BitDigest September 11 · Issue #740

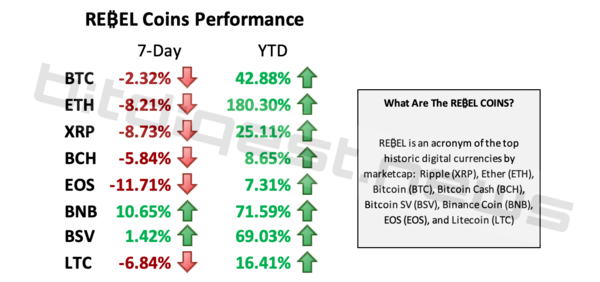

- Crypto prices end the week flat following recent pull back

- Christine Lagarde announces that the ECB will release its verdict on the digital Euro shortly

- Pomp gets Cramer to buy bitcoin

The Headlines

ECB Verdict on Digital Euro Expected Shortly

Switzerland Approves Blockchain Act

IRS Looking to Track Privacy Coin Transactions

Treasury Sanctions Russia-Linked Election Interferors

Bank Settlement Coin Project Delayed

tZERO Approved to Launch Retail Broker

Square Introduces Crypto Patent Alliance

Bitstamp to Use Nasdaq Matching Engine

Pomp Gets Cramer to Buy Bitcoin

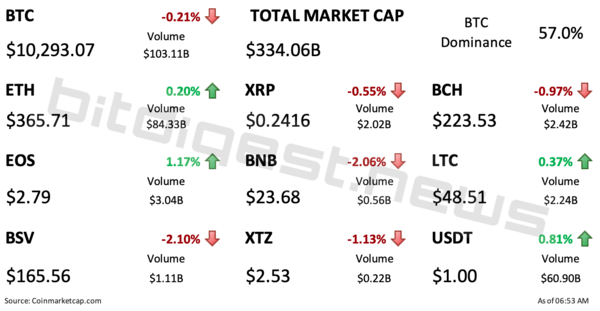

Market Data

CBDCs Coming Within 2 Years

Exchange, Custody and Product News

Binance Commits $100 million to Applications Built on its Blockchain

Coinbase Adding Yearn

Thoughts on the Ecosystem

Digital Assets are No Longer on the Fringe

Privacy and Immutability Need to be Addressed

Bitcoin Can Be the Native Internet Currency

Reports you may have missed

As outlined in this weekâs Core Strategy note, our âBuy in Mayâ thesis was kept intact following the Fedâs announcement of tapering QT and a dovish FOMC meeting, helping yields begin to roll over. This morningâs non-farm payrolls data has helped fuel further yield deterioration with a large downside surprise of 175k payrolls vs. 238k expected, and the unemployment rate ticking up to 3.9% (3.8% exp.). The US10Y (-1.68%) briefly...

We are finally starting to see some relief in interest rates and the DXY 0.00% following yesterday's FOMC meeting and the Treasury's quarterly refunding announcement. BTC 5.78% has rebounded from yesterday's low of $56.5k and is now trading just above $59k, while ETH 3.26% is attempting to break through $3k resistance. SOL 2.35% has outperformed, gaining 10% compared to BTC yesterday and is now trading just below $140. The market is showing decent breadth...

Risk markets were selling off before today's FOMC meeting where it was unanimously voted to keep interest rates steady. The Fed announced it would be reducing the speed of its balance sheet taper from $60 billion per month to $25 billion per month, a larger than expected reduction. Following the announcements and Chair Powellâs comments, yields turned sharply lower with the US10Y falling 9 basis points while equity indices rose....

We are witnessing a continuation of the recent weakness in crypto markets today, with BTC 5.78% now testing $60k, ETH 3.26% just below $3k, and SOL 2.35% dipping under $130. The broader altcoin market is experiencing even more pronounced declines, with very few names posting a green candle today. The market was pushed lower in the overnight hours following a disappointing debut from the Hong Kong ETFs (more on that below). However, this...