Coinbase Launches Wallet as a Service, Silvergate Shutting Down

Market Update

- After January's total number of job openings came in higher than expected yesterday, initial jobless claims spiked this morning to 211k versus 195k expected, giving markets a slight boost. The $SPY and $QQQ are up 0.13% and 0.53%, respectively, at the time of writing. Crypto markets are mixed today, with $BTC trading at $21.5k (-1.03%) and $ETH trading at $1.53k (-0.27%). After being some of the biggest winners in the first two months of the year, LSD protocols have been underperforming so far in March. $LDO, $RPL, and $FXS are down 21.82%, 18.79%, and 26.04%, respectively this month. Many investors may be locking in gains as the macro-environment has increased in hawkishness in recent weeks.

- Coinbase has launched a new product called wallet as a service (WaaS), which companies can use to onboard its users to the digital economy seamlessly. Many companies currently face a multitude of challenges when it comes to integrating with Web3, such as users needing a crypto wallet to engage with digital assets and complete transactions. WaaS helps alleviate this problem by providing a scalable and secure set of wallet infrastructure APIs, allowing companies to create and deploy digital wallets for their end-users easily. WaaS also handles the storage of wallet seed phrases, so end-users can create wallets with simple usernames and passwords. WaaS leverages Multi-Party Computation (MPC) technology which splits private key storage between Coinbase and the end-user, meaning that keys will be kept safe even if a user’s device is compromised. Coinbase’s new WaaS product and its new Base network should help drive industry adoption.

- On Wednesday evening, troubled crypto bank Silvergate announced its intention to wind down its operations and voluntarily begin liquidating its assets. Due to turmoil in the crypto market in the last six months, Silvergate saw a huge withdrawal of customer deposits, causing it to sell securities at significant losses to meet customer redemptions. The bank’s closure was widely expected following the events of last week when Silvergate failed to file its 10-K for the 2022 fiscal year, raising concerns about the bank's financial health. That was followed by a multitude of clients announcing the termination of their relationships with the bank, and the closure of the Silvergate Exchange Network (SEN). The bank’s wind down and liquidation will include full repayment of all customer deposits, and Silvergate will be seeking legal consultation on how best to preserve the residual value of its assets. $SI is down 29.53% in mid-day trading following the unfortunate news.

