Owning the Casino Stack: SOL, JTO, RAY, BONK (Core Strategy Rebalance)

Key Takeaways

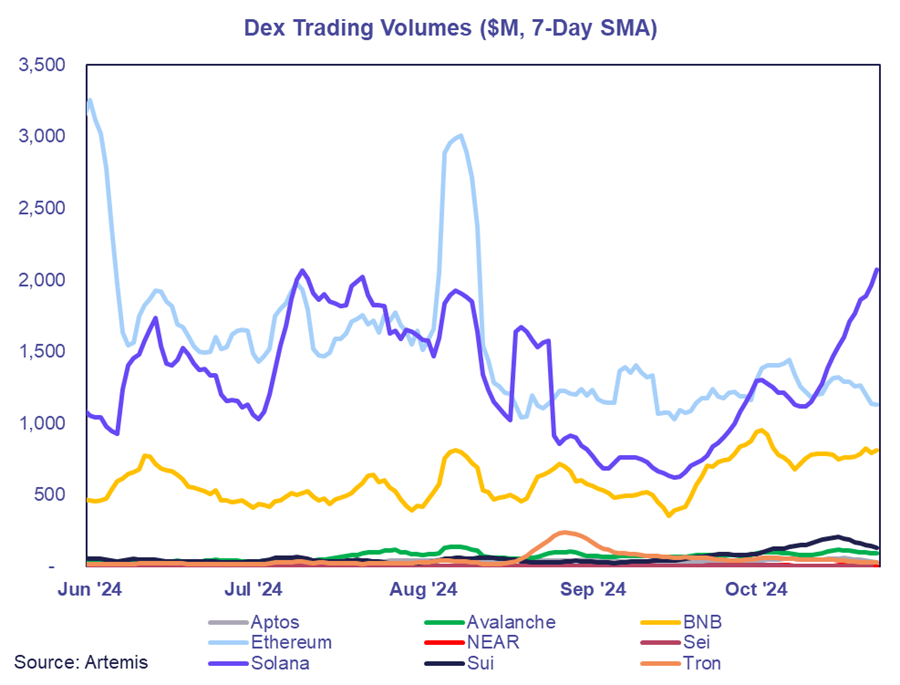

- SOL DEX Volumes Remain Strong: Last week, we increased SOL's weighting in our Core Strategy due to surging DEX volumes on Solana, which have persisted and driven SOL's outperformance against ETH and BTC.

- SOL Beta: Given SOL's relative strength and its rising on-chain activity, we believe it's prudent to seek SOL beta exposure via projects benefiting from this speculative frenzy.

- Adding JTO, RAY, BONK: Viewing memecoins as a new form of gambling, it's logical to own the full "casino stack"—SOL (the currency of Vegas), JTO (Vegas infrastructure), RAY (the casino itself), and BONK (Blackjack).

- Removing MKR: Our thesis on MKR has not played out as expected, largely due to weak acceptance of its rebrand to SKY and ETH's underperformance. Will possibly revisit at a later date.

