The Ten Rules of Bitcoin Investing: No. 4

- Tom Lee’s First 5 Bitcoin (Replay)

- The Ten Rules of Bitcoin Investing: No. 1

- The Ten Rules of Bitcoin Investing: No. 2

- The Ten Rules of Bitcoin Investing: No. 3

- The Ten Rules of Bitcoin Investing: No. 5

(FSInsight.com’s head of research Tom Lee revealed the first five of his ten rules of Bitcoin investing on April 23, 2020 and gave an updated outlook for the remainder of the year. The final five of ten rules will be published later this year. The webinar is available on the website and the following is a condensed version of his comments. This is the third in a series of 10 scheduled reports, one for each of his rules. Stay tuned for the next one.)

The Ten Rules of Bitcoin Investing: Rule No. 4

Bitcoin performs best when S&P 500 Index is performing strongly

If you have read the first three parts of this series, you’d know that the U.S. is going to be very important in the continued development of Bitcoin and crypto currencies; that the Bitcoin Misery index is a proprietary FSI tool that has been a good way to evaluate how investors feel about Bitcoin’s price action; and that Bitcoin’s 200-day moving average (dma), and the halvening, which took place May 11, are important factors to consider.

This report is based on:

1 Empirical data we have found that suggests there is a correlation of performance between Bitcoin and the Standard & Poor’s 500 index (SPX).

That’s something many investors might consider counter intuitive, given the role of crypto currencies as alternative investments.

2 Dynamics of the investor base interested in BTC.

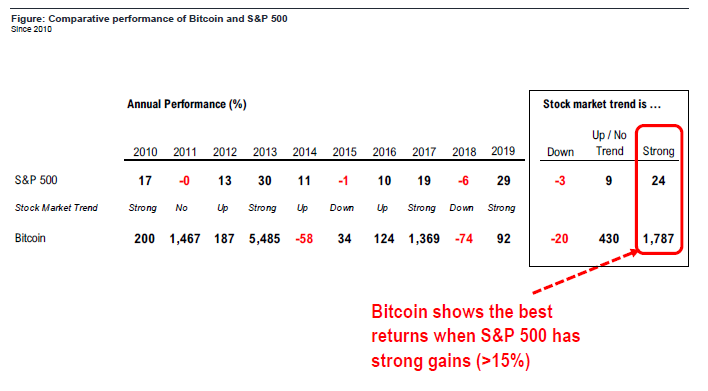

We have also found that Bitcoin performs best when the Standard & Poor’s 500 index (SPX) is doing well. In other words, BTC performs in sync with the SPX. See table below.

Granted, there are only 10 years of history, but it is notable. For example, where the SPX has the strongest gains, guess what? We see the best returns for Bitcoin.

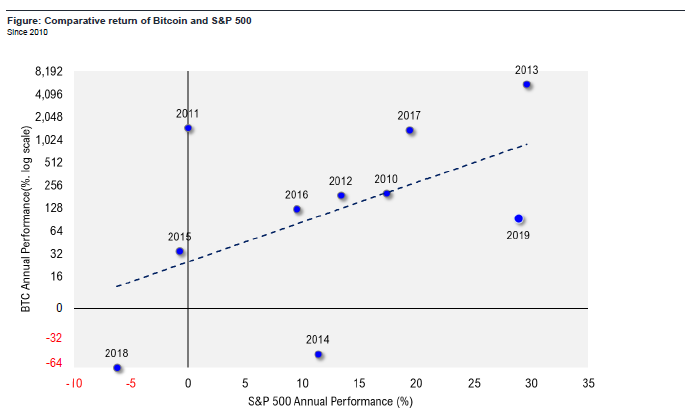

So does this mean Bitcoin is a risk-on asset? Maybe. But we think the better explanation is Bitcoin works best when there is a clear macro trend. This positive correlation relationship is even more apparent when looking at a chart below. As can be seen, in years when the SPX was up, BTC tended also to be up, last year being the most recent example. In only one year, 2014, was the SPX up and BTC down, while there were years when BTC was up but the SPX was down (2015) or flat (2011).

(This is the fourth part in a series of Tom Lee’s 10 Rules for Bitcoin Investing. As a reminder, Rule No. 3, about buying BTC above its 200-dma, was published May 14; No. 2, about the BMI index, May 8; and No. 1, May 1, says that the USA is the determining factor for cryptocurrency’s future. For more, please see Tom’s Take May 1, or the webinar replay.)