VIX + Bitcoin = more of a risk on day than it appears

STRATEGY: VIX barely surged… meh. Bitcoin = leading indicator? >50% it bottomed

I am to share some unstructured market commentary today. Today is one of the days where it is apparent that the linkage between Bitcoin + digital assets and financial markets increased significantly over the past year. And given the wild moves today, I thought it appropriate to send out some post-closing thoughts (not in any particular order):

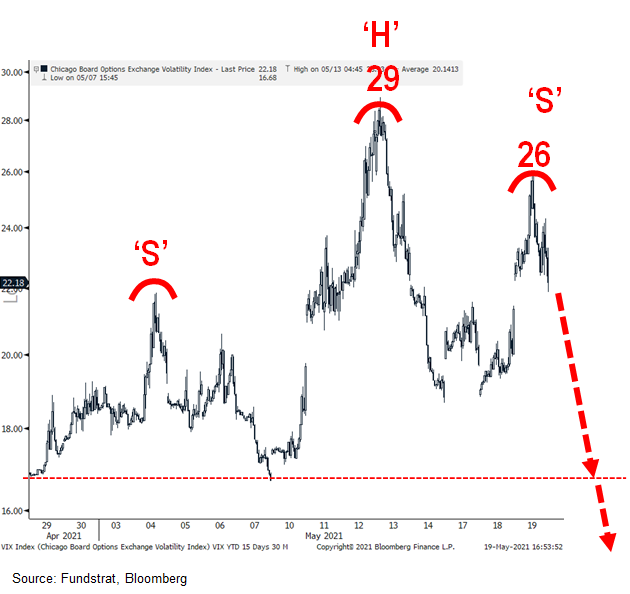

– VIX surged to nearly 26 today but ended the day basically flat

– VIX has little energy to surge higher and lower than the 28 last week

– If I “squint” I am seeing an H&S (head and shoulders) on the VIX

– If it manages to break the “neckline” ~17, VIX going to move to the low teens

– This would be very very risk-on

– Overnight, two things triggered panic

– Reuters rehashed an old story of China ban (China ban) — nothing new

– concerns about BlockFi liquidity given erroneous rewards being sent (BlockFi story)

– But this caused a healthy shakeout

– Bitcoin narrative has splintered in 2021 given enormous wallet growth

– many new to crypto are not drawn to “sound money”

– lots of leverage offered by exchanges = liquidations of newbies

– During the 2015-2017 Bitcoin rally, 9 declines of >20%, 5 declines >30%, so this is a normal course

– Bitcoin crashed overnight and sliced through the 200D (~$40k)

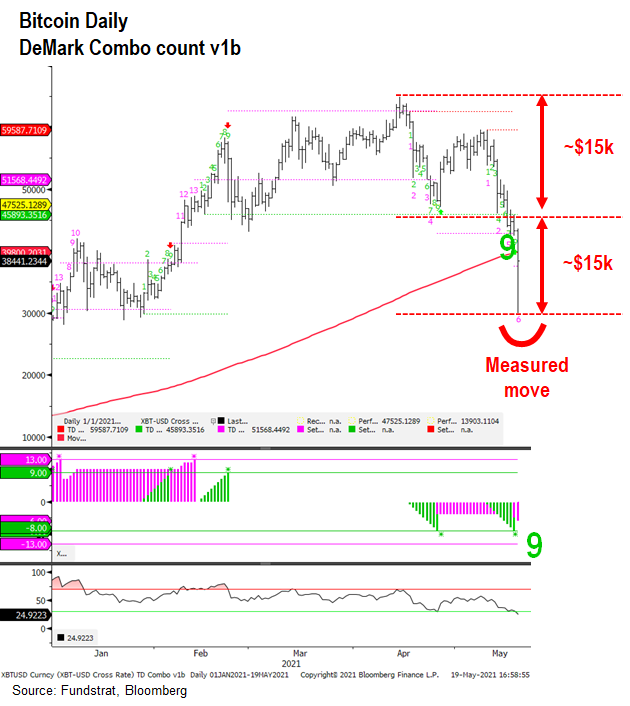

– Made a nice “touch” (worse than that) and on a ‘9’ DeMark Buy Setup (daily)