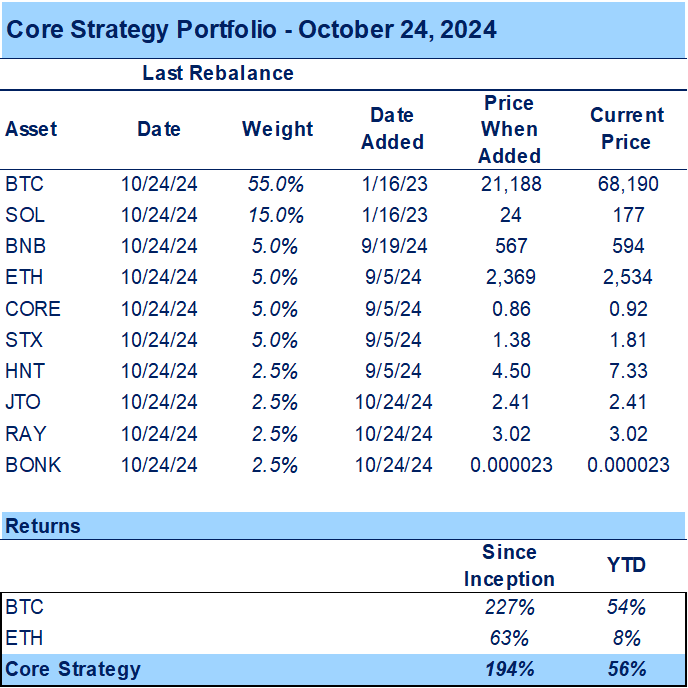

- Core Strategy – As we approach year-end, we maintain an optimistic outlook for the crypto market. Favorable seasonality, election-driven tailwinds, and suitable liquidity conditions create a favorable backdrop, skewing risks to the upside. We maintain a bias toward being overweight SOL and remain generally focused on the majors, while selectively adding exposure to altcoins such as HNT, JTO, BONK, RAY, STX, BNB, and CORE. As a reminder, our Core Strategy allocation model, along with crypto equity baskets and trade recommendations, can be found at the end of each note.

SOL Outperformance

Last week, we highlighted the explosive activity on Solana as DEX volumes surpassed those on Ethereum, leading us to increase SOL’s weighting in our Core Strategy. These elevated DEX volumes have persisted through this week, and SOL has dramatically outperformed, breaking out against ETH and gaining ground against BTC—all amid a sharp bond selloff and a rally in the DXY.

A significant portion of this volume has been driven by rampant speculation on memecoins. Today’s note won’t pontificate too much on the merits of memecoins, as we’ve previously expressed our view: the smaller memecoins are akin to a new iteration of casino games, while the more “established” ones serve as perpetual call options on market froth.

To be clear, Solana’s traction extends beyond the memecoin frenzy. Our Core Strategy portfolio reflects this broader trend, with HNT being a featured asset. However, it’s evident that the speculative aspects of on-chain activity are responsible for the current acceleration of capital flow onto Solana, serving as the primary driver of SOL’s recent outperformance.

Given SOL’s relative strength and its rising on-chain activity, we believe it’s prudent to seek additional beta exposure in projects benefiting from this speculative frenzy.

Own the Casino

It’s an imperfect metaphor, but if we think of Solana as the on-chain Vegas, it’s first and foremost important to own the currency of choice in Vegas—thus our overweight position on SOL. Then it’s logical to consider where this commodity is flowing and where value is accruing.

In our analogy, if memecoins are the replacement for blackjack, then the venues where these tokens trade are the casinos. We should look at where these tokens are being exchanged to identify who is monetizing this speculation. In this case, the preeminent casino on Solana is Raydium.

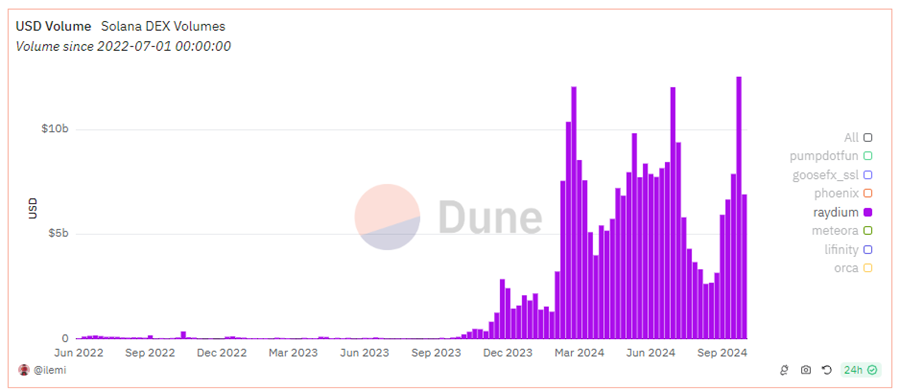

Raydium is a spot DEX on Solana that launched in Q1 2021.

Volumes have recently exploded on Raydium as on-chain activity has picked up. Its TVL now amounts to over $2 billion.

