The Ten Rules of Bitcoin Investing: Rule No. 5

- Tom Lee’s First 5 Bitcoin (Replay)

- The Ten Rules of Bitcoin Investing: No. 1

- The Ten Rules of Bitcoin Investing: No. 2

- The Ten Rules of Bitcoin Investing: No. 3

- The Ten Rules of Bitcoin Investing: No. 4

(FSInsight.com’s head of research Tom Lee revealed the first five of his ten rules of Bitcoin investing on April 23, 2020, and gave an updated outlook for the remainder of the year. The webinar is available on the website and the following is a condensed version of his comments. This is the second in a series of 10 reports from his webinar, one for each of his rules. Stay tuned for the next one.)

The Ten Rules of Bitcoin Investing: Rule No. 5

The Rule of ‘The Ten Best Days.’

If you have read the first four parts of this series, you’d know that:

1 the U.S. is going to be very important in the continued development of Bitcoin and crypto currencies;

2 the Bitcoin Misery index is a proprietary FSI tool that has been a good way to evaluate how investors feel about Bitcoin’s price action;

3 Bitcoin’s 200-day moving average (dma), and the halvening, which took place May 11, are important factors to consider;

4 Bitcoin performs best when the Standard & Poor’s 500 index is performing well.

In Rule No. 5, it’s important for investors to know that the reason a “buy and hold” strategy (or hold on for dear life, HODL) makes sense for Bitcoin is that only a handful of days each year account for the bulk of BTC’s gains.

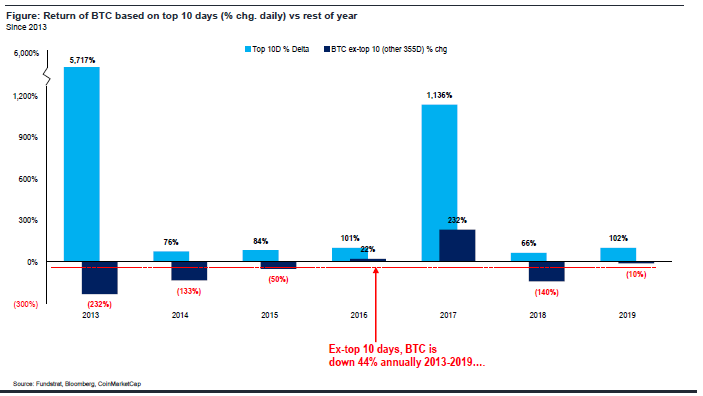

As shown in the chart below, BTC was down, on average, every year if we exclude the gains for the top 10 days (based on percentage moves). And if we look at the top 10 “point gain” days, BTC would be down even more every year.

However, the “buy and hold” (or HODL) strategy produces very different forward returns depending on when you bought.

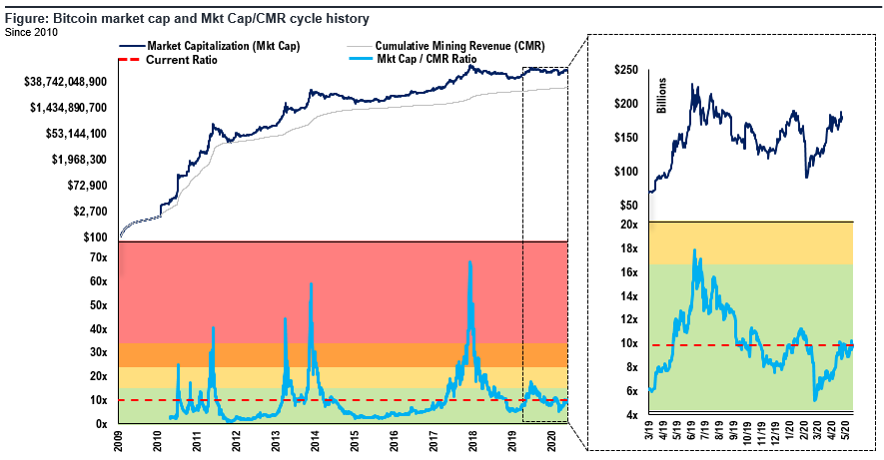

As you can see in the next chart, BTC moves in boom and bust cycles, and its Market Cap to Cumulative Mining Revenue (Mkt Cap/CMR) ratio is one of the best relative fundamental valuation metrics for predicting those waves

In our view, the best way to capture the top 10 “point gain” days is to HODL when Mkt Cap/CMR multiples are low.