Daily Technical Strategy

Mark L. Newton, CMT

Head of Technical Strategy

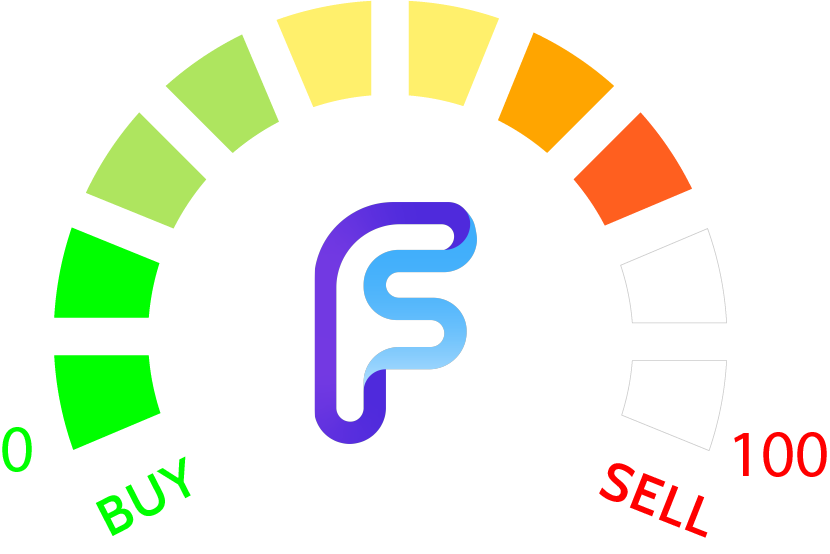

Bitcoin's decline looked set to undercut February's low close of 21639 as of Wednesday, but price is getting near support where $BTCUSD is expected to stabilize and turn back higher. This entire consolidation since early February has taken the shape of a giant corrective ABC pattern which could be complete within the next 3-5 days. While many might ordinarily view a breakdown to new monthly lows as being bearish, BTCUSD is set to record its first DeMark related exhaustion signal on daily charts since mid-February potentially as early as tomorrow, Friday 3/10. The price found support last month near its 38.2% Fibonacci retracement area and we think that maximum downside into March would take Bitcoin down to $20,450 before this turns back up to challenge and exceed February highs. Momentum is nearing oversold levels, and it looks right to buy weakness, as we believe that BTCUSD is an excellent risk/reward on this recent pullback. Cycles show Bitcoin likely rising into mid-April, so despite BTCUSD's underperformance of late, prices should rebound in the weeks to come. Upside resistance lies at 25k, but exceeding that would be expected to bring about a move up to $27.50-$28k, which is an area of huge overhead resistance on gains.

Daily Important Metrics

All metrics as of March 9, 2023 12:32 PM

All Funding rates are on bps

Crypto Prices

| Symbol | Market Cap | Last Price | Daily Change | Year to Date | Relative to BTC YTD |

BTC BTC | $416B | $21,517 | ↓ -2.67% | ↑ 30% | |

ETH ETH | $187B | $1,529 | ↓ -1.86% | ↑ 28% | ↓ -2.29% |

ADA ADA | $11B | $0.3167 | ↓ -2.25% | ↑ 28% | ↓ -1.58% |

DOGE DOGE | $9.5B | $0.0714 | ↓ -2.51% | ↑ 1.83% | ↓ -28% |

MATIC MATIC | $9.3B | $1.07 | ↓ -1.97% | ↑ 40% | ↑ 10% |

SOL SOL | $6.9B | $18.14 | ↓ -4.62% | ↑ 83% | ↑ 53% |

DOT DOT | $6.7B | $5.72 | ↑ 0.65% | ↑ 32% | ↑ 1.74% |

LINK LINK | $3.4B | $6.55 | ↓ -1.79% | ↑ 18% | ↓ -12% |

NEAR NEAR | $1.6B | $1.89 | ↓ -1.02% | ↑ 48% | ↑ 18% |

Exchange Traded Products (ETPs)

| Symbol | Premium to Nav | Last Price | Daily Change | Year to Date | Relative to BTC YTD |

| GBTC | ↓ -33% | $12.55 | ↓ -5.21% | ↑ 51% | ↑ 22% |

| BITW | ↓ -54% | $9.14 | ↓ -0.33% | ↑ 70% | ↑ 40% |

| ETHE | ↓ -49% | $7.94 | ↑ 4.34% | ↑ 67% | ↑ 37% |

| BTCC | ↓ -0.06% | $3.95 | ↓ -2.95% | ↑ 30% | ↑ 0.48% |

News

QUICK BITS

CoinDesk Arthur Hayes Proposes Bitcoin-Backed NakaDollar, Which Would Rely on Exchanges to Maintain Dollar Peg A stablecoin backed by $1 worth of bitcoin and 1x short of a bitcoin perpetual future can be used to provide stability to such a token, Hayes said. |

Bitcoin.com Silvergate Bank Announces Voluntary Liquidation as Crypto Industry Woes Persist At 4:30 p.m. Eastern Time, Silvergate Bank announced its intention to wind down the crypto-friendly bank’s operations and voluntarily liquidate the company’s as... |

MARKET DATA

Coin Telegraph Alameda Research to sell interest in Sequoia Capital for $45M to Abu Dhabi The investment branch of FTX, Alameda Research, reached an agreement to sell its interest in Sequoia Capital for $45 m... |