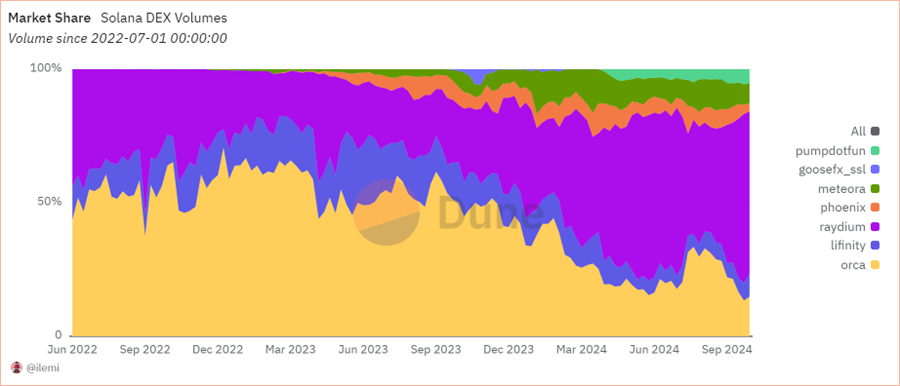

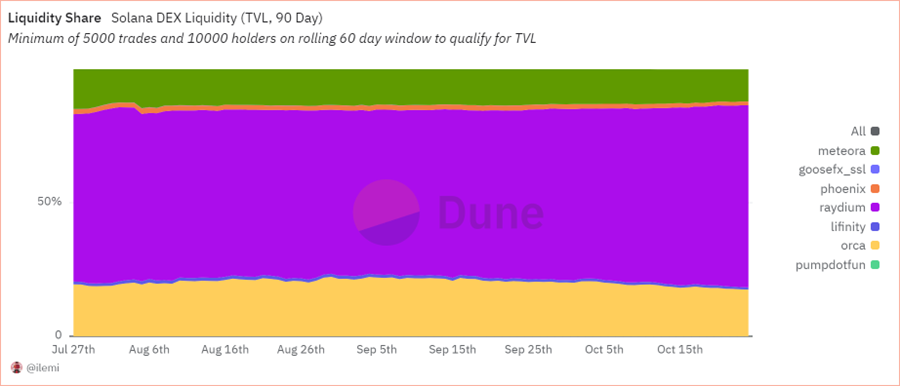

Raydium’s market share on Solana has commensurately surged in recent months, as over 60% of DEX volume on Solana runs through Raydium (up from 30% at the start of the year) and Raydium currently accounts for nearly 70% of all Solana DEX liquidity.

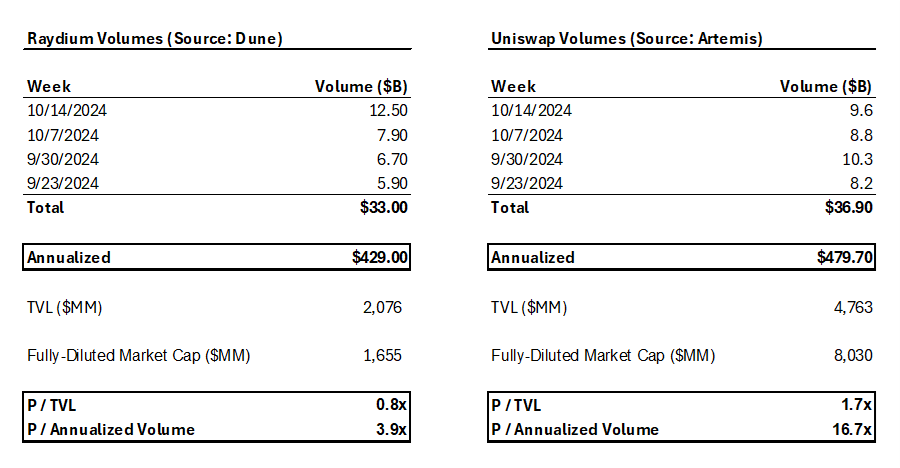

When comparing Raydium’s current fully diluted market cap to both its TVL and recent volumes, it is priced quite favorably relative to Uniswap, the market leader. Additionally, the Uniswap metrics below account for all chains on which the app is deployed, making Raydium’s figures even more impressive by comparison. Please note that we have included native tokens in the TVL calculation.

Tokenomics & Value Accrual

RAY, the app’s native token, was launched alongside the DEX, and all RAY stakeholders have fully vested. It reached an ATH of $17 in 2021 and is currently trading just north of $3.

Raydium charges 3 bps fees on AMM volume, 12% on LP fees for concentrated liquidity pools, and 0.4 SOL per liquidity pool creation.

A significant windfall for Raydium has been the creation of pump.fun, a platform for launching memecoins. When a token is launched on pump.fun and reaches a particular market cap threshold, pump.fun deposits a set amount of liquidity into Raydium where users can add to liquidity pools and trade the token.