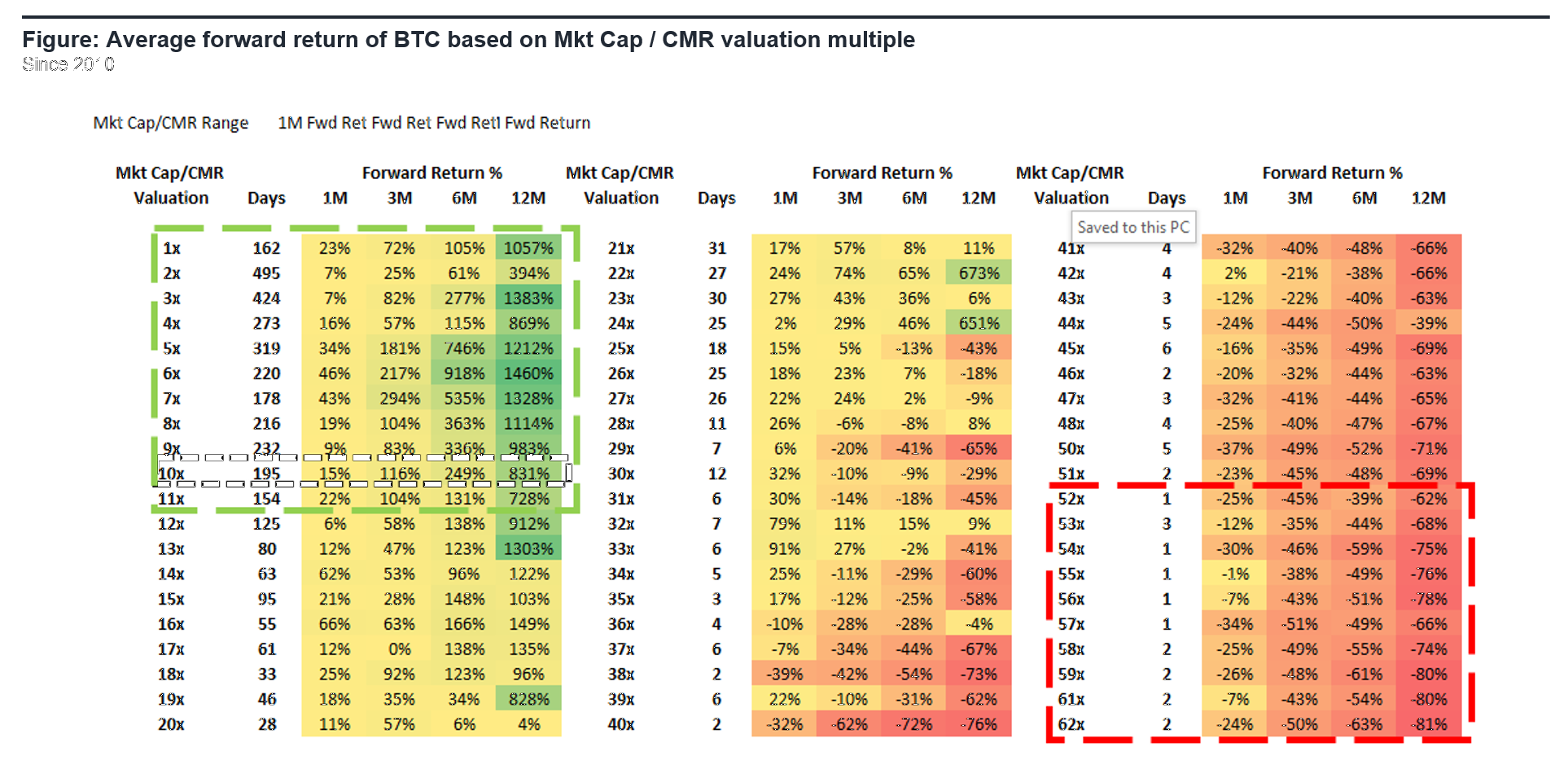

Now, as Warren Buffett says, price is what you pay but value is what you get. Unsurprisingly, BTC is a much better store of value and much better investment if it’s purchased at lower Mkt Cap/CMR valuation levels, and it performs very poorly if purchased near the high end of the range. (See chart.)

At today’s levels, forward returns for BTC over 1M, 3M, 6M and 12M have historically been very attractive.

