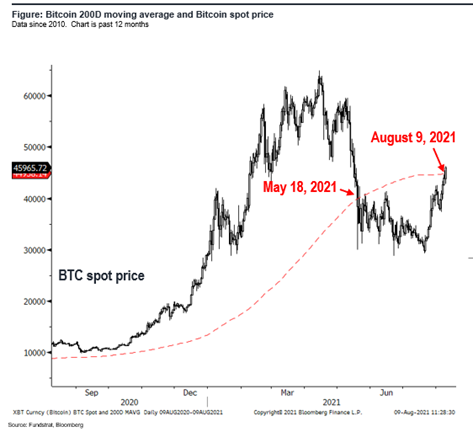

Bitcoin crosses above 200D, invoking Rule #3 --> Buy Bitcoin above its 200D

STRATEGY: Rule #3 kicking in –> Buy Bitcoin –> $100K into YE

Bitcoin crosses above its 200D…

Bitcoin today crossed above its 200D moving average ($44,938), invoking Bitcoin Rule #3 –> Buy Bitcoin BTC 0.55% above its 200D moving average

– Bitcoin fell below its 200D on May 18th, 2021

– Recall, we “stepped aside” on Bitcoin at that date

– Bitcoin has since been range-traded between $30k-$40k

With Bitcoin crossing above its 200D, we think Bitcoin will rally strongly into YE. This is consistent with our view that “everything rallies” into YE.

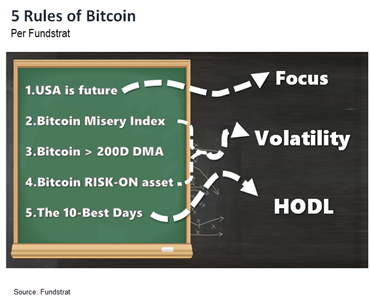

RECAP: 5 rules of Bitcoin

Our 5 rules of Bitcoin are below. The most known is #5, the “10 best days”, or the rationale to HODL Bitcoin. But Rule #3 is a biggie.

As shown below, Bitcoin’s forward performance is far stronger when it is trading above its 200D moving average:

>200D, 6M forward return +193%

<200D, 6M forward return +10%

You get the picture, Bitcoin is a network effect/network value asset, and also apparently aided by price momentum.

STRATEGY: Buy Bitcoin or Buy Crypto equities

The associated action for Rule #3 is simple.

– go long

Why is this happening?

This is not clear. But Bitcoin is facing a legislative and regulatory assault from China and the USA, and yet, Bitcoin is rallying. This is a key insight.

– Bad news is apparently baked in

– Last seller has sold

What is a way to gain exposure to Bitcoin rally?

Digital assets should broadly rally. Thus:

– BTC 0.55% ETH -0.65% + tokens/projects <– digital assets

– BITW 0.29% GBTC 0.60% <– ETNs tied to Bitcoin

Crypto equities:

Est Beta to BTC

– Silvergate SI 1.38% 5X – 10X

– Mogo MOGO 2X – 3X

– Coinbase COIN 0.14% 2X – 3X

– Voyager VYGVF 2X – 3X

– Riot Blockchain RIOT 1.13% 2X – 3X

– Microstrategy MSTR 0.75% 1X

– Paypal PYPL -0.28% 0.5X

– Square SQ 0.5X