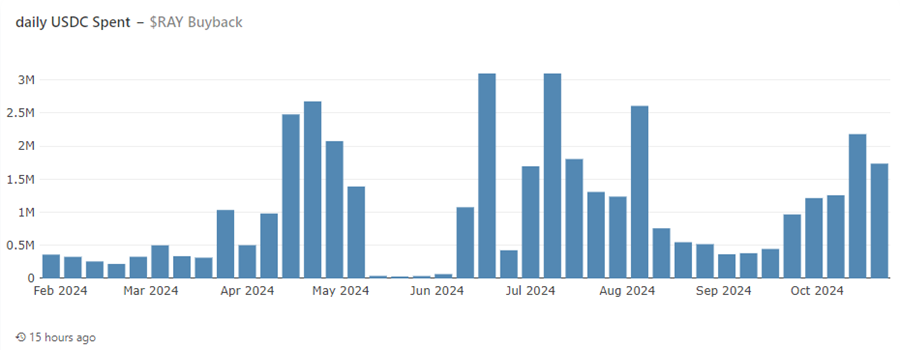

Importantly, the majority of trading fees go toward buying back RAY on the open market, while pool creation fees go to the DAO treasury. This creates a flywheel effect of buy pressure on the RAY token. As demonstrated in the chart below, in the four weeks prior to this one, we saw $6.4 million in buy pressure for the RAY token. With DEX fees accelerating, it’s likely that we’ll see the organic buy pressure continue.

To summarize the reasons to be bullish on RAY:

- Market Dominance in Solana’s DEX Ecosystem: Raydium handles over 60% of decentralized exchange (DEX) volume and nearly 70% of all DEX liquidity on Solana.

- Favorable Valuation and Positive Tokenomics: Compared to competitors like Uniswap, Raydium is attractively priced. The platform uses trading fees to buy back RAY tokens, creating continuous buy pressure and potential price appreciation.

- Strategic Partnerships with Pump.Fun: The integration with pump.fun for memecoin launches has boosted Raydium’s volumes and liquidity. New tokens reaching market cap thresholds deposit liquidity into Raydium, increasing activity and fee generation.

- Capitalizing on Speculative Frenzy: As the primary venue for memecoin trading on Solana, Raydium is well-positioned to capitalize on the current speculative trading surge, enhancing fee revenues and value accrual to RAY token holders.

Own the Vegas Infrastructure

While DEXs are helpful in matching the supply and demand of speculative traders, these transactions must be processed and accounted for by Vegas, and Vegas uses its trusted validators to render this service. Enter Jito, a liquid staking protocol on the Solana blockchain that enhances staking rewards through Maximum Extractable Value (MEV) strategies.

Jito offers two critical solutions for Solana users:

- Liquid Staking: Just like Lido on Ethereum, Jito allows Solana users to earn yield on their SOL while utilizing their assets in Solana DeFi via the issuance of the JitoSOL derivative token.

- MEV Infrastructure: MEV refers to profit opportunities in transaction ordering that validators can exploit. Prior to Jito’s solution, MEV searchers would spam the Solana network to have their transactions processed first, causing congestion. The Jito validator client solves this problem by optimizing block building to reduce front-running and transaction fee competition, resulting in lower gas fees and less congestion. This is similar in spirit to what Flashbots on Ethereum does.

Key Features of the Jito Client

- Bundles: MEV searchers submit transaction bundles—groups of transactions executed as a single atomic unit. This reduces spam by allowing searchers to send a prioritized set of transactions rather than flooding the network.

- Block Engine: Jito connects MEV searchers and validators via an off-chain auction system. The engine simulates and selects the most profitable transaction bundles, which are then forwarded to validators for processing. This increases validator rewards and improves network efficiency.

- Relayer: Jito filters and verifies transactions on a separate server before forwarding them to the Block Engine and validators, offloading some responsibilities from the validators.

These features enable validators to earn more from MEV while reducing spam. Importantly, they allow stakers using JitoSOL to benefit from MEV rewards in addition to traditional staking rewards.