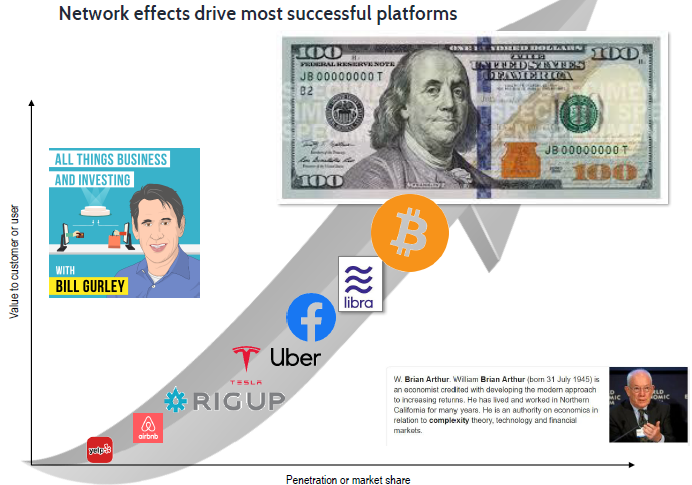

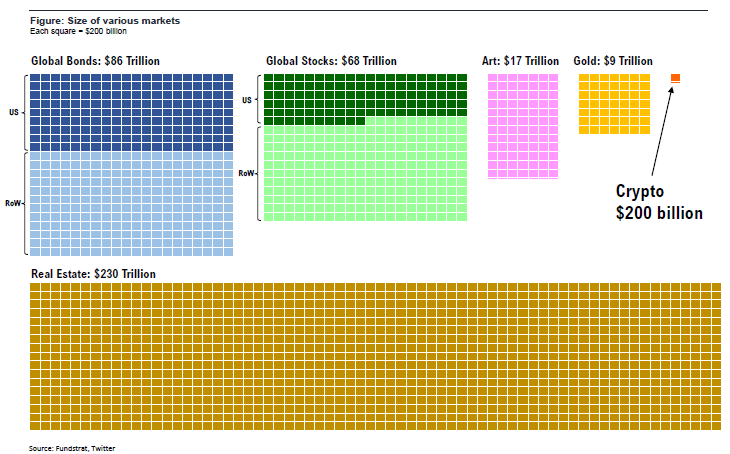

Remember that network effects drive most successful platforms. Yet BTC is not 10%, not even 1% but actually 0.1% of financial assets, or overall addressable investments. It is effectively individual or retail ownership only and at that size it is too small for network effects.

Bitcoin’s network valuation is $200 billion which ranks it as tiny versus other liquid markets.

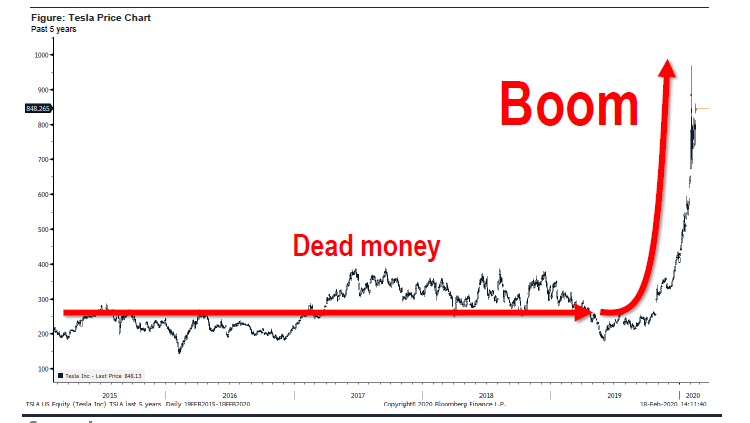

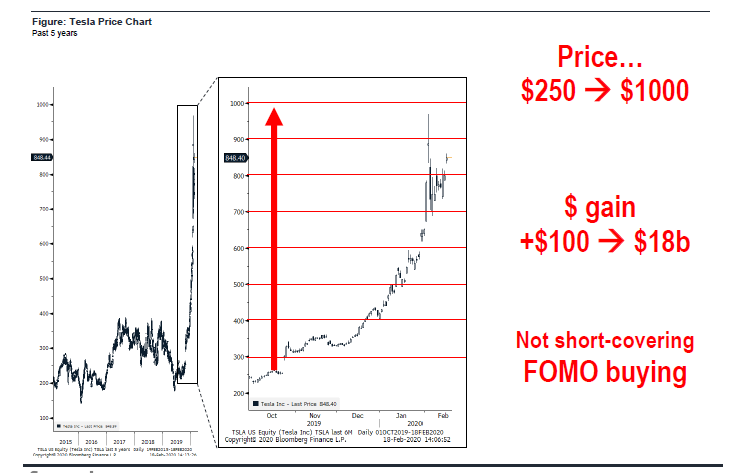

What’s happened to Tesla’s (TSLA) stock could be instructive about network effects.

The huge rally in TSLA this year is due to the Russell 1000 growth manager having fears of being left out. Call it institutional FOMO. Tesla is less than 0.7% of the weight in the Russell 1000 but is one of the biggest contributors to YTD gains. Sound familiar?

What we say is institutional FOMO was a $135 billion increase in TSLA’s value in 90 days. Network effects can be powerful.

(This is the fifth part in a series of Tom Lee’s 10 Rules for Bitcoin Investing. As a reminder, Rule No. 4, Bitcoin performs best when the Standard & Poor’s 500 index is performing well, was published May 29; No. 3, about buying BTC above its 200-dma, was published May 14; No. 2, about the BMI index, May 8; and No. 1, May 1, says that the USA is the determining factor for cryptocurrency’s future. For more, please see Tom’s Take May 1, or the webinar replay.)