– Bitcoin touched “$30k” which is the DeMark downside target

– Bitcoin made a $15k move below support, similar to the $15k from all-time highs (see chart)

– Odds >50% Bitcoin has made its “bottom”

– Supporting evidence? Look at Crypto equities like SI or MOGO, SI surged 6% today

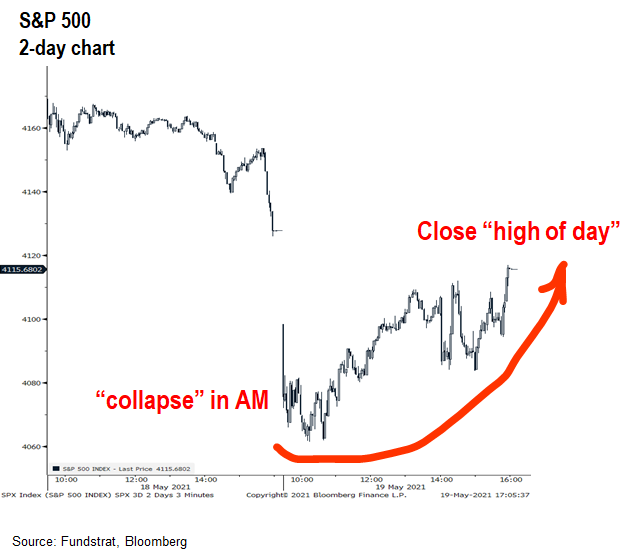

– Stocks opened down big and closed essentially rallying since 1:30 pm ET (post-Europe)

– Seems like many “top callers” were again thumping their chest

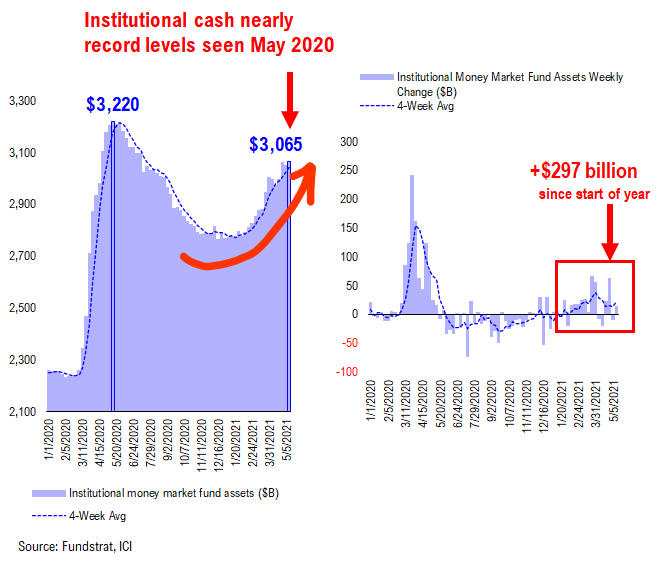

– given the $3.1T (near-record level) of institutional cash on the sidelines

– given that markets finished nearly “flat on day”

– we see greater odds of a market melt-up + Epicenter (aka cyclical) “crash up”

BOTTOM LINE: As Ugly as today was, some positive outcomes = risk-on

So to summarize, a few positives happened today. There are 3:

– VIX could not move above 28, possible H&S

– >50% odds Bitcoin bottomed

– S&P 500 “collapsed” in AM and finished high of the day

Doesn’t it seem like some of that $3.1T of “dry powder” is coming off the sidelines?

Bottom line: As tumultuous markets continue, we see today as a healthy shakeout and part of a broader consolidation. Both Bitcoin and equities are moving in tandem. I view today as a validation that the stronger odds favor a rise in Risk-on assets.