Traction & Value Accrual

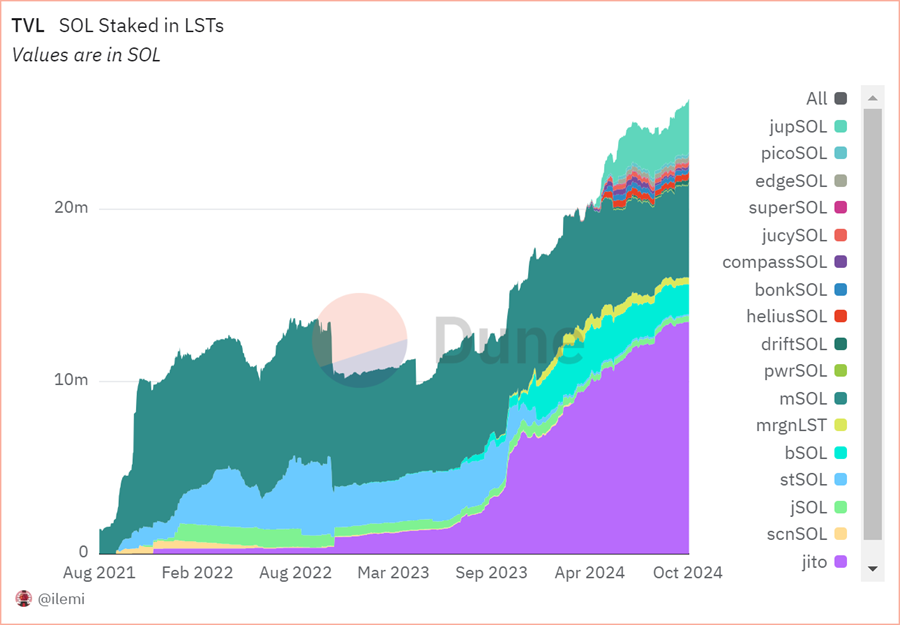

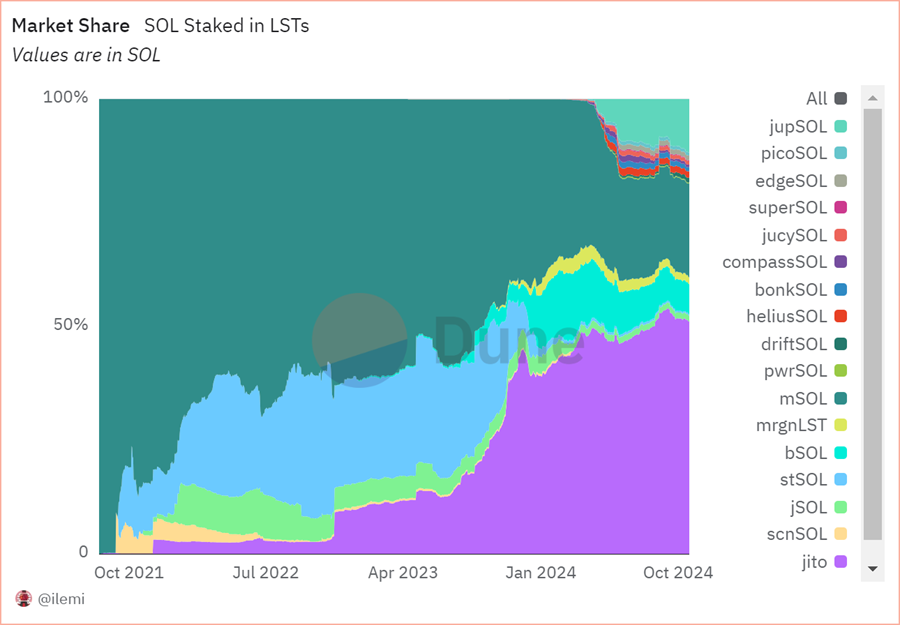

Jito has dominated the liquid staking market on Solana since entering the fold. JitoSOL accounts for 13 million of the 26 million liquid-staked SOL on the network, having grown its market share from just over 7% at the beginning of 2023 to 50% today.

The protocol has two primary fee streams: staking rewards and tip fees.

