle today. The market was pushed lower in the overnight hours following a disappointing debut from the Hong Kong ETFs (more on that below). However, this...