CRYPTO INFRASTRUCTURE

The Block Coinbase announces Wallet-as-a-Service product to simplify web3 onboarding Coinbase has announced Wallet-as-a-Service (WaaS), making it easier for companies to build web3 experiences for users. The post Coin... |

The Block Gate.io launching Visa crypto debit card in Europe Gate Group plans to launch a Visa crypto debit card through its Lithuana-based company, Gate Global UAB — with a waitlist open for EEA users. ... |

CoinDesk SWIFT to Start Phase Two Pilot After Finding 'Value' in CBDC The banking network will now look at applications like securities settlement and trade finance |

REGULATION

Bitcoinist CFTC Re-Asserts That Stablecoins Remain Under Its Jurisdiction The Chairman of the Commodity Futures Trading Commission (CFTC), Rostin Behnam, has once again reaffirmed the agency’s position that stablecoins should be class... |

FUNDRAISING AND M&A

The Block Polychain Capital leads web3 dev tool provider Cubist’s $7 million raise Web3 infrastructure provider Cubist raises $7 million to build tools that will help developers starting with an open-source SDK. The... |

The Block Gyroscope unveils $4.5 million in funding as it prepares to launch ‘unique’ stablecoin The protocol raised $4.5 million in a seed funding round last year, led by Placeholder and Galaxy. The post Gyroscope unveils $4.5 ... |

The Block Framework Ventures leads $15.8 million round into ‘proof of solvency’ startup Proven, a firm providing ZK-proof technology so that crypto firms can prove solvency, raised a $15.8 million round led by Framework Ventures. ... |

NFTS

CoinJournal Animoca Brands and Planet Hollywood announce members-only NFT club in LA The new NFT club will be called Club 3. The club will be launched by Animoca Brands in collaboration with Planet Hollywood Group and Meta Hollywood. Club 3 will... |

PRODUCT UPDATES AND PARTNERSHIPS

CryptoPotato SelfKey Releases AI and zk-Based Solutions for Safer Digital Verification [PRESS RELEASE – Hong Kong, Hong Kong, 9th March 2023] Self-sovereign identity service, SelfKey, has released a new whitepaper detailing KYC solutions with feat... |

Reports you may have missed

U.S. equity indices are under pressure today following disappointing economic growth in conjunction with hotter-than-expected prices paid, sparking stagflation fears and reducing the chances of rate cuts. The $SPY has declined 0.91% to test $501 and the $QQQ has dropped 1.12% to $421, being weighed down by a 12% drop in META following its Q1 earnings release. Crypto markets are faring better, with BTC0.30% (-0.28%) trading at $64k and ETH0.24% ...

It has been a challenging day for crypto prices, with $BTC giving back yesterday's gains to fall to $68.5k, $ETH declining to $3,500, and $SOL currently trading around $176. Most altcoins are also experiencing downturns. The lone standout among large cap crypto assets today is $TON, which is rallying on rumors of USDT launching on the TON Network. Equity indices also faced a drawdown earlier in the day, sliding after...

Crypto assets are building on the weekendâs gains. $BTC (+3.47%) eclipsed $72.7k this morning before paring gains to approximately $71.8k. $ETH (+5.58%) is showing relative strength today, gaining to $3,650, helping the ETHBTC ratio reclaim the .05 mark. Last weekâs ETF net flows totaled $484 million, displaying the continued demand for exposure among traditional investors. Equity indices are relatively flat today, with the SPY and QQQ both gaining about 0.05%...

Despite March Non-Farm Payrolls blowing expectations out of the water (303k vs 214k exp.), equity indices are rebounding, with the SPY and QQQ gaining 1.23% and 1.50%, respectively. Although crypto assets held up during yesterdayâs equity sell-off, they fell overnight, with $BTC (-1.06%) reaching the low $66,000s before rebounding to $67.7k at the time of writing. $ETH (-0.53%) is trading slightly above $3k as the ETHBTC ratio has fallen below .05%,...