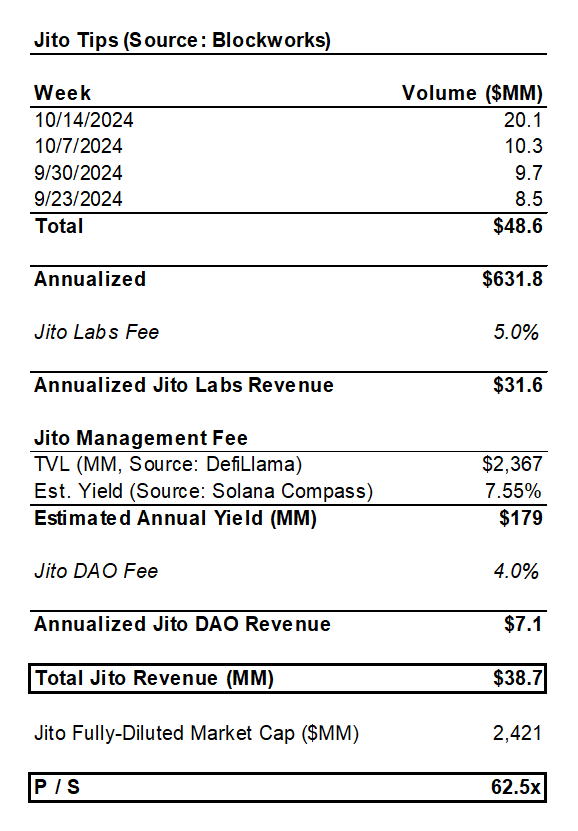

- Staking Rewards: Jito charges an annual management fee equal to 4% of total staking rewards. It also collects a fee of 0.1% on withdrawal value, applicable only if users directly unstake via the website. This revenue goes to the Jito DAO. At the current TVL of $2.4 billion and assuming a 7.55% yield, this equates to an annualized protocol revenue of approximately $7.1 million.

- Tip Fees: The Jito client allows MEV searchers to submit tips to Jito-enabled validators to incentivize the inclusion of their transactions in the next block. This is lucrative for validators but currently operates outside of the Solana protocol. Jito Labs, the development team behind Jito, takes a 5% fee on this sum, and none of the value accrues to the Jito DAO.

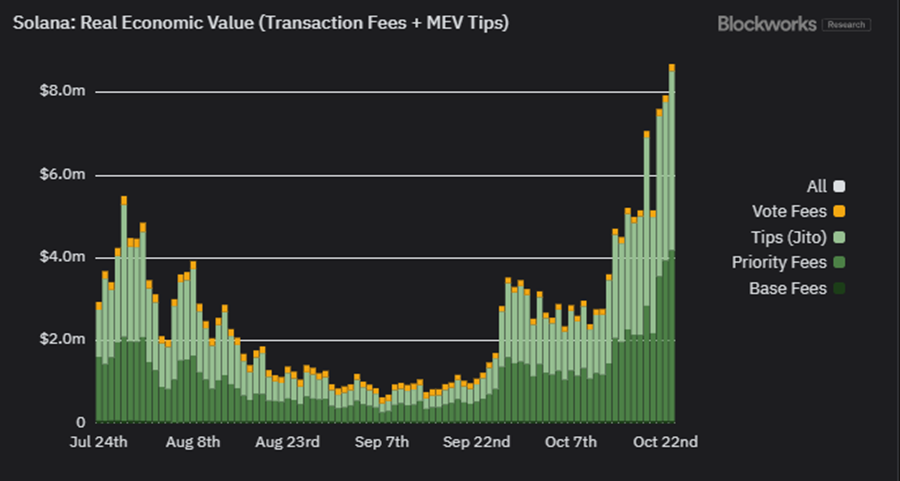

We’ve seen tip fees skyrocket since the memecoin frenzy began.

While it’s challenging to annualize fees in crypto due to its cyclical nature, the past four full weeks of Jito tips amounted to $48.6 million in fees paid to Jito validators. Annualized, this amounts to $632 million, which at a 5% take rate for Jito Labs equates to $31.6 million.

See below for a breakdown of the fees generated by the protocol.

While there’s a disconnect between the Jito tips and the Jito DAO, there’s an outstanding proposal from Jito’s DAO to allocate 3% of all MEV tips collected by the protocol to the DAO treasury and to TipRouter, an in-house program developed for Jito’s forthcoming restaking platform.

Jito Labs has also pledged to reduce its own tip share from 5% to 3%, meaning 6% of all Jito MEV tips would be taxed under the new program, up from 5% currently.

The proposal estimates the fee switch would generate $22.8 million in annual revenue for the recently formed Jito DAO, broadly in line with our estimates above.

Tokenomics

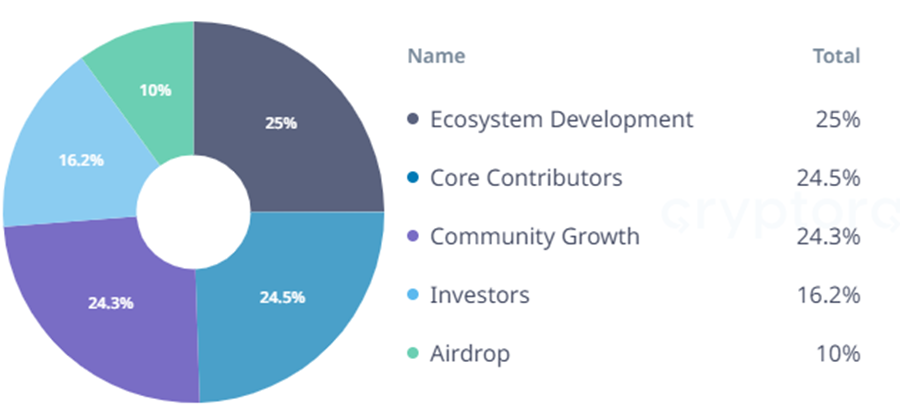

JTO is a governance token that allows holders to vote on issues related to the protocol. It was launched via airdrop in late 2023, reaching an ATH of over $5.30 in April, and currently trades just north of $2.40.

Similar to many other governance tokens, value accrual is tied to tokenholders possessing the right to enable the flow of protocol earnings to themselves at a future date.

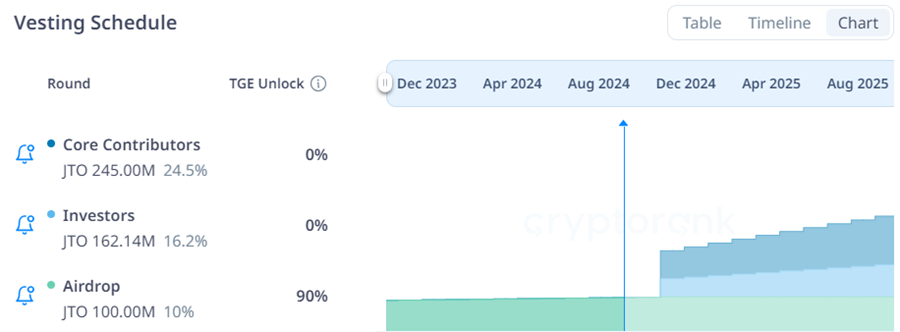

In a more crypto-friendly regulatory environment, we could see this “fee switch” enacted, allowing the value earned by the DAO to flow to tokenholders. One concern is that the token has a relatively small float—currently approximately 12%—with the majority of the locked tokens held in the Jito treasury or by core contributors and investors.

It’s worth noting that Jito has a major unlock coming up in December, which will double its float overnight. This might be something to consider derisking around, depending on the broader macro environment as the date approaches.

Jito has introduced a unique solution that benefits validators and users alike, reaping monetary benefits as a result. It is the engine that makes the proverbial Vegas run.

We believe this is a good time to consider starting a position in JTO as the Solana ecosystem heats up. To summarize the reasons to be bullish on JTO:

- Market Leader in Solana Liquid Staking: JitoSOL captures 50% of liquid-staked SOL, up from just over 7% at the start of 2023, indicating rapid adoption.

- Enhances Rewards via MEV Strategies: Jito’s MEV infrastructure boosts staking rewards for validators and users while reducing network congestion.

- Significant and Growing Revenue Streams: Generates approximately $7.1 million annually from staking rewards; MEV tip fees have surged, and a proposed fee switch could add $22.8 million annually to the Jito DAO.

- Potential Value Accrual to Token Holders: JTO governance token may benefit from future fee switches. Investors should be aware of the upcoming major token unlock in December.

The Blackjack Game Itself

The last piece of the casino stack is the blackjack game itself. As mentioned above, we appreciate memecoins for what they are and do not shy away from their ability to enhance a portfolio’s performance. Therefore, we are adding BONK, our preferred memecoin on Solana, to the portfolio.

There’s an argument to be made that BONK is more than just a memecoin. It differentiates itself in several key ways:

- Utility and Ecosystem: Unlike many memecoins that are purely speculative, BONK has built a functional ecosystem with BonkSwap (a decentralized exchange), Bonk BOT (a tool for easier token use), and Bonk Rewards (an incentive program for staking).

- Community Governance: BONK is governed by a DAO, giving the community direct control over its future and fostering decentralized decision-making.

- Staking: BONK offers single-sided staking pools, allowing users to earn yields without requiring a second asset—a unique feature among memecoins.

- Burning Mechanism: It employs a token-burning mechanism to reduce supply over time, supporting scarcity and potentially increasing its value.

That said, ultimately, those bidding on BONK in the open market are most likely focused on its memetic value above all else, and thus one should view it through that lens.

Other Core Strategy Changes

It is evident that our thesis on MKR has not played out as expected. We believe that much of this has to do with poor acceptance of the rebrand from MKR to SKY. In fact, it looks like the DAO is proposing to reverse the rebrand—a move they spent considerable time and capital on—which suggests they agree with our assessment.

Additionally, it hasn’t helped that ETH continues to underperform. MKR remains a fundamentally useful and undervalued project in the space, but if the market isn’t recognizing it, there’s no use in waiting around when there are better opportunities in the market.

Therefore, we are removing MKR from the Core Strategy portfolio. We will keep an eye on it and may revisit if we sense that the market is becoming more bullish on its prospects.

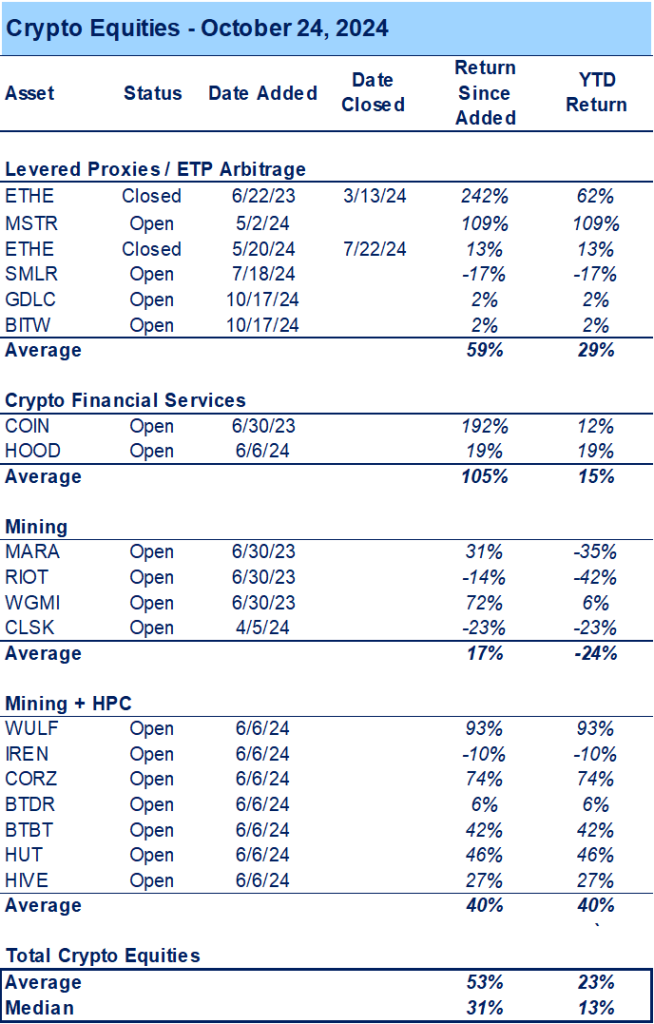

Core Strategy

Tickers in this report: BTC -3.07% , XRP -2.37% , SOL -3.67% , ETH -2.52% , HNT -2.22% , STX N/A% , MKR -0.73% , BNB -1.14% , CORE 0.37% , JTO 5.28% , BONK 0.21% , RAY -0.16% , MSTR -2.84% , SMLR, COIN -8.40% , HOOD -8.94% , MARA -3.97% , RIOT -3.72% , WGMI -3.70% , CLSK -2.81% , WULF -0.87% , IREN -5.69% , CORZ -3.76% , BTDR -12.93% , BTBT -2.82% , HUT -4.87% , HIVE -4.04% , AVAX -0.18% , XRP -2.37% , GDLC, BITW